Ultimate USAA Car Insurance

Ellie Moore

Photo: Ultimate USAA Car Insurance

As a policyholder or risk manager, navigating the complexities of car insurance can feel like a high-stakes endeavor. The search for reliable, comprehensive, and cost-effective coverage is paramount, especially when considering providers known for specialized services. Are you losing peace of mind due to uncertainty about your car insurance coverage, or perhaps missing out on optimal value? This guide unveils how policyholders and risk managers can secure comprehensive protection, optimize premiums, and navigate policies with confidence through Ultimate USAA Car Insurance. We'll delve into everything from USAA car insurance rates to USAA auto insurance coverage options, ensuring you have the insights needed for informed decisions.

What Makes a Premium Ultimate USAA Car Insurance Essential for Policyholders and Risk Managers?

In today's dynamic automotive landscape, a robust car insurance policy is more than just a legal requirement; it's a critical financial safeguard. For eligible policyholders, Ultimate USAA Car Insurance offers a unique blend of specialized service and competitive pricing, setting it apart in the market. USAA has a long-standing reputation, providing vehicle coverage to military members since 1922, demonstrating a deep understanding of their unique needs.

The car insurance market continues to evolve, with significant growth driven by technological advancements and changing consumer expectations. In 2024, the total direct premiums written for private passenger auto insurance climbed by 13.3% year-over-year. Despite only catering to military members and their families, USAA holds a significant market share, ranking among the top five insurers in the U.S.. This demonstrates a strong return on investment for comprehensive USAA car insurance, as it consistently offers competitive rates that often beat national averages for eligible members. The value proposition of USAA is intrinsically linked to its exclusive membership model, fostering loyalty and a sense of belonging within the military community.

Critical Evaluation Criteria for Policyholders and Risk Managers:

Choosing the right car insurance requires a careful evaluation of several key factors.

Cost Structure Analysis

Understanding the cost structure of Ultimate USAA Car Insurance involves looking beyond the initial premium. On average, full coverage car insurance from USAA costs around $117 monthly ($1,407 annually), while minimum coverage is approximately $35 monthly ($417 annually). These rates are generally lower than the national average.

USAA car insurance pricing models consider various factors, including driving history, vehicle type, location, coverage levels, and deductibles. Higher deductibles can lead to lower premiums, but also mean higher out-of-pocket costs in case of a claim. The company also offers numerous USAA car insurance discounts, such as those for safe drivers, good students, multi-vehicle policies, and bundling auto with property insurance. For military personnel, specific savings like the on-base discount (up to 15% on comprehensive coverage) and vehicle storage discount (up to 60% off) are particularly valuable. While a dedicated "USAA car insurance TCO calculator" might not be a direct tool, understanding these elements allows policyholders to effectively calculate the total cost of ownership for their insurance, maximizing savings over time.

Compliance & Security Requirements

Navigating state-specific USAA car insurance regulations is crucial for ensuring adequate and legal coverage. Every state has different car insurance requirements, primarily focusing on liability coverage. USAA offers all standard coverage options, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. It's often advisable to purchase higher liability coverage limits than the state minimums to better protect your assets. USAA also provides unique protections like Accident Forgiveness and Car Replacement Assistance (CRA), which pays 20% more than the actual cash value if your vehicle is a total loss. These features go beyond standard offerings, providing enhanced financial security and peace of mind.

Integration Capabilities

The efficiency of managing your insurance policy and claims is significantly enhanced by seamless integration capabilities. USAA has made substantial advancements in its digital offerings, allowing policyholders to manage their accounts, file claims, and access information through their website and mobile app. The USAA car insurance claims process integration is designed to be streamlined, enabling members to report details, get estimates (often within four hours using the photo estimation tool), arrange repairs, and track claim status online. This digital transformation is a key aspect of USAA's innovation strategy, focusing on customer experience. Furthermore, USAA has partnered with Google Cloud to transform insurance operations, leveraging AI and data analytics to improve processes like claims prediction and risk management, although specific external "USAA car insurance API compatibility" for policyholders isn't directly highlighted.

Implementation Roadmap: Maximizing Ultimate USAA Car Insurance ROI

Maximizing the return on investment (ROI) from your Ultimate USAA Car Insurance involves strategic policy management and leveraging available benefits.

Here's a step-by-step guide:

- Confirm Eligibility: USAA car insurance is exclusively for active-duty military, National Guard and Reservists, veterans who have honorably served, contracted ROTC cadets, officer candidates, and their spouses and children. Ensure you meet these core eligibility criteria.

- Obtain a Personalized Quote: Request a free quote online or over the phone, adjusting coverage levels to match your budget and risk tolerance. This is a critical step in understanding your potential USAA car insurance rates.

- Explore and Apply Discounts: Actively seek out and apply for all eligible USAA car insurance discounts. These can include multi-vehicle, safe driver, good student, vehicle storage, military on-base, and bundling discounts. Stacking discounts can lead to significant savings.

- Tailor Your Coverage: Customize your USAA auto insurance coverage options to fit your specific needs. Consider add-ons like roadside assistance, rental reimbursement, and Car Replacement Assistance for enhanced protection.

- Understand the USAA Car Insurance Claims Process: Familiarize yourself with the process to ensure a rapid USAA car insurance policy activation and efficient claims handling if an incident occurs. USAA aims to settle claims as swiftly as possible, with some claims taking a few business days while more complex ones may take weeks.

- Monitor and Adjust: Regularly review your policy and adjust coverage as your needs change, such as during deployment or when purchasing a new vehicle. The USAA car insurance policy deployment timeline can be relatively quick, especially with digital tools for managing policies.

2025 Trends: The Future of Ultimate USAA Car Insurance for Policyholders and Risk Managers:

The auto insurance industry is undergoing a significant transformation, with Ultimate USAA Car Insurance at the forefront of adopting new technologies and approaches.

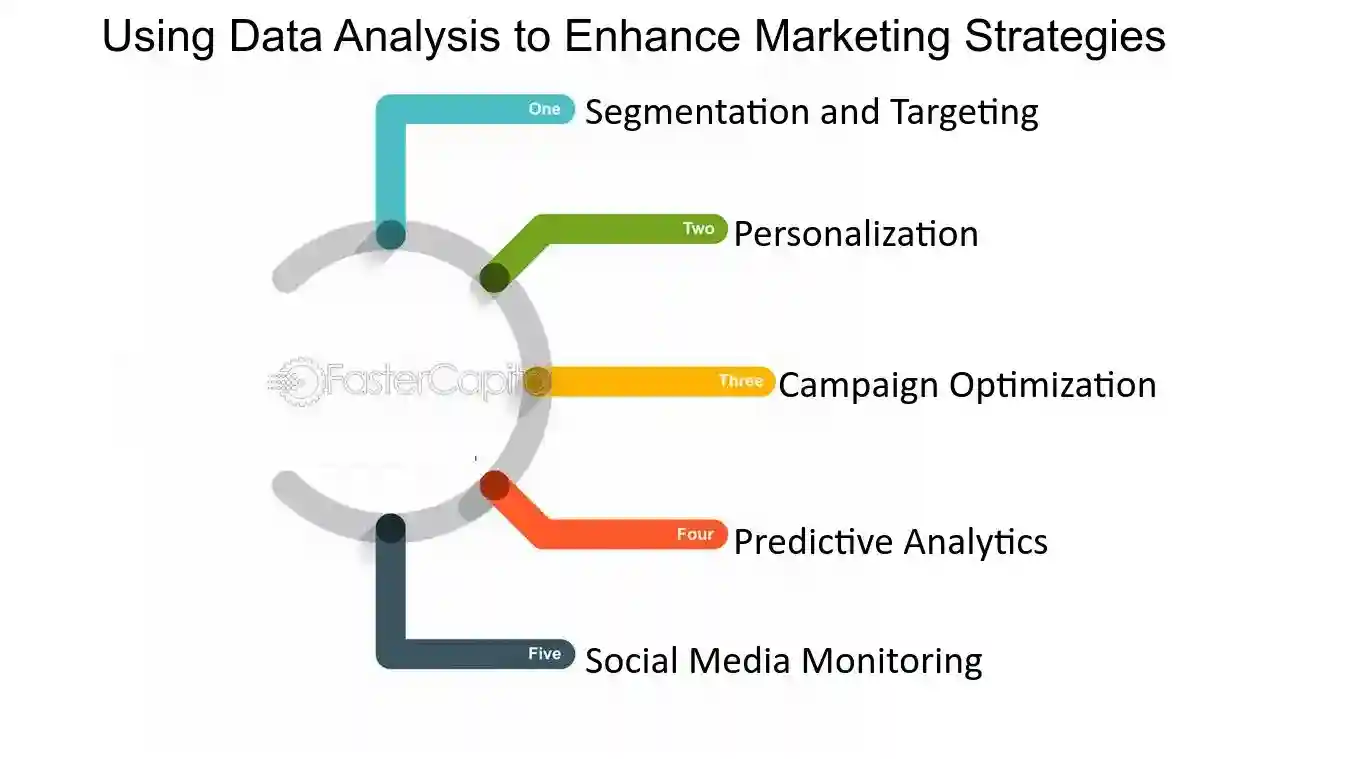

According to industry insights, the car insurance market will continue to be shaped by technological advancements. We are seeing a rise in emerging USAA car insurance technologies, including:

- Telematics and Usage-Based Insurance (UBI): Telematics, which uses devices or apps to monitor driving behavior, is becoming mainstream. USAA's SafePilot® program, for instance, offers discounts up to 30% for safe driving habits, rewarding policyholders for responsible behavior. This personalized approach can significantly impact USAA car insurance rates.

- AI and Automation: Artificial intelligence (AI) is streamlining the claims process, making it faster and more efficient. AI-powered chatbots and virtual assistants are being used for claims initiation, damage assessment, and customer support. USAA is leveraging AI and machine learning to improve claims processing, risk assessment, and customer experience.

- Connected and Autonomous Vehicles (AVs): As vehicles become smarter and more connected, liability questions are shifting from drivers to manufacturers and software providers. Insurers like USAA are adapting pricing models to reflect these changes, developing new products for varying levels of autonomy.

- Digital Transformation: Mobile apps and online portals are becoming more feature-rich, allowing customers to easily view policy details, make payments, submit claims, and request roadside assistance. This focus on digital self-service is a key element in improving the customer experience.

For policyholders and risk managers, these trends mean more personalized coverage, efficient claims processing, and potentially greater savings through behavior-based programs.

Conclusion

Securing Ultimate USAA Car Insurance offers eligible policyholders and risk managers a trustworthy and reassuring path to comprehensive vehicle protection. With its deep understanding of the military community's unique needs, USAA provides competitive USAA car insurance rates, flexible USAA auto insurance coverage options, and a robust USAA car insurance claims process. By leveraging the numerous USAA car insurance discounts and embracing emerging technologies, policyholders can maximize their savings and enjoy unparalleled peace of mind.

Ready to experience the difference of premium USAA auto insurance solutions? Don't leave your vehicle's protection to chance. Get customized USAA car insurance quotes today and compare USAA policy options to find the coverage that best fits your needs.

FAQ Section

1. What's the typical cost range for premium Ultimate USAA Car Insurance?

The typical cost range for premium Ultimate USAA Car Insurance varies based on individual factors like driving history, vehicle type, location, and chosen coverage. On average, full coverage can be around $1,407 annually, while minimum coverage averages $417 annually. USAA car insurance pricing models are designed to be competitive for eligible members, often falling below national averages.

2. How quickly can policyholders implement Ultimate USAA Car Insurance?

Policyholders can typically activate Ultimate USAA Car Insurance rapidly, especially through USAA's digital platforms. Filing a claim or managing policy details can be done quickly online or via the mobile app. For claims, the photo estimation tool can provide an estimate in as little as four hours, contributing to a rapid USAA car insurance policy activation and claims resolution.

3. What compliance standards should Ultimate USAA Car Insurance meet?

Ultimate USAA Car Insurance policies must meet state-mandated minimum liability coverage requirements. Beyond these basic requirements, USAA maintains high standards for regulatory compliance in the insurance industry. For policyholders, this means their coverage adheres to the necessary legal frameworks, providing a secure and compliant insurance solution.

4. Can Ultimate USAA Car Insurance integrate with existing risk management systems?

While direct external "USAA car insurance system integration" with personal risk management systems isn't a widely advertised feature for individual policyholders, USAA itself utilizes advanced data analytics and platforms like Google Cloud to manage financial risks and improve enterprise compliance. For individual policyholders, the robust digital tools and streamlined USAA car insurance claims process integration through their website and mobile app provide effective ways to manage their policies and claims, serving as an integrated component of their personal financial and risk management strategy.

Finance & Investment

View All

January 18, 2025

Marine One Finance Loan OptionsDominate search & engage audiences with expert SEO content. Discover how to create valuable, authoritative content that satisfies both search engines & readers.

Ellie Moore

April 18, 2025

Power Finance Texas Review for LocalsMaster expert SEO content strategy. Blend compelling writing with SEO science, focusing on user intent, keywords, and quality to rank high & deliver value.

Ellie Moore

January 5, 2025

The Role of Data in Market AnalysisExplore how data plays a crucial role in effective market analysis. Learn to leverage analytics for smarter business moves.

Ellie Moore

April 6, 2025

Rexas Finance Crypto Future ExplainedUnlock higher rankings and engaged readers with expert SEO content. Learn to create authoritative, user-centric content that search engines love.

Ellie Moore

June 17, 2025

Online Finance Degree Study Smart Earn BigGo beyond keywords! Learn to create expert SEO content that builds authority, satisfies users, and elevates your search rankings for lasting success.

Ellie Moore

January 28, 2025

Capital One Auto Finance ReviewMaster expert SEO content! Go beyond keywords to create valuable, trustworthy information that genuinely helps users, ranks high, and builds lasting trust.

Ellie Moore

Insurance

View AllDiscover how microinsurance provides affordable coverage solutions for underserved populations worldwide.

Ellie Moore

Unpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Learn how liability insurance shields businesses from financial risks and legal challenges. Secure your company's future today!

Ellie Moore

Navigate American Family Insurance options with confidence. Find optimal coverage, understand pricing, and secure peace of mind for your evolving needs.

Ellie Moore

Find out why term life insurance is more popular, affordable, and flexible than whole life. Choose the right coverage for you!

Ellie Moore

Save on premiums with usage-based auto insurance. Learn how your driving habits shape coverage and costs!

Ellie Moore

Education

View AllDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MoreRevive ancient teaching with the Socratic method! Learn how this questioning approach encourages deep thinking and active learning.

Read MoreSocial skills training is key for kids with autism. Learn practical strategies to improve social interaction and communication in children with ASD.

Read MoreForest schools offer hands-on learning in nature. Discover how this approach nurtures creativity, problem-solving, and environmental awareness in students.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MoreExplore the ongoing debate on standardized testing. Learn its pros, cons, and whether it should remain a key part of education.

Read MorePopular Post 🔥

View All

1

3

4

5

6

7

8

9

10

Health

Automotive

View All

February 11, 2025

Top In-Car Entertainment Upgrades for Drivers

Upgrade your in-car entertainment! Find out the best modern audio, video, and smart tech options to enhance your driving experience.

January 31, 2025

How Self-Driving Cars Are Redefining Daily Commutes

Explore how autonomous vehicles are revolutionizing the way we commute. Learn about tech advances and future trends. Ready to ride the future?

September 10, 2025

Hills Automotive Keeps You Moving Forward

Keep moving forward with Hills Automotive! We're your trusted partner for vehicle reliability, offering expert care & comprehensive services.

August 23, 2025

Finish Line Automotive Keeps You On Track

Keep your car safe, save money, and extend its life with Finish Line Automotive's expert maintenance & repair. Stay "on track"!

February 11, 2025

Child Car Seat Safety: Installation Tips & Rules

Keep your kids safe with proper car seat installation. Learn about safety guidelines, age recommendations, and common mistakes to avoid.

July 31, 2025

Understanding Automotive Components Holdings Value

Deep dive into the multi-trillion dollar automotive components market. Understand its value, growth, and why it's crucial for investors & enthusiasts.