Bull vs. Bear Market: Understanding Market Cycles and Their Impact

Ellie Moore

Photo: Bull vs. Bear Market: Understanding Market Cycles and Their Impact

In the thrilling world of finance, understanding market cycles is crucial for investors seeking to maximize their returns and manage risks effectively. The terms 'Bull Market' and 'Bear Market' are often thrown around, but what do they really mean and how do they impact your investment journey? In this article, we'll embark on an informative exploration of these market cycles, providing you with valuable insights to navigate the ever-changing financial landscape. Get ready to decipher the mysteries of bull and bear markets and become a more informed investor.

Understanding Bull and Bear Markets

Bull Market: The Rising Tide

Imagine a powerful bull charging forward, and you've captured the essence of a bull market. In financial terms, a bull market refers to a prolonged period of rising prices and optimistic investor sentiment. During this phase, the overall trend of the market is upward, and investors are filled with confidence and enthusiasm.

Key Characteristics:

- Rising Stock Prices: In a bull market, stock prices consistently trend upwards, often driven by strong economic growth, positive corporate earnings, and investor confidence.

- Increased Investor Confidence: Investors are optimistic, believing that the market will continue to rise. This optimism fuels further buying, creating a self-reinforcing cycle.

- Economic Growth: Bull markets often coincide with a thriving economy, characterized by low unemployment, high consumer confidence, and robust business activity.

- Long-Term Trend: Bull markets can last for months or even years, making them an attractive period for investors to grow their wealth.

Bear Market: Navigating the Downturn

Now, picture a cautious bear, and you'll understand the nature of a bear market. A bear market is characterized by declining stock prices and widespread pessimism among investors. It's a phase where the market experiences a significant downward trend.

Key Traits:

- Falling Stock Prices: In a bear market, stock prices decline by a substantial amount, typically 20% or more from their recent highs. This decline can be triggered by various factors, such as economic downturns, geopolitical events, or market corrections.

- Pessimistic Sentiment: Investors become cautious and fearful, expecting further price drops. This pessimism may lead to increased selling, exacerbating the downward trend.

- Economic Challenges: Bear markets often coincide with economic recessions, rising unemployment, and declining business activity.

- Opportunities for Value Investors: While bear markets can be challenging, they also present opportunities for value investors to buy quality assets at discounted prices.

Market Cycle Analysis: Riding the Waves

Market cycles are an inherent part of the financial ecosystem, and understanding their patterns can be a powerful tool for investors. Let's delve into the analysis of these cycles and their impact.

Identifying Market Trends

- Historical Data Analysis: Studying historical market data can reveal patterns and trends. By examining past bull and bear markets, investors can gain insights into potential triggers and market behavior.

- Technical Analysis: Technical analysts use charts, indicators, and patterns to identify market trends. Tools like moving averages, relative strength index (RSI), and trend lines can help predict potential market shifts.

- Fundamental Analysis: This approach focuses on evaluating the intrinsic value of assets. By analyzing economic indicators, company financials, and industry trends, investors can make informed decisions during market cycles.

Strategies for Navigating Market Cycles

- Long-Term Investing: Instead of trying to time the market, consider adopting a long-term investment strategy. This approach allows you to ride out short-term market fluctuations and benefit from the overall upward trend in bull markets.

- Diversification: Diversifying your portfolio across different asset classes, sectors, and regions can help mitigate risks during bear markets. When one asset class underperforms, others may provide stability.

- Value Investing: Bear markets can present opportunities for value investors to buy undervalued stocks. By focusing on companies with strong fundamentals and potential for long-term growth, investors can capitalize on market downturns.

- Risk Management: Implement risk management strategies such as stop-loss orders to limit potential losses during market downturns. Regularly reviewing and rebalancing your portfolio can also help manage risk.

Bull and Bear Market Investing: Strategies for Success

Navigating bull and bear markets requires a strategic approach. Here are some tips to enhance your investment journey:

- Stay Informed: Keep yourself updated with economic news, market trends, and industry developments. Understanding the underlying factors driving market cycles is crucial for making informed investment decisions.

- Embrace Diversification: Diversify your portfolio to spread risk. Consider a mix of stocks, bonds, real estate, and other asset classes to create a well-rounded investment strategy.

- Long-Term Perspective: Focus on long-term investment goals rather than short-term market fluctuations. Bull markets can provide substantial growth, but bear markets can also offer opportunities for strategic investments.

- Risk Assessment: Evaluate your risk tolerance and invest accordingly. Understand that bull markets can be exciting but also carry the risk of overvaluation, while bear markets present both challenges and opportunities.

- Learn from History: Study past market cycles to identify patterns and learn from successful investment strategies. History often repeats itself, and understanding historical trends can provide valuable insights.

Conclusion: Embracing Market Cycles

Bull and bear markets are integral parts of the financial landscape, offering both challenges and opportunities for investors. By understanding market cycles, investors can make informed decisions, manage risks, and capitalize on market trends. Whether it's riding the wave of a bull market or navigating the challenges of a bear market, staying informed, adopting a long-term perspective, and employing strategic investment strategies are key to success. Remember, market cycles are a natural part of the investment journey, and with the right approach, you can unlock the potential of both bull and bear markets.

So, are you ready to embrace the ups and downs of market cycles and become a savvy investor? The financial world awaits your strategic moves!

Finance & Investment

View All

April 18, 2025

Power Finance Loans You Can TrustGo beyond "good enough." Master expert SEO content to rank higher, build authority, and deeply engage your audience with E-E-A-T principles.

Ellie Moore

July 25, 2025

Hedge Meaning in Finance TermsMaster expert SEO content! Learn to create valuable, E-E-A-T-driven content that satisfies user intent, boosts rankings, and builds authority.

Ellie Moore

June 22, 2025

Trade Finance Explained for BeginnersMaster SERP rankings with expert SEO content. Learn to create valuable, authoritative, and trustworthy content that satisfies users & search engines.

Ellie Moore

January 21, 2025

The Mindset Behind Business SuccessDiscover the entrepreneurial mindset that drives business success. Learn how to think and act like a leader!

Ellie Moore

April 5, 2025

What Is Quantitative Finance AboutUnlock higher rankings & engaged readers with expert SEO content. Master E-E-A-T, create "people-first" articles, and dominate search results in 2025.

Ellie Moore

March 14, 2025

Cinch Auto Finance Loan ReviewUnlock top rankings with expert SEO content! Learn to create strategic, people-first content that satisfies both search engines and readers for lasting success.

Ellie Moore

Insurance

View AllConcerned about rising auto costs? Discover how to get premium auto insurance quotes for optimal coverage, maximum savings, and financial peace of mind.

Ellie Moore

Discover how microinsurance provides affordable coverage solutions for underserved populations worldwide.

Ellie Moore

Learn how gig workers can protect themselves with insurance solutions designed for freelance and flexible work.

Ellie Moore

Protect your assets! Secure optimal premium renters insurance coverage & peace of mind. Avoid financial loss with our comprehensive guide.

Ellie Moore

Navigate insurance complexities. This guide helps policyholders, agents & risk managers find top-rated providers for optimal coverage, peace of mind & financial...

Ellie Moore

Navigate dental insurance with our guide. Find essential plans for comprehensive coverage, financial security, and peace of mind for you or your business.

Ellie Moore

Education

View AllExplore how virtual reality is revolutionizing learning by providing immersive educational experiences. Ready to see VR in action?

Read MoreMultilingual education promotes diversity and cultural understanding. Learn why it matters and how it benefits students in a globalized world.

Read MoreUnderstand dyslexia and discover effective ways to support dyslexic students in the classroom. Learn proven strategies to improve learning outcomes.

Read MoreRevive ancient teaching with the Socratic method! Learn how this questioning approach encourages deep thinking and active learning.

Read MoreForest schools offer hands-on learning in nature. Discover how this approach nurtures creativity, problem-solving, and environmental awareness in students.

Read MoreGPKP kritik keras Dinas TPH&Nak Musi Rawas soal transparansi pupuk bersubsidi. Penutupan data publik dinilai langgar UU KIP dan merugikan hak petani kecil.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

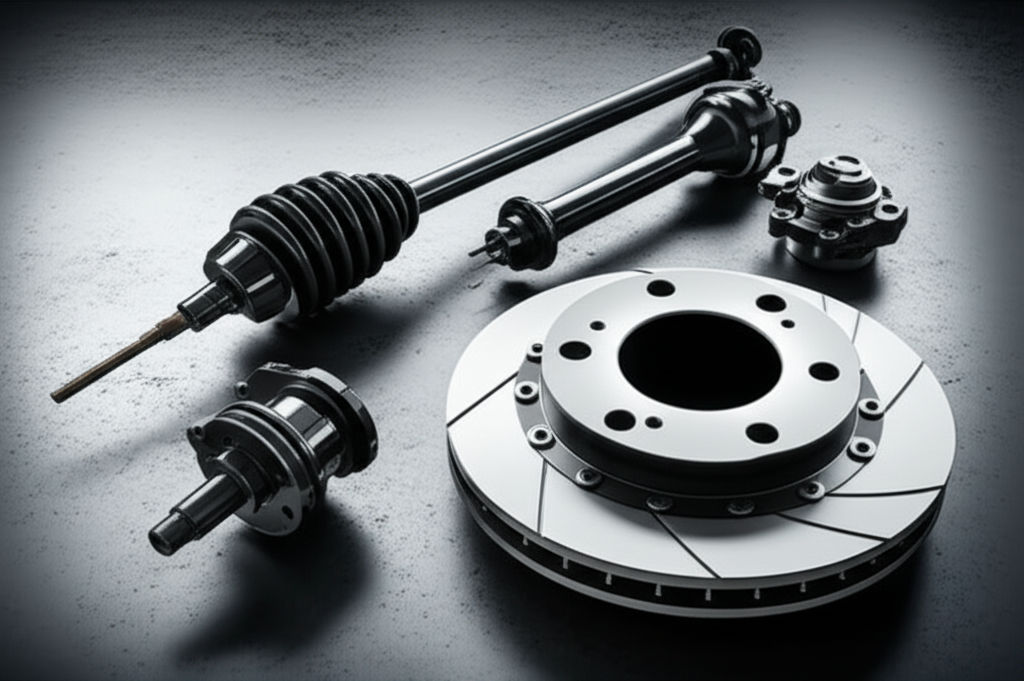

February 14, 2025

Choosing the Best Car Audio System Setup

Upgrade your ride with the perfect car audio system! Learn how to choose the right setup for an enhanced sound experience on the road.

August 7, 2025

Duracell Automotive Battery Benefits And Features

Unlock reliable power for your car! Discover why Duracell automotive batteries offer enduring performance and trusted peace of mind.

August 23, 2025

Finish Line Automotive Keeps You On Track

Keep your car safe, save money, and extend its life with Finish Line Automotive's expert maintenance & repair. Stay "on track"!

July 19, 2025

What You Should Know About Semi Automotive Parts

Demystify semi-automotive parts! Learn what they are & why they're crucial for your vehicle's safety, performance, and longevity. Essential guide for car owners...

February 7, 2025

Buying a Car Online? Tips for Safe, Smart Shopping

Want to buy a car online confidently? Get tips on how to find the best deals, avoid scams, and make secure transactions. Click for expert advice!

August 21, 2025

City Automotive Experts Ready To Help

Your guide to trusted city automotive experts. Discover how local mechanics offer expert care, build trust, and ensure your vehicle's safety & longevity.