Dealing with Debt Collectors: Legal Advice

Ellie Moore

Photo: Dealing with Debt Collectors: Legal Advice

Dealing with Debt Collectors: Legal Advice and Practical Tips

Dealing with debt collectors can be a stressful and overwhelming experience, especially when you're unsure of your rights and the legal steps you can take. Whether you're behind on payments or just being harassed by aggressive collection agencies, understanding the laws surrounding debt collection and how to protect yourself can make a world of difference. This comprehensive guide will provide you with valuable legal advice on handling debt collectors, offering practical tips and clear steps for navigating this challenging situation.

Understanding Debt Collection: What You Need to Know

Before diving into the specifics of dealing with debt collectors, it's important to have a solid understanding of what debt collection is and how it works. Debt collectors are third-party companies hired by creditors to recover money that is owed. When you're unable to pay off a debt within the agreed-upon time frame, creditors may turn to debt collectors to recoup the outstanding balance.

While debt collectors are entitled to pursue payment, they must follow strict regulations to protect consumers from unfair practices. In the U.S., the Fair Debt Collection Practices Act (FDCPA) outlines the rules for how debt collectors can behave, including restrictions on harassment, false representations, and other forms of mistreatment.

Legal Rights When Dealing with Debt Collectors

Knowing your legal rights is the first step in handling debt collectors effectively. As a consumer, you are protected under various federal and state laws, and understanding these protections can help you avoid being taken advantage of. Here are some key rights to keep in mind:

1. The Right to Be Informed of the Debt

Debt collectors must inform you in writing about the debt they are attempting to collect. This written notice, typically sent within five days of the initial contact, must include the following details:

- The amount of the debt

- The name of the creditor

- A statement informing you of your right to dispute the debt

2. The Right to Dispute the Debt

If you believe the debt is not yours or the amount is incorrect, you have the right to dispute it. You can request verification of the debt in writing, and the collector must provide proof that you owe the money. If they fail to do so, they cannot continue to pursue the debt.

3. Protection from Harassment

Debt collectors are prohibited from using abusive or harassing tactics. For example, they cannot:

- Call you before 8 a.m. or after 9 p.m.

- Use threatening language or make false claims

- Contact you at work if you request them not to

- Contact your family or friends about your debt, unless they are co-signers or guarantors

4. The Right to Cease Communication

If you are overwhelmed by constant calls or simply wish to stop communication with a debt collector, you have the right to request that they cease contacting you. This request must be made in writing, and once received, the collector can only contact you to inform you of legal actions they intend to take.

5. The Right to Seek Legal Help

If you feel that a debt collector is violating your rights or engaging in illegal practices, you have the right to consult with an attorney. Additionally, you may file a complaint with the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC).

Steps to Take When Dealing with Debt Collectors

Now that you're aware of your legal rights, here are practical steps you can take to manage debt collectors and reduce the stress of dealing with them.

1. Verify the Debt

When you first hear from a debt collector, the first thing you should do is verify the debt. As mentioned earlier, they are legally required to send you a written notice detailing the debt within five days. If you don’t receive this information, or if you believe the debt is incorrect, you should request verification. Don’t engage in further communication until you’ve confirmed the legitimacy of the debt.

2. Keep Records of All Communications

Document every interaction you have with debt collectors. This includes phone calls, letters, and any other form of communication. Write down the date, time, and a summary of what was discussed during each conversation. If the collector violates your rights, having this documentation will be crucial when filing a complaint or taking legal action.

3. Respond to the Debt Collector (If Necessary)

While it’s tempting to ignore debt collectors, responding to them can help you resolve the situation more effectively. If you don’t owe the debt, or if it’s past the statute of limitations, you can inform the collector of your position. It’s important to know when the statute of limitations has expired, as it may prevent the collector from taking legal action against you.

4. Negotiate a Settlement or Payment Plan

If the debt is legitimate and you’re unable to pay it in full, try negotiating a payment plan or settlement with the collector. You may be able to reduce the total amount owed by offering a lump sum or setting up a manageable monthly payment schedule. Be sure to get any agreements in writing.

5. Know When to Seek Legal Help

If debt collectors continue to harass you or if they are violating your rights under the FDCPA, it may be time to seek legal counsel. An attorney can help you file a lawsuit if necessary or provide advice on how to handle the situation effectively.

Common Mistakes to Avoid When Dealing with Debt Collectors

While it's important to take the right steps when dealing with debt collectors, it’s equally crucial to avoid certain common mistakes that can make the situation worse. Here are a few things to keep in mind:

1. Ignoring the Debt

Ignoring the debt won’t make it go away. In fact, it may lead to more aggressive collection tactics and additional legal consequences. Respond to debt collectors as soon as possible and handle the situation proactively.

2. Agreeing to Unreasonable Terms

Debt collectors may try to pressure you into agreeing to terms that are unrealistic or unaffordable. Be cautious when negotiating, and make sure any agreements are reasonable given your financial situation.

3. Providing Personal Information Without Verification

Never share sensitive information such as your Social Security number or bank account details unless you are sure the collector is legitimate. Scammers may try to steal your identity under the guise of debt collection.

What to Do If You're Sued by a Debt Collector

If you are sued by a debt collector, it's crucial to take immediate action. Ignoring the lawsuit can lead to a default judgment against you, which can result in wage garnishment, bank account levies, or property liens. Here’s what you should do:

- Review the Lawsuit: Carefully read the complaint and ensure that the debt is yours and the amount is correct.

- Respond to the Lawsuit: You must respond to the lawsuit by the deadline specified in the court documents. Failing to do so will likely result in a judgment being entered against you.

- Defend Your Case: If you believe the debt is invalid, gather evidence to support your case, such as payment records or proof that the statute of limitations has expired.

- Consider Settlement: If the debt is valid, consider negotiating a settlement or repayment plan to avoid further legal consequences.

Frequently Asked Questions (FAQs)

How do I stop debt collectors from contacting me?

You can stop debt collectors from contacting you by sending them a written request to cease communication. Once they receive this request, they can only contact you to inform you of legal actions they may take.

Can a debt collector sue me for a debt I can't pay?

Yes, debt collectors can sue you if the debt is valid. However, if you can’t pay, you may be able to negotiate a settlement or repayment plan with the collector or request that the debt be written off.

How long can debt collectors pursue a debt?

The statute of limitations for debt collection varies by state and the type of debt. Generally, the time period ranges from 3 to 10 years. Once this period has passed, debt collectors can no longer sue you for the debt.

Conclusion

Dealing with debt collectors can be a daunting experience, but by understanding your legal rights and taking proactive steps, you can navigate the situation with confidence. Always remember to verify the debt, maintain thorough documentation, and never hesitate to seek legal help if you feel your rights are being violated. By staying informed and organized, you can regain control over your financial situation and minimize the impact of debt collectors on your life.

If you’ve had any experience with debt collectors, share your thoughts in the comments below. And don't forget to share this article with anyone who might benefit from this valuable advice!

Finance & Investment

View All

April 1, 2025

The Psychology of Money: Unlock Financial SuccessDiscover how your mindset shapes financial decisions. Learn how to rewire your thinking for lasting financial success. Take control of your money today!

Ellie Moore

May 1, 2025

Kinsmith Finance Loan ServicesUnlock top rankings & organic traffic with expert SEO content. Discover how E-E-A-T builds authority & future-proofs your brand for lasting digital success.

Ellie Moore

November 24, 2025

Aqua Finance Consumer Loan ReviewElevate your SEO with expert content! Discover how to create authoritative, E-E-A-T-aligned content that ranks higher, builds trust, and engages your audience.

Ellie Moore

October 14, 2025

Finance Newsletter Ideas for ReadersExpert SEO content isn't just keywords. Learn to build authority (E-E-A-T), satisfy user intent, and deliver value for top rankings & more business.

Ellie Moore

March 29, 2025

Gold’s Role in a Diversified PortfolioDiscover why gold and precious metals are essential in a diversified portfolio. Protect your wealth with these timeless investments!

Ellie Moore

May 26, 2025

Santander Auto Finance ReviewBoost your online presence! Craft expert SEO content to earn higher search rankings, attract more organic traffic, and engage your readers effectively.

Ellie Moore

Insurance

View AllDiscover how microinsurance provides affordable coverage solutions for underserved populations worldwide.

Ellie Moore

Explore aviation insurance options, from aircraft liability to passenger protection. Secure the skies for your operations!

Ellie Moore

Explore emerging trends reshaping insurance in 2025. Stay ahead with insights on AI, blockchain, and coverage innovations.

Ellie Moore

Before you travel, get the essential tips for choosing the perfect travel insurance policy for peace of mind.

Ellie Moore

Protect your paycheck with disability insurance. Learn why income protection is a must-have for financial security.

Ellie Moore

Learn how self-insured companies manage risks, reduce costs, and create customized insurance solutions for employees.

Ellie Moore

Education

View AllIs a college degree still worth it? Dive into a detailed analysis of the ROI on higher education, including costs, benefits, and future prospects.

Read MorePlay is crucial in early learning! Discover how play-based learning enhances cognitive, emotional, and social development in young children.

Read MoreOutdoor learning promotes cognitive and social growth. Explore how nature-based education enhances learning outcomes and student well-being.

Read MoreShould smartphones be allowed in classrooms? Explore the pros and cons of using smartphones in education and their impact on learning.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MorePopular Post 🔥

View All

1

3

4

5

6

7

8

9

Health

Automotive

View All

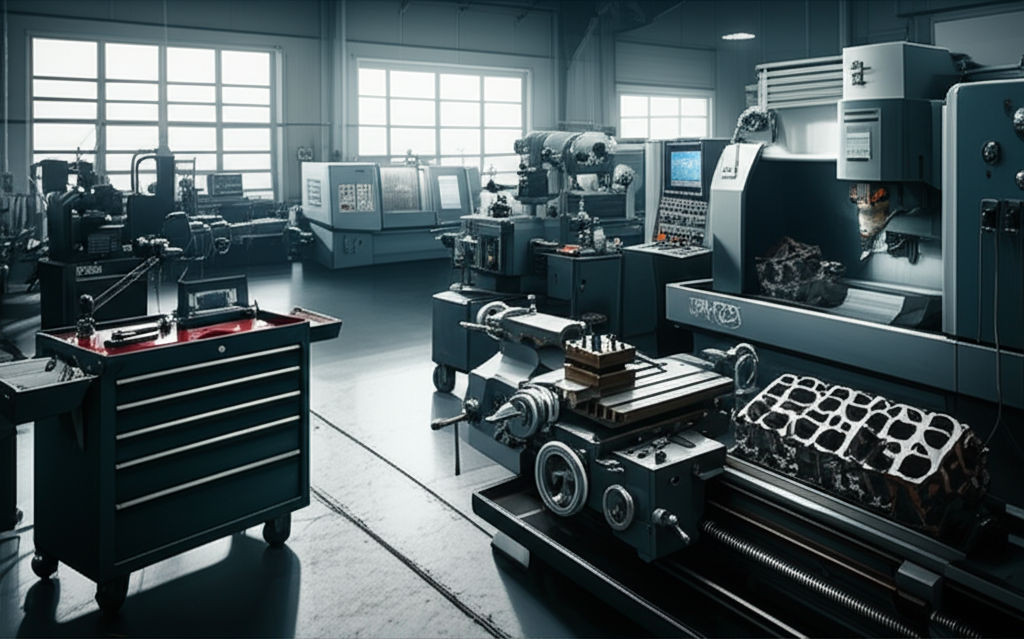

July 15, 2025

Choosing The Best Automotive Machine Shop Nearby

Your engine deserves expert care. Discover how to choose a top automotive machine shop for precision repairs, rebuilding, and performance.

February 7, 2025

Car Subscriptions: The Future of Vehicle Ownership

Explore the rise of car subscription services. Find out how they work, pros & cons, and why they’re becoming the latest trend in mobility.

August 8, 2025

High Tech Automotive Tools For Modern Mechanics

Modern mechanics need high-tech automotive tools to repair complex vehicles. Revolutionize your shop with advanced diagnostic equipment for EVs & ADAS.

July 23, 2025

Find Reliable Automotive Machine Shops Near Me

Locate top automotive machine shops for engine repair. Ensure your vehicle's performance, longevity, and save money with expert engine services.

August 24, 2025

Harris Automotive Dependable Local Service

Choose a dependable local auto service for peace of mind. Harris Automotive offers trusted expertise, fair pricing, and top-tier care for your vehicle.

August 2, 2025

Automotive Painter Jobs And How To Get Hired

Drive your career forward! Learn how to get hired as an automotive painter, mastering the art of vehicle refinishing for a rewarding profession.