How Life Insurance Can Secure Your Family's Future

Ellie Moore

Photo: How Life Insurance Can Secure Your Family's Future

Life Insurance: Why It’s More Than Just a Safety Net

What Is Life Insurance and Why Does It Matter?

Life insurance isn’t just about death. Yep, I said it. While the core idea is to provide a payout to loved ones when you’re gone, the reality is that life insurance is one of the smartest long-term financial tools you can have in your back pocket. From safeguarding your family’s future to building wealth or covering debts, it’s way more versatile than most people think.

So what is life insurance? In simple terms, it’s a contract between you and an insurance company. You pay a premium (monthly or annually), and in return, your beneficiaries receive a lump sum called a death benefit when you pass away.

But here’s the kicker: not all life insurance policies are created equal.

🧠 Types of Life Insurance: Which One’s Right for You?

Let’s break down the two main types: Term Life Insurance and Permanent Life Insurance.

✅ Term Life Insurance (Affordable and Simple)

- Coverage Duration: 10, 20, or 30 years

- Best For: Budget-conscious individuals, young families, or anyone looking for straightforward coverage

- Key Perks:

- Low premiums

- High coverage for low cost

- Great for temporary needs like mortgage protection

👉 Example: A 30-year-old non-smoker might pay just $20/month for a $500,000, 20-year term policy.

🏦 Permanent Life Insurance (Lifetime Coverage + Cash Value)

Includes:

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

Best For: Wealth building, estate planning, or those seeking lifelong security.

Perks:

- Lasts a lifetime

- Builds cash value over time (think of it like a savings account with tax perks)

- Can be borrowed against or even cashed out

👀 Heads Up: It’s pricier than term life, but offers long-term financial benefits and tax advantages.

🔑 Benefits of Life Insurance You Probably Didn’t Know

Life insurance goes way beyond just covering funeral costs. Here's how it really adds value:

1. Income Replacement

Imagine your family trying to pay the bills, cover tuition, and manage debt without your income. A solid policy fills that gap.

2. Debt Coverage

Your mortgage, student loans, or credit card debt won’t just vanish. A life insurance policy can help prevent passing those burdens on to your family.

3. Wealth Transfer & Estate Planning

Especially true for permanent life insurance this is where you can pass down wealth tax-efficiently.

4. Business Protection

Own a business? A life insurance policy can fund a buy-sell agreement or ensure the company stays afloat if a key player dies.

5. Living Benefits

Some policies offer accelerated benefits if you’re diagnosed with a terminal illness. You can access a portion of your death benefit to cover treatment or end-of-life costs.

💡 Actionable Tips for Choosing the Right Life Insurance Policy

Navigating policies can be tricky but it doesn’t have to be. Here are some practical tips:

- Assess Your Needs:

- How many dependents do you have?

- What debts and monthly expenses exist?

- What’s your current income?

- Calculate the Right Coverage:

- A common rule: 10-15x your annual income

- Add in debts, college expenses, and long-term care costs

- Compare Quotes Online:

- Use trusted platforms like Policygenius, Haven Life, or NerdWallet

- Look at customer reviews, financial ratings (A.M. Best), and claim payout reputation

- Work With an Independent Agent:

- They’re not tied to one insurer, so you get unbiased recommendations

- Don’t Wait Until You’re Older:

- The younger and healthier you are, the cheaper your policy will be

📊 Real-Life Case Study: How Life Insurance Saved a Family’s Future

Let’s talk about James, a 38-year-old father of two from Austin, Texas. He bought a $750,000 term policy for $30/month. Tragically, James passed away in a car accident five years later.

Thanks to that policy:

- His wife was able to pay off their mortgage

- Their children’s college education was fully funded

- She had enough income replacement for 10 years

James’s decision gave his family peace of mind during an unimaginable time. That’s the power of planning ahead.

🔍 Life Insurance Myths Busted

❌ "I’m young, I don’t need it."

Reality: That’s exactly why you should get it. Younger people lock in lower rates and can avoid medical red flags later on.

❌ "It’s too expensive."

Truth bomb: Term life can cost less than your Netflix subscription.

❌ "I have coverage through work."

Employer-sponsored life insurance is usually limited (1-2x salary). What happens if you change jobs? It’s a nice bonus not a replacement.

📈 SEO Tip: How to Boost Your Financial Site with Life Insurance Content

Life insurance content is evergreen. Sprinkle in primary keywords like:

- Life insurance

- Term life insurance

- Whole life insurance

- Affordable life insurance

- Best life insurance companies

And secondary terms such as:

- Life insurance for families

- Tax benefits of life insurance

- Life insurance for young adults

Use them naturally across headings, meta tags, image alt text, and internal links for maximum SEO value.

🙋♀️ Frequently Asked Questions (FAQs)

Q1: When should I buy life insurance?

Answer: The sooner, the better especially if you’re young and healthy. It’s cheaper and easier to qualify.

Q2: How much life insurance do I really need?

Answer: A good rule of thumb is 10–15x your income, plus debts and future expenses (like college or caregiving costs).

Q3: What’s the difference between term and whole life insurance?

Answer: Term covers a specific time period and is more affordable. Whole life lasts forever and includes a savings component.

Q4: Can I have more than one life insurance policy?

Answer: Absolutely. Many people layer term policies or add a permanent policy later in life for extra security.

Q5: Is life insurance taxable?

Answer: In most cases, death benefits are tax-free to your beneficiaries. However, cash value gains in permanent policies may have tax implications if cashed out.

🎯 Final Thoughts: Is Life Insurance Worth It?

If you're on the fence, think about this: Life insurance is not for you it’s for the people you love. Whether you're in your 20s building a future, in your 40s protecting your family, or planning your legacy, there’s a policy that fits.

Don't wait for a wake-up call to take action.

🚀 Ready to Take the First Step?

Leave a comment below if you have questions, or share your personal experiences with life insurance. And if this article helped you, pass it on it might just help someone else make a life-changing decision.

Finance & Investment

View All

March 22, 2025

What the National Finance Center Really DoesGo beyond basic SEO. Discover how to craft expert content using Google's E-E-A-T framework to build trust, authority, and rank higher in search results.

Ellie Moore

May 10, 2025

American Honda Finance ContactCraft expert SEO content to dominate search results. Go beyond keywords to build trust, value, and E-E-A-T for higher rankings and audience engagement.

Ellie Moore

May 19, 2025

Forward Financing Business LoansGo beyond basic SEO! Learn to create expert content based on Google's E-E-A-T framework to boost rankings, traffic, and build trust in your niche.

Ellie Moore

January 24, 2025

Top Online Finance Masters ProgramsYour blueprint for expert SEO content. Dominate search, engage readers, and build authority with E-E-A-T-driven strategies that Google loves.

Ellie Moore

April 12, 2025

Eagle Finance Personal Loan ReviewMaster expert SEO content to build online authority. Learn to understand user intent and apply E-E-A-T for high-quality, traffic-driving results.

Ellie Moore

June 9, 2025

Empower Finance Helping You Take ControlMaster SEO with expert content! Build authority, earn trust, and drive organic traffic. Understand E-E-A-T to create high-ranking, valuable content that truly e...

Ellie Moore

Insurance

View AllDiscover how artificial intelligence simplifies claims, enhances accuracy, and speeds up insurance processes.

Ellie Moore

Is earthquake insurance worth it? Learn about coverage, costs, and risks to make an informed decision for your property.

Ellie Moore

Protect your freelance career with tailored insurance. Discover coverage options for self-employed individuals.

Ellie Moore

Understand how insurers assess risks to calculate premiums. Learn how your profile impacts your policy cost.

Ellie Moore

Discover how peer-to-peer insurance models operate, offering community-based risk-sharing alternatives.

Ellie Moore

Understand the differences between HMO, PPO, and EPO health insurance networks. Pick the plan that suits your needs best!

Ellie Moore

Education

View AllLearn how UNESCO promotes education for all globally. Explore key initiatives and efforts aimed at fostering equal learning opportunities for everyone.

Read MoreLearn key strategies for creating inclusive classrooms. Discover how to foster equality, engagement, and a sense of belonging for every student.

Read MoreForest schools offer hands-on learning in nature. Discover how this approach nurtures creativity, problem-solving, and environmental awareness in students.

Read MoreDiscover why liberal arts education remains valuable in today’s tech-driven world. Explore how it fosters critical thinking and adaptability.

Read MoreExplore how emotional intelligence impacts academic performance. Learn strategies to help students develop emotional skills for better learning outcomes.

Read MoreRevive ancient teaching with the Socratic method! Learn how this questioning approach encourages deep thinking and active learning.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

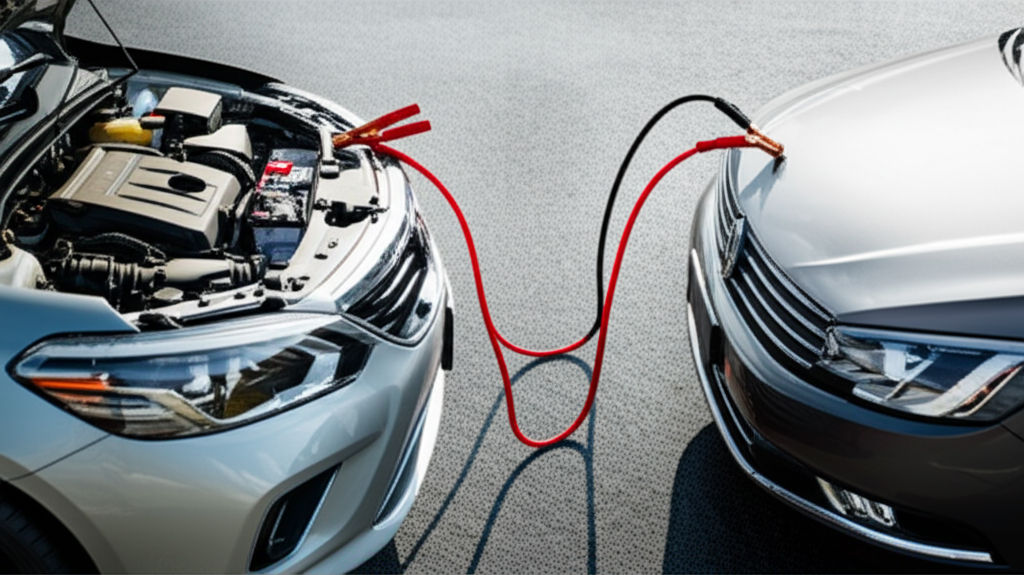

September 10, 2025

Hills Automotive Keeps You Moving Forward

Keep moving forward with Hills Automotive! We're your trusted partner for vehicle reliability, offering expert care & comprehensive services.

February 2, 2025

Must-Know Vehicle Safety Features for Every Driver

Stay safe on the road by learning about essential vehicle safety features. Discover the tech that could save your life. Drive smart, drive safe!

July 17, 2025

Grote Automotive Products And Services Review

Grote Automotive: A century of innovation in vehicle safety & visibility. Discover trusted products for enhanced performance, reliability, and peace of mind.

July 15, 2025

How To Automotive Correct Paint Flaws Easily

Restore your car's shine! Learn to easily fix common automotive paint flaws like swirls, scratches & water spots yourself with our comprehensive guide.

August 16, 2025

How Automotive Lift Movers Make Work Easier

Transform your garage with automotive lift movers! Explore how portable and mobile lifts offer unmatched flexibility, efficiency, and safety.

July 11, 2025

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.