Smart Strategies for Managing Student Loan Repayments in 2024

Ellie Moore

Photo: Smart Strategies for Managing Student Loan Repayments in 2024

Navigating the complexities of student loan repayments can feel overwhelming, especially in the ever-evolving landscape of financial obligations. As we move further into 2024, students and graduates alike face unique challenges and opportunities regarding their loans. This article aims to provide practical strategies for managing student loan repayments effectively, ensuring that you can take control of your financial future.

Understanding the Current Landscape of Student Loans

The State of Student Debt in 2024

As of 2024, student loan debt in the United States has reached staggering levels, with millions of borrowers carrying an average debt of over $30,000. The pandemic has led to various changes in loan policies, including temporary pauses on federal student loan repayments. However, as these pauses come to an end, it's essential to understand the options available to manage your debts effectively.

Types of Student Loans

Before diving into repayment strategies, it's crucial to identify the types of loans you may have. Federal loans, such as Direct Subsidized and Unsubsidized Loans, typically offer more flexible repayment options compared to private loans. Understanding whether your loans are federal or private can influence your repayment strategy significantly.

Smart Strategies for Managing Repayments

1. Create a Comprehensive Budget

One of the most effective ways to manage student loan repayments is by establishing a clear budget. Start by listing all sources of income and monthly expenses. This will give you a clearer picture of your financial situation and help you allocate funds for loan repayments.

Example:

Consider Sarah, a recent graduate with a monthly income of $3,000. After calculating her expenses rent, groceries, utilities, and discretionary spending she finds she can comfortably set aside $400 for her student loans each month. By sticking to her budget, Sarah ensures she doesn't fall behind on her payments.

2. Explore Repayment Plans

Federal student loans offer several repayment plans tailored to different financial situations. For instance, Income-Driven Repayment (IDR) plans adjust your monthly payment based on your income and family size. If you're facing financial hardship, these plans can significantly reduce your monthly payments.

Consider This:

If you earn $30,000 a year and have federal loans, you might qualify for a payment as low as $100 per month under an IDR plan. This relief can provide significant breathing room in your budget.

3. Stay Informed About Forgiveness Programs

Many borrowers are unaware of the various student loan forgiveness programs available. Programs like Public Service Loan Forgiveness (PSLF) can be a game-changer for those working in qualifying public service jobs. Researching eligibility requirements and keeping track of your qualifying payments is crucial.

Anecdote:

John, a teacher, diligently tracked his payments and applied for PSLF after ten years of teaching in a low-income school. His loans were forgiven, which allowed him to invest more in his future.

4. Consider Refinancing

For those with private loans or high-interest federal loans, refinancing can be an attractive option. Refinancing may lower your interest rate and reduce your monthly payment. However, it's essential to weigh the pros and cons, as refinancing federal loans means losing access to federal protections and repayment options.

5. Make Extra Payments When Possible

If your budget allows, making extra payments can significantly reduce the total interest paid over the life of the loan. Even small additional payments can make a difference.

Real-Life Example:

Emily, a recent graduate, decided to put her tax refund toward her student loans. By doing so, she reduced her principal balance and saved on interest, which ultimately shortened her repayment term.

6. Utilize Employer Repayment Assistance

Many companies now offer student loan repayment assistance as part of their benefits packages. If your employer offers such a program, take advantage of it! This can significantly ease your repayment burden and help you pay off your loans faster.

7. Stay Engaged and Communicate with Loan Servicers

Maintaining open communication with your loan servicer is vital. If you encounter financial difficulties, reach out to discuss your options. They may offer deferment or forbearance, allowing you to temporarily pause payments without penalties.

Conclusion

Managing student loan repayments in 2024 requires a proactive and informed approach. By understanding your loans, creating a solid budget, exploring repayment options, and staying informed about forgiveness programs, you can navigate this financial landscape more effectively. Remember that every borrower’s situation is unique, and what works for one person may not work for another.

As you embark on this journey, remain flexible and open to adjusting your strategies as needed. By taking control of your student loans now, you can pave the way for a brighter, debt-free future. The road to financial freedom may be challenging, but with the right strategies, it's certainly achievable.

Finance & Investment

View All

September 1, 2025

MBA in Finance Career BenefitsElevate your rankings & authority with expert SEO content. Learn how valuable, E-E-A-T-driven insights captivate audiences and boost online success.

Ellie Moore

September 18, 2025

Best Finance Resources for 2025Drive organic growth & top rankings with expert SEO content. Learn to create valuable, trustworthy content that satisfies users & search engines.

Ellie Moore

April 19, 2025

Snap Finance Customer Service HelpBoost rankings & trust with expert SEO content. Discover how Google's E-E-A-T framework guides valuable, authoritative, and trustworthy online success.

Ellie Moore

January 22, 2025

Next Generation Personal Finance ToolsUnlock higher rankings & engaged readers with expert SEO content. Discover how to create authoritative, valuable content focused on E-E-A-T & user intent.

Ellie Moore

May 20, 2025

Hearth Financing for Home ProjectsElevate your SEO with expert, people-first content. Understand Google's E-E-A-T framework to build trust, rank higher, and genuinely serve your audience.

Ellie Moore

October 10, 2025

Corporacion Financiera Nacional OverviewMaster expert SEO content! Learn to create valuable, authoritative, and trustworthy content that ranks high, engages users, and aligns with E-E-A-T principles.

Ellie Moore

Insurance

View AllProtect your valuable vehicle with premium auto insurance. Discover comprehensive coverage, competitive rates, and peace of mind tailored to your needs.

Ellie Moore

Discover Premium Dairyland Insurance for unparalleled financial security. Specialized auto & motorcycle coverage, ideal for high-risk drivers. Get peace of mind...

Ellie Moore

Renting comes with risks. Safeguard your belongings, finances, and peace of mind with Allstate Renters Insurance. Explore coverage, costs, and essential benefit...

Ellie Moore

Protect your finances with Liberty Mutual Car Insurance. Our comprehensive guide helps policyholders & risk managers optimize coverage & compare rates.

Ellie Moore

Navigate American Family Insurance options with confidence. Find optimal coverage, understand pricing, and secure peace of mind for your evolving needs.

Ellie Moore

Safeguard your trips with Ultimate Allianz Travel Insurance. Get comprehensive coverage for cancellations, medical emergencies & more. Travel with confidence!

Ellie Moore

Education

View AllHelp students master metacognition! Learn how teaching students to think about their thinking can improve problem-solving and critical thinking skills.

Read MoreForest schools offer hands-on learning in nature. Discover how this approach nurtures creativity, problem-solving, and environmental awareness in students.

Read MoreTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreDiscover how flipped classrooms work and why they’re becoming popular. Learn the key benefits of this innovative teaching approach.

Read MoreDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

July 23, 2025

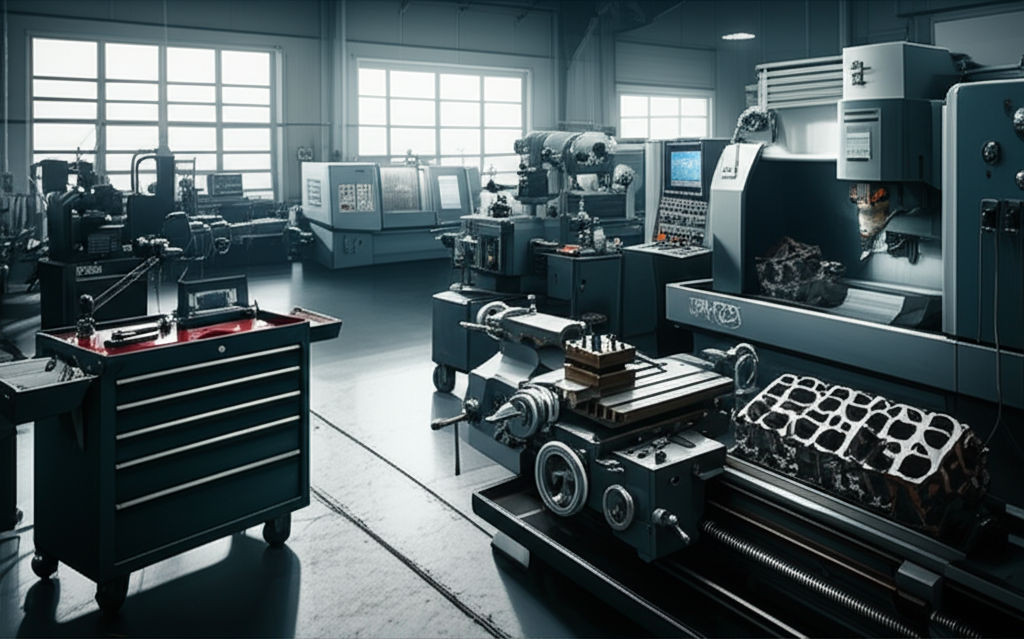

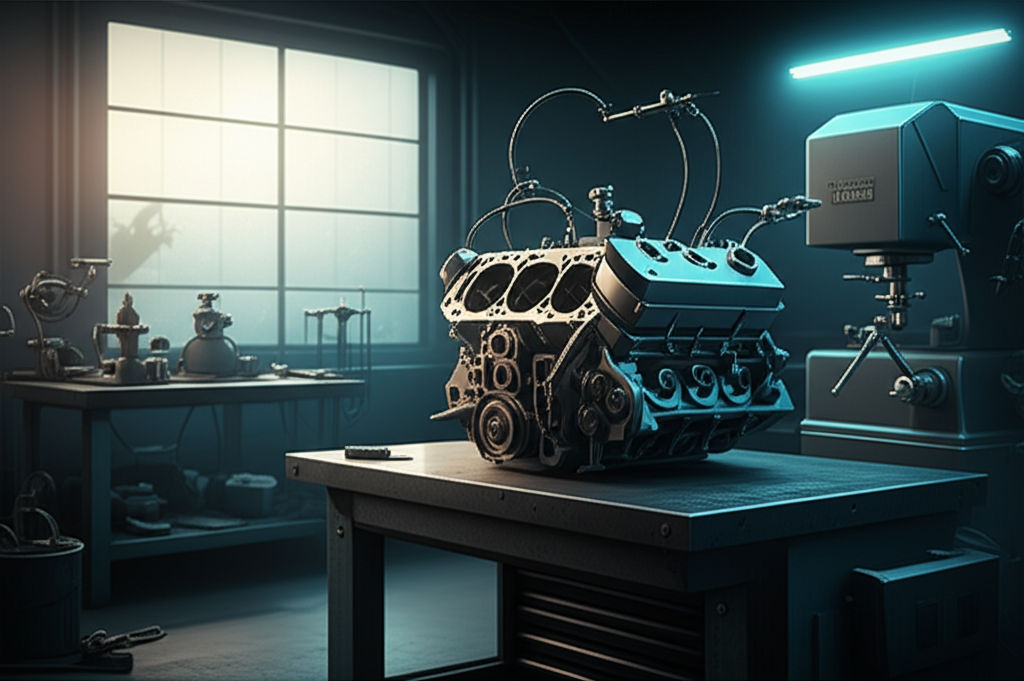

Find Reliable Automotive Machine Shops Near Me

Locate top automotive machine shops for engine repair. Ensure your vehicle's performance, longevity, and save money with expert engine services.

July 12, 2025

Find Trusted Automotive Machine Shop Near Me

For complex engine issues, trust a specialized automotive machine shop. Get precision repairs & enhance performance. Find a reputable one near you!

September 3, 2025

Best Automotive Polishing Compound For Shine

Transform your car's paint! Discover how to use automotive polishing compounds to eliminate defects & achieve a brilliant, mirror-like shine.

August 25, 2025

Isuzu Automotive Dealership Deals To Know

Unlock the best Isuzu deals! Our guide covers financing, leasing, and smart buying tips for D-Max, mu-X, and commercial trucks. Buy smart.

July 28, 2025

Mayse Automotive Services For Every Vehicle Type

Mayse Automotive: Your trusted partner for comprehensive care across all vehicle types. Expert, certified technicians & advanced tools ensure smooth driving.

July 24, 2025

Dans Automotive Services That Save You Time

Reclaim your time! Dan's Automotive offers convenient, efficient car care. Streamline maintenance with express services & save stress.