Microinsurance: Affordable Coverage for All

Ellie Moore

Photo: Microinsurance: Affordable Coverage for All

Microinsurance: Affordable Coverage for All

In today's rapidly evolving world, financial security is more important than ever. However, traditional insurance often remains out of reach for many, particularly those in low-income communities. This is where microinsurance steps in, offering affordable coverage for all. By tailoring insurance products to the needs and financial capacities of underserved populations, microinsurance plays a crucial role in promoting financial inclusion and resilience. In this article, we delve deep into the world of microinsurance, exploring its benefits, challenges, and the path forward toward making coverage accessible to everyone.

What is Microinsurance?

Definition and Scope

Microinsurance refers to insurance products specifically designed to meet the needs of low-income individuals and communities. Unlike traditional insurance, which often requires substantial premiums and extensive documentation, microinsurance offers simplified, low-cost options that provide essential coverage against various risks, such as health issues, property damage, or loss of income.

Importance of Microinsurance

In regions where formal employment and stable incomes are scarce, the financial safety nets provided by microinsurance can be life-changing. By mitigating the impact of unexpected events, microinsurance helps individuals and families maintain their livelihoods, prevent falling into poverty, and foster economic stability within communities.

The Growing Need for Affordable Coverage

Global Statistics on Insurance Coverage

Globally, a significant portion of the population remains uninsured. According to the World Bank, over half of the world's population lacks access to basic insurance services. This gap is particularly pronounced in developing countries, where informal economies dominate and access to traditional financial services is limited.

Vulnerable Populations

Certain groups are more susceptible to risks and less likely to have insurance coverage. These include:

- Low-income households: Struggling to meet daily needs, these families prioritize immediate expenses over insurance.

- Rural communities: Limited access to financial institutions and information hampers insurance uptake.

- Women: Often excluded from formal employment and financial decision-making, increasing their vulnerability.

Benefits of Microinsurance

Financial Protection

At its core, microinsurance provides a safety net against unforeseen events. Whether it's a medical emergency, natural disaster, or loss of property, having insurance coverage can prevent catastrophic financial setbacks.

Empowerment and Inclusion

By making insurance accessible and affordable, microinsurance empowers individuals to take control of their financial futures. It fosters a sense of security, enabling people to invest in education, start businesses, and improve their living standards without the constant fear of financial ruin.

Real-Life Examples

- Health Microinsurance in Kenya: Programs like the National Hospital Insurance Fund (NHIF) offer affordable health coverage to millions, significantly reducing out-of-pocket medical expenses.

- Agricultural Microinsurance in India: Schemes like Pradhan Mantri Fasal Bima Yojana (PMFBY) protect farmers against crop failures, ensuring their livelihoods remain stable despite adverse weather conditions.

How Microinsurance Works

Types of Microinsurance

Microinsurance encompasses various types tailored to specific needs:

- Health Microinsurance: Covers medical expenses, hospital stays, and sometimes preventive care.

- Life Microinsurance: Provides financial support to beneficiaries in the event of the policyholder's death.

- Property Microinsurance: Protects assets such as homes, livestock, or crops against damage or loss.

- Disability Microinsurance: Offers income replacement in case of disability preventing the insured from working.

Distribution Channels

Effective distribution is key to the success of microinsurance. Common channels include:

- Microfinance Institutions (MFIs): Leveraging existing relationships with clients to offer insurance products.

- Mobile Technology: Utilizing mobile phones for enrollment, premium payments, and claims processing.

- Community-Based Organizations: Partnering with local groups to build trust and ensure culturally appropriate solutions.

Affordability Factors

Several factors contribute to making microinsurance affordable:

- Low Premiums: Keeping costs minimal to align with the financial capabilities of low-income individuals.

- Simplified Processes: Reducing paperwork and streamlining procedures to lower administrative costs.

- Flexible Payment Options: Allowing premiums to be paid in small, manageable installments.

Challenges and Solutions in Microinsurance

Common Challenges

- Limited Awareness: Many potential beneficiaries are unaware of microinsurance products or misunderstand their benefits.

- Trust Issues: Skepticism towards insurance providers can hinder uptake.

- Regulatory Hurdles: Navigating diverse regulatory environments can be complex and costly.

- Risk Assessment: Accurately assessing and pricing risk for low-income populations can be challenging.

Innovative Solutions

- Educational Campaigns: Raising awareness through community workshops, radio programs, and partnerships with local leaders.

- Building Trust: Collaborating with trusted local institutions and ensuring transparent communication to foster trust.

- Regulatory Support: Advocating for supportive policies and streamlined regulatory processes to facilitate microinsurance offerings.

- Advanced Technology: Utilizing data analytics and mobile technology to enhance risk assessment and streamline operations.

Getting Started with Microinsurance: Practical Tips

For Consumers

- Assess Your Needs: Identify the risks most relevant to your situation, such as health, property, or income loss.

- Compare Plans: Evaluate different microinsurance products based on coverage, premiums, and benefits.

- Understand the Terms: Ensure you fully understand the policy terms, including exclusions and claim procedures.

- Choose Reputable Providers: Opt for established providers with a track record of reliability and customer service.

For Providers

- Understand the Target Market: Conduct thorough research to understand the specific needs and preferences of your target audience.

- Simplify Products: Design straightforward insurance products that are easy to understand and purchase.

- Leverage Technology: Use mobile platforms and digital tools to reach a wider audience and streamline operations.

- Build Partnerships: Collaborate with microfinance institutions, community organizations, and local leaders to enhance distribution and trust.

The Future of Microinsurance

Trends and Innovations

- Digital Transformation: Continued advancements in mobile technology and data analytics will further simplify enrollment, premium payments, and claims processing.

- Product Diversification: Expanding beyond traditional insurance types to include innovative products like weather-indexed insurance for farmers.

- Integration with Other Services: Bundling microinsurance with other financial services, such as savings accounts and loans, to provide comprehensive financial solutions.

Potential Impact

As microinsurance evolves, its potential to drive financial inclusion and economic resilience grows. By providing affordable coverage to all, microinsurance can help reduce poverty, empower marginalized communities, and foster sustainable development globally.

Conclusion

Microinsurance stands as a beacon of hope for millions who lack access to traditional insurance. By offering affordable coverage for all, it not only provides financial protection but also promotes empowerment and inclusion. As the industry continues to innovate and overcome challenges, the vision of a world where everyone is safeguarded against life's uncertainties becomes increasingly attainable.

Take Action Today: If you or someone you know could benefit from microinsurance, explore available options and consider enrolling in a plan that suits your needs. Share this article to spread awareness and help build a more secure and inclusive future for all.

Frequently Asked Questions (FAQ)

What is the difference between microinsurance and traditional insurance?

Microinsurance is specifically designed for low-income individuals, offering simplified, low-cost coverage with minimal premiums and straightforward processes. Traditional insurance typically involves higher premiums, comprehensive coverage, and more extensive eligibility requirements.

Who can benefit from microinsurance?

Microinsurance benefits a wide range of individuals, especially those in low-income communities, rural areas, informal sectors, and vulnerable populations such as women and small-scale farmers.

How can I enroll in a microinsurance plan?

Enrollment processes vary by provider but generally involve contacting a microinsurance provider through their distribution channels, such as microfinance institutions, mobile platforms, or community organizations. Ensure you understand the coverage and terms before signing up.

Are microinsurance claims easy to process?

Many microinsurance providers utilize technology to streamline the claims process, making it faster and more efficient. However, the ease of processing can depend on the provider and the specific product.

Can microinsurance cover multiple risks?

Yes, microinsurance products can be tailored to cover various risks, including health, life, property, and income loss. Some providers offer bundled packages to address multiple needs simultaneously.

Finance & Investment

View All

June 12, 2025

Finance Tires Pay Later Options ReviewedGo beyond keywords! Craft expert SEO content that builds authority (E-E-A-T), satisfies user intent, and ranks high on Google.

Ellie Moore

May 2, 2025

New Car Finance Rates GuideUnlock higher rankings and engaged readers with expert SEO content. Learn to create authoritative, trustworthy content that Google and users love.

Ellie Moore

November 23, 2024

7 Ways to Prepare Financially for a RecessionRecession-proof your finances with these 7 essential strategies! Learn how to prepare for economic downturns, protect your assets, and navigate financial challenges. Start building resilience today!

Ellie Moore

May 5, 2025

Proceed Finance Loan OptionsGo beyond keywords! Craft expert SEO content that builds authority, earns trust, and ranks high. Master E-E-A-T for online visibility.

Ellie Moore

January 15, 2025

The Journal of Finance HighlightsElevate your online presence with expert SEO content. Create valuable, user-centric material that ranks high and builds trust with readers and Google.

Ellie Moore

April 18, 2025

Power Finance Texas Review for LocalsMaster expert SEO content strategy. Blend compelling writing with SEO science, focusing on user intent, keywords, and quality to rank high & deliver value.

Ellie Moore

Insurance

View AllFind out why marine insurance is vital for protecting cargo, vessels, and shipping operations in international trade.

Ellie Moore

Why are millennials delaying life insurance? Explore the trends and factors influencing their decisions.

Ellie Moore

Discover how return of premium life insurance works and whether it’s the right choice for you. Understand the benefits and costs!

Ellie Moore

Discover how insurance policies have evolved over time to meet changing needs, from early models to modern-day coverage.

Ellie Moore

Learn how gig workers can protect themselves with insurance solutions designed for freelance and flexible work.

Ellie Moore

Explore how life insurance doubles as an investment tool. Learn about cash value policies and long-term financial benefits.

Ellie Moore

Education

View AllIs a college degree still worth it? Dive into a detailed analysis of the ROI on higher education, including costs, benefits, and future prospects.

Read MoreDiscover why liberal arts education remains valuable in today’s tech-driven world. Explore how it fosters critical thinking and adaptability.

Read MoreSocial skills training is key for kids with autism. Learn practical strategies to improve social interaction and communication in children with ASD.

Read MoreHow does social media affect learning and behavior? Uncover the positive and negative effects of social platforms on students today.

Read MoreRevive ancient teaching with the Socratic method! Learn how this questioning approach encourages deep thinking and active learning.

Read MoreArts education is key to fostering creativity. Learn why it’s important in schools and how it helps students develop essential life skills.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 3, 2025

Best Automotive Polishing Compound For Shine

Transform your car's paint! Discover how to use automotive polishing compounds to eliminate defects & achieve a brilliant, mirror-like shine.

September 13, 2025

Main Street Automotive Where Service Matters

Experience car care where service truly matters. Main Street Automotive combines expertise, transparency, & trust for your peace of mind.

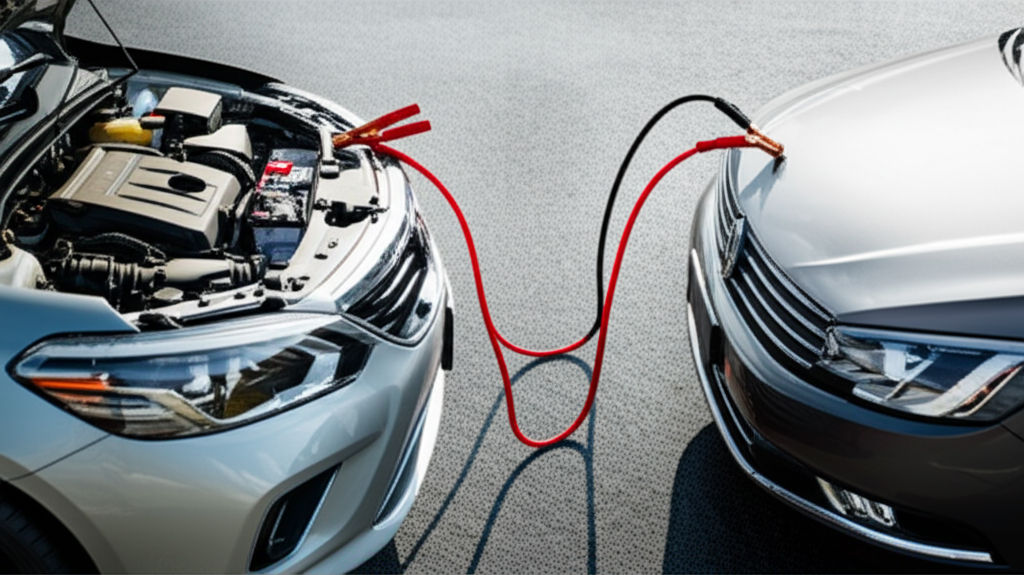

July 11, 2025

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

July 26, 2025

Five Star Automotive Service Reviews And Ratings

Discover why 5-star auto service reviews are crucial. They build trust, guide consumer decisions, and drive growth for top-tier repair shops.

September 8, 2025

Excel Automotive Gets Your Car Back On Track

Get your car back on track with Excel Automotive! Expert diagnosis, repair & maintenance for all common issues. Drive confidently again.

September 4, 2025

Top Automotive Posters For Garage Decor

Revamp your garage! Discover how automotive posters transform your space into a personalized sanctuary, reflecting your passion for cars & speed.