Why You Need Cybersecurity Insurance Today

Ellie Moore

Photo: Why You Need Cybersecurity Insurance Today

Why You Need Cybersecurity Insurance Today

In today’s digital world, data breaches, cyberattacks, and online fraud are growing concerns for individuals, businesses, and organizations alike. With the rise in cyber threats, it’s no longer enough to have just basic IT protections in place. Cybersecurity insurance has become a must-have for anyone who uses the internet for work or personal purposes. But why is cybersecurity insurance more critical than ever? In this article, we’ll explore why you need cybersecurity insurance today and how it can protect your assets, reputation, and peace of mind.

What is Cybersecurity Insurance?

Cybersecurity insurance, also known as cyber insurance or cyber liability insurance, is designed to help businesses and individuals recover from cyberattacks, data breaches, and other technology-related incidents. It provides financial protection in the event of a cyberattack, helping cover the costs of legal fees, data recovery, system repairs, business interruption, and even public relations efforts to restore your reputation.

As cybercriminals become more sophisticated, insurance companies have adapted by offering policies tailored to the modern risks associated with digital operations. This type of coverage can be crucial for mitigating the financial fallout of a cyberattack, especially for small and medium-sized businesses (SMBs) that may not have the resources to recover on their own.

The Rising Threat of Cyberattacks

The increasing frequency and complexity of cyberattacks should be a wake-up call for everyone. According to a report by Cybersecurity Ventures, cybercrime is predicted to cost the world $10.5 trillion annually by 2025. This statistic highlights the scale and financial damage these crimes can inflict, underscoring the urgent need for cybersecurity insurance.

Cyberattacks come in many forms, including:

- Phishing attacks: Fraudulent attempts to gain sensitive information by disguising as a trustworthy entity.

- Ransomware: Malicious software that encrypts a company’s data and demands payment for the decryption key.

- Data breaches: Unauthorized access to sensitive data, often for criminal purposes.

- Denial-of-Service (DoS) attacks: Disrupting the normal operation of a network, rendering services unavailable.

The variety of cyber threats means that any business, regardless of size, could be vulnerable to a costly attack. Cybersecurity insurance acts as a safety net, ensuring that you’re prepared to handle the financial consequences if and when the worst happens.

The Financial Impact of Cyberattacks

The financial toll of a cyberattack can be overwhelming. In addition to direct costs like ransom payments or legal fees, businesses often face reputational damage and loss of customer trust, both of which can take years to rebuild.

Let’s break down some common costs associated with a cyberattack:

- Ransom Payments: In cases of ransomware attacks, the ransom fee can be substantial. The average ransom payment in 2022 was $140,000, with some high-profile attacks seeing ransom demands in the millions.

- Legal Fees and Regulatory Fines: Companies may face lawsuits from customers whose data was compromised or fines for failing to comply with data protection regulations like GDPR.

- Data Recovery and System Repairs: Restoring systems and recovering lost data is expensive, especially if the attack caused widespread damage.

- Reputational Damage: Rebuilding trust with customers and partners after a breach can take years and may result in a permanent loss of clients.

For businesses that operate entirely online or rely on digital systems for daily operations, the financial risk is even higher. Without cybersecurity insurance, these costs could threaten the very existence of a company.

Key Benefits of Cybersecurity Insurance

There’s no doubt that cybersecurity insurance provides significant advantages. Here are some of the key benefits that make it an essential investment for businesses today:

1. Financial Protection

Cybersecurity insurance offers critical financial protection in the event of a cyberattack. The policy can cover a wide range of costs, including:

- Investigation and forensic analysis to identify the source of the breach.

- Data restoration and system repair expenses.

- Legal costs for defending against lawsuits and regulatory fines.

- Crisis management and PR services to manage reputational damage.

2. Mitigating the Risk of Downtime

A cyberattack can cripple your business operations, often causing significant downtime. The longer your systems are down, the more revenue you lose. Cybersecurity insurance can help cover the costs of business interruption and enable you to get back on track quickly.

3. Compliance with Regulations

In many industries, compliance with data protection laws and regulations is mandatory. Cybersecurity insurance can help ensure you meet legal requirements and avoid penalties related to data breaches. It can also help businesses implement best practices for cybersecurity, further protecting against potential threats.

4. Peace of Mind

Knowing that you have cybersecurity insurance in place can provide peace of mind. You’ll be able to focus on running your business or managing your personal online presence, knowing that you’re covered in case of a cyberattack.

How to Choose the Right Cybersecurity Insurance Policy

With the growing demand for cybersecurity insurance, choosing the right policy can feel overwhelming. Here are some tips to help you make the best decision for your needs:

1. Assess Your Risk

Start by assessing your risk. What type of data do you handle? Are you storing sensitive information like customer credit card details or personal health data? The more critical and valuable your data, the higher your risk. Tailoring your policy to your specific needs is essential for ensuring comprehensive coverage.

2. Understand the Coverage Options

Cybersecurity insurance policies can vary widely in terms of coverage. Look for a policy that covers both first-party and third-party risks:

- First-party coverage: Covers your company’s own losses, such as data recovery and business interruption costs.

- Third-party coverage: Covers the costs of claims made by customers or other businesses who were affected by your breach.

3. Consider Policy Limits and Deductibles

Make sure to review the policy limits and deductibles. Some policies may have low coverage limits, which could leave your business exposed in the event of a large-scale attack. Look for policies with limits that reflect the size and complexity of your operations.

4. Evaluate Your Provider’s Reputation

Just like with any type of insurance, it’s crucial to choose a reputable insurance provider. Check reviews and ask for references to make sure the provider has a solid history of responding to claims quickly and efficiently.

Real-Life Examples: Cybersecurity Insurance in Action

Let’s look at some real-life examples of businesses that benefited from having cybersecurity insurance:

Example 1: The Ransomware Attack on a Healthcare Provider

A healthcare provider in the U.S. was hit with a ransomware attack that encrypted their patient records. The cost of restoring the data, paying the ransom, and dealing with regulatory fines amounted to millions of dollars. Thankfully, the provider had cybersecurity insurance, which covered most of the expenses. The insurance helped them avoid going out of business and ensured patient records were restored.

Example 2: A Small E-Commerce Business Victim of a Data Breach

A small e-commerce company experienced a data breach when hackers gained access to their customer payment information. The company was hit with lawsuits and fines, but their cybersecurity insurance covered legal fees, fines, and the cost of notifying customers. The insurance helped the company recover quickly and maintain customer trust.

Conclusion

Cybersecurity insurance is no longer a luxury it’s a necessity. The digital age brings with it numerous opportunities, but it also exposes us to unprecedented risks. Cyberattacks are on the rise, and without proper protection, the consequences can be devastating. Cybersecurity insurance provides essential financial protection, mitigates risks, and gives you peace of mind, ensuring that your business or personal online activities remain secure.

Don’t wait until it’s too late invest in cybersecurity insurance today to safeguard your future.

FAQ: Cybersecurity Insurance

Q: How much does cybersecurity insurance cost?

A: The cost of cybersecurity insurance depends on several factors, including the size of your business, the type of coverage you need, and the level of risk. On average, small businesses can expect to pay between $500 to $1,500 annually for a basic policy.

Q: Is cybersecurity insurance only for businesses?

A: While businesses are the most common policyholders, individuals who store sensitive personal data online may also benefit from cybersecurity insurance.

Q: Does cybersecurity insurance cover all types of cyberattacks?

A: Most policies cover a wide range of cyberattacks, but it's essential to review your policy to ensure that it includes coverage for the types of risks you face.

Q: How can I reduce my cybersecurity insurance premium?

A: You can reduce your premium by implementing strong cybersecurity measures such as firewalls, encryption, and regular system updates. Some insurers offer discounts for businesses that show proactive security measures.

Finance & Investment

View All

March 21, 2025

Kia Finance Phone Number and Quick SupportUnlock top rankings with expert SEO content. Learn how E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) creates valuable, people-first conten...

Ellie Moore

June 1, 2025

AI Finance Trends Shaping 2025Stand out online! Discover how expert SEO content, focused on E-E-A-T & value, drives higher rankings, organic traffic, and builds brand authority.

Ellie Moore

January 9, 2025

Best Ford Finance Offers 2025Elevate your rankings with expert SEO content. Learn how E-E-A-T drives authority, trust, and traffic by delivering genuine value, not just keywords.

Ellie Moore

October 26, 2025

Vanderbilt Mortgage Finance ReviewCreate expert SEO content that ranks! Learn E-E-A-T to build trust, authority, and drive traffic with valuable, Google-loved content.

Ellie Moore

October 6, 2025

Baby Boy Names Meaning WealthGo beyond keywords! Create expert SEO content that ranks high, satisfies E-E-A-T, and genuinely helps your audience. Get actionable strategies.

Ellie Moore

April 18, 2025

Power Finance Loans You Can TrustGo beyond "good enough." Master expert SEO content to rank higher, build authority, and deeply engage your audience with E-E-A-T principles.

Ellie Moore

Insurance

View AllPolicyholders & risk managers: Navigate life insurance with confidence. Find essential coverage to safeguard your financial legacy and ensure peace of mind.

Ellie Moore

Understand the differences between HMO, PPO, and EPO health insurance networks. Pick the plan that suits your needs best!

Ellie Moore

Understand the legal side of insurance with this guide to policy exclusions. Learn what’s not covered and why it matters.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Protect your property from natural disasters. Find out what’s included in insurance policies for floods, earthquakes, and more!

Ellie Moore

Follow this simple step-by-step guide to filing an insurance claim successfully. Avoid mistakes and get the coverage you need.

Ellie Moore

Education

View AllLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreArts education is key to fostering creativity. Learn why it’s important in schools and how it helps students develop essential life skills.

Read MoreLearn how UNESCO promotes education for all globally. Explore key initiatives and efforts aimed at fostering equal learning opportunities for everyone.

Read MoreDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MoreLearn how gamification is transforming modern classrooms. Explore fun, interactive strategies that boost engagement and learning outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

January 31, 2025

Top Tips for Restoring Classic Cars Like a Pro

Want to restore a classic car? Get expert tips and tricks for a flawless restoration. Discover how to bring vintage beauties back to life!

July 16, 2025

Explore Exciting Cox Automotive Jobs Opportunities

Drive your career forward with Cox Automotive! Explore diverse job opportunities shaping the future of mobility through innovation and technology.

August 8, 2025

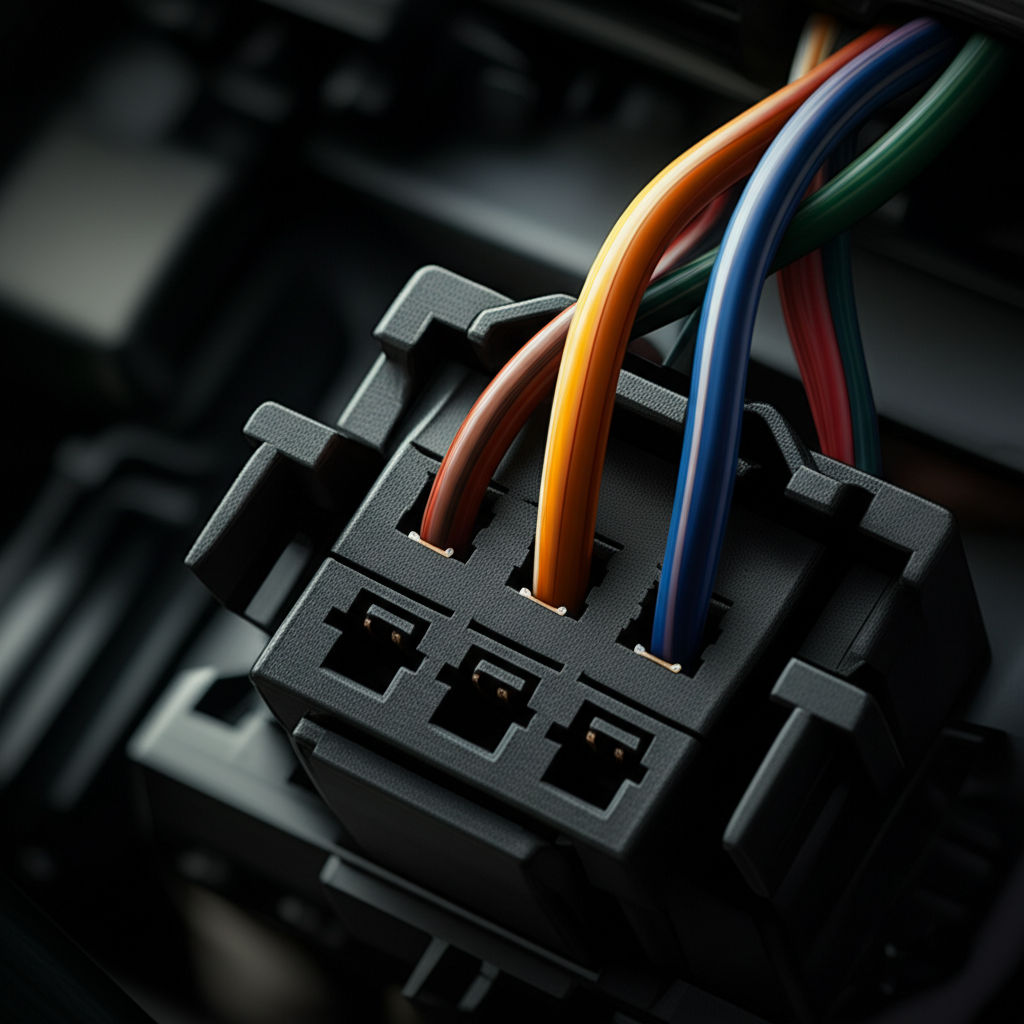

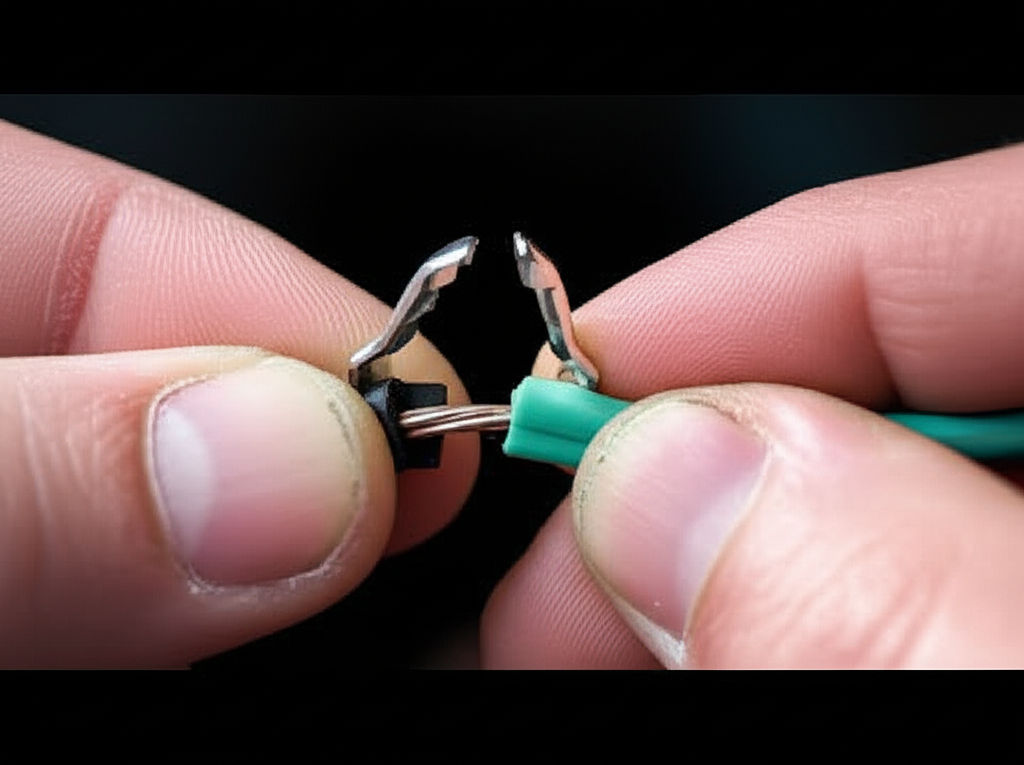

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

August 12, 2025

Thomas Automotive Repairs With A Personal Touch

Thomas Automotive: Expert auto repair with a personal touch. We build trust through clear communication & genuine care, not just fix cars.

August 19, 2025

How To Use Automotive Wire Connectors Safely

Master automotive wire connectors for safe, reliable, and high-performance vehicle electrical systems. Avoid hazards & ensure peace of mind!

August 16, 2025

Where To Find Automotive Mechanic Jobs Today

Unlock a rewarding auto mechanic career! Discover high-demand jobs in a rapidly evolving, high-tech automotive industry. Your guide to success.