Insurance for Freelancers: What You Need

Ellie Moore

Photo: Insurance for Freelancers: What You Need

Insurance for Freelancers: What You Need

Freelancing offers unparalleled flexibility and autonomy, allowing individuals to craft careers that align with their passions and lifestyles. However, this freedom comes with its own set of challenges, particularly when it comes to managing risks and ensuring financial stability. One critical aspect often overlooked by freelancers is insurance. Understanding and securing the right insurance coverage is essential to protect your business, health, and personal assets. In this comprehensive guide, we delve into the insurance for freelancers landscape, providing you with the knowledge and tools to make informed decisions.

Understanding Freelancer Insurance

What is Freelancer Insurance?

Freelancer insurance refers to a range of insurance policies tailored to the unique needs of self-employed professionals. Unlike traditional employees who typically receive benefits through their employers, freelancers must independently secure coverage to safeguard against various risks associated with their work.

Why It's Essential for Freelancers

Without the safety net of employer-provided insurance, freelancers are exposed to potential financial hardships stemming from health issues, accidents, liability claims, and other unforeseen events. Insurance provides peace of mind, allowing you to focus on your work without constantly worrying about possible setbacks.

Types of Insurance for Freelancers

Navigating the world of insurance can be daunting, especially with the myriad of options available. Here’s a breakdown of the essential types of insurance for freelancers:

1. Health Insurance

Health insurance for freelancers is crucial as it covers medical expenses, including doctor visits, hospital stays, and prescription medications. Without employer-sponsored plans, freelancers must seek individual policies or join marketplace plans to ensure they have adequate health coverage.

2. Liability Insurance

Liability insurance protects freelancers from legal claims related to their work. Whether it's accidental damage to a client's property or allegations of negligence, liability insurance covers legal fees and potential settlements, safeguarding your personal and business assets.

3. Professional Indemnity Insurance

Also known as errors and omissions insurance, professional indemnity insurance covers claims arising from mistakes or omissions in your professional services. For instance, if a client alleges that your work caused them financial loss, this insurance can cover legal defense costs and any settlements.

4. Disability Insurance

Disability insurance provides income replacement if you're unable to work due to illness or injury. For freelancers, who lack employer-sponsored disability benefits, this coverage ensures financial stability during periods of incapacity.

5. Equipment Insurance

Freelancers often rely on essential equipment such as laptops, cameras, or specialized tools. Equipment insurance covers the repair or replacement costs if your gear is damaged, lost, or stolen, ensuring you can continue your work without significant interruptions.

6. Business Owner's Policy (BOP)

A Business Owner's Policy combines various types of coverage into a single package, typically including property, liability, and business interruption insurance. This comprehensive coverage is ideal for freelancers looking to streamline their insurance needs.

Assessing Your Insurance Needs

Evaluating Risks Specific to Freelancing

Every freelancer faces unique risks based on their industry, clientele, and work environment. To determine the appropriate insurance coverage, consider the following:

- Nature of Work: Are you providing consulting services, creative work, or technical solutions?

- Clientele: Do you work with high-profile clients or small businesses?

- Work Environment: Do you operate from home, a co-working space, or on-site locations?

Determining Necessary Coverage

Once you've identified potential risks, assess which types of insurance are essential for your specific situation. For example, a freelance graphic designer might prioritize equipment insurance and professional indemnity insurance, while a freelance writer might focus more on liability and health insurance.

How to Choose the Right Insurance for Freelancers

Factors to Consider

When selecting insurance policies, consider the following factors to ensure you choose the best coverage for your needs:

- Coverage Limits: Ensure the policy provides sufficient coverage for potential risks.

- Premiums: Balance the cost of premiums with the level of coverage offered.

- Exclusions: Understand what is not covered to avoid unexpected gaps.

- Reputation of the Insurer: Choose reputable insurers known for reliable customer service and claims handling.

Comparing Providers

Research and compare multiple insurance providers to find the best fit. Look for reviews, compare quotes, and consult with insurance advisors if necessary. Websites and platforms that specialize in freelancer insurance can offer tailored solutions and competitive pricing.

Practical Tips for Managing Insurance as a Freelancer

1. Budgeting for Insurance

Incorporate insurance premiums into your monthly budget to ensure you can afford the coverage without financial strain. Consider setting aside a specific amount each month dedicated to insurance expenses.

2. Bundling Policies

Many insurers offer discounts when you bundle multiple policies together. For instance, combining health insurance with liability insurance can reduce your overall premiums while providing comprehensive coverage.

3. Regularly Reviewing Coverage

As your freelance business grows and evolves, so do your insurance needs. Regularly review and update your policies to ensure they align with your current business operations and risk profile.

4. Understanding Policy Terms

Take the time to thoroughly understand the terms and conditions of your insurance policies. Being aware of coverage limits, exclusions, and claim processes can prevent complications when you need to file a claim.

Real-Life Example: The Importance of Insurance for Freelancers

Consider Jane, a freelance web developer who lost her primary laptop to theft. Fortunately, she had equipment insurance, which covered the replacement cost, allowing her to resume work without significant downtime. Additionally, when a client alleged that a bug in her code caused their website to crash, her professional indemnity insurance covered the legal fees, preventing a potentially crippling financial burden. Jane's proactive approach to securing the right insurance policies exemplifies how insurance for freelancers can provide essential protection and peace of mind.

Frequently Asked Questions (FAQ)

1. Do I really need insurance as a freelancer?

Yes, insurance is crucial for freelancers to protect against various risks that can lead to significant financial losses. It provides a safety net, ensuring that unexpected events do not derail your business or personal finances.

2. How much does freelancer insurance cost?

The cost varies based on factors such as the type of coverage, coverage limits, your industry, and the insurance provider. It's advisable to obtain quotes from multiple insurers to find a plan that fits your budget and needs.

3. Can I get multiple types of insurance from one provider?

Many insurance companies offer bundled policies that combine different types of coverage, which can often lead to discounts and simplified management of your insurance needs.

4. Is professional indemnity insurance necessary for all freelancers?

While not mandatory, professional indemnity insurance is highly recommended, especially for freelancers who provide specialized services or advice. It protects against claims of negligence or mistakes in your professional work.

5. How can I lower my insurance premiums?

You can lower premiums by bundling multiple policies, increasing deductibles, maintaining a good credit score, and implementing risk-reduction measures in your business operations.

Conclusion

Navigating the world of insurance for freelancers can seem overwhelming, but securing the right coverage is a vital step in safeguarding your business and personal well-being. By understanding the different types of insurance available, assessing your specific needs, and choosing the right policies, you can mitigate risks and focus on what you do best growing your freelance career.

Are you a freelancer looking to protect your business? Take action today by evaluating your insurance needs and exploring the best coverage options available. Share your experiences in the comments below, or reach out to fellow freelancers to discuss the insurance strategies that have worked for you. Together, we can build a resilient and secure freelance community.

Finance & Investment

View All

October 20, 2025

Honest Mariner Finance Reviews 2025Unlock organic growth with expert SEO content. Learn to create high-value, E-E-A-T driven content that ranks higher and truly engages your audience.

Ellie Moore

October 18, 2025

Jeep 0 Percent Financing for 72 MonthsElevate your brand with expert SEO content. Rank higher, build authority, and drive traffic by creating valuable, trustworthy information.

Ellie Moore

January 6, 2025

Exploring Finance on YahooMaster expert SEO content to build online authority. Learn to create valuable, credible material that boosts rankings, engagement, and satisfies search engines...

Ellie Moore

May 7, 2025

What Is Finance and Why It MattersUnlock higher rankings and engaged readers with expert SEO content. Discover how to create E-E-A-T-focused content Google prioritizes for success.

Ellie Moore

January 19, 2025

Minnesota Housing Finance Agency GuideUnlock online success with expert SEO content. Learn why valuable, authoritative content boosts rankings, traffic, trust, and conversions. Master E-E-A-T.

Ellie Moore

November 28, 2024

Retirement Savings by Age: Are You on Track?Are your retirement savings on track? Discover the recommended savings milestones by age. Learn how to assess your progress and make adjustments. Secure your financial future!

Ellie Moore

Insurance

View AllLearn how liability insurance shields businesses from financial risks and legal challenges. Secure your company's future today!

Ellie Moore

Explore the vital role actuaries play in risk management, pricing, and shaping the future of insurance policies.

Ellie Moore

Enhance your coverage with insurance riders. Learn about their types, benefits, and why they’re crucial for customizing policies.

Ellie Moore

Discover how parametric insurance uses data to quickly respond to natural disasters and protect assets.

Ellie Moore

Discover how return of premium life insurance works and whether it’s the right choice for you. Understand the benefits and costs!

Ellie Moore

Protect your property from natural disasters. Find out what’s included in insurance policies for floods, earthquakes, and more!

Ellie Moore

Education

View AllProject-based learning engages students by tackling real-world problems. Learn how this approach fosters critical thinking and creativity.

Read MoreTake learning beyond the textbook with experiential education. Discover how real-world experiences create lasting knowledge and skills.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreSocial skills training is key for kids with autism. Learn practical strategies to improve social interaction and communication in children with ASD.

Read MoreLearn key strategies for creating inclusive classrooms. Discover how to foster equality, engagement, and a sense of belonging for every student.

Read MoreDiscover how AI-powered personalized learning is reshaping education. Learn how smart tech tailors content to fit individual student needs.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 9, 2025

Exclusive Automotive Service For Premium Cars

Discover why exclusive automotive service is essential for your premium car. Protect your investment, maintain peak performance, and ensure specialized care.

July 14, 2025

What Makes True Automotive Stand Out In The Market

What defines True Automotive excellence? It's customer trust, transparency, and expert service. Learn to spot leaders who prioritize you.

August 8, 2025

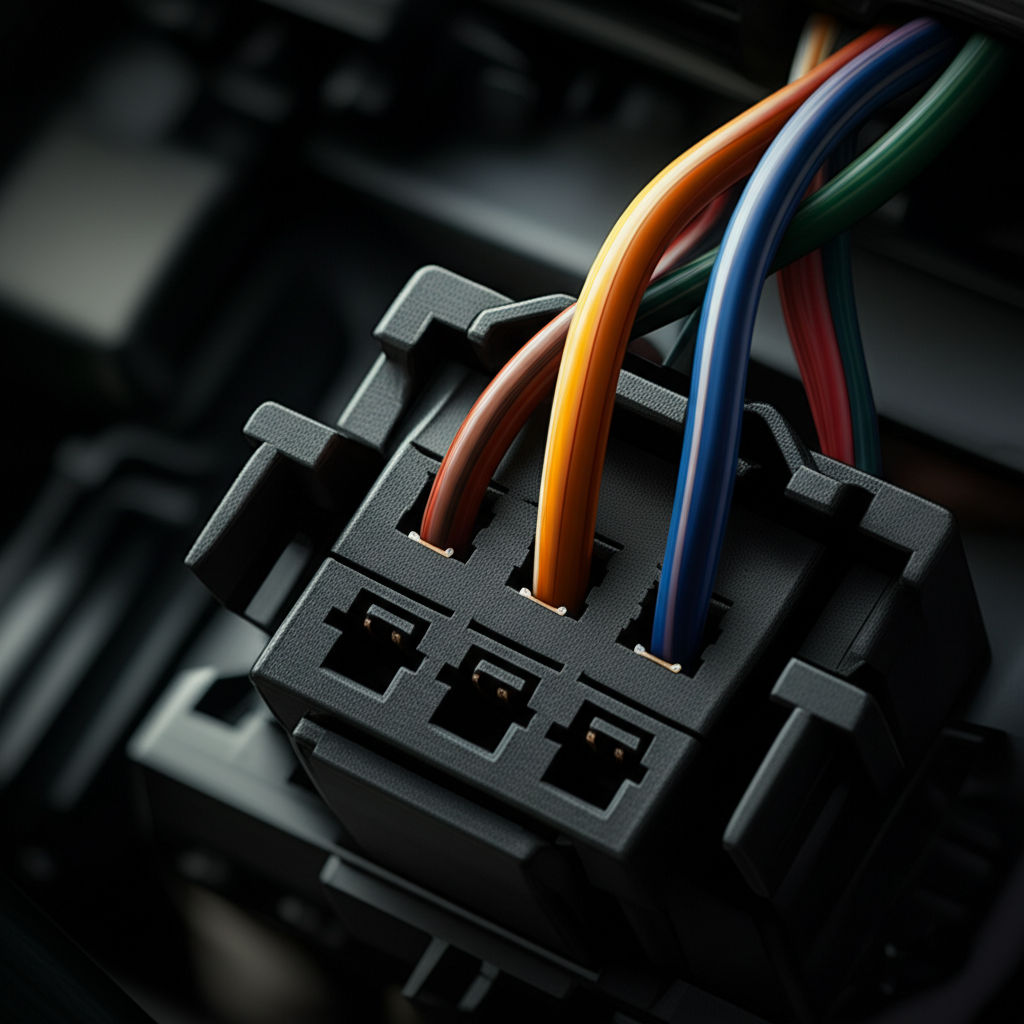

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

August 3, 2025

Choosing The Best Automotive Spray Gun For Jobs

Achieve a flawless finish! Our guide helps you choose the perfect automotive spray gun, covering HVLP, RP, and LVLP types for pro results.

September 8, 2025

Direct Automotive Services Done Right

Get convenient, quality car care at your location! This guide helps you choose reliable direct automotive services for hassle-free vehicle maintenance.

February 6, 2025

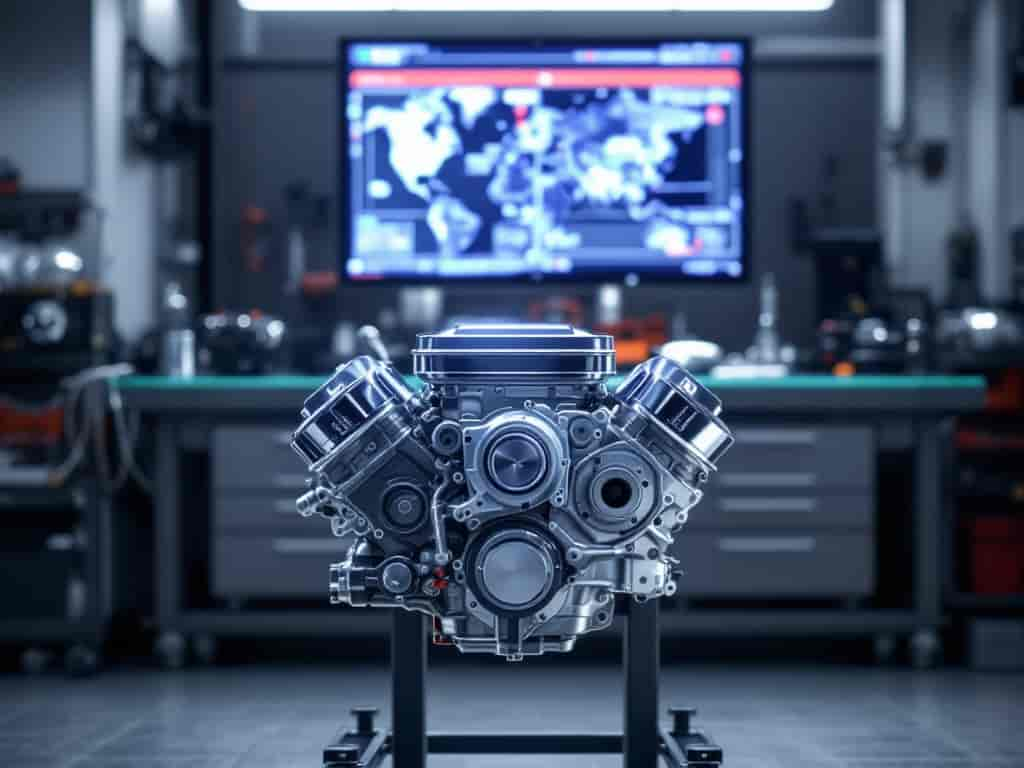

Performance Upgrades: Power Meets Reliability

Boost your car’s performance while ensuring reliability. Learn key upgrades that balance speed, power, and safety for optimal driving.