Choosing the Best Brokerage Account Made Simple

Ellie Moore

Photo: Choosing the Best Brokerage Account Made Simple

Choosing the Best Brokerage Account Made Simple: A Comprehensive Guide

Investing is no longer an exclusive club for seasoned traders or financial experts. Today, anyone with a goal to grow their wealth can dive into the world of investing. However, the first step choosing the right brokerage account can feel overwhelming. With so many options, features, and fees, where do you even begin? Let’s break it down and simplify the process.

What Is a Brokerage Account and Why Do You Need One?

A brokerage account is a financial account that allows you to buy, sell, and hold investments such as stocks, bonds, ETFs, mutual funds, and more. Whether you're saving for retirement, building wealth, or exploring new income streams, a brokerage account is your gateway to the investment world.

Key Benefits of a Brokerage Account:

- Access to various investment options.

- Potential for higher returns compared to savings accounts.

- Tools and resources to manage your financial future.

Factors to Consider When Choosing a Brokerage Account

To find the best brokerage account for your needs, focus on these essential factors:

1. Fees and Commissions

Brokerage fees can significantly impact your investment returns over time. While many platforms now offer commission-free trading on stocks and ETFs, other fees may still apply. Look out for:

- Account Maintenance Fees: Some brokers charge monthly or annual fees.

- Trading Fees: Costs for executing trades in less common investments like mutual funds or bonds.

- Withdrawal Fees: Charges for transferring money out of your account.

Pro Tip: Opt for a brokerage with transparent pricing and minimal fees, especially if you’re just starting.

2. Investment Options

The right brokerage should offer access to the types of investments you’re interested in. Common choices include:

- Stocks: Great for long-term growth.

- Exchange-Traded Funds (ETFs): A diversified and cost-effective option.

- Mutual Funds: Ideal for hands-off investors.

- Options and Futures: Suitable for advanced strategies.

3. Account Types

Different brokerage accounts cater to unique goals:

- Individual Taxable Accounts: Flexible and perfect for general investing.

- Retirement Accounts (IRAs): Tax-advantaged accounts for long-term savings.

- Margin Accounts: Allow borrowing money for trading but come with higher risk.

Choose based on your financial objectives and investment horizon.

4. Platform Usability

A user-friendly interface can make or break your investment experience. Test the platform’s:

- Ease of navigation.

- Availability of research tools.

- Mobile app performance.

Many brokers offer demo accounts take advantage of these before committing.

5. Customer Support

Investing can be intimidating, especially for beginners. Reliable customer service ensures you have help when needed. Look for:

- 24/7 support availability.

- Multiple channels like chat, phone, and email.

- Educational resources or webinars.

Top Brokerage Accounts for Every Investor

To help you narrow down your choices, here’s a comparison of some popular brokerage accounts:

| Broker | Best For | Fees | Highlights |

|---|---|---|---|

| Robinhood | Beginners | $0 commission | Easy-to-use app, no account fees. |

| Fidelity | Retirement investing | $0 commissions | Great IRA options, robust research. |

| Charles Schwab | Comprehensive services | $0 commissions | Extensive resources, no minimums. |

| E*TRADE | Active traders | $0 commissions | Advanced tools, customizable charts. |

| Vanguard | Long-term investors | Low mutual fund fees | Known for index fund options. |

How to Open a Brokerage Account: Step-by-Step Guide

- Determine Your Investment Goals: Understand why you’re investing retirement, short-term gains, or long-term growth.

- Research and Compare Brokers: Use the factors outlined above to compare options.

- Complete the Application Process:

- Provide personal information (SSN, address, employment details).

- Choose the type of account (individual, joint, or retirement).

- Fund Your Account: Transfer money through bank accounts or wire transfers.

- Start Investing: Use the broker’s tools to research and place your first trade.

Common Mistakes to Avoid

- Ignoring Fees: Small fees add up over time, eroding your profits.

- Overlooking Support: Beginners need access to help and resources.

- Investing Without Research: Blindly following trends can lead to losses.

FAQs About Choosing the Best Brokerage Account

1. What’s the difference between a full-service broker and a discount broker?

- Full-Service Broker: Offers personalized advice and wealth management, ideal for high-net-worth individuals.

- Discount Broker: Focuses on low-cost trading, perfect for self-directed investors.

2. Can I have multiple brokerage accounts?

Yes! Having multiple accounts allows you to diversify investments or separate goals (e.g., retirement vs. short-term trading).

3. What’s the minimum amount required to start?

Many brokers have no minimum deposit requirements, but certain accounts like margin accounts may need a specific balance.

Final Thoughts: Start Your Investment Journey Today

Choosing the best brokerage account doesn’t have to be daunting. By understanding your goals, comparing features, and staying informed, you can confidently select the platform that aligns with your needs. Remember, the right account is more than just a tool it’s your partner in achieving financial success.

Ready to take the next step? Share your thoughts in the comments, or explore our in-depth guides to mastering the world of investing!

Finance & Investment

View All

November 27, 2025

Yahoo Finance Stock Market Guide 2025Unlock online authority & visibility with expert SEO content. Create high-value, E-E-A-T-driven content that builds trust, meets user intent, and ranks.

Ellie Moore

June 12, 2025

GM Finance Plans That Help You Save MoreUnlock top search rankings with expert SEO content. Discover how to craft valuable, E-E-A-T-driven content that captivates users and algorithms.

Ellie Moore

April 8, 2025

Public vs. Private Equity: Key Differences ExplainedCompare public and private equity investing. Learn how each works and which aligns better with your investment goals and risk tolerance.

Ellie Moore

November 11, 2025

Continental Finance Credit Card InfoCrafting Expert SEO Content: Your Guide to Higher Rankings and Engaged Readers In the ever-evolving world of digital marketing, simply stuffing keywords into an...

Ellie Moore

October 7, 2025

BTC Yahoo Finance Live TrackerGo beyond keywords! Discover expert SEO content that builds authority, earns trust, and ranks high. Master content that truly engages your audience.

Ellie Moore

July 7, 2025

FHA Financing Options for BuyersUnlock digital visibility with expert SEO content. Learn how to rank higher, attract traffic, and build authority by satisfying both users and search engines.

Ellie Moore

Insurance

View AllUnlock the secrets to getting cheap auto insurance fast! Our guide helps you find the best rates and reliable coverage, turning a daunting task into a financial...

Ellie Moore

Find optimal premium car insurance quotes online. This guide helps policyholders, agents & risk managers compare rates for robust, high-value coverage.

Ellie Moore

Discover how microinsurance provides affordable coverage solutions for underserved populations worldwide.

Ellie Moore

Stay safe with these tips to identify and avoid common insurance scams. Protect yourself from fraud and make informed decisions.

Ellie Moore

Secure lifelong financial stability with Complete Whole Life Insurance. Discover guaranteed growth, comprehensive protection, and accessible cash value for your...

Ellie Moore

Safeguard your rental assets with Lemonade Renters Insurance. Get smart, comprehensive, and affordable coverage for ultimate peace of mind.

Ellie Moore

Education

View AllCompetency-based education focuses on mastery over seat time. Learn how this model is reshaping how we measure student success.

Read MoreExplore the ongoing debate on standardized testing. Learn its pros, cons, and whether it should remain a key part of education.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MorePlay is crucial in early learning! Discover how play-based learning enhances cognitive, emotional, and social development in young children.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 5, 2025

Top Automotive Swap Meets Near Me This Year

Unearth automotive treasures at vibrant swap meets! Find rare parts, classic cars, & connect with enthusiasts. Your guide to top events this year.

August 14, 2025

Are Brunt Boots Good For Automotive Work

Considering Brunt Boots for auto work? Discover if they meet the safety & comfort demands of mechanics, including EH, slip & toe protection.

September 1, 2025

Automotive Body Kits That Transform Your Car

Redefine your car's look & performance with automotive body kits. Explore components, installation, and how to create a unique masterpiece.

July 11, 2025

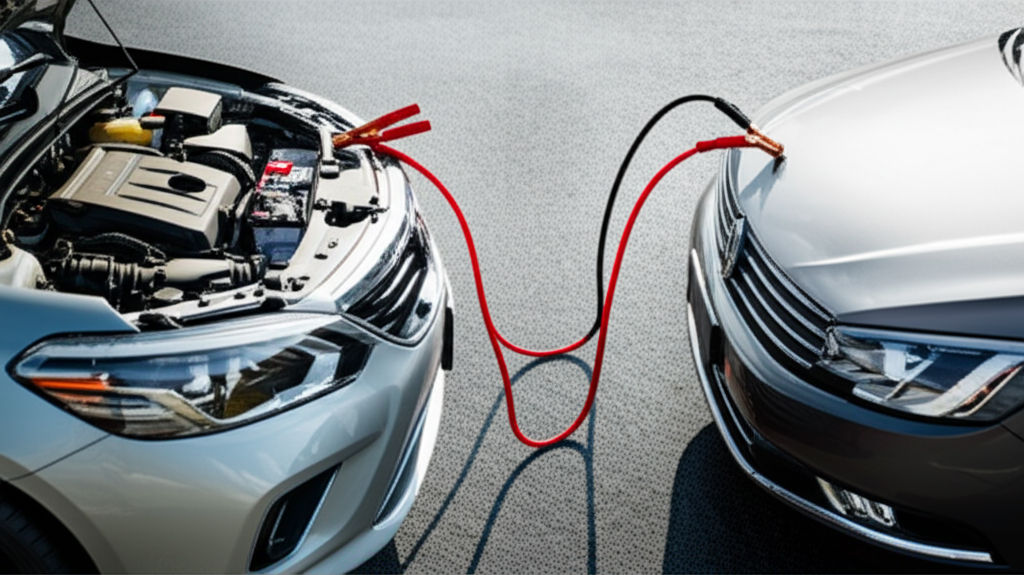

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

July 31, 2025

Understanding Automotive Components Holdings Value

Deep dive into the multi-trillion dollar automotive components market. Understand its value, growth, and why it's crucial for investors & enthusiasts.

July 22, 2025

How Automotive Flex Enhances Vehicle Performance

Beyond horsepower: explore automotive flex! This engineered balance of rigidity & movement is vital for your car's performance, handling & comfort.