Disability Insurance: Securing Your Income

Ellie Moore

Photo: Disability Insurance: Securing Your Income

Disability Insurance: Securing Your Income

In an unpredictable world, securing your income against unforeseen circumstances is paramount. Disability insurance emerges as a crucial safety net, ensuring that your financial stability remains intact even when life throws unexpected challenges your way. This comprehensive guide delves into the essence of disability insurance, offering actionable insights to help you make informed decisions about protecting your income.

What is Disability Insurance?

Disability insurance is a policy designed to replace a portion of your income if you become unable to work due to illness or injury. It serves as a financial cushion, covering essential expenses like mortgage payments, utilities, and daily living costs during periods of disability. Understanding the different types of disability insurance and how they function is key to selecting the right coverage for your needs.

Types of Disability Insurance

- Short-Term Disability Insurance

- Coverage Duration: Typically covers disabilities lasting from a few weeks up to six months.

- Best For: Temporary conditions like surgeries, childbirth, or minor injuries.

- Long-Term Disability Insurance

- Coverage Duration: Provides benefits for extended periods, often until retirement age or recovery.

- Best For: Severe illnesses, chronic conditions, or significant injuries that hinder long-term work capability.

- Individual Disability Insurance

- Coverage: Purchased independently, offering personalized coverage based on your specific needs.

- Best For: Self-employed individuals or those whose employers do not provide disability benefits.

- Employer-Sponsored Disability Insurance

- Coverage: Offered as part of employee benefits packages, often at group rates.

- Best For: Employees seeking additional financial security without the hassle of individual policies.

Why Disability Insurance is Essential

Life is inherently unpredictable. From accidents to illnesses, numerous factors can impede your ability to earn a living. Without a safety net, the financial strain can be overwhelming, leading to debt accumulation, depleted savings, and even the inability to meet basic living expenses. Disability insurance ensures that you continue to receive income, maintaining your lifestyle and financial commitments during challenging times.

Key Benefits of Disability Insurance

- Income Protection: Replaces a portion of your lost income, ensuring financial stability.

- Peace of Mind: Alleviates stress knowing you have a backup plan in place.

- Debt Coverage: Helps in managing existing debts and prevents additional borrowing.

- Flexibility: Various policy options allow customization based on individual needs.

How to Choose the Right Disability Insurance Policy

Selecting the appropriate disability insurance policy involves evaluating several factors to ensure comprehensive coverage tailored to your specific circumstances. Here’s a step-by-step guide to help you navigate the selection process:

1. Assess Your Financial Needs

- Monthly Expenses: Calculate your essential monthly costs, including housing, utilities, groceries, and transportation.

- Debt Obligations: Consider existing debts like mortgages, student loans, and credit card balances.

- Lifestyle Maintenance: Determine the amount needed to maintain your current standard of living.

2. Understand Policy Features

- Benefit Amount: Typically, policies replace 60-70% of your pre-disability income.

- Benefit Period: The duration for which benefits are paid, ranging from a few years to until retirement.

- Elimination Period: The waiting period before benefits commence, usually between 30 to 90 days.

3. Compare Policy Types

Evaluate the differences between short-term and long-term disability insurance to determine which aligns with your needs. Consider factors like job stability, health conditions, and financial obligations.

4. Evaluate Premium Costs

Premiums vary based on age, health, occupation, and coverage amount. Obtain quotes from multiple insurers to find a policy that offers comprehensive coverage at a reasonable cost.

5. Check Policy Exclusions

Understand what is not covered by the policy. Common exclusions include disabilities resulting from self-inflicted injuries, participation in high-risk activities, or pre-existing conditions.

Applying for Disability Insurance: A Step-by-Step Guide

Navigating the application process for disability insurance can be daunting. Here’s a streamlined approach to ensure a smooth experience:

1. Gather Necessary Documentation

- Medical Records: Provide detailed information about your health history and current conditions.

- Employment Details: Include job description, income details, and employment history.

- Personal Information: Supply identification documents and financial information.

2. Complete the Application

Fill out the application form accurately, ensuring all required fields are completed. Incomplete or inaccurate information can lead to delays or denial of benefits.

3. Undergo Medical Examination

Many insurers require a medical exam to assess your health status and determine eligibility. Be honest and thorough during the examination to avoid discrepancies.

4. Await Policy Approval

The insurer will review your application, medical records, and examination results. This process can take several weeks to months, depending on the complexity of your case.

5. Review the Policy

Once approved, carefully review the policy terms, coverage details, and any exclusions. Consult with a financial advisor or insurance agent if you have questions or need clarification.

Common Challenges and Solutions

Securing disability insurance can come with its set of challenges. Being aware of these obstacles and knowing how to address them can enhance your chances of obtaining the right coverage.

1. High Premium Costs

Solution:

- Increase Your Deductible: Opting for a higher elimination period can lower premium costs.

- Group Policies: If available, consider employer-sponsored plans which often have lower premiums.

- Healthy Lifestyle: Maintaining good health can lead to lower premiums and better coverage options.

2. Policy Denials

Solution:

- Thorough Documentation: Provide comprehensive medical and employment records.

- Professional Assistance: Hire a disability attorney or advocate to strengthen your application.

- Appeal Process: Familiarize yourself with the insurer’s appeal process and submit timely, well-documented appeals.

3. Understanding Policy Terms

Solution:

- Educate Yourself: Take time to understand key terms and conditions of the policy.

- Seek Expert Advice: Consult with insurance professionals to clarify any uncertainties.

- Read Reviews: Research the insurer’s reputation and customer feedback to gauge reliability.

Real-Life Example: John’s Story

John, a 35-year-old software engineer, decided to invest in a long-term disability insurance policy. Two years into his career, John was involved in a severe car accident, resulting in partial paralysis. Due to his disability, he was unable to continue his demanding job. His disability insurance kicked in, replacing 70% of his income. This financial support allowed John to focus on rehabilitation without the stress of meeting his monthly obligations. John's story underscores the importance of having robust disability coverage to navigate life’s unexpected turns.

Practical Tips for Maximizing Your Disability Insurance

To ensure you get the most out of your disability insurance policy, consider the following tips:

- Regularly Review Your Coverage: Life circumstances change, so periodically assess your policy to ensure it still meets your needs.

- Stay Informed: Keep abreast of any changes in insurance laws or policies that could affect your coverage.

- Maintain Good Health: A healthy lifestyle can not only lower your premiums but also improve your chances of qualifying for benefits.

- Understand Your Policy: Familiarize yourself with all aspects of your policy, including how to file claims and the documentation required.

Frequently Asked Questions (FAQ)

1. What qualifies as a disability for insurance purposes?

A disability is typically defined as a condition that prevents you from performing the essential duties of your occupation. The specific criteria vary by policy and insurer, so it’s important to review your policy details.

2. Can I have multiple disability insurance policies?

Yes, you can have multiple policies, such as employer-sponsored coverage combined with an individual policy. However, the total benefits usually won’t exceed 100% of your income.

3. How are disability insurance benefits taxed?

Generally, if you pay the premiums with after-tax dollars, the benefits are tax-free. However, if your employer pays the premiums or you pay with pre-tax dollars, the benefits may be taxable.

4. Can I change my disability insurance policy after purchasing it?

Some policies allow for modifications, such as increasing coverage or adding riders. It’s best to consult with your insurer or agent to understand the options available.

5. What happens if I return to work after receiving disability benefits?

Most policies require you to report any return to work. Benefits will typically cease once you resume your occupation, but some policies may offer partial benefits if you return to work part-time.

Conclusion: Take Action Today

Protecting your income through disability insurance is a proactive step towards financial security. By understanding the types of policies available, assessing your needs, and navigating the application process diligently, you can safeguard your financial future against unforeseen disabilities. Don’t wait until it’s too late evaluate your disability insurance options today and ensure that you and your loved ones remain financially stable, no matter what challenges arise.

Have questions or experiences with disability insurance? Share your thoughts in the comments below, and don’t forget to share this article with friends and family who might benefit from this essential information. For more insights on financial security and insurance options, explore our related articles here.

Finance & Investment

View All

July 14, 2025

How to Get a Finance Manager JobBeyond keywords: Craft expert SEO content that aligns with E-E-A-T to earn trust, authority, and top search engine rankings.

Ellie Moore

November 15, 2024

10 Financial Management Tools You Need to Start Using TodayOptimize your finances with these 10 essential tools! Discover the top financial management apps and software to simplify your money management and take control of your financial future.

Ellie Moore

March 23, 2025

Find Your Risk Tolerance: What Kind of Investor?Discover what risk tolerance means and how it affects your investment decisions. Uncover your investor profile and make smarter financial choices today!

Ellie Moore

May 26, 2025

Santander Auto Finance ReviewBoost your online presence! Craft expert SEO content to earn higher search rankings, attract more organic traffic, and engage your readers effectively.

Ellie Moore

February 24, 2025

Home Financing Options ExplainedUnlock top SERP rankings with expert SEO content. Learn to create valuable, authoritative (E-E-A-T) content that engages and converts your audience.

Ellie Moore

November 16, 2024

5 Strategies to Cut Monthly Expenses and Boost Your SavingsSlash your monthly expenses and boost your savings with these 5 powerful strategies! Learn practical tips to reduce costs and increase your financial security. Start saving more today!

Ellie Moore

Insurance

View AllRemote work brings new risks—find out what insurance coverage digital nomads and remote workers need in a changing world.

Ellie Moore

Discover how return of premium life insurance works and whether it’s the right choice for you. Understand the benefits and costs!

Ellie Moore

Discover how lifestyle changes, like quitting smoking or driving less, can unlock insurance discounts. Start saving now!

Ellie Moore

Learn how self-insured companies manage risks, reduce costs, and create customized insurance solutions for employees.

Ellie Moore

Discover how parametric insurance uses data to quickly respond to natural disasters and protect assets.

Ellie Moore

Protect your paycheck with disability insurance. Learn why income protection is a must-have for financial security.

Ellie Moore

Education

View AllUnderstanding memory is key to better teaching. Learn how memory functions and how to use this knowledge to enhance teaching techniques.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreUnderstand dyslexia and discover effective ways to support dyslexic students in the classroom. Learn proven strategies to improve learning outcomes.

Read MoreFinancial literacy is essential for today’s students. Discover why teaching money management early can lead to smarter financial decisions.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

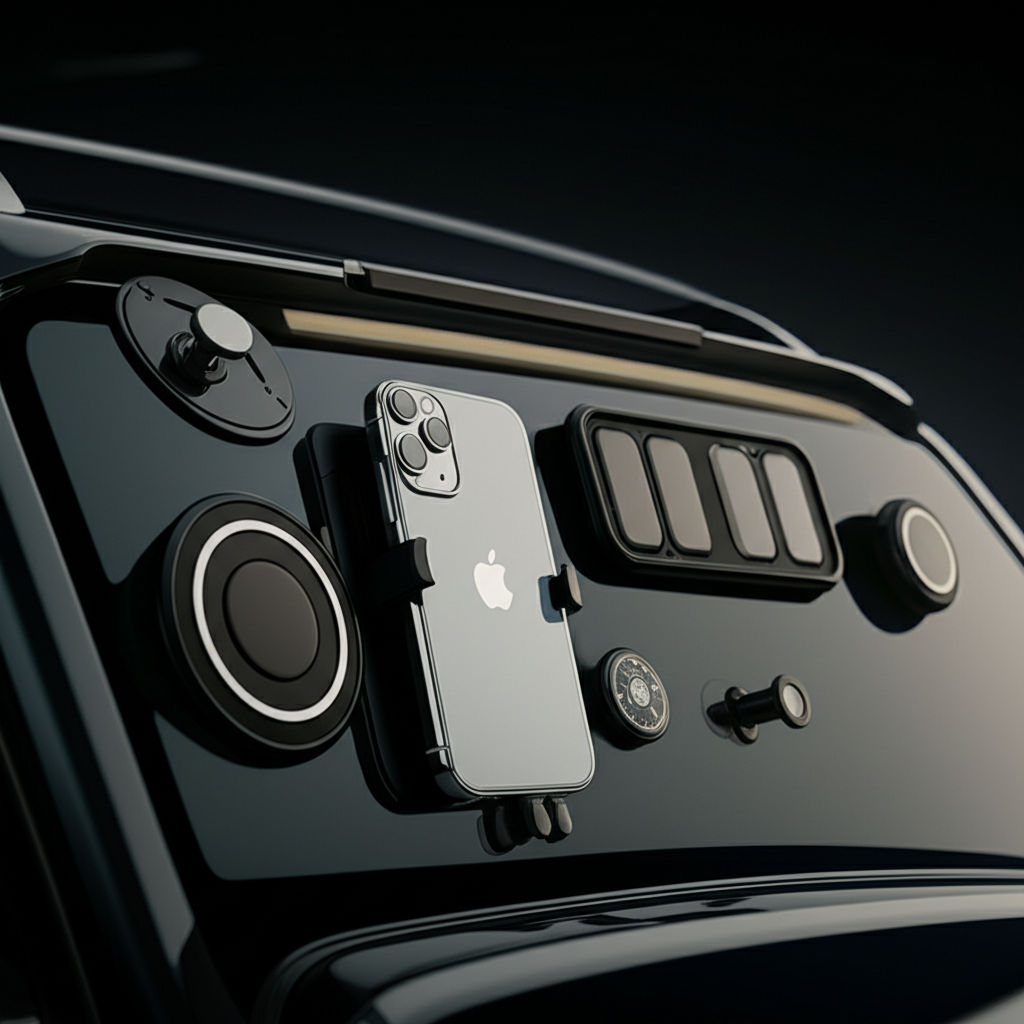

July 18, 2025

Magnetic Automotive Accessories For Your Vehicle

Transform your car with magnetic accessories! Enjoy effortless convenience, versatility & sleek design for phone mounts, organization & more. Simplify your driv...

August 18, 2025

What To Expect From An Automotive Technician Job

Beyond wrenches: Discover the modern automotive technician career. It's a dynamic, high-tech role focused on diagnostics, tech, and problem-solving.

July 28, 2025

Portable Automotive Air Conditioner Buying Guide

Transform hot drives into cool cruises! Our guide to portable car ACs offers instant relief, efficiency, and versatility for ultimate comfort.

July 30, 2025

Anything Automotive You Should Know Today

The automotive world is shifting! Learn about EVs, charging, and new tech to make smarter driving decisions for your wallet and the planet.

February 9, 2025

Ultimate Car Camping Guide: Gear & Road Trip Tips

Planning a car camping trip? Get the ultimate guide on gear, setups, and essential road trip tips for an unforgettable adventure!

August 26, 2025

Mastertech Automotive Repairs And Diagnostics

Mastertech Automotive decodes modern car repairs. Get expert diagnostics for complex vehicles, ensuring precise fixes & peace of mind.