Is College Worth It? Evaluating ROI in 2025

Ellie Moore

Photo: Is College Worth It? Evaluating ROI in 2025

Is College Worth It? Evaluating ROI in 2025

In recent years, the question “Is college worth it?” has sparked fierce debates. With rising tuition costs, student loan debt, and the changing nature of the job market, many are questioning whether a traditional four-year degree is still the best investment. As we move further into 2025, it's essential to evaluate the return on investment (ROI) of a college education in a landscape that's significantly different from a decade ago.

This article will explore the various factors that determine whether college is worth it in 2025, breaking down the financial, professional, and personal benefits of higher education.

Understanding ROI in the Context of College

Before we dive into specifics, it’s important to define what we mean by ROI in terms of education. The return on investment for college refers to the economic benefit one receives from obtaining a degree relative to the costs associated with earning it. In simpler terms, it’s about whether the financial, professional, and personal gains outweigh the financial burdens of tuition, student loans, and potential lost income from years spent studying.

The Rising Cost of College Tuition: A Major Consideration

One of the most significant challenges when evaluating the worth of a college degree is the escalating cost of tuition. In 2025, the average cost of attending a private university can easily exceed $50,000 per year, and public universities are not far behind, with out-of-state tuition ranging from $25,000 to $40,000 annually.

How Student Debt Affects ROI

With rising tuition costs, it’s no surprise that student loan debt has also skyrocketed. As of 2025, U.S. student loan debt has surpassed $1.7 trillion, a staggering figure that highlights the financial burden many students face after graduation.

For many, this means years of paying off loans that could take decades to eliminate. The challenge becomes clear: the ROI of college is significantly impacted if students are unable to secure high-paying jobs that allow them to pay down debt quickly.

Key Stats:

- Average Student Loan Debt in 2025: $37,000 per borrower

- Percentage of Borrowers with Student Debt: Over 60% of college graduates

- Average Annual Income for Recent Graduates: $45,000–$55,000

Given these numbers, many wonder if the financial payoff from a degree can offset the cost of borrowing and delayed earnings during college years.

The Job Market in 2025: Is a Degree Still Necessary?

Another critical factor when evaluating the worth of a college education is the job market itself. In 2025, job market shifts accelerated by the pandemic, remote work, and technological advancements have dramatically altered the employment landscape.

Jobs with and without a Degree:

- Tech Industry: Jobs in tech, particularly coding, data analysis, and software development, are in high demand. Many tech companies are no longer requiring a formal degree but instead value certifications, portfolios, and hands-on experience.

- Trade Professions: Skilled trade jobs such as plumbing, electrician, and HVAC technicians often require vocational training rather than a college degree. These careers can offer high salaries and job security, often without the massive student loan debt.

- Healthcare: Careers in healthcare generally require specific degrees or certifications, but the demand for nurses, physical therapists, and medical assistants continues to grow. These roles often provide significant salary potential and job stability.

As of 2025, 30% of college graduates are employed in jobs that don't require a degree, calling into question whether the investment in education is worthwhile for everyone.

What Are the Long-Term Financial Benefits of a Degree?

Despite the rise of non-degree career paths, research consistently shows that individuals with a college degree tend to earn more over the course of their careers compared to those with only a high school diploma.

Earning Potential:

- College Graduates: On average, they earn $1 million more over their lifetime than those without a degree.

- High School Graduates: While they may enter the workforce sooner, their long-term earning potential is significantly lower. According to a study from the Georgetown University Center on Education and the Workforce, high school graduates earn about $600,000 less than bachelor’s degree holders over 40 years.

Soft Skills and Personal Growth: More Than Just Money

While financial benefits are a key component of ROI, college offers more than just a paycheck. The soft skills gained through a university experience critical thinking, communication, problem-solving, and leadership are valuable assets that can enhance both personal and professional life. Many employers still consider these intangible benefits of a degree to be highly valuable, even if they don’t necessarily translate directly into a salary increase.

Additionally, college can provide networking opportunities, exposure to different ideas and cultures, and a broader perspective on life. For many, this personal growth is as significant as financial returns.

The Rise of Alternative Education Options

In recent years, alternative education options have been gaining traction, challenging the traditional college model. Online courses, coding bootcamps, and vocational schools offer a more flexible and affordable way to gain skills and certifications without the long-term commitment of a four-year degree.

Popular Alternatives:

- Bootcamps: Intensive, short-term programs focused on specific skills like coding, data analysis, or UX design. These programs can often be completed in 3–6 months and cost significantly less than a traditional degree.

- Online Education Platforms: Websites like Coursera, edX, and Udemy offer affordable courses from top universities in subjects ranging from artificial intelligence to digital marketing. These can help individuals boost their credentials without breaking the bank.

- Vocational Training: Focuses on practical, job-ready skills in areas like plumbing, electrical work, and automotive repair. These careers offer good salaries and low student debt.

How to Evaluate Whether College Is Worth It for You in 2025

Evaluating the worth of college in 2025 is not a one-size-fits-all answer. Several factors need to be taken into consideration before making such a significant decision:

- Career Goals: Does your desired career require a degree? Certain fields (law, medicine, engineering) still demand higher education.

- Financial Situation: Can you afford tuition, and are you prepared for potential student loans? Consider scholarships, grants, and other forms of financial aid.

- Alternative Pathways: Are there non-college options that can provide similar career opportunities, such as bootcamps, certifications, or apprenticeships?

- Personal Goals: Are you seeking personal growth, exposure to new ideas, or professional networking opportunities that a traditional college experience provides?

Conclusion: Is College Worth It in 2025?

In 2025, the value of college depends largely on individual circumstances, career aspirations, and financial outlook. For many, a college degree remains a worthwhile investment due to the potential for higher earnings, job stability, and personal development. However, for others, alternative education pathways might offer a more cost-effective and flexible route to career success.

Ultimately, deciding whether college is worth it involves evaluating the financial, professional, and personal benefits against the costs and potential alternatives. It’s not just about the degree itself but about aligning your education with your long-term goals.

FAQs

1. Is college still worth it if I want to work in tech? Yes, but not necessarily a traditional degree. Many tech jobs value skills and experience over formal education, so coding bootcamps or self-taught portfolios can be just as effective.

2. How long does it take to pay off student loans in 2025? The timeline to pay off student loans varies greatly depending on the amount borrowed and the borrower’s income. On average, it can take 10-20 years to pay off student loans, depending on the repayment plan.

3. What are the best alternatives to a traditional college degree? Popular alternatives include coding bootcamps, online certifications, trade schools, and apprenticeships, all of which can offer specialized training in a shorter amount of time and at a lower cost.

4. Can I earn as much as a college graduate without a degree? Yes, some non-degree careers, especially in the skilled trades and tech, offer competitive salaries without the need for a four-year degree. However, these may require additional certifications or training.

Finance & Investment

View All

March 7, 2025

High Paying Finance Jobs 2025Elevate your online presence! Discover expert SEO content strategies to rank higher, attract more traffic, and convert users effectively.

Ellie Moore

April 2, 2025

Cryptocurrency Staking: A Smart Investment GuideUnderstand cryptocurrency staking and how it works. Learn strategies to earn passive income and maximize rewards in the crypto world!

Ellie Moore

March 29, 2025

Gold’s Role in a Diversified PortfolioDiscover why gold and precious metals are essential in a diversified portfolio. Protect your wealth with these timeless investments!

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

September 1, 2025

MBA in Finance Career BenefitsElevate your rankings & authority with expert SEO content. Learn how valuable, E-E-A-T-driven insights captivate audiences and boost online success.

Ellie Moore

March 31, 2025

Protect Your Portfolio in a Market DownturnDiscover strategies to safeguard your portfolio during market downturns. Learn how to minimize losses and thrive in uncertain times.

Ellie Moore

Insurance

View AllEssential Direct Car Insurance: Your Roadmap to Unwavering Protection Are you losing valuable peace of mind and financial security due to inadequate car insuran...

Ellie Moore

Unpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Secure optimal insurance protection without overspending. Learn how policyholders and risk managers can get cheap, high-value coverage today.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Secure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Secure Your Sanctuary: Unpacking Essential Renters Insurance Georgia Plans Are you leaving your financial security to chance, risking thousands in unforeseen da...

Ellie Moore

Education

View AllTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

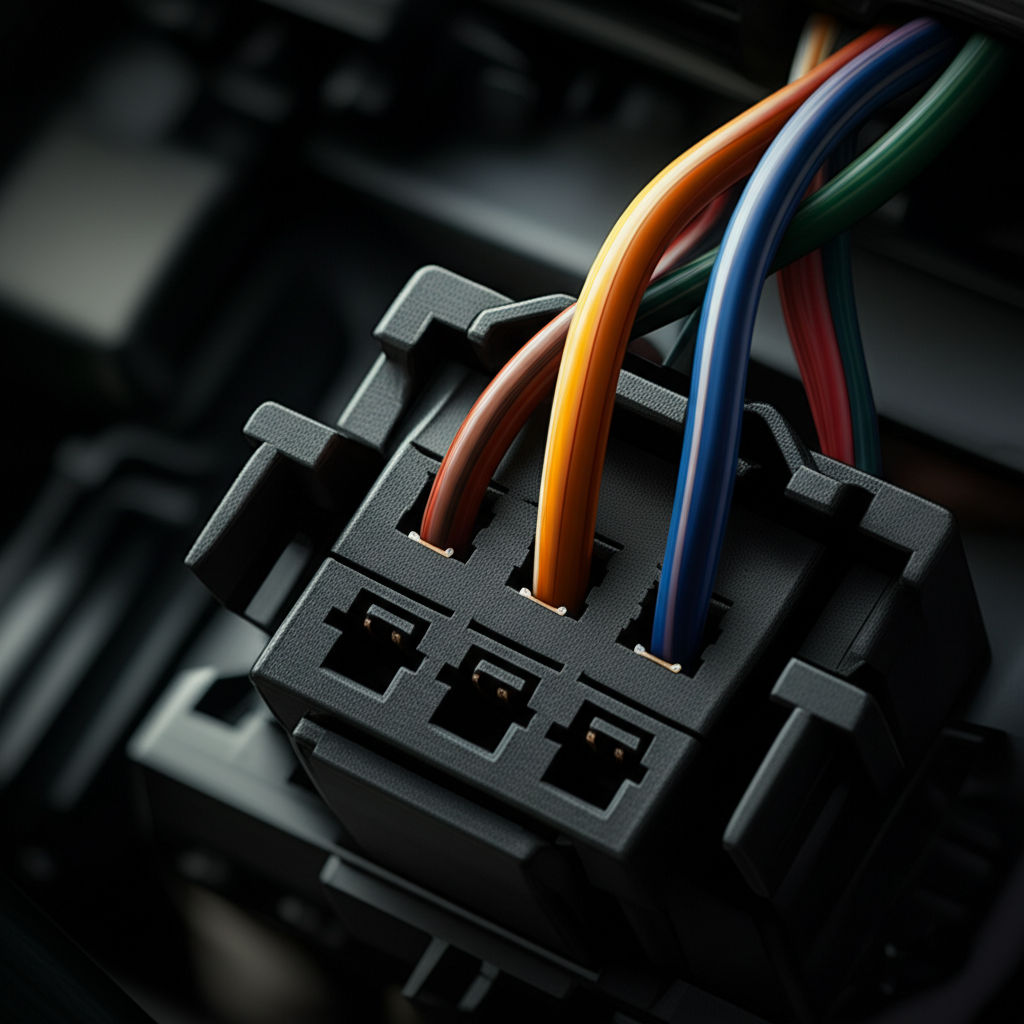

August 15, 2025

Best Automotive Electrical Connectors Reviewed

Boost vehicle safety & performance! This guide reveals why quality automotive electrical connectors are crucial & helps you choose the best ones.

July 30, 2025

AM Automotive Parts That Keep Your Car Running

Your car's unsung heroes: Essential AM automotive parts. Learn how aftermarket components ensure reliability, performance, and affordable vehicle maintenance.

February 10, 2025

Retro Car Features We Miss and Want Back

From bench seats to hidden headlights, check out the retro car features we’d love to see return. Which nostalgic design is your favorite?

September 4, 2025

Automotive Sales Jobs Near Me You Should Try

Drive your career in auto sales! Discover a lucrative, dynamic path with high earning potential, skill development, and great growth opportunities.

August 8, 2025

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

February 4, 2025

Tire Care Guide: Boost Tire Life & Performance

Maximize tire life with essential tire care tips! Learn how proper maintenance improves performance and ensures safety on every drive.