The Benefits of Delaying Social Security

Ellie Moore

Photo: The Benefits of Delaying Social Security – Should You Wait?

Social Security is a crucial aspect of retirement planning for millions of Americans, offering a steady income stream during one's golden years. While many individuals aim to claim their benefits as soon as they become eligible, there's a growing trend of delaying Social Security claims. This article explores the advantages of postponing SocialSecurity benefits and helps you decide if waiting is the best strategy for your retirement journey. By understanding the potential benefits and considering various factors, you can make an informed decision that maximizes your retirement income.

Understanding Social Security Benefits

What is Social Security?

Social Security is a federal program designed to provide financial support to retired workers, disabled individuals, and their families. It is primarily funded through payroll taxes, and the benefits are based on an individual's earnings history. Social Security serves as a vital safety net, ensuring a basic income for retirees and providing stability during retirement.

Eligibility and Claiming Age

To be eligible for SocialSecurity benefits, individuals must have worked and paid Social Security taxes for a minimum number of years. The full retirement age (FRA), at which one can receive full retirement benefits, varies depending on birth year, typically ranging from 66 to 67 years old. However, you can choose to claim benefits as early as age 62, albeit with reduced monthly payments.

The Advantages of Delaying Social Security

1. Increased Monthly Benefits

One of the most significant benefits of delaying Social Security is the potential for higher monthly payments. For each year you postpone claiming benefits beyond your FRA, your benefit amount increases by a certain percentage, known as the delayed retirement credit. This credit can result in a substantial boost to your monthly income, providing a more comfortable retirement lifestyle.

Let's illustrate this with an example. Imagine Sarah, who has a full retirement age of 67. If she decides to delay claiming benefits until age 70, her monthly payments could be up to 32% higher than if she had claimed at her FRA. This increase can significantly impact her overall retirement income, allowing her to cover expenses more comfortably.

2. Longevity Insurance

Postponing Social Security can also be viewed as a form of longevity insurance. As life expectancy continues to rise, many retirees worry about outliving their savings. By delaying benefits, you ensure a higher monthly income later in life, providing a financial buffer during advanced retirement years. This is especially beneficial for those with a family history of longevity or those concerned about the financial implications of a longer lifespan.

3. Continued Earnings Potential

Delaying Social Security allows you to continue working and earning income without reducing your benefits. If you claim benefits before reaching FRA and continue working, your benefits may be temporarily reduced if your earnings exceed a certain threshold. By waiting, you can avoid this reduction and maximize your overall retirement income.

Factors to Consider

1. Health and Life Expectancy

Your health and family medical history play a crucial role in deciding whether to delay Social Security. If you have a shorter life expectancy or significant health concerns, it might make more sense to claim benefits earlier. However, if you are in good health and expect to live a long life, delaying benefits can provide a more substantial income stream in the long run.

2. Current Financial Situation

Your current financial circumstances should also be carefully considered. If you have sufficient savings and other sources of income, delaying Social Security can be a strategic choice. It allows your savings to grow and provides a more robust financial foundation for the future. However, if you're facing financial hardships or have limited savings, claiming benefits earlier may be necessary to meet immediate needs.

3. Spousal Benefits

Married couples should also evaluate the impact of delaying Social Security on spousal benefits. If one spouse delays claiming benefits, it can increase the survivor benefit for the other spouse in the event of their death. This is an essential consideration, especially if one spouse has a significantly higher earning history.

Real-Life Example

Consider the story of John and Emily, a retired couple in their late 60s. John, a former engineer, decided to delay his Social Security benefits until age 70, while Emily, a teacher, claimed her benefits at her FRA of 67. John's decision to wait resulted in a higher monthly benefit, providing a substantial boost to their retirement income.

As they entered their 70s, John's higher benefit became even more valuable. Emily, who had a history of health issues, required additional medical care. John's increased Social Security income allowed them to cover these expenses without depleting their savings rapidly. This real-life example highlights how delaying Social Security can provide financial security and peace of mind during retirement.

Conclusion

Delaying Social Security benefits can be a powerful strategy for maximizing retirement income, but it's not a one-size-fits-all approach. The decision to wait should be based on a careful evaluation of personal circumstances, health, and financial goals. By considering the advantages and factors mentioned above, you can make an informed choice that aligns with your retirement vision.

Remember, Social Security is just one piece of the retirement puzzle. It's essential to consult with financial advisors and experts who can guide you in creating a comprehensive retirement plan that includes various income sources and strategies. Whether you decide to delay or claim benefits early, understanding your options is the key to a secure and fulfilling retirement journey.

By exploring the benefits and considerations of delaying Social Security, this article aims to empower readers to make informed decisions about their retirement planning. Through a balanced approach and real-life examples, it encourages readers to think critically about their unique circumstances and take control of their financial future.

Do you have any personal experiences or thoughts on delaying Social Security? Share your insights in the comments below, and let's continue the conversation!

Finance & Investment

View All

March 7, 2025

High Paying Finance Jobs 2025Elevate your online presence! Discover expert SEO content strategies to rank higher, attract more traffic, and convert users effectively.

Ellie Moore

April 2, 2025

Cryptocurrency Staking: A Smart Investment GuideUnderstand cryptocurrency staking and how it works. Learn strategies to earn passive income and maximize rewards in the crypto world!

Ellie Moore

March 29, 2025

Gold’s Role in a Diversified PortfolioDiscover why gold and precious metals are essential in a diversified portfolio. Protect your wealth with these timeless investments!

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

September 1, 2025

MBA in Finance Career BenefitsElevate your rankings & authority with expert SEO content. Learn how valuable, E-E-A-T-driven insights captivate audiences and boost online success.

Ellie Moore

March 31, 2025

Protect Your Portfolio in a Market DownturnDiscover strategies to safeguard your portfolio during market downturns. Learn how to minimize losses and thrive in uncertain times.

Ellie Moore

Insurance

View AllEssential Direct Car Insurance: Your Roadmap to Unwavering Protection Are you losing valuable peace of mind and financial security due to inadequate car insuran...

Ellie Moore

Unpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Secure optimal insurance protection without overspending. Learn how policyholders and risk managers can get cheap, high-value coverage today.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Secure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Secure Your Sanctuary: Unpacking Essential Renters Insurance Georgia Plans Are you leaving your financial security to chance, risking thousands in unforeseen da...

Ellie Moore

Education

View AllTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 15, 2025

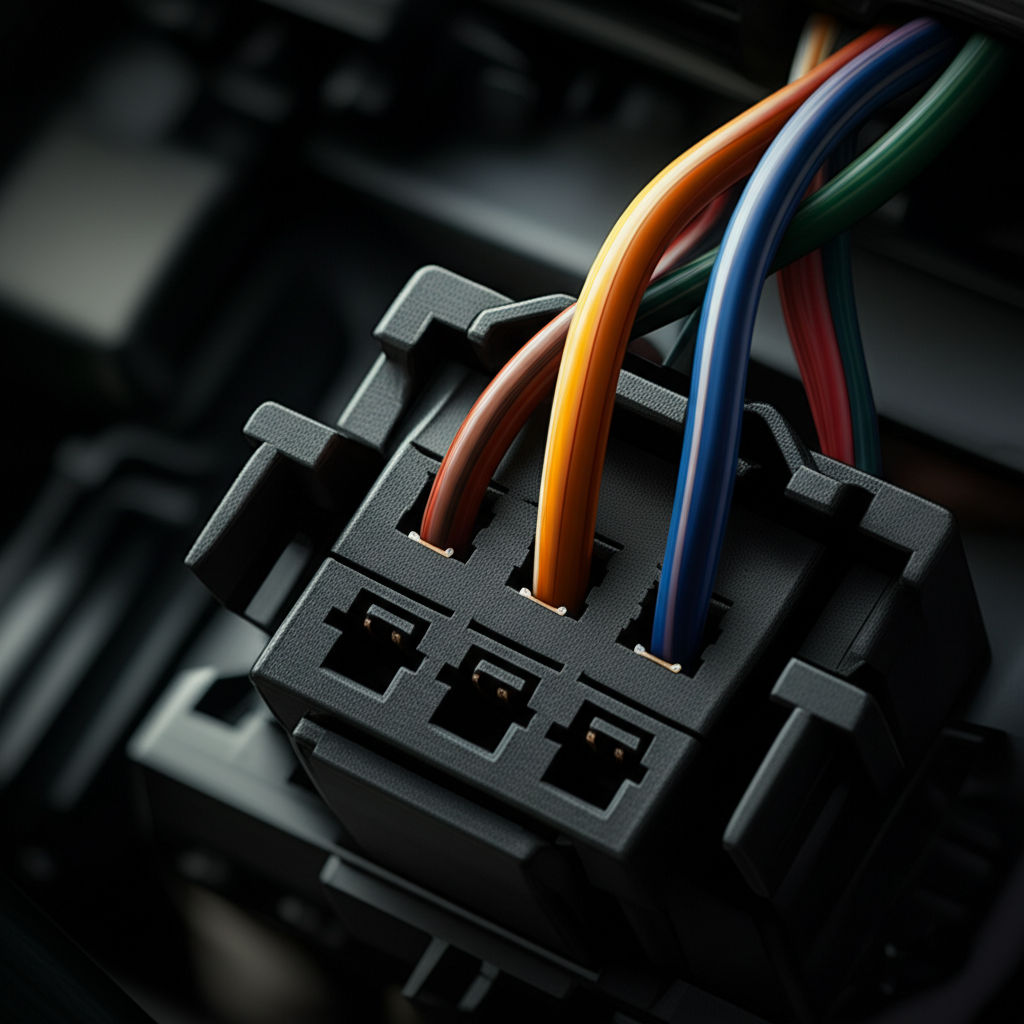

Best Automotive Electrical Connectors Reviewed

Boost vehicle safety & performance! This guide reveals why quality automotive electrical connectors are crucial & helps you choose the best ones.

July 30, 2025

AM Automotive Parts That Keep Your Car Running

Your car's unsung heroes: Essential AM automotive parts. Learn how aftermarket components ensure reliability, performance, and affordable vehicle maintenance.

February 10, 2025

Retro Car Features We Miss and Want Back

From bench seats to hidden headlights, check out the retro car features we’d love to see return. Which nostalgic design is your favorite?

September 4, 2025

Automotive Sales Jobs Near Me You Should Try

Drive your career in auto sales! Discover a lucrative, dynamic path with high earning potential, skill development, and great growth opportunities.

August 8, 2025

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

February 4, 2025

Tire Care Guide: Boost Tire Life & Performance

Maximize tire life with essential tire care tips! Learn how proper maintenance improves performance and ensures safety on every drive.