Unlocking the Secrets of Value Stocks: Finding Hidden Gems in the Market

Ellie Moore

Photo: Unlocking the Secrets of Value Stocks: Finding Hidden Gems in the Market

In the vast and often complex world of stock markets, value investing is a powerful strategy that can lead investors to hidden treasures. This approach, popularized by legendary investors like Warren Buffett, focuses on uncovering undervalued stocks with the potential for significant growth. In this article, we'll embark on a journey to understand the art of value investing, learn how to identify these hidden gems, and navigate the market with a keen eye for long-term success. Get ready to unlock the secrets of the stock market and discover the power of value investing.

Understanding Value Investing: A Timeless Strategy

The Core Principle

Value investing is a time-honored investment strategy that revolves around the simple yet powerful idea of buying stocks that are trading below their intrinsic value. These stocks are often overlooked by the market, but they hold the potential for substantial returns. Value investors believe that the market occasionally misprices stocks, creating opportunities for savvy investors to profit.

A Historical Perspective

The roots of value investing can be traced back to the early 20th century, with pioneers like Benjamin Graham, who is often regarded as the father of value investing. Graham's principles, outlined in his book The Intelligent Investor, have stood the test of time and continue to guide investors in their quest for undervalued stocks.

Identifying Undervalued Stocks: A Treasure Hunt

Fundamental Analysis

At the heart of value investing lies fundamental analysis, a meticulous process of evaluating a company's financial health and growth prospects. Investors delve into financial statements, studying metrics like revenue growth, profit margins, and debt levels. The goal is to determine whether a company's stock price reflects its true value.

Key Metrics to Watch

- Price-to-Earnings Ratio (P/E Ratio): This metric compares a company's stock price to its earnings per share. Value investors seek stocks with a low P/E ratio, indicating they might be undervalued.

- Price-to-Book Ratio (P/B Ratio): This measures a company's market value relative to its book value. A low P/B ratio can signal an undervalued stock.

- Return on Equity (ROE): ROE assesses a company's profitability by measuring how efficiently it generates profits from shareholders' equity. Value investors look for companies with a high ROE.

Real-Life Example

Imagine a company, 'TechGenius Inc.', that has recently faced a temporary setback due to a product recall. As a result, its stock price has plummeted, causing investors to panic. However, a value investor might see this as an opportunity. By analyzing TechGenius's financial statements, they discover that the company has a solid balance sheet, a history of innovation, and a loyal customer base. Despite the short-term challenges, the investor believes that TechGenius is fundamentally strong and will bounce back. This is a classic example of finding value in the midst of market turmoil.

Market Value Analysis: Uncovering Hidden Gems

Market Sentiment and Overreactions

Value investing often involves going against the grain. Market sentiment can sometimes lead to overreactions, causing stock prices to deviate from their intrinsic value. Value investors aim to identify these overreactions and take advantage of the market's short-term focus.

The Power of Patience

Value investing demands a long-term perspective. It requires investors to be patient and wait for the market to recognize the true value of their investments. This strategy is not for those seeking quick profits but for those willing to hold onto stocks for the long haul.

The Art of Value Investing: A Practical Approach

Building a Diverse Portfolio

Diversification is key in value investing. Building a portfolio with a mix of undervalued stocks across different sectors can help manage risk. This approach ensures that your investments are not overly concentrated in a single industry, reducing the impact of sector-specific downturns.

Continuous Research and Learning

Successful value investors are lifelong learners. They stay updated on market trends, study financial reports, and continuously refine their investment strategies. The stock market is ever-evolving, and staying informed is crucial for making informed investment decisions.

Managing Risk and Emotions

Value investing involves a certain level of risk, as with any investment strategy. It's essential to set clear investment goals and manage your risk tolerance. Emotional discipline is vital staying calm during market fluctuations and making rational decisions based on research and analysis is key to long-term success.

Conclusion: Unlocking Profits in the Stock Market

Value investing is a powerful approach that allows investors to uncover hidden gems in the stock market. By understanding the principles of fundamental analysis, recognizing undervalued stocks, and embracing a long-term perspective, investors can build a robust and profitable portfolio. The journey of value investing is an intellectual adventure, requiring patience, research, and a keen eye for market trends.

As you embark on your stock market education, remember that value investing is not just about numbers and ratios it's an art that combines financial analysis with a deep understanding of market dynamics. With the right knowledge and a disciplined approach, you can unlock the secrets of value stocks and pave the way for financial success. Happy investing!

Finance & Investment

View All

March 7, 2025

High Paying Finance Jobs 2025Elevate your online presence! Discover expert SEO content strategies to rank higher, attract more traffic, and convert users effectively.

Ellie Moore

April 2, 2025

Cryptocurrency Staking: A Smart Investment GuideUnderstand cryptocurrency staking and how it works. Learn strategies to earn passive income and maximize rewards in the crypto world!

Ellie Moore

March 29, 2025

Gold’s Role in a Diversified PortfolioDiscover why gold and precious metals are essential in a diversified portfolio. Protect your wealth with these timeless investments!

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

September 1, 2025

MBA in Finance Career BenefitsElevate your rankings & authority with expert SEO content. Learn how valuable, E-E-A-T-driven insights captivate audiences and boost online success.

Ellie Moore

March 31, 2025

Protect Your Portfolio in a Market DownturnDiscover strategies to safeguard your portfolio during market downturns. Learn how to minimize losses and thrive in uncertain times.

Ellie Moore

Insurance

View AllEssential Direct Car Insurance: Your Roadmap to Unwavering Protection Are you losing valuable peace of mind and financial security due to inadequate car insuran...

Ellie Moore

Unpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Secure optimal insurance protection without overspending. Learn how policyholders and risk managers can get cheap, high-value coverage today.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Secure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Secure Your Sanctuary: Unpacking Essential Renters Insurance Georgia Plans Are you leaving your financial security to chance, risking thousands in unforeseen da...

Ellie Moore

Education

View AllTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

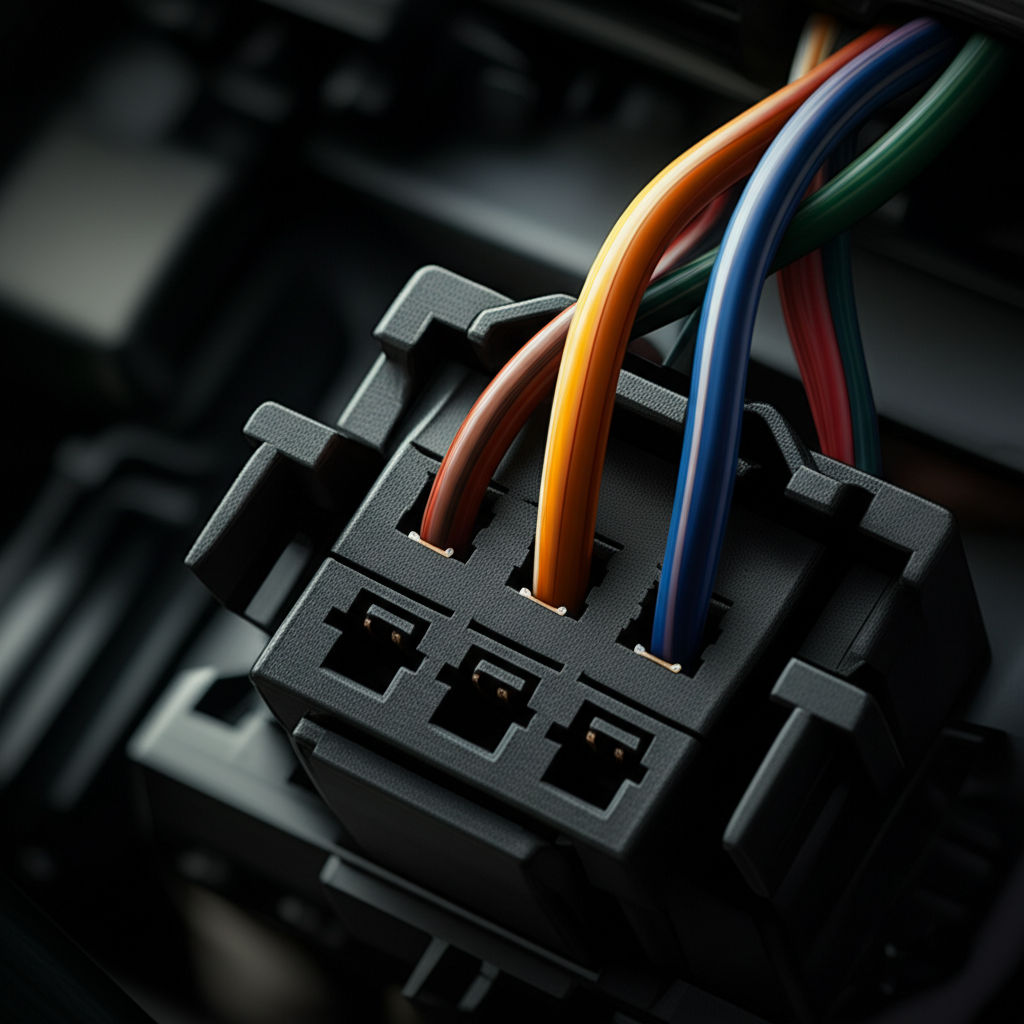

August 15, 2025

Best Automotive Electrical Connectors Reviewed

Boost vehicle safety & performance! This guide reveals why quality automotive electrical connectors are crucial & helps you choose the best ones.

July 30, 2025

AM Automotive Parts That Keep Your Car Running

Your car's unsung heroes: Essential AM automotive parts. Learn how aftermarket components ensure reliability, performance, and affordable vehicle maintenance.

February 10, 2025

Retro Car Features We Miss and Want Back

From bench seats to hidden headlights, check out the retro car features we’d love to see return. Which nostalgic design is your favorite?

September 4, 2025

Automotive Sales Jobs Near Me You Should Try

Drive your career in auto sales! Discover a lucrative, dynamic path with high earning potential, skill development, and great growth opportunities.

August 8, 2025

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

February 4, 2025

Tire Care Guide: Boost Tire Life & Performance

Maximize tire life with essential tire care tips! Learn how proper maintenance improves performance and ensures safety on every drive.