Insurance for Remote Workers: What to Know

Ellie Moore

Photo: Insurance for Remote Workers: What to Know

Insurance for Remote Workers: What You Need to Know

Remote work has become a cornerstone of modern employment, offering flexibility, convenience, and the ability to work from anywhere. However, along with the freedom to choose your workspace, there are various considerations that come with being a remote worker, and one of the most important is insurance. Whether you're a full-time freelancer, a part-time remote worker, or someone working from home for an employer, understanding the different types of insurance you need is essential for your peace of mind and financial security.

In this article, we'll dive into the world of insurance for remote workers, explore the types of insurance coverage you should consider, and provide practical tips to help you navigate the complexities of remote work insurance. From health and home office insurance to liability protection, we’ve got you covered.

The Importance of Insurance for Remote Workers

The rapid shift toward remote work has created new challenges and opportunities for workers and employers alike. As more people work from home or other remote locations, many are discovering that their existing insurance policies may not fully cover their needs. This gap in coverage can lead to unforeseen costs and risks.

Without proper insurance, remote workers could face financial hardship if an accident occurs, their property is damaged, or they need healthcare services. Having the right insurance protects both your health and your business, ensuring you're not caught off guard by unexpected circumstances.

Why Remote Workers Need Insurance

Here’s why it’s crucial for remote workers to have insurance:

- Health and Well-Being Protection: Remote workers, especially freelancers and independent contractors, often lack access to employer-sponsored health insurance. Without coverage, you might be forced to pay out-of-pocket for healthcare services, which can quickly become expensive.

- Property and Equipment Protection: Remote work typically involves using your own technology and equipment, such as computers, office furniture, and phones. In case of theft, damage, or malfunction, it's important to have insurance that covers these items.

- Liability Coverage: If you're working from home and a visitor gets injured on your property, or if you make a mistake that impacts a client, you could be held liable. Having insurance protects you from costly legal fees and compensation claims.

- Income Stability: For freelancers and independent workers, health issues or accidents could mean losing income. Income protection insurance can safeguard your earnings if you’re unable to work due to illness or injury.

Types of Insurance Every Remote Worker Should Consider

1. Health Insurance for Remote Workers

One of the biggest concerns for remote workers, particularly freelancers and self-employed individuals, is healthcare. Unlike traditional employees who often have employer-sponsored health insurance, remote workers must seek their own coverage.

When looking for health insurance, consider the following options:

- Marketplace Insurance: Depending on your country, you might qualify for health insurance through a government marketplace. For example, in the U.S., the Affordable Care Act (ACA) allows remote workers to purchase coverage through state-run or federal marketplaces.

- Private Health Insurance: If you prefer a private plan, look for one that covers your specific health needs. Compare premiums, deductibles, and out-of-pocket costs to ensure you're getting the best deal for your situation.

- Health Savings Accounts (HSAs): An HSA is a tax-advantaged savings account that allows you to set aside money for medical expenses. If you have a high-deductible health plan, pairing it with an HSA can help cover out-of-pocket costs.

2. Home Office Insurance

As a remote worker, your home office is where you likely spend the majority of your time working. However, your homeowner’s or renter’s insurance might not cover your work-related equipment, such as laptops, printers, or even office furniture, in case of theft or damage.

To protect your home office setup, consider the following:

- Business Property Insurance: This insurance covers office equipment and supplies that are used for business purposes. If you use a lot of technology for work, this is a wise investment.

- Home-Based Business Insurance: If you run a business from home, this specialized insurance can cover risks like theft, fire, or accidents involving clients or visitors.

- In-Home Business Liability: Some policies provide coverage for liability issues that might arise from accidents in your home office. This can include things like client injuries or damage to property while you’re working.

3. Liability Insurance

Liability insurance is crucial for remote workers who provide professional services, such as consultants, marketers, writers, and designers. This insurance protects you from lawsuits that might arise if something goes wrong with a project or service you provided.

Consider:

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this covers you if a client sues for negligence, mistakes, or failure to deliver services as promised.

- General Liability Insurance: This type of insurance protects you from third-party claims of injury, property damage, or accidents that occur as a result of your work.

- Cyber Liability Insurance: If you handle sensitive client data, cyber liability insurance is a must. This coverage protects you in the event of a data breach or cyberattack.

4. Income Protection Insurance

Income protection insurance, also called disability insurance, is an essential policy for remote workers who rely solely on their ability to work. If you are injured or ill and unable to work for an extended period, income protection insurance will replace a portion of your lost earnings.

- Short-Term Disability Insurance: Provides coverage for a limited period if you are temporarily unable to work due to illness or injury.

- Long-Term Disability Insurance: Offers longer-term financial support if you’re out of work for months or even years due to a serious health issue.

5. Workers’ Compensation Insurance

Workers' compensation insurance provides financial support if you get injured while working. While this is typically associated with traditional office settings or physical labor, remote workers may also face risks that require coverage.

For example, if you slip and fall in your home office or suffer from a repetitive strain injury due to long hours at the computer, workers’ compensation can cover medical bills and lost wages.

If you're self-employed, workers' compensation may not be required, but it’s something to consider depending on your location and the nature of your work.

How to Choose the Right Insurance Coverage for Your Needs

Choosing the right insurance as a remote worker can feel overwhelming, but it doesn’t have to be. Here are a few steps to help you navigate the process:

- Assess Your Risk: Identify the types of risks you face based on your work, lifestyle, and health. Are you primarily working with clients online? Do you use expensive equipment? Do you travel often for business?

- Understand Your Legal Requirements: Some areas require certain insurance policies, such as workers' compensation or liability insurance. Be sure to check your local regulations to ensure you're compliant.

- Shop Around: Don't settle for the first insurance plan you find. Compare coverage options, read customer reviews, and consult with an insurance advisor to get the best policy for your needs.

- Review Regularly: As your work evolves, so should your insurance coverage. Regularly assess whether your current policies still provide adequate protection and adjust them as needed.

Conclusion: Protect Your Remote Work Lifestyle with the Right Insurance

Insurance may not be the first thing on your mind when you think about remote work, but it's a vital part of ensuring that you’re covered in case of accidents, illnesses, or unexpected financial burdens. The right insurance will provide you with peace of mind, knowing that you’re protected whether you're working from your kitchen table or a beachside café.

Whether you're a freelancer, an independent contractor, or a remote employee, taking the time to understand and secure the appropriate insurance coverage is an investment in your health, well-being, and financial security. Don’t wait until it’s too late explore your options, shop around, and make sure your remote work lifestyle is well-protected.

FAQ

1. Do remote workers need health insurance?

Yes, especially if you’re self-employed or work for a company that doesn’t provide health insurance. It’s essential to have coverage to protect against medical expenses.

2. What happens if I damage my work equipment while working remotely?

If you have home office insurance or business property coverage, you may be able to file a claim for repairs or replacement. Be sure to check with your insurance provider for specific coverage details.

3. Is income protection insurance necessary for remote workers?

While not mandatory, income protection insurance is highly recommended for anyone who relies on their ability to work. It provides financial support if you’re unable to work due to illness or injury.

4. Can I get insurance if I work from home part-time?

Yes, you can still get insurance for your home office, even if you work part-time. Be sure to look into specific policies that suit your needs.

Finance & Investment

View All

April 4, 2025

Finance Jobs Near Me Hiring Right NowCraft expert SEO content that truly ranks, engages, and converts. Master the strategic blend of user needs, E-E-A-T, and optimization for digital success.

Ellie Moore

January 25, 2025

Unlock Market Insights with Competitive AnalysisSee how competitive analysis helps unlock market insights, enabling smarter decisions and stronger business strategies.

Ellie Moore

October 1, 2025

Yahoo Finance Market Movements TodayUnlock top search rankings with expert SEO content. Craft valuable, authoritative content that satisfies search engines & readers, boosting traffic & trust.

Ellie Moore

March 27, 2025

Value vs. Growth Investing: What’s the Difference?Compare value investing and growth investing strategies. Discover their key differences and decide which suits your financial goals best.

Ellie Moore

May 5, 2025

RCO Finance Services ReviewCraft expert SEO content to rank higher & engage audiences. Learn to build trust, deliver value, and satisfy user intent for organic traffic success.

Ellie Moore

May 28, 2025

VA Financing Rates and BenefitsMaster expert SEO content to dominate search results. Create valuable, authoritative content that ranks high, drives traffic, and builds your brand's authority.

Ellie Moore

Insurance

View AllDon't gamble with your finances. Discover essential auto insurance coverage to protect your assets, minimize risk, and gain peace of mind on the road.

Ellie Moore

Geico policyholder or risk manager? Discover how to unlock significant Geico insurance savings, optimize coverage, and reduce premiums effectively.

Ellie Moore

Learn how blockchain is enhancing transparency and security in modern insurance policies. Is your coverage future-ready?

Ellie Moore

Explore how your credit score affects insurance premiums. Learn how to improve your score and save on coverage!

Ellie Moore

Moving abroad? Learn everything about international health insurance, from coverage options to must-have benefits for expats.

Ellie Moore

Discover how artificial intelligence simplifies claims, enhances accuracy, and speeds up insurance processes.

Ellie Moore

Education

View AllMultilingual education promotes diversity and cultural understanding. Learn why it matters and how it benefits students in a globalized world.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreFinancial literacy is essential for today’s students. Discover why teaching money management early can lead to smarter financial decisions.

Read MoreProject-based learning engages students by tackling real-world problems. Learn how this approach fosters critical thinking and creativity.

Read MoreTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreLearn how UNESCO promotes education for all globally. Explore key initiatives and efforts aimed at fostering equal learning opportunities for everyone.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 26, 2025

Oriole Automotive A Local Name You Can Trust

Oriole Automotive: Quincy's trusted local auto repair experts. Get personalized service, quality care, and community-focused solutions.

July 11, 2025

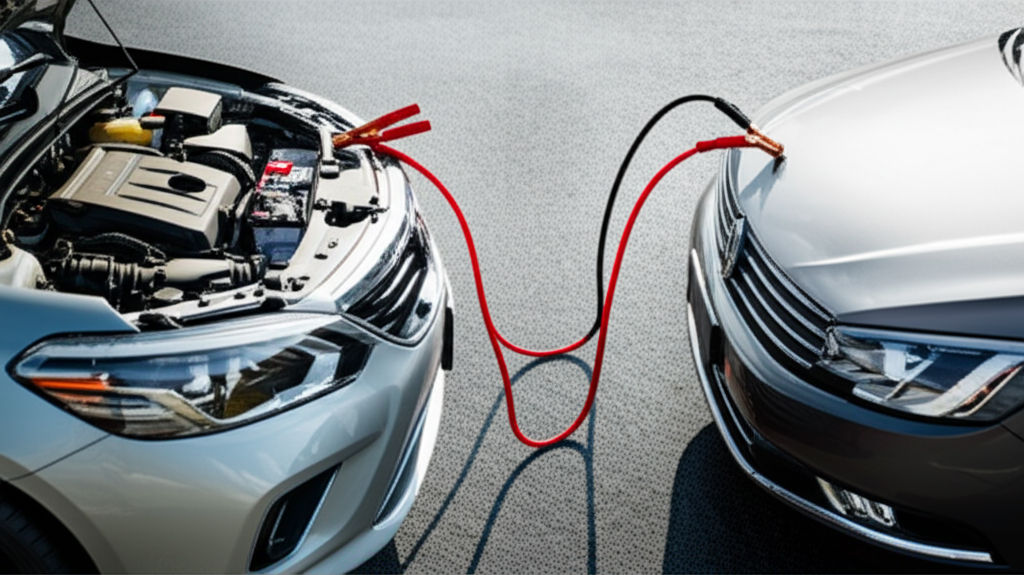

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

September 2, 2025

Finding Local Automotive Machine Shops Today

Unlock your engine's potential! Learn how to find a trusted automotive machine shop for precision repairs, performance enhancements, and expert care.

August 17, 2025

Why You Need Automotive Paint Protection Today

Safeguard your car's investment! Learn why automotive paint protection is essential today to shield your vehicle from environmental damage & preserve its value.

August 11, 2025

Rush Automotive Fast And Reliable Car Service

Rush Automotive offers fast, reliable car service you can trust. Get quick repairs, minimize downtime, and enjoy peace of mind on the road.

July 28, 2025

Oaks Automotive Tips For Long Lasting Repairs

Invest in your vehicle's future with Oaks Automotive's long-lasting car repairs. We ensure quality service, preventing recurring issues for peace of mind.