Essential Liability Insurance

Ellie Moore

Photo: Essential Liability Insurance

Essential Liability Insurance: Safeguarding Your Future in a Complex World

Are you a business owner, policyholder, or risk manager losing sleep over potential financial setbacks from unforeseen legal claims? The complexities of modern business operations, coupled with an increasingly litigious environment, make robust protection non-negotiable. This is where Essential Liability Insurance steps in, acting as a critical shield against significant financial losses. Understanding the nuances of commercial liability insurance quotes and navigating business liability insurance cost can seem daunting, but ignoring these vital protections can lead to catastrophic consequences.

This guide reveals how policyholders and risk managers can safeguard their assets, ensure business continuity, and secure peace of mind by making informed decisions about their liability coverage.

What Makes a Premium Essential Liability Insurance Essential for Policyholders and Risk Managers?

In today's dynamic business landscape, liability risks are constant and evolving. From customer injuries on your premises to errors in professional services, the potential for lawsuits is ever-present. A premium Essential Liability Insurance policy isn't just a safety net; it's a strategic investment in your business's longevity and stability.

The liability insurance market continues to demonstrate significant growth, underscoring the increasing recognition of its importance. Global liability insurance premiums reached $313.2 billion in 2025, with the US sector alone generating over $145 billion. This growth is driven by several factors, including rising litigation costs, greater awareness of legal responsibilities, and the expansion of industrial workforces. For businesses, this means that the return on investment (ROI) of a comprehensive liability policy is not merely about avoiding costly payouts but also about protecting reputation, maintaining operational stability, and ensuring uninterrupted growth. Avoiding a single significant lawsuit can far outweigh years of premium payments.

Critical Evaluation Criteria for Policyholders and Risk Managers:

Choosing the right liability insurance requires careful consideration of several key factors tailored to your specific needs.

Cost Structure Analysis

Understanding the cost structure of Essential Liability Insurance is paramount. Factors influencing your premiums include your industry, business size, location, number of employees, and claims history. For instance, a construction company typically faces higher liability insurance costs than an accounting firm due to increased risk exposure.

When evaluating policies, don't just look at the headline premium. Utilize a liability insurance premium calculator to get a more accurate estimate based on your specific risk profile. Consider the various liability insurance pricing models that providers use, which integrate underwriting and investment performance to determine rates. A comprehensive understanding of these models can help you negotiate better terms and find a policy that offers optimal coverage without unnecessary expenses.

Compliance & Security Requirements

The insurance industry is highly regulated, with strict rules at both state and federal levels governing licensing, underwriting, risk assessment, data privacy, and claims processing. For policyholders and risk managers, ensuring your Essential Liability Insurance meets all relevant insurance regulatory compliance standards is not just a legal obligation but a critical measure for consumer protection and market integrity.

Compliance involves adhering to guidelines that protect consumer data, prevent money laundering, and ensure fair practices. Look for policies and providers that clearly demonstrate adherence to these requirements, including certifications and robust internal controls. Can you afford the penalties and reputational damage that non-compliance could bring?

Integration Capabilities

In today's interconnected business environment, the ability of your insurance solutions to integrate with existing systems is increasingly important. Insurance policy management software integration can streamline various processes, from policy administration to claims management, and enhance overall operational efficiency.

Seamless integration with customer relationship management (CRM) systems, underwriting platforms, and data analytics tools provides a 360-degree view of policyholders, allowing for better data analysis, personalized services, and improved decision-making. This includes liability insurance system integration with your existing accounting or risk management software, ensuring a cohesive and efficient approach to managing your business's protections.

Implementation Roadmap: Maximizing Essential Liability Insurance ROI

Maximizing the return on investment from your Essential Liability Insurance involves a strategic, step-by-step approach:

- Assess Your Risks Thoroughly: Conduct a comprehensive risk assessment to identify all potential liability exposures unique to your business. This might include general liability, professional liability (errors and omissions), product liability, cyber liability, and directors and officers liability.

- Consult with an Expert: Engage with experienced insurance agents or brokers specializing in commercial liability. They can help you understand complex policy language, identify gaps in coverage, and tailor a policy to your specific needs.

- Compare Commercial Liability Insurance Quotes: Don't settle for the first quote. Obtain multiple commercial liability insurance quotes from different providers to compare coverage limits, deductibles, exclusions, and premiums.

- Customize Your Coverage: Work with your insurer to customize your policy. Ensure it covers specific risks relevant to your industry and operations. For example, if you handle sensitive customer data, robust cyber liability coverage is crucial.

- Understand Policy Terms and Conditions: Carefully review the policy's terms, conditions, and exclusions. Pay close attention to coverage limits and how claims are handled.

- Implement Risk Management Practices: Insurance is a transfer of risk, but effective risk management practices can significantly reduce your exposure and potentially lower your premiums. This includes safety protocols, employee training, and robust data security measures.

- Regular Review and Updates: Your business evolves, and so should your insurance. Regularly review and update your liability insurance policy deployment timeline to ensure it remains aligned with your current operations, growth, and emerging risks.

2025 Trends: The Future of Essential Liability Insurance for Policyholders and Risk Managers:

The insurance industry is constantly evolving, driven by technological advancements and changing risk landscapes. For policyholders and risk managers, staying abreast of these trends is crucial for proactive risk management.

According to Deloitte's 2025 global insurance outlook, the non-life sector performance is expected to improve, with a focus on underwriting profitability and risk management. Key trends shaping the sector include digital claims processing, AI-based risk assessment tools, and flexible liability policies.

The future of Essential Liability Insurance will be significantly influenced by emerging liability insurance technologies. Artificial intelligence (AI) and advanced data analytics are redefining risk assessment, enabling insurers to develop more nuanced pricing strategies and customer-centric products. AI is also playing a dual role in cybersecurity, both enabling defenses and empowering attackers, leading to new types of cyber liability coverage, such as CISO liability insurance.

Furthermore, the integration of digital platforms and ecosystems will become more prevalent, offering comprehensive solutions that extend beyond traditional insurance to include wellness programs and financial advisory services. Regulators are also proactively embracing AI, developing frameworks for responsible use to ensure transparency, fairness, and compliance.

Conclusion

Securing robust Essential Liability Insurance is not merely a compliance checkbox; it's a fundamental pillar of sound business strategy. For policyholders and risk managers, understanding the intricacies of coverage, evaluating cost structures, ensuring regulatory adherence, and embracing technological integration are vital steps toward protecting your enterprise. By proactively managing your liability exposures, you safeguard your financial health, preserve your reputation, and ensure the uninterrupted pursuit of your business goals.

Don't leave your business vulnerable to unexpected claims. Take the proactive step today to secure your future. Get customized liability insurance quotes and request a comprehensive risk assessment to tailor the perfect comprehensive business liability insurance solution for your unique needs.

FAQ Section (HPK-Optimized)

What's the typical cost range for premium Essential Liability Insurance?

The cost of premium Essential Liability Insurance varies significantly based on factors like your industry, business size, location, and claims history. For general liability insurance, small businesses might pay an average of $68 to $85 per month, or around $810 annually. However, these are averages, and specific liability insurance pricing models will determine your exact premium. More hazardous industries or those with higher risk exposure will typically incur higher costs.

How quickly can policyholders and risk managers implement Essential Liability Insurance?

The speed of implementing Essential Liability Insurance can vary. For many standard policies, the application and approval process can be relatively swift, sometimes within 24 to 48 hours for straightforward applications. However, more complex policies or those requiring additional underwriting might take longer. While some policies can be bound immediately, the full policy issuance might take anywhere from a few days to several weeks, particularly for rapid liability insurance policy setup in commercial lines.

What compliance standards should Essential Liability Insurance meet?

Essential Liability Insurance must meet various liability insurance regulatory requirements at both state and federal levels. These standards typically cover licensing, policy form approval, rate filings, claims handling practices, solvency, and data privacy. Regulations are designed to protect consumers from unfair practices, ensure financial stability, and safeguard sensitive personal data. Insurers must also adhere to anti-money laundering (AML) regulations and consumer protection laws.

Can Essential Liability Insurance integrate with existing business systems?

Yes, modern Essential Liability Insurance solutions are increasingly designed for integration with existing business systems. This liability insurance system integration can include connecting with customer relationship management (CRM) software, policy administration systems, claims processing software, underwriting platforms, and even enterprise resource planning (ERP) solutions. Such integrations aim to streamline business processes, improve data accuracy, automate tasks, and provide a unified view of customer and policy data, ultimately enhancing operational efficiency and customer experience.

Finance & Investment

View All

November 27, 2025

Yahoo Finance Stock Market Guide 2025Unlock online authority & visibility with expert SEO content. Create high-value, E-E-A-T-driven content that builds trust, meets user intent, and ranks.

Ellie Moore

June 12, 2025

GM Finance Plans That Help You Save MoreUnlock top search rankings with expert SEO content. Discover how to craft valuable, E-E-A-T-driven content that captivates users and algorithms.

Ellie Moore

April 8, 2025

Public vs. Private Equity: Key Differences ExplainedCompare public and private equity investing. Learn how each works and which aligns better with your investment goals and risk tolerance.

Ellie Moore

November 11, 2025

Continental Finance Credit Card InfoCrafting Expert SEO Content: Your Guide to Higher Rankings and Engaged Readers In the ever-evolving world of digital marketing, simply stuffing keywords into an...

Ellie Moore

October 7, 2025

BTC Yahoo Finance Live TrackerGo beyond keywords! Discover expert SEO content that builds authority, earns trust, and ranks high. Master content that truly engages your audience.

Ellie Moore

July 7, 2025

FHA Financing Options for BuyersUnlock digital visibility with expert SEO content. Learn how to rank higher, attract traffic, and build authority by satisfying both users and search engines.

Ellie Moore

Insurance

View AllUnlock the secrets to getting cheap auto insurance fast! Our guide helps you find the best rates and reliable coverage, turning a daunting task into a financial...

Ellie Moore

Find optimal premium car insurance quotes online. This guide helps policyholders, agents & risk managers compare rates for robust, high-value coverage.

Ellie Moore

Discover how microinsurance provides affordable coverage solutions for underserved populations worldwide.

Ellie Moore

Stay safe with these tips to identify and avoid common insurance scams. Protect yourself from fraud and make informed decisions.

Ellie Moore

Secure lifelong financial stability with Complete Whole Life Insurance. Discover guaranteed growth, comprehensive protection, and accessible cash value for your...

Ellie Moore

Safeguard your rental assets with Lemonade Renters Insurance. Get smart, comprehensive, and affordable coverage for ultimate peace of mind.

Ellie Moore

Education

View AllCompetency-based education focuses on mastery over seat time. Learn how this model is reshaping how we measure student success.

Read MoreExplore the ongoing debate on standardized testing. Learn its pros, cons, and whether it should remain a key part of education.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MorePlay is crucial in early learning! Discover how play-based learning enhances cognitive, emotional, and social development in young children.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 5, 2025

Top Automotive Swap Meets Near Me This Year

Unearth automotive treasures at vibrant swap meets! Find rare parts, classic cars, & connect with enthusiasts. Your guide to top events this year.

August 14, 2025

Are Brunt Boots Good For Automotive Work

Considering Brunt Boots for auto work? Discover if they meet the safety & comfort demands of mechanics, including EH, slip & toe protection.

September 1, 2025

Automotive Body Kits That Transform Your Car

Redefine your car's look & performance with automotive body kits. Explore components, installation, and how to create a unique masterpiece.

July 11, 2025

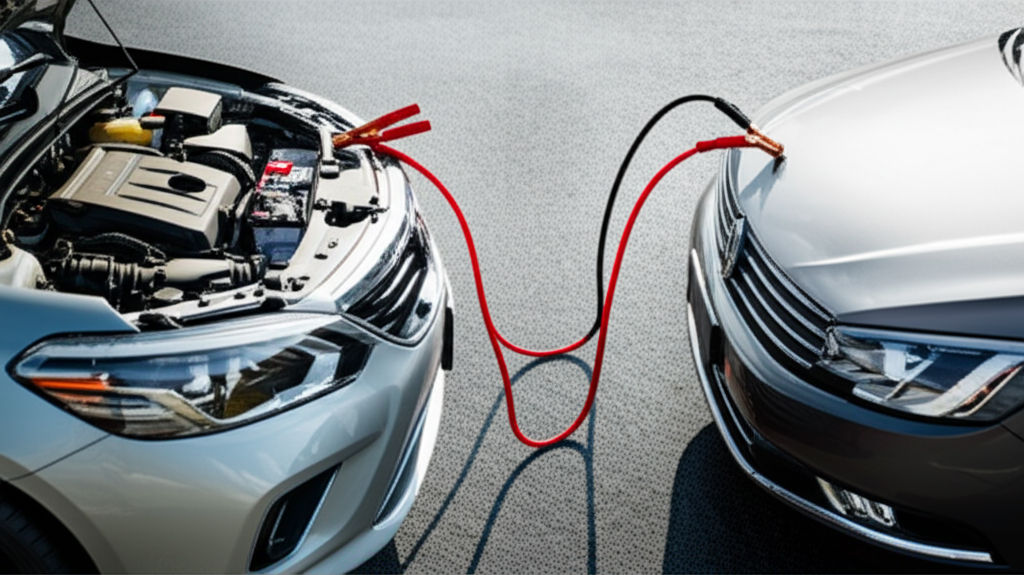

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

July 31, 2025

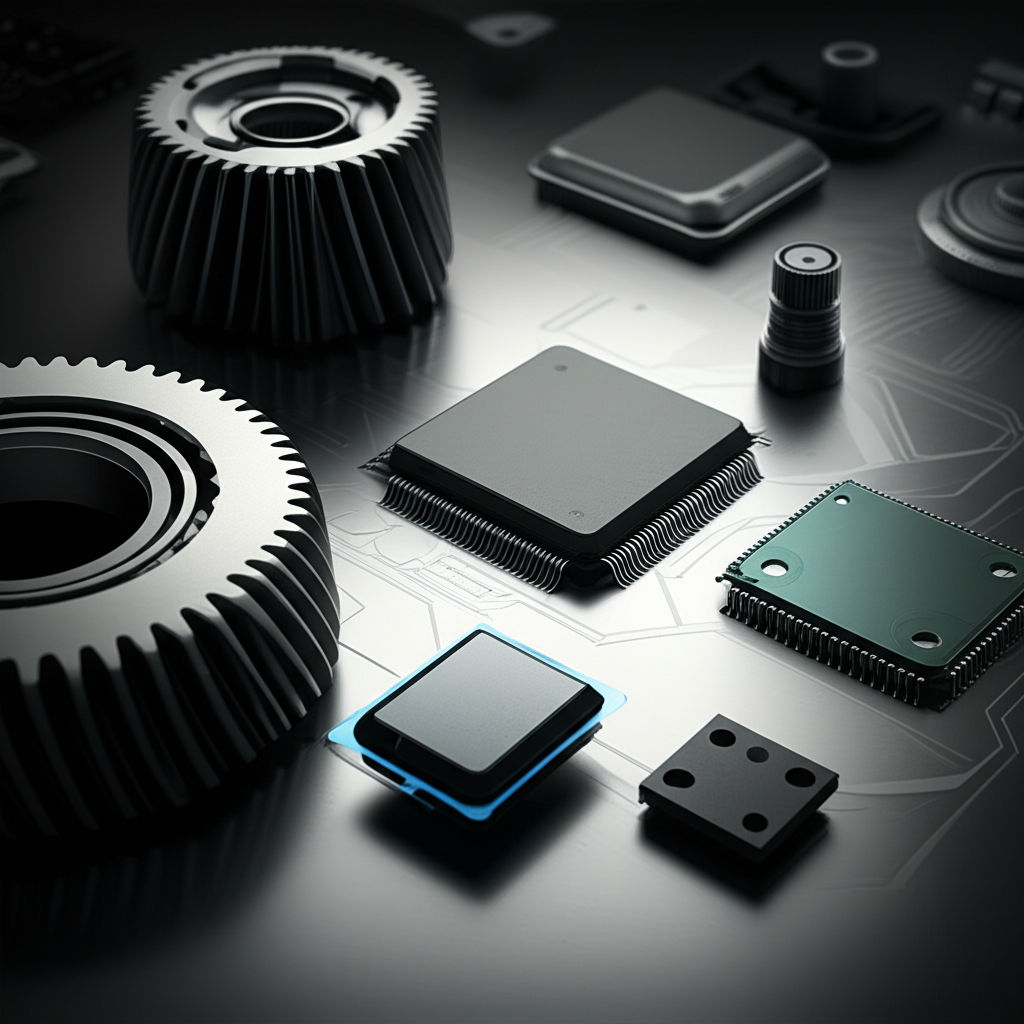

Understanding Automotive Components Holdings Value

Deep dive into the multi-trillion dollar automotive components market. Understand its value, growth, and why it's crucial for investors & enthusiasts.

July 22, 2025

How Automotive Flex Enhances Vehicle Performance

Beyond horsepower: explore automotive flex! This engineered balance of rigidity & movement is vital for your car's performance, handling & comfort.