Public vs. Private Equity: Key Differences Explained

Ellie Moore

Photo: Public vs. Private Equity: Key Differences Explained

Public vs. Private Equity: Key Differences Explained

Equity investing often presents a maze of opportunities, but one of the most significant choices is deciding between public equity and private equity. While both serve as investment vehicles, they differ fundamentally in their approach, accessibility, and outcomes. Understanding these distinctions is crucial for investors looking to maximize returns and manage risks effectively.

In this article, we’ll break down the differences between public and private equity, explore their respective advantages and challenges, and provide actionable insights for navigating this essential aspect of investing.

What Is Public Equity?

Public equity refers to investments in companies that are publicly traded on stock exchanges such as the New York Stock Exchange (NYSE) or NASDAQ. Public equity is accessible to a wide range of investors, from individuals to institutional investors.

Key Features of Public Equity

- Liquidity: Stocks in public markets can be bought and sold easily, offering high liquidity.

- Regulation: Publicly traded companies are heavily regulated by bodies like the SEC, ensuring transparency and investor protection.

- Accessibility: Anyone with a brokerage account can invest in public equities, making it a democratic investment option.

- Volatility: Prices can fluctuate significantly due to market sentiment, macroeconomic changes, and corporate performance.

Example

Consider Apple Inc. (AAPL): Shares of Apple are traded publicly, allowing millions of investors worldwide to buy and sell them with minimal restrictions.

What Is Private Equity?

Private equity, on the other hand, involves investments in companies that are not publicly traded. These investments are typically made by private equity firms, venture capitalists, or accredited investors with substantial capital.

Key Features of Private Equity

- Illiquidity: Unlike public equity, private equity investments are long-term and cannot be easily sold.

- High Entry Barrier: Private equity often requires significant capital, restricting access to institutional investors and high-net-worth individuals.

- Active Management: Investors often take an active role in managing or restructuring the company to maximize returns.

- Potentially High Returns: With increased risk comes the potential for outsized returns, particularly in high-growth or turnaround scenarios.

Example

A private equity firm may acquire a struggling manufacturing company, revamp its operations, and sell it later for a profit.

Key Differences Between Public and Private Equity

1. Accessibility

- Public Equity: Open to all investors even small investments are possible.

- Private Equity: Limited to accredited investors or institutional entities due to high capital requirements.

2. Risk and Reward

- Public Equity: Offers a broad risk-reward spectrum depending on stock selection and market trends.

- Private Equity: Higher risk due to limited liquidity but potentially higher returns, especially in successful exits.

3. Liquidity

- Public Equity: Shares can be sold at market value almost instantly.

- Private Equity: Requires years to realize returns as funds are locked until a liquidity event occurs.

4. Transparency

- Public Equity: Regulated and publicly disclosed financials allow for detailed analysis.

- Private Equity: Limited disclosure as private companies are not obligated to share financial details publicly.

Pros and Cons of Public Equity

Advantages

- Liquidity: Immediate access to cash when needed.

- Transparency: Easily available financial data.

- Flexibility: Suitable for short- or long-term investment goals.

Challenges

- Market Volatility: Susceptible to rapid price changes.

- Limited Influence: Individual investors have little say in company decisions.

Pros and Cons of Private Equity

Advantages

- Higher Returns: Potential for substantial profits in successful ventures.

- Active Role: Direct involvement in decision-making processes.

- Long-Term Growth: Focused on building lasting value.

Challenges

- High Risk: Greater exposure to business failures.

- Limited Access: Reserved for wealthy or accredited investors.

- Illiquidity: Capital tied up for extended periods.

How to Choose Between Public and Private Equity

1. Define Your Financial Goals

If you prioritize flexibility and accessibility, public equity might be the better choice. For long-term growth and potentially higher returns, private equity could be worth exploring.

2. Assess Risk Tolerance

Public equity suits those with moderate risk tolerance due to its liquidity and regulation. Private equity requires a higher appetite for risk given its illiquidity and business-specific focus.

3. Consider Time Horizon

Public equity works well for short- and medium-term goals. Private equity aligns better with long-term investments.

4. Analyze Capital Requirements

For investors with limited capital, public equity is the more feasible option. Private equity often demands substantial initial investments.

FAQs About Public vs. Private Equity

Q1: Can retail investors participate in private equity?

Generally, private equity is limited to accredited investors. However, some platforms, like crowdfunding and private equity funds, are lowering barriers for retail investors.

Q2: Which is riskier: public or private equity?

Both carry risks, but private equity is often considered riskier due to its illiquidity and limited diversification options.

Q3: What are common exit strategies in private equity?

Exit strategies include mergers, acquisitions, or public offerings, where investors sell their stake for a profit.

Conclusion

Choosing between public and private equity depends on your financial goals, risk tolerance, and investment horizon. Public equity offers accessibility and liquidity, making it suitable for most investors. In contrast, private equity requires significant capital and patience but can yield impressive returns for those willing to take the risk.

Whether you’re an individual investor or a seasoned professional, understanding these distinctions ensures you make informed decisions that align with your financial objectives. Ready to take the next step? Start by analyzing your portfolio and explore how these equity options can enhance your investment strategy.

Call-to-Action

Did this guide help clarify your understanding of public vs. private equity? Share your thoughts in the comments below, or explore our other in-depth articles to sharpen your investment knowledge!

Finance & Investment

View All

July 25, 2025

Hedge Meaning in Finance TermsMaster expert SEO content! Learn to create valuable, E-E-A-T-driven content that satisfies user intent, boosts rankings, and builds authority.

Ellie Moore

August 7, 2025

Lawn Mower Financing for HomeownersMaster expert SEO content to dominate search rankings. Learn to create high-value, E-E-A-T compliant content that engages users & satisfies algorithms.

Ellie Moore

February 3, 2025

How to Identify Your Target Market EasilyLearn how to identify and understand your target market through effective segmentation techniques. Start reaching them today!

Ellie Moore

February 22, 2025

Used Auto Finance Rates 2025Craft expert SEO content that ranks! This guide reveals how to leverage E-E-A-T, user intent, and deep research to master the SERP.

Ellie Moore

April 12, 2025

Chase Auto Finance Contact InformationMaster expert SEO content: the powerful blend of quality, optimization, and user design to dominate search, boost traffic, and build brand authority online.

Ellie Moore

June 21, 2025

Sunset Finance Reliable Loans Near YouMaster expert SEO content! Learn how to create high-value, authoritative content that aligns with Google's E-E-A-T for better rankings and trusted authority.

Ellie Moore

Insurance

View AllEssential Otto Insurance: Comprehensive protection for policyholders & risk managers. Optimize risk, find best rates, and secure your financial future.

Ellie Moore

Discover how lifestyle changes, like quitting smoking or driving less, can unlock insurance discounts. Start saving now!

Ellie Moore

Explore the vital role actuaries play in risk management, pricing, and shaping the future of insurance policies.

Ellie Moore

Secure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Discover how parametric insurance uses data to quickly respond to natural disasters and protect assets.

Ellie Moore

Concerned about rising auto costs? Discover how to get premium auto insurance quotes for optimal coverage, maximum savings, and financial peace of mind.

Ellie Moore

Education

View AllLearn how gamification is transforming modern classrooms. Explore fun, interactive strategies that boost engagement and learning outcomes.

Read MoreSocial skills training is key for kids with autism. Learn practical strategies to improve social interaction and communication in children with ASD.

Read MoreDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MoreShould smartphones be allowed in classrooms? Explore the pros and cons of using smartphones in education and their impact on learning.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 9, 2025

Greg's Automotive Honest Work At A Fair Price

Tired of dishonest auto shops? Greg's Automotive offers transparent, honest work at a fair price. Build trust with clear communication & no upsells.

September 6, 2025

Best Automotive Wheel Covers For Every Car

Wheel covers: More than just looks! Enhance your car's style, protect components, and boost value. Find the perfect covers in our guide.

July 19, 2025

Marks Automotive Services And Quality Guarantee

Marks Automotive: trusted car care & comprehensive services backed by an unwavering quality guarantee for your vehicle's peace of mind.

July 22, 2025

All Things Automotive To Keep Your Car Running

Maximize your car's life & save money! Learn essential maintenance tips for optimal performance, safety, and longevity. Keep your vehicle running smoothly.

July 11, 2025

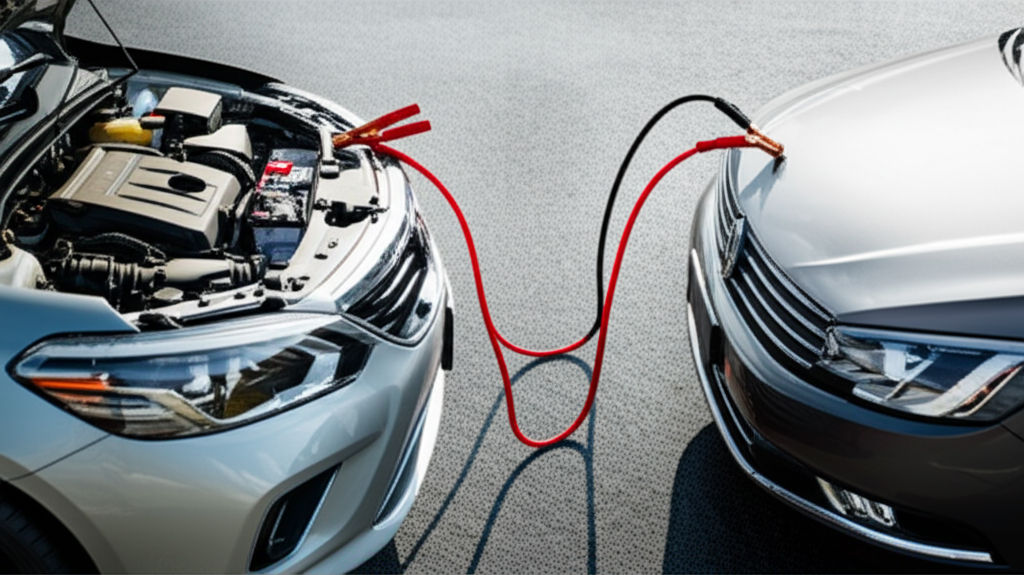

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

August 13, 2025

1st Choice Automotive Reliable And Fast Repairs

Need fast, reliable auto repairs? 1st Choice Automotive offers trusted service with certified technicians & advanced diagnostics for quality care.