Understanding Stock Market Indices: A Comprehensive Guide for Beginners

Ellie Moore

Photo: Understanding Stock Market Indices: A Comprehensive Guide for Beginners

Are you ready to embark on a journey into the fascinating world of stock market indices? If you're new to investing or simply want to enhance your financial literacy, understanding stock market indices is a crucial step towards becoming a savvy investor. In this comprehensive guide, we'll demystify the concept of stock market indices, providing you with the knowledge and confidence to navigate the financial markets like a pro. Get ready to unlock the secrets of this essential investment tool!

What are Stock Market Indices?

Stock market indices, often referred to as stock indexes, are powerful tools that provide a snapshot of the overall performance of a specific group of stocks or a particular market segment. Think of them as financial barometers that measure the health and direction of the stock market. But what exactly do they represent?

In simple terms, a stock market index is a statistical measure that tracks the value of a selected group of stocks, allowing investors to gauge the overall performance of the market or a specific sector. These indices serve as benchmarks, providing valuable insights into market trends, investor sentiment, and the overall economic climate.

Diving Deeper into Index Construction

To truly understand stock market indices, let's take a closer look at how they are constructed. Index construction involves a meticulous process of selecting and combining stocks to create a representative sample of the market or a specific industry.

Selection Criteria: Index providers, such as S&P Dow Jones Indices or FTSE Russell, carefully choose stocks based on various criteria. These may include market capitalization, liquidity, industry representation, and company size. For example, the S&P 500 index includes 500 large-cap stocks across various sectors, making it a widely followed benchmark for the U.S. stock market.

Weighting Methods: Once the stocks are selected, they are weighted within the index using different methods. Common weighting techniques include:

- Price-Weighted Index: Each stock's influence is determined by its share price. Examples include the Dow Jones Industrial Average (DJIA).

- Market-Capitalization Weighted Index: Stocks are weighted based on their total market value. The S&P 500 and the Nasdaq Composite are well-known examples.

- Equal-Weighted Index: All stocks have an equal impact, regardless of their size or price. This method provides a more balanced representation.

Why Do Stock Market Indices Matter?

You might be wondering, why should you care about these seemingly abstract numbers? Well, stock market indices play a pivotal role in the investment world, and here's why:

1. Market Performance Tracking: Indices offer a quick and efficient way to track the performance of the entire market or specific sectors. Investors can gauge the overall health of the economy and make informed decisions based on index trends.

2. Benchmarking: Stock market indices serve as benchmarks against which investors can compare the performance of their investment portfolios. For instance, if your portfolio consistently outperforms the S&P 500, it indicates that your investment strategy is generating above-average returns.

3. Investment Product Creation: Indices are the foundation for various financial products like index funds and exchange-traded funds (ETFs). These investment vehicles aim to replicate the performance of a specific index, offering investors a convenient way to gain exposure to a diversified portfolio.

4. Economic Indicators: Changes in stock market indices can reflect broader economic trends and investor sentiment. A rising index may signal economic growth and investor optimism, while a declining index could indicate a downturn or market uncertainty.

Exploring Popular Stock Market Indices

Let's explore some of the most well-known stock market indices and their significance:

1. S&P 500 Index: This iconic index comprises 500 large-cap U.S. companies across various sectors. It is widely regarded as the best representation of the U.S. stock market and is often used as a benchmark for portfolio performance.

2. Dow Jones Industrial Average (DJIA): The DJIA is one of the oldest and most recognized indices, tracking the performance of 30 large, publicly-owned companies in the U.S. It is price-weighted, meaning higher-priced stocks have a more significant impact on the index's movement.

3. Nasdaq Composite: This index includes over 3,000 stocks listed on the Nasdaq stock exchange, focusing on technology and growth companies. It provides a snapshot of the tech sector's performance.

4. FTSE 100: The FTSE 100 is a prominent index in the UK, comprising the 100 largest companies listed on the London Stock Exchange by market capitalization. It represents the performance of the UK's top corporations.

Navigating the World of Indices as a Beginner

As a beginner, navigating the world of stock market indices can be both exciting and overwhelming. Here are some practical tips to help you get started:

- Start with Education: Invest time in learning the basics of stock market indices and their role in investing. Online resources, books, and financial news websites can be valuable sources of information.

- Monitor Market News: Stay updated with market news and economic developments. Understanding the factors influencing index movements will help you interpret market trends and make more informed investment decisions.

- Explore Index Funds: Consider investing in index funds or ETFs that track a specific index. This approach offers instant diversification and allows you to mirror the performance of a broad market or sector.

- Practice with Virtual Trading: Before diving into the real market, consider using virtual trading platforms to simulate index investing. This risk-free environment lets you test strategies and gain confidence.

Conclusion

Stock market indices are not just numbers on a screen; they are powerful tools that unlock the secrets of market performance and investor sentiment. By understanding the construction and significance of these indices, you've taken a significant step towards becoming a more informed investor. Remember, investing is a journey, and continuous learning is key. Stay curious, keep exploring, and let the world of stock market indices guide you towards financial success.

As you embark on your investment journey, keep an eye on the latest trends, diversify your knowledge, and always seek reliable sources for market insights. Happy investing!

Finance & Investment

View All

March 31, 2025

Protect Your Portfolio in a Market DownturnDiscover strategies to safeguard your portfolio during market downturns. Learn how to minimize losses and thrive in uncertain times.

Ellie Moore

March 31, 2025

Auto Finance Basics for First Time BuyersElevate your content strategy! Discover how expert SEO content, driven by E-E-A-T and user intent, helps you rank higher and stand out in the evolving digital l...

Ellie Moore

January 4, 2025

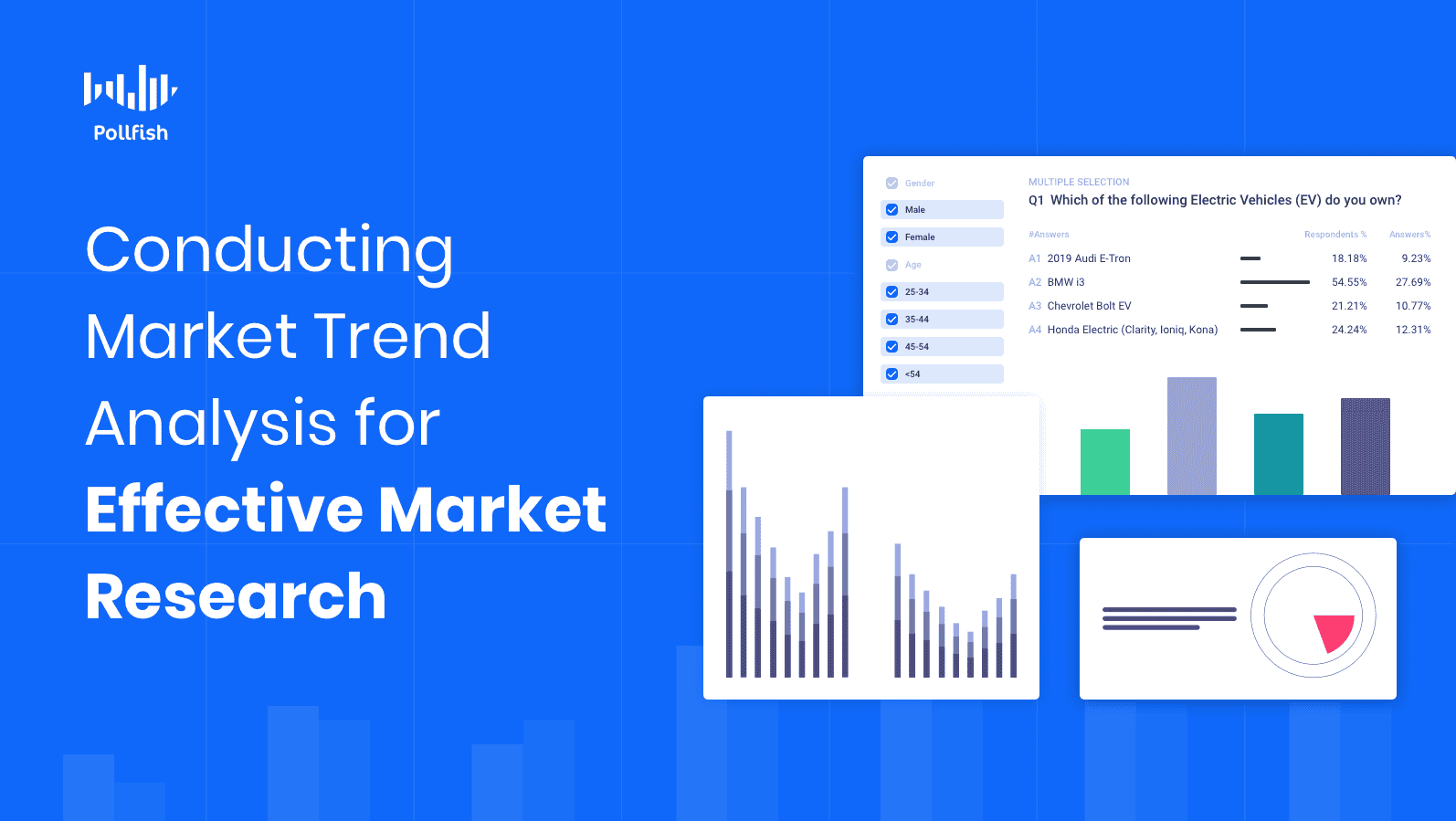

How to Use Market Analysis to Identify TrendsLearn how market analysis can help you identify emerging trends and adapt your business strategy for long-term success.

Ellie Moore

June 12, 2025

Ford Finance Specials You Should Not MissUnlock top rankings with expert SEO content. Learn why E-E-A-T and helpful content are vital for building trust and standing out in Google's evolving landscape.

Ellie Moore

January 20, 2025

Latest Market News from MSNBC FinanceUnlock your online potential with expert SEO content. Drive rankings, organic traffic, and brand trust by creating high-quality, E-E-A-T-focused material.

Ellie Moore

March 22, 2025

What the National Finance Center Really DoesGo beyond basic SEO. Discover how to craft expert content using Google's E-E-A-T framework to build trust, authority, and rank higher in search results.

Ellie Moore

Insurance

View AllSecure your business future! Learn how Essential Next Insurance Plans help agents, policyholders, and risk managers mitigate risk & optimize premiums.

Ellie Moore

Protect your paycheck with disability insurance. Learn why income protection is a must-have for financial security.

Ellie Moore

Secure your business's future. Explore Premium Erie Insurance Coverage to mitigate risks, ensure financial stability, and optimize your risk management strategy...

Ellie Moore

Premium Mapfre Insurance Options: Securing Your Future with Confidence Are you concerned about unforeseen risks impacting your assets or business continuity? In...

Ellie Moore

Enhance your coverage with insurance riders. Learn about their types, benefits, and why they’re crucial for customizing policies.

Ellie Moore

Protect your journey! Discover why complete travel insurance is vital for safeguarding your finances and peace of mind from unexpected trip disruptions.

Ellie Moore

Education

View AllHow does social media affect learning and behavior? Uncover the positive and negative effects of social platforms on students today.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreFinancial literacy is essential for today’s students. Discover why teaching money management early can lead to smarter financial decisions.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 7, 2025

Evans Automotive Offers Trusted Vehicle Solutions

Evans Automotive: Your trusted partner for comprehensive vehicle solutions. Experience transparent, expert care & peace of mind on the road.

February 5, 2025

Must-Have Tools for Every DIY Mechanic

Are you a DIY mechanic? Equip yourself with these essential tools for hassle-free car repairs and maintenance. See what every toolbox needs!

August 7, 2025

Duracell Automotive Battery Benefits And Features

Unlock reliable power for your car! Discover why Duracell automotive batteries offer enduring performance and trusted peace of mind.

August 13, 2025

VIP Automotive Premium Service For Your Car

Elevate your car care with VIP Automotive Premium Service. Discover proactive, personalized maintenance for peak performance, longevity, and an ultimate driving...

February 5, 2025

Connected Cars & IoT: Driving into a Smarter Future

Learn how connected cars and IoT are reshaping the auto industry. Discover what this new tech era means for drivers. Ready for the future?

August 6, 2025

Diamond Automotive Services That Shine Bright

Discover diamond-level car care! Learn what makes automotive services shine with expert technicians, transparency, and trust to protect your valuable vehicle.