The Ultimate Guide to Financial Planning for First-Time Investors

Ellie Moore

Photo: The Ultimate Guide to Financial Planning for First-Time Investors

Investing can feel like stepping into a vast, uncharted territory, especially for first-time investors. With a plethora of options and advice available, it’s easy to feel overwhelmed. However, effective financial planning can transform this daunting experience into a rewarding journey. This guide will provide you with essential strategies and insights to help you navigate the world of investing confidently.

Understanding Financial Planning

What is Financial Planning?

Financial planning is the process of setting goals, assessing your financial situation, and creating a strategy to achieve those goals. For first-time investors, it serves as a roadmap that outlines how to invest wisely to build wealth over time. Think of financial planning as a GPS for your financial journey—without it, you may find yourself lost in the complexities of investment choices.

Why is Financial Planning Important?

Many first-time investors dive headfirst into the stock market without a clear plan, often leading to hasty decisions and potential losses. A well-structured financial plan helps you:

- Identify Goals: Understanding your short-term and long-term financial goals is crucial. Are you saving for retirement, a home, or your children’s education?

- Assess Risk Tolerance: Knowing how much risk you can comfortably take on will guide your investment choices.

- Allocate Resources: A financial plan will help you decide how much of your income to invest and how to diversify your portfolio.

Steps to Create a Financial Plan

Step 1: Set Clear Financial Goals

Start by defining your financial objectives. For instance, if you're aiming to buy a home in five years, your investment strategy will differ from someone saving for retirement 30 years down the line. Write down your goals and prioritize them. This clarity will guide your investment decisions.

Step 2: Analyze Your Current Financial Situation

Take a comprehensive look at your finances. This includes:

- Income: What are your sources of income?

- Expenses: What are your fixed and variable costs?

- Debt: How much debt do you currently have, and what are the interest rates?

By understanding where you stand financially, you can better determine how much you can allocate toward investments.

Step 3: Determine Your Risk Tolerance

Risk tolerance is personal and varies from individual to individual. It’s influenced by various factors, including age, income, and financial goals. For example, a 25-year-old investor may be more willing to take risks compared to someone in their 50s. Consider taking a risk assessment questionnaire to help gauge your comfort level with market fluctuations.

Step 4: Develop an Investment Strategy

Your investment strategy should align with your goals and risk tolerance. Here are a few strategies to consider:

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate) to mitigate risk.

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions. This approach can reduce the impact of volatility.

- Index Funds or ETFs: For beginners, these funds are often recommended due to their lower fees and broad market exposure.

Step 5: Monitor and Adjust Your Plan

Investing is not a set-it-and-forget-it endeavor. Regularly review your financial plan and investment performance. Are you on track to meet your goals? If your financial situation changes (a new job, a significant expense), you may need to adjust your strategy.

Real-Life Examples

Consider the story of Sarah, a 30-year-old graphic designer. Sarah initially invested in individual stocks without a clear strategy. After experiencing significant losses during a market downturn, she sought advice from a financial planner. Together, they created a diversified portfolio that included index funds and bonds, aligned with her risk tolerance. Over the next five years, Sarah's investments steadily grew, and she felt more confident about her financial future.

Another example is John, a recent college graduate who decided to start investing immediately. He set a goal to save for a house in five years. By following a disciplined approach, contributing a portion of his salary to a high-yield savings account and low-cost index funds, John was able to accumulate a substantial down payment sooner than he anticipated.

Common Mistakes to Avoid

As a first-time investor, it's essential to be aware of common pitfalls:

- Chasing Trends: Avoid investing based on popular trends or tips from friends. Conduct your research.

- Neglecting Emergency Savings: Ensure you have an emergency fund in place before diving into investments. This will provide a financial cushion in case of unexpected expenses.

- Emotional Investing: Making decisions based on fear or greed can lead to poor outcomes. Stick to your plan and remain disciplined.

Conclusion: Embrace the Journey

Financial planning is a powerful tool for first-time investors. By taking the time to set clear goals, assess your financial situation, and develop a tailored investment strategy, you can navigate the complexities of investing with confidence. Remember that investing is a long-term journey, and patience is key. Embrace the process, learn from your experiences, and watch your financial future unfold. With a solid plan in place, you'll be well on your way to achieving your financial dreams.

Finance & Investment

View All

March 7, 2025

High Paying Finance Jobs 2025Elevate your online presence! Discover expert SEO content strategies to rank higher, attract more traffic, and convert users effectively.

Ellie Moore

April 2, 2025

Cryptocurrency Staking: A Smart Investment GuideUnderstand cryptocurrency staking and how it works. Learn strategies to earn passive income and maximize rewards in the crypto world!

Ellie Moore

March 29, 2025

Gold’s Role in a Diversified PortfolioDiscover why gold and precious metals are essential in a diversified portfolio. Protect your wealth with these timeless investments!

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

September 1, 2025

MBA in Finance Career BenefitsElevate your rankings & authority with expert SEO content. Learn how valuable, E-E-A-T-driven insights captivate audiences and boost online success.

Ellie Moore

March 31, 2025

Protect Your Portfolio in a Market DownturnDiscover strategies to safeguard your portfolio during market downturns. Learn how to minimize losses and thrive in uncertain times.

Ellie Moore

Insurance

View AllEssential Direct Car Insurance: Your Roadmap to Unwavering Protection Are you losing valuable peace of mind and financial security due to inadequate car insuran...

Ellie Moore

Unpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Secure optimal insurance protection without overspending. Learn how policyholders and risk managers can get cheap, high-value coverage today.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Secure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Secure Your Sanctuary: Unpacking Essential Renters Insurance Georgia Plans Are you leaving your financial security to chance, risking thousands in unforeseen da...

Ellie Moore

Education

View AllTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 15, 2025

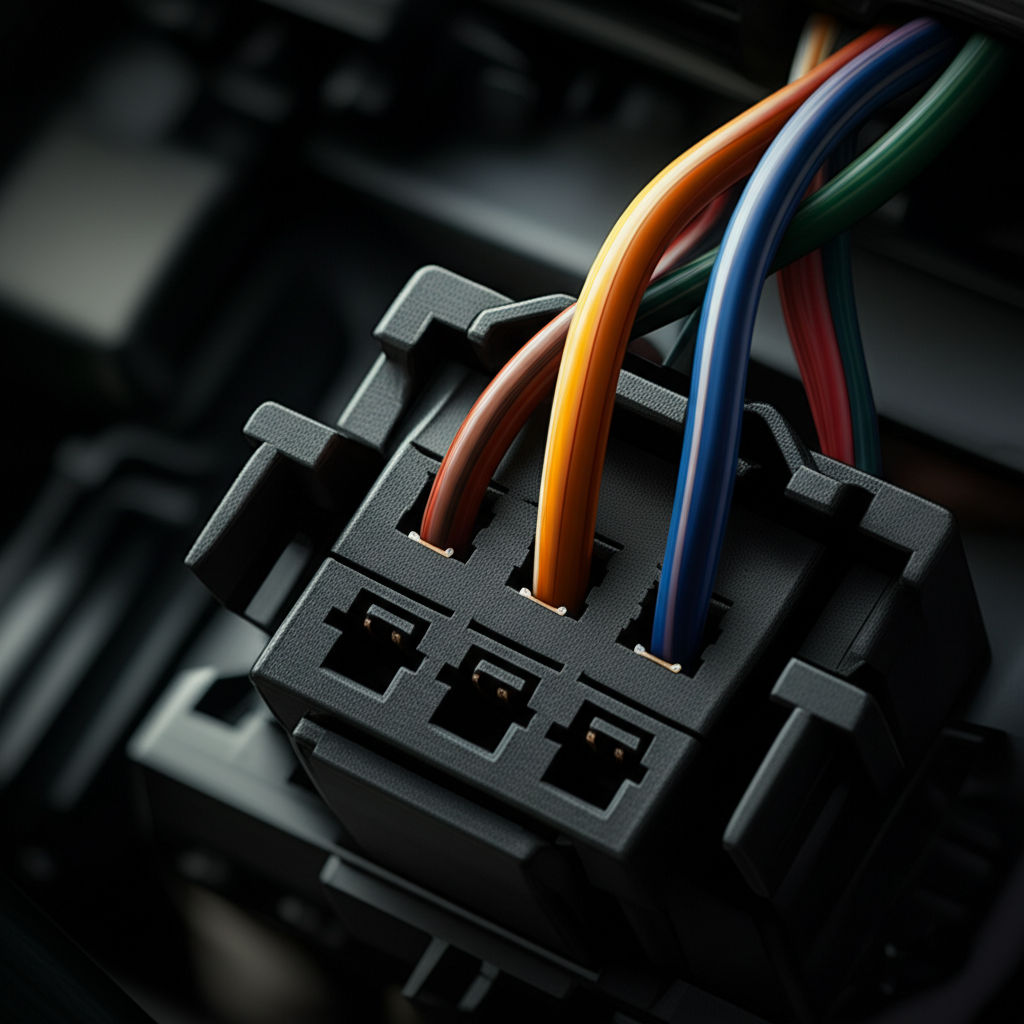

Best Automotive Electrical Connectors Reviewed

Boost vehicle safety & performance! This guide reveals why quality automotive electrical connectors are crucial & helps you choose the best ones.

July 30, 2025

AM Automotive Parts That Keep Your Car Running

Your car's unsung heroes: Essential AM automotive parts. Learn how aftermarket components ensure reliability, performance, and affordable vehicle maintenance.

February 10, 2025

Retro Car Features We Miss and Want Back

From bench seats to hidden headlights, check out the retro car features we’d love to see return. Which nostalgic design is your favorite?

September 4, 2025

Automotive Sales Jobs Near Me You Should Try

Drive your career in auto sales! Discover a lucrative, dynamic path with high earning potential, skill development, and great growth opportunities.

August 8, 2025

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

February 4, 2025

Tire Care Guide: Boost Tire Life & Performance

Maximize tire life with essential tire care tips! Learn how proper maintenance improves performance and ensures safety on every drive.