The 2024 Guide to Social Security

Ellie Moore

Photo: The 2024 Guide to Social Security – What You Need to Know Now

As we navigate the complexities of modern life, understanding the intricacies of social security is more crucial than ever. The year 2024 marks a pivotal moment for many individuals, particularly those nearing retirement or seeking to secure their financial future. Social security, a cornerstone of retirement planning, offers a vital safety net that can significantly impact one's quality of life. However, the landscape of social security is constantly evolving, with changes in laws, regulations, and economic conditions. In this guide, we aim to demystify the intricacies of social security in 2024, providing you with the essential information you need to know now.

Understanding Social Security

Social security is a federal program designed to provide financial assistance to eligible individuals, primarily those who have worked and paid taxes into the system. The program was enacted in 1935 to address the economic insecurity faced by millions of Americans during the Great Depression. Over the years, it has evolved to include various benefits such as retirement, disability, and survivor benefits.

How Social Security Works

Here’s a simplified overview of how social security works:

- Contributions: When you work, you pay Social Security taxes (6.2% for employees and 6.2% for employers). These contributions are pooled into a trust fund.

- Earnings Record: Your earnings are tracked and used to calculate your Social Security benefit amount.

- Benefits Calculation: The amount of your Social Security benefit is based on your earnings record, which is averaged over your 35 highest-earning years.

- Benefit Types: There are several types of benefits, including retirement benefits, disability benefits, and survivor benefits.

Historical Context and Recent Changes

In recent years, there have been significant changes to the Social Security system. For instance, the Social Security Administration (SSA) has implemented various measures aimed at ensuring the program’s sustainability. These measures include raising the full retirement age from 65 to 67 for those born after 1960.

Why Understanding Social Security Matters

Understanding social security is crucial for several reasons:

- Financial Planning: Knowing how much you can expect in retirement benefits helps you plan your finances more effectively.

- Retirement Security: Social security provides a predictable income stream during retirement, which can be especially important if you have other sources of income that are not guaranteed.

- Disability Support: If you become disabled, social security offers a vital source of income to help you maintain a decent standard of living.

- Inheritance Benefits: If you pass away, your spouse or dependents may be eligible for survivor benefits.

Navigating the Complexities of Social Security in 2024

Eligibility and Application Process

To be eligible for social security benefits, you generally need to have worked and paid Social Security taxes for a certain period. The application process typically begins several years before you plan to retire, but it’s essential to understand the eligibility criteria and the application process.

Eligibility Criteria:

- Work History: You must have worked and earned a certain amount of money to qualify. The specific requirements vary depending on your birth year.

- Age: Generally, you can start receiving full retirement benefits at age 67, but you can choose to start earlier (62) or later (70).

Application Process:

- Online Application: The SSA provides an online application process for most beneficiaries.

- In-Person Application: You can also apply in person at your local SSA office.

- Documentation: Gather necessary documents such as your birth certificate, Social Security card, and work history records.

Impact of Inflation on Benefits

Inflation can significantly impact the purchasing power of your social security benefits. Since the cost of living increases over time, it’s essential to understand how inflation might affect your benefits.

Impact Analysis:

- Cost-of-Living Adjustments (COLAs): The SSA adjusts benefits annually to account for inflation, ensuring that recipients can maintain a similar standard of living.

- Future Predictions: While it’s difficult to predict future inflation rates with certainty, historical data suggests that COLAs often keep pace with inflationary pressures.

Retirement Strategies

Understanding retirement strategies is crucial for maximizing your social security benefits. Here are some strategies you should consider:

Strategy 1: Optimizing Benefit Timing

- File Strategically: Timing your retirement can make a significant difference. Filing too early might reduce your monthly benefit amount.

- Delayed Retirement Credits: Delaying retirement beyond age 67 can increase your monthly benefit by 8% per year up to age 70.

Strategy 2: Combining Benefits

- Spousal Benefits: If you’re married, combining your earnings records and applying for spousal benefits might increase your overall benefits.

- Divorce Considerations: Even if you’re divorced, you may still qualify for spousal benefits if you were married for at least nine months.

Disability Benefits

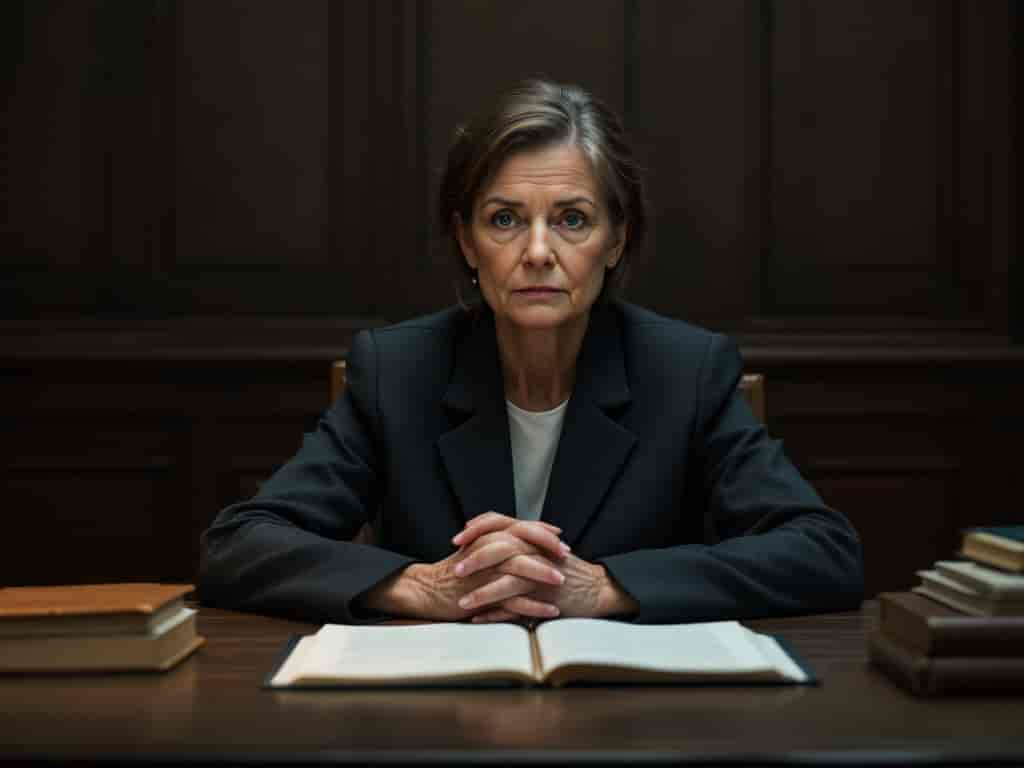

Disability benefits can provide crucial financial support if you become unable to work due to an illness or injury. Here’s a brief overview of the process:

Disability Application Process:

- Initial Application: Submit an initial application through the SSA’s website or at a local office.

- Medical Evaluation: Undergo medical evaluations to determine if your condition meets the SSA’s definition of disability.

- Appeals Process: If your initial application is denied, you can appeal the decision.

Survivor Benefits

Survivor benefits offer financial support to spouses or dependents after the death of a worker. Here’s how it works:

Eligibility for Survivor Benefits:

- Surviving Spouses: A surviving spouse may be eligible for benefits based on their deceased spouse’s earnings record.

- Dependent Benefits: Children and other dependents may also qualify for benefits based on their parent’s earnings record.

Real-Life Examples

Let’s look at a few real-life examples to illustrate these concepts better:

Example 1: Optimizing Benefit Timing

Jane worked as an accountant for 35 years and is planning to retire at age 65. She has an option to delay her retirement benefits until age 67 to increase her monthly benefit amount by 8% per year. By delaying her retirement, Jane can potentially earn more in retirement benefits and reduce her reliance on other sources of income.

Example 2: Combining Spousal Benefits

John worked as an engineer for 30 years before retiring at age 65 with a modest pension. His wife, Sarah, worked part-time for five years but never earned enough to qualify for significant retirement benefits on her own. By applying for spousal benefits using John’s earnings record, Sarah can significantly boost her monthly income in retirement.

Example 3: Disability Support

Mark suffered an injury on the job that left him unable to work. After applying for disability benefits through the SSA, he received an initial denial. However, after appealing the decision based on new medical evidence, Mark was awarded disability benefits that provided him with much-needed financial support during his recovery period.

Conclusion

Navigating the complexities of social security requires careful planning and understanding. By grasping the eligibility criteria, application process, impact of inflation on benefits, and various retirement strategies, you can maximize your social security benefits and secure a more stable financial future. Whether you're planning for retirement or seeking support in case of disability or widowhood, this guide has provided you with essential insights tailored to your needs. Remember to seek professional advice if you have specific questions or concerns about your individual situation. With this knowledge at hand, you're better equipped to ensure that your golden years shine brightly without financial anxiety.

Resources

For further information on social security benefits or to start the application process, visit the official website of the Social Security Administration (SSA) at www.ssa.gov. Additionally, consider consulting with a financial advisor specializing in retirement planning to tailor strategies specific to your situation.

By staying informed and proactive about social security benefits, you're taking significant steps towards securing a comfortable and secure financial future. Happy planning

Finance & Investment

View All

June 29, 2025

Easy Beyond Finance Login StepsCraft expert SEO content to achieve higher rankings, build authority, and truly engage your audience. Learn to leverage E-E-A-T for digital success.

Ellie Moore

October 9, 2025

Citizens One Auto Finance ReviewMaster expert SEO content to build online authority, drive traffic, and boost rankings. Learn strategies for Google-loved, audience-trusted content.

Ellie Moore

March 7, 2025

Google Finance Watchlist SetupUnlock higher rankings & engaged audiences with expert SEO content. Discover the E-E-A-T blueprint for building digital authority and trust.

Ellie Moore

March 25, 2025

Inside the Work of the Senate Finance CommitteeGo beyond basic content. Discover how expert SEO content drives rankings, builds authority, and attracts sustainable organic traffic for lasting online success.

Ellie Moore

October 6, 2025

Best Schools to Study FinanceUnlock lasting online success with expert SEO content. Learn to create valuable, E-E-A-T driven content that satisfies search engines and human readers.

Ellie Moore

April 26, 2025

Finance and Financial Services InfoUnlock top rankings & reader engagement with expert SEO content. Discover how to create valuable, authoritative, and user-friendly content for today's web.

Ellie Moore

Insurance

View AllLearn how liability insurance shields businesses from financial risks and legal challenges. Secure your company's future today!

Ellie Moore

Navigate dental insurance with our guide. Find essential plans for comprehensive coverage, financial security, and peace of mind for you or your business.

Ellie Moore

Protect your small business from cyber threats with essential cyber insurance. Learn why it’s critical in today’s digital age.

Ellie Moore

Insure your valuables! Learn what’s covered, from antiques to art, and how to ensure proper protection for collectibles.

Ellie Moore

Secure your future with Complete Progressive Insurance Protection. Get unrivaled coverage, optimize rates, and achieve peace of mind against risks.

Ellie Moore

Discover how parametric insurance uses data to quickly respond to natural disasters and protect assets.

Ellie Moore

Education

View AllMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MoreHelp students master metacognition! Learn how teaching students to think about their thinking can improve problem-solving and critical thinking skills.

Read MoreMultilingual education promotes diversity and cultural understanding. Learn why it matters and how it benefits students in a globalized world.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreDiscover how AI-powered personalized learning is reshaping education. Learn how smart tech tailors content to fit individual student needs.

Read MoreOutdoor learning promotes cognitive and social growth. Explore how nature-based education enhances learning outcomes and student well-being.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 7, 2025

Duracell Automotive Battery Benefits And Features

Unlock reliable power for your car! Discover why Duracell automotive batteries offer enduring performance and trusted peace of mind.

August 19, 2025

B and D Automotive Honest Car Repairs

Tired of auto repair uncertainty? B and D Automotive builds trust with honest, transparent service, fair pricing, and genuine care for your vehicle.

July 13, 2025

Beginner’s Guide To Automotive Primer Application

Master flawless car paint! This guide demystifies automotive primer, covering types & application for stunning, durable finishes. Essential for beginners.

July 11, 2025

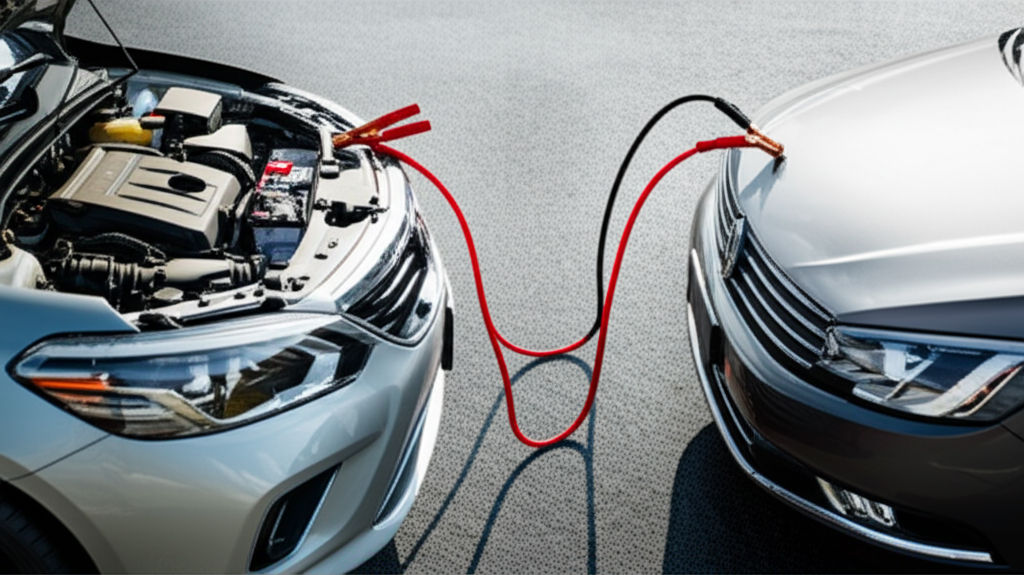

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

August 9, 2025

Kens Automotive Tips For Vehicle Maintenance

Master proactive car care with Ken's expert tips! Boost safety, save on repairs, improve fuel efficiency, and extend your vehicle's life.

July 22, 2025

Automotion 2025 What To Expect In Automotive Tech

Explore Automotion 2025's future tech: electric vehicles, advanced autonomy, and AI reshaping mobility, safety, and the driving experience.