Luxury Car Detailing in the USA How Mobile Services Are Taking Over

Ellie Moore

Photo: Luxury Car Detailing in the USA How Mobile Services Are Taking Over

driven additional Tesla, Toyota, and others provide over-the-air software upgrades along with, occasionally, fixes and BMW provides video chat roadside assistance in collaboration with tech startup Blitzz. Fleet managers can track usage and performance and control costs by means of fleet management technologies and tax and expense management tools as well as

software upgrades. Long as this fits within protection and privacy rules, data from linked cars can also be sold to insurance, advertisers, and other pertinent users. Different packages will probably show up with varying degrees of add-ons and the ability to trade up and add or exclude services. Key to success will be the partners involved in providing the linked services,

who must be creative and customer-oriented there should be demand for really excellent services like improved satnav. For established manufacturers, who have to inspire staff members to adopt a customer-centric and customer lifetime value (CLV) mindset that transcends manufacturing and delivery of physical vehicles, delivering connected services

Marks a significant cultural change and brings in new people

with software backgrounds and as-a-service mindset. Furthermore crucial for the connected-car consumer experience will be using utm.Subscription models, with their range of options including time- or mileage-based pricing, and complete packages including insurance and maintenance expenses, are ready to explode in the new as-a-service environment. While

owners may be able to rent their vehicles to public ride-sharing companies possibly integrating autonomous driving technology some OEMs will provide subscriptions to ride-sharing and/or mobility servicesMicroownership memberships are monthly for clients who do not want to commit to a car especially for those carefully weighing an electric vehicle. By

increasing the spectrum of ownership arrangements, consumers have more options and maybe the brand may reach other consumer segments. Retaining brand loyalty within this model presents one of the main difficulties for OEMs since it emphasizes on a flawless and easy client experience across all mobility offerings. As OEMs consider these models, their

Capacity to be monetized through income sources and foster

customer loyalty takes front stage. With so many fresh competitors in the mobility services space, automakers face difficulty developing and controlling new alliances with these companies while also keeping consumer loyalty. With the industry expected to climb yearly by more than percent to reach US$35 billion by 2029, a recent analysis forecasts a notable

increase in car subscriptions.seventy-one Paying for services on subscription is a quite recent practice, though, and one consumers are currently debating. Some subscription trials—mostly involving Audi and BMW—have been shelved or canceled. Getting clients to pay monthly for a package of services they feel should be included in the first purchase-based on care to

safeguard consumer data has presented one challenge.Traditionally, automakers have concentrated marketing initiatives on components, warranties, finance, and vehicle sales Automakers lacked a single image of the client to help increase selling prospects since different functions sometimes operated in silos and dealers had direct contact with

Purchasers That changes with the advent of connected

cars and various ownership structures. Nowadays, manufacturers may more readily access after-sale income sources, including those from secondhand cars To optimize customer lifetime value (CLV), a worldwide manufacturer is adopting a fresh approach using data from linked automobiles and fresh revenue sources. Using customer relationship software to obtain

a whole picture of clients, KPMG in Italy helped the client modify its marketing operating model as part of this endeavor The corporation developed a CLV software to evaluate and forecast behavior using this data, then implemented it all over the company.The organization is now in a position to maximize income sources, enhance the customer experience at every

ouchpoint, and change customer behavior and requirements by means of this fresh awareness of them. Using online buying systems and, when feasible, direct sales, both conventional manufacturers and EV suppliers are trying to get closer to the customer. Automakers might potentially choose a platform "agency" model whereby consumers

Conclution

purchase direct but vehicle fulfillment is via the dealer which might also provide other services. With a whole customer experience spanning online and retail, recent consolidation in the United States has produced the brand-agnostic digital mega-dealer. By means of purchase, these strong dealer groupings keep expanding and show ever more influence. Targeting suitable segments open to new channels, consumer and notably commercial and

fleet vehicles may also be marketed through an OEM and convenience Direct client delivery is another top concern for OEMs and dealers alike to improve the purchasing experience. This demands for a digital platform and related logistics able to smoothly handle the process from order to vehicle receipt. Regulatory change may be required in some areas to allow direct sales or dealer networks, or alternatively to software providers, who would supply

customised software for vehicles used by electricians or plumbers, for exampl Both operationally and culturally, switching from a conventional dealership model to whereby some or all automobiles are purchased straight from the manufacturer marks a significant transition. Dealers must be persuaded of the importance of turning from merely the location where drivers purchase their vehicles to be more of a delivery and servicing center. Pushing dealers

Finance & Investment

View All

March 7, 2025

High Paying Finance Jobs 2025Elevate your online presence! Discover expert SEO content strategies to rank higher, attract more traffic, and convert users effectively.

Ellie Moore

April 2, 2025

Cryptocurrency Staking: A Smart Investment GuideUnderstand cryptocurrency staking and how it works. Learn strategies to earn passive income and maximize rewards in the crypto world!

Ellie Moore

March 29, 2025

Gold’s Role in a Diversified PortfolioDiscover why gold and precious metals are essential in a diversified portfolio. Protect your wealth with these timeless investments!

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

September 1, 2025

MBA in Finance Career BenefitsElevate your rankings & authority with expert SEO content. Learn how valuable, E-E-A-T-driven insights captivate audiences and boost online success.

Ellie Moore

March 31, 2025

Protect Your Portfolio in a Market DownturnDiscover strategies to safeguard your portfolio during market downturns. Learn how to minimize losses and thrive in uncertain times.

Ellie Moore

Insurance

View AllEssential Direct Car Insurance: Your Roadmap to Unwavering Protection Are you losing valuable peace of mind and financial security due to inadequate car insuran...

Ellie Moore

Unpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Secure optimal insurance protection without overspending. Learn how policyholders and risk managers can get cheap, high-value coverage today.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Secure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Secure Your Sanctuary: Unpacking Essential Renters Insurance Georgia Plans Are you leaving your financial security to chance, risking thousands in unforeseen da...

Ellie Moore

Education

View AllTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 15, 2025

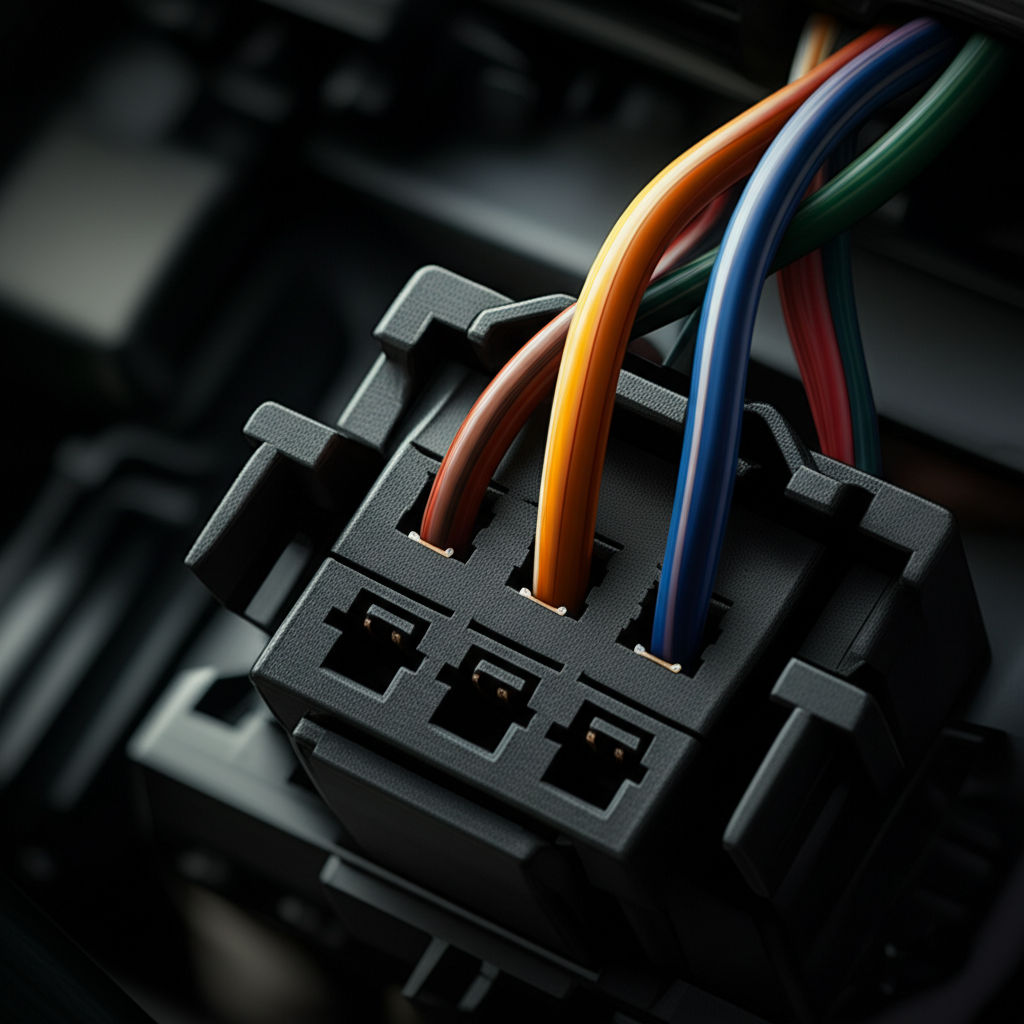

Best Automotive Electrical Connectors Reviewed

Boost vehicle safety & performance! This guide reveals why quality automotive electrical connectors are crucial & helps you choose the best ones.

July 30, 2025

AM Automotive Parts That Keep Your Car Running

Your car's unsung heroes: Essential AM automotive parts. Learn how aftermarket components ensure reliability, performance, and affordable vehicle maintenance.

February 10, 2025

Retro Car Features We Miss and Want Back

From bench seats to hidden headlights, check out the retro car features we’d love to see return. Which nostalgic design is your favorite?

September 4, 2025

Automotive Sales Jobs Near Me You Should Try

Drive your career in auto sales! Discover a lucrative, dynamic path with high earning potential, skill development, and great growth opportunities.

August 8, 2025

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

February 4, 2025

Tire Care Guide: Boost Tire Life & Performance

Maximize tire life with essential tire care tips! Learn how proper maintenance improves performance and ensures safety on every drive.