Risk Management Masterclass: Protecting Your Investments in Uncertain Times

Ellie Moore

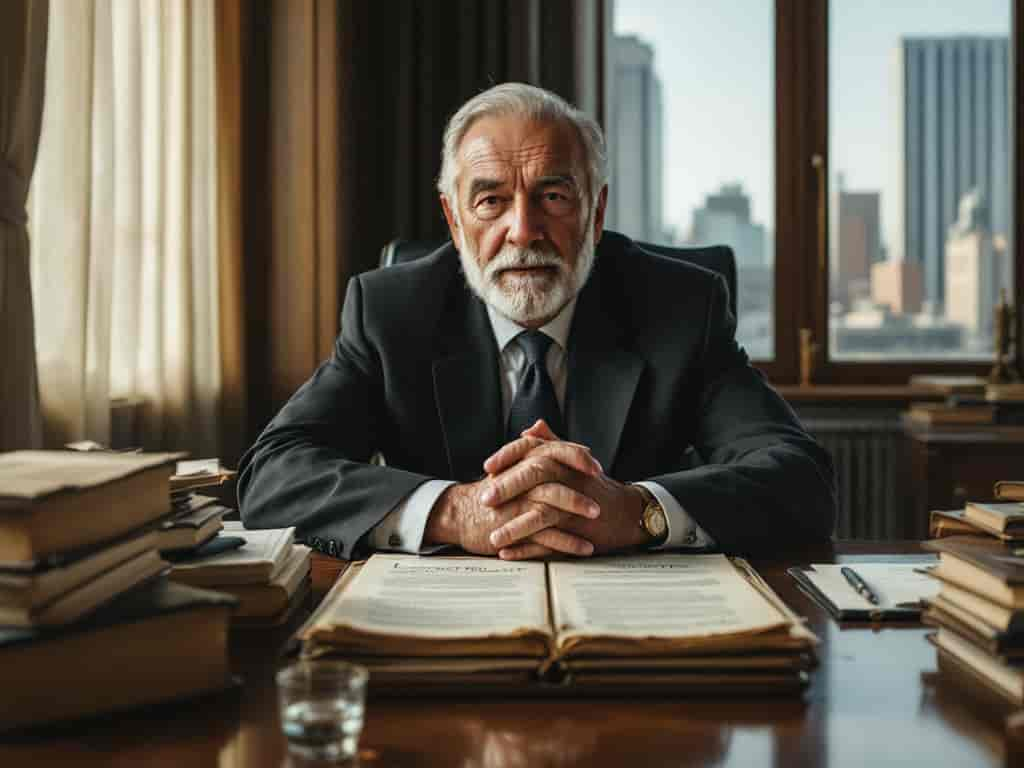

Photo: Risk Management Masterclass: Protecting Your Investments in Uncertain Times

Navigating Market Storms: A Guide to Investment Resilience in 2024

Introduction: Embracing the Challenge of Market Volatility

In the ever-changing landscape of finance, market volatility is a force that both intimidates and intrigues investors. As we sail into the latter part of 2024, understanding and managing investment risks are paramount for anyone seeking to safeguard their financial assets. This article aims to be your compass through the turbulent waters of market volatility, offering practical insights and strategies to protect your investments in these uncertain times.

Understanding Market Volatility: A Double-Edged Sword

Market volatility, often likened to a wild rollercoaster ride, refers to the rapid and significant price fluctuations in financial markets. It is a natural byproduct of the dynamic interplay between investor sentiment and market fundamentals. While volatility can be unnerving, it also presents opportunities for those who approach it with a strategic mindset.

The Two Faces of Volatility:

- Sentiment-Driven Volatility: This type of volatility is primarily influenced by investor emotions and perceptions. News headlines, economic forecasts, and market trends can all contribute to shifts in sentiment, causing prices to swing dramatically. For instance, a recent surge in tech stock prices might be attributed to optimistic investor sentiment, only to be followed by a sharp decline as doubts emerge about the sector's long-term prospects.

- Fundamental-Driven Volatility: Here, market movements are rooted in the actual performance and financial health of companies. Earnings reports, product launches, or industry-wide trends can significantly impact stock prices. For example, a pharmaceutical company's stock may soar after announcing a breakthrough drug, reflecting the market's confidence in its fundamentals.

The Art of Risk Management: Strategies for Uncertain Markets

In the face of market volatility, effective risk management becomes a critical skill for investors. It involves a thoughtful approach to portfolio construction and a proactive mindset to navigate the ups and downs of the market.

1. Active Selection and Deep Understanding:

- Know Your Holdings: The key to weathering volatility is to intimately understand the companies and assets in your portfolio. Conduct thorough research, analyze financial statements, and stay updated on industry news. This knowledge provides the conviction to hold steady during market turbulence.

- Active Selection: Actively choose investments based on their fundamentals and long-term prospects. Avoid the trap of following the crowd or making decisions solely based on short-term trends. This approach reduces the risk of being caught in sentiment-driven bubbles.

2. Tax Management Strategies:

- Tax Loss Harvesting: Consider implementing tax-efficient strategies like tax loss harvesting. Tools such as Aperio direct indexing SMAs can automate this process, allowing you to offset capital gains with losses, thereby reducing your overall tax liability.

- Option Overlay Strategies: Explore options like SpiderRock's option overlay strategies to manage risk exposure. These strategies enable you to adjust your portfolio's risk profile using options, providing a buffer during volatile periods.

3. Rebalancing and Diversification:

- Regular Rebalancing: Periodically review and rebalance your portfolio to maintain your desired asset allocation. This ensures that your investments align with your risk tolerance and financial goals. For instance, if a particular stock has outperformed, consider trimming its position to reinvest in other assets.

- Diversification: Diversifying your portfolio across various asset classes, sectors, and regions can help mitigate risk. While it doesn't guarantee profit, it can reduce the impact of volatility in any one area. However, remember that diversification must be tailored to your specific investment objectives.

Q4 2024: Navigating the Turbulent Waters

As we approach the final quarter of 2024, several factors could contribute to market turbulence. The summer months, often characterized by lighter trading and extended positioning, might amplify sentiment-driven volatility. Additionally, investors will be keeping a close eye on key economic indicators and company earnings reports, which could further influence market sentiment.

Key Considerations:

- Stay Informed: Keep abreast of market news and analysis. Subscribe to reputable financial publications and consider using data-driven insights from sources like Bloomberg and BlackRock Investment Institute.

- Patience is a Virtue: Volatility can test an investor's resolve. Remember that short-term fluctuations are normal, and long-term success often lies in staying the course. Avoid making impulsive decisions based on temporary market movements.

- Adapt and Adjust: Market conditions evolve, and so should your investment strategy. Be prepared to adapt your portfolio as new information emerges. This might involve adjusting your asset allocation, reevaluating your risk tolerance, or exploring new investment opportunities.

Conclusion: A Balanced Approach to Market Volatility

In the realm of investing, market volatility is an ever-present companion. While it can be unsettling, it also presents opportunities for those who approach it with a balanced perspective and a well-equipped toolkit. By understanding the nature of volatility, adopting sound risk management strategies, and staying informed, investors can navigate uncertain markets with confidence.

As we've explored, managing investment risks requires a combination of knowledge, adaptability, and a long-term vision. It's about embracing the challenge of market volatility, not fearing it. Remember, the key to success lies in staying informed, making thoughtful decisions, and maintaining a balanced approach to your investments.

So, as you venture into the final months of 2024, approach market volatility with a sense of curiosity and strategic foresight. By implementing the strategies discussed, you'll be well-equipped to protect your investments and potentially capitalize on the opportunities that volatility presents. Happy investing!

Finance & Investment

View All

April 19, 2025

Snap Finance Customer Service HelpBoost rankings & trust with expert SEO content. Discover how Google's E-E-A-T framework guides valuable, authoritative, and trustworthy online success.

Ellie Moore

January 24, 2025

Entrepreneurial Mindset for BeginnersLearn the basics of developing an entrepreneurial mindset. Start your journey to business success today!

Ellie Moore

May 28, 2025

VW Finance Deals and OffersMaster expert SEO content to boost rankings & engage readers. Discover strategies to create authoritative, trustworthy articles that satisfy E-E-A-T.

Ellie Moore

March 24, 2025

Minimize Risk with Dollar-Cost AveragingLearn how dollar-cost averaging helps you minimize investment risks and stay consistent in volatile markets. Start building wealth the smart way today!

Ellie Moore

June 22, 2025

Trade Finance Explained for BeginnersMaster SERP rankings with expert SEO content. Learn to create valuable, authoritative, and trustworthy content that satisfies users & search engines.

Ellie Moore

April 23, 2025

Bajaj Finance Share Price UpdateMaster expert SEO content to rank higher, build authority, and drive conversions. Discover the blueprint for valuable, E-E-A-T-compliant content.

Ellie Moore

Insurance

View AllConcerned about rising auto costs? Discover how to get premium auto insurance quotes for optimal coverage, maximum savings, and financial peace of mind.

Ellie Moore

Safeguard your condo investment! Understand essential HO-6 insurance to cover property, liability, and HOA master policy gaps.

Ellie Moore

Secure your assets & optimize risk management with Premium Bristol West Insurance. Get comprehensive auto coverage, quotes, and essential protection today.

Ellie Moore

Navigate American Family Insurance options with confidence. Find optimal coverage, understand pricing, and secure peace of mind for your evolving needs.

Ellie Moore

Learn how gig workers can protect themselves with insurance solutions designed for freelance and flexible work.

Ellie Moore

Find top-rated home insurance to protect your biggest investment. Get insights on best rates, comprehensive policies, and efficient claims for peace of mind.

Ellie Moore

Education

View AllIs a college degree still worth it? Dive into a detailed analysis of the ROI on higher education, including costs, benefits, and future prospects.

Read MoreUnderstand the causes, effects, and potential solutions to the student loan debt crisis. Learn what can be done to ease this financial burden.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MoreHelp students develop a love for learning! Discover effective ways to foster a growth mindset in students and promote lifelong success.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreResearch universities play a key role in advancing knowledge. Explore how they drive innovation, discovery, and societal progress.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 9, 2025

Exclusive Automotive Service For Premium Cars

Discover why exclusive automotive service is essential for your premium car. Protect your investment, maintain peak performance, and ensure specialized care.

February 4, 2025

Tire Care Guide: Boost Tire Life & Performance

Maximize tire life with essential tire care tips! Learn how proper maintenance improves performance and ensures safety on every drive.

July 31, 2025

Innovative Automotive Concepts Changing The Industry

Explore how innovative automotive concepts, from EVs to AI, are transforming mobility for a safer, cleaner, and smarter future.

February 16, 2025

Urban Mobility Trends: E-Bikes, Scooters & More

Explore the future of urban mobility with e-bikes, scooters, and microcars. Learn how these trends are transforming city transportation.

August 3, 2025

Automotive Seam Sealer Tape Preparation Tips

Unlock automotive longevity! Learn essential seam sealer tape prep tips to prevent rust & ensure lasting vehicle protection.

August 13, 2025

1st Choice Automotive Reliable And Fast Repairs

Need fast, reliable auto repairs? 1st Choice Automotive offers trusted service with certified technicians & advanced diagnostics for quality care.