Navigating Market Trends: How to Stay Ahead of the Curve and Maximize Returns

Ellie Moore

Photo: Navigating Market Trends: How to Stay Ahead of the Curve and Maximize Returns

Navigating the Ever-Changing Market Trends: A Comprehensive Guide to Staying Ahead

Introduction: Embracing the Dynamic Market Landscape

In today's fast-paced business world, keeping up with market trends is not just a strategic advantage; it's a necessity for businesses aiming to thrive and investors seeking to maximize their returns. The ability to navigate market trends effectively can be the difference between success and being left behind. This article aims to provide an insightful journey through the art of understanding and leveraging market trends, offering a practical guide to staying ahead of the curve.

Understanding Market Trends: Unlocking the Basics

Market trends are the heartbeat of the business world, representing the general direction in which a market is moving. These trends can encompass various aspects, from consumer behavior shifts to technological advancements and economic fluctuations. Staying attuned to these trends is crucial for businesses and investors alike, as they provide valuable insights for strategic decision-making.

Market Trend Analysis is a powerful tool that involves examining these trends to identify patterns, changes, and potential opportunities. It's about deciphering the story behind the data, allowing businesses to adapt and innovate, and investors to make informed choices.

The Art of Identifying Trends

Identifying market trends is both a science and an art. It involves a keen eye for detail and a comprehensive approach. Here's a breakdown of the process:

- Data Collection: The first step is gathering relevant data from various sources. This includes industry reports, market research, consumer surveys, and economic indicators. For instance, tracking the sales growth of electric vehicles can provide insights into the evolving automotive market.

- Pattern Recognition: Analyzing the collected data involves identifying patterns and correlations. Are there consistent shifts in consumer preferences? Are certain industries experiencing rapid growth or decline? For instance, a rising trend in online shopping might indicate a shift in retail strategies.

- Trend Confirmation: Once patterns are identified, it's essential to validate them. This can be done by comparing findings with other sources and industry experts. For instance, a trend towards sustainable packaging might be confirmed by environmental initiatives in the industry.

- Future Projection: The ultimate goal is to predict future trends. By understanding the past and present, analysts can forecast potential market directions. For example, the growing popularity of remote work might suggest a rise in demand for digital collaboration tools.

Strategies for Staying Ahead of the Curve

Adaptability: The Key to Survival

In a rapidly changing market, adaptability is a superpower. Businesses that can quickly adjust their strategies based on emerging trends are more likely to stay relevant. For instance, a fashion brand might pivot to sustainable clothing lines if consumer preferences shift towards eco-friendly products.

Embrace Innovation and Technology

Technology often drives market trends, and those who embrace it gain a competitive edge. Consider the rise of e-commerce platforms, which revolutionized retail. Staying updated with technological advancements and implementing them in business operations can be a powerful strategy.

Diversify Your Portfolio

For investors, diversification is a time-tested approach to managing risk. By spreading investments across various sectors and asset classes, investors can capitalize on multiple market trends. For example, investing in renewable energy stocks alongside tech startups can provide a balanced portfolio.

Stay Informed and Network

Knowledge is power in the world of market trends. Stay updated through industry publications, conferences, and networking events. Engaging with industry peers can provide valuable insights and early signals of emerging trends.

Case Study: The Rise of Digital Payments

A notable market trend in recent years has been the widespread adoption of digital payment methods. This shift was driven by consumer demand for convenience and security. Businesses that recognized this trend early on, like online payment platforms and digital wallet providers, experienced significant growth.

Maximizing Investment Returns: A Strategic Approach

Identifying Market Opportunities

- Research and Analysis: Conduct thorough research and analysis to identify sectors or industries with high growth potential. For instance, the healthcare industry's focus on telemedicine during the pandemic created investment opportunities.

- Risk Assessment: Evaluate the risks associated with each investment opportunity. Understanding market volatility and potential challenges is crucial for informed decision-making.

- Industry Insights: Stay informed about industry-specific trends. For example, the rise of electric vehicles has created opportunities in battery technology and charging infrastructure.

Long-Term vs. Short-Term Strategies

- Long-Term Investments: Focus on industries with sustained growth potential. For instance, investing in renewable energy companies can offer long-term returns as the world transitions to cleaner energy sources.

- Short-Term Opportunities: Capitalize on short-term market fluctuations. Day traders often exploit these trends, buying and selling assets within a day to profit from price movements.

Diversification and Risk Management

- Portfolio Diversification: Spread investments across different asset classes and industries. This reduces the impact of any single market trend on your overall returns.

- Risk Mitigation: Implement risk management strategies such as setting stop-loss orders to limit potential losses. Stay informed about market risks and adjust your portfolio accordingly.

Conclusion: A Constant Journey of Adaptation

Navigating market trends is a dynamic and continuous process. It requires a blend of analytical skills, adaptability, and a forward-thinking mindset. By embracing market trend analysis, businesses can innovate, and investors can make strategic decisions.

Staying ahead of the curve is not about predicting the future with certainty but about being prepared for it. It's a journey of constant learning, adapting, and seizing opportunities. As the market evolves, so should our strategies, ensuring we maximize returns and remain relevant in an ever-changing business landscape.

In the world of market trends, knowledge is power, and the ability to act on that knowledge is the key to success. Stay informed, stay agile, and embrace the exciting journey of navigating market trends.

Finance & Investment

View All

June 29, 2025

Easy Beyond Finance Login StepsCraft expert SEO content to achieve higher rankings, build authority, and truly engage your audience. Learn to leverage E-E-A-T for digital success.

Ellie Moore

October 9, 2025

Citizens One Auto Finance ReviewMaster expert SEO content to build online authority, drive traffic, and boost rankings. Learn strategies for Google-loved, audience-trusted content.

Ellie Moore

March 7, 2025

Google Finance Watchlist SetupUnlock higher rankings & engaged audiences with expert SEO content. Discover the E-E-A-T blueprint for building digital authority and trust.

Ellie Moore

March 25, 2025

Inside the Work of the Senate Finance CommitteeGo beyond basic content. Discover how expert SEO content drives rankings, builds authority, and attracts sustainable organic traffic for lasting online success.

Ellie Moore

October 6, 2025

Best Schools to Study FinanceUnlock lasting online success with expert SEO content. Learn to create valuable, E-E-A-T driven content that satisfies search engines and human readers.

Ellie Moore

April 26, 2025

Finance and Financial Services InfoUnlock top rankings & reader engagement with expert SEO content. Discover how to create valuable, authoritative, and user-friendly content for today's web.

Ellie Moore

Insurance

View AllLearn how liability insurance shields businesses from financial risks and legal challenges. Secure your company's future today!

Ellie Moore

Navigate dental insurance with our guide. Find essential plans for comprehensive coverage, financial security, and peace of mind for you or your business.

Ellie Moore

Protect your small business from cyber threats with essential cyber insurance. Learn why it’s critical in today’s digital age.

Ellie Moore

Insure your valuables! Learn what’s covered, from antiques to art, and how to ensure proper protection for collectibles.

Ellie Moore

Secure your future with Complete Progressive Insurance Protection. Get unrivaled coverage, optimize rates, and achieve peace of mind against risks.

Ellie Moore

Discover how parametric insurance uses data to quickly respond to natural disasters and protect assets.

Ellie Moore

Education

View AllMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MoreHelp students master metacognition! Learn how teaching students to think about their thinking can improve problem-solving and critical thinking skills.

Read MoreMultilingual education promotes diversity and cultural understanding. Learn why it matters and how it benefits students in a globalized world.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreDiscover how AI-powered personalized learning is reshaping education. Learn how smart tech tailors content to fit individual student needs.

Read MoreOutdoor learning promotes cognitive and social growth. Explore how nature-based education enhances learning outcomes and student well-being.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 7, 2025

Duracell Automotive Battery Benefits And Features

Unlock reliable power for your car! Discover why Duracell automotive batteries offer enduring performance and trusted peace of mind.

August 19, 2025

B and D Automotive Honest Car Repairs

Tired of auto repair uncertainty? B and D Automotive builds trust with honest, transparent service, fair pricing, and genuine care for your vehicle.

July 13, 2025

Beginner’s Guide To Automotive Primer Application

Master flawless car paint! This guide demystifies automotive primer, covering types & application for stunning, durable finishes. Essential for beginners.

July 11, 2025

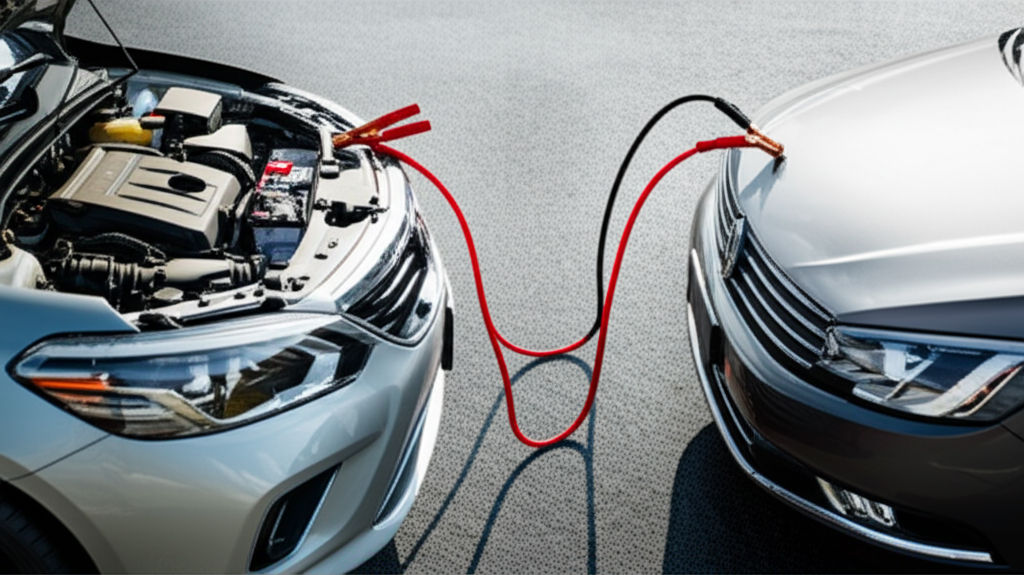

How To Use Jumper Cables For Automotive Emergencies

Don't get stranded! Learn to safely jump start your car with our comprehensive guide. Master jumper cables and tackle dead batteries with confidence.

August 9, 2025

Kens Automotive Tips For Vehicle Maintenance

Master proactive car care with Ken's expert tips! Boost safety, save on repairs, improve fuel efficiency, and extend your vehicle's life.

July 22, 2025

Automotion 2025 What To Expect In Automotive Tech

Explore Automotion 2025's future tech: electric vehicles, advanced autonomy, and AI reshaping mobility, safety, and the driving experience.