Retirement Savings: Are You on Track? Here’s How to Check

Ellie Moore

Photo: Retirement Savings: Are You on Track? Here’s How to Check

The question of retirement savings often looms large. Are you on track to secure a comfortable retirement? This is a crucial question that many of us may not fully address until it’s almost too late. In this article, we will explore how to assess your retirement savings, what benchmarks to consider, and actionable steps to ensure you are on the right path.

Understanding Retirement Savings

Retirement savings refer to the funds set aside to support your lifestyle after you stop working. The earlier you start saving, the more time your money has to grow through compound interest. However, many individuals find themselves uncertain about whether they are saving enough or if their strategies are effective.

The Importance of Starting Early

Consider Sarah, who began saving for retirement at age 25. By contributing just $200 a month into a retirement account with an average annual return of 7%, she could accumulate over $500,000 by age 65. In contrast, her friend Mike started saving at 40 and would need to contribute more than double that amount each month to reach the same goal. This example highlights the power of starting early and consistently contributing to your savings.

Assessing Your Current Situation

To determine if you’re on track for retirement, follow these steps:

1. Calculate Your Retirement Needs

Begin by estimating how much money you’ll need in retirement. A common rule of thumb is that you will need about 70% to 80% of your pre-retirement income annually to maintain your lifestyle. For instance, if you earn $70,000 a year, aim for $49,000 to $56,000 annually in retirement.

2. Review Your Current Savings

Next, take stock of your current savings. Include all retirement accounts such as 401(k)s, IRAs, and any other investments. Use online calculators or spreadsheets to track your total savings and project future growth based on your current contributions.

3. Understand Your Savings Rate

Your savings rate is the percentage of your income that you save for retirement. Financial experts often recommend saving at least 15% of your gross income each year. If you’re falling short of this benchmark, it may be time to reevaluate your budget and spending habits.

Analyzing Your Investment Strategy

Once you have a clear picture of your current situation, it’s essential to analyze how your savings are invested.

Diversification Matters

Diversification involves spreading your investments across various asset classes stocks, bonds, real estate to reduce risk. For example, during market downturns, bonds may perform better than stocks, helping stabilize your portfolio. If all your investments are concentrated in one area, you could face significant losses during market fluctuations.

Risk Tolerance Assessment

Understanding your risk tolerance is crucial when selecting investments. Are you comfortable with high-risk stocks that can yield high returns but also substantial losses? Or do you prefer safer investments with lower returns? Knowing where you stand can help tailor an investment strategy that aligns with your comfort level and retirement timeline.

Adjusting Your Plan

If after assessing your situation and strategy you find yourself off track, don’t panic! There are several steps you can take to improve your retirement outlook.

Increase Contributions

If possible, gradually increase your contributions to retirement accounts. Even a small increase can significantly impact over time due to compound interest. For instance, if Sarah from our earlier example decides to increase her monthly contribution from $200 to $250, she could potentially add tens of thousands more by retirement.

Explore Additional Income Streams

Consider ways to boost your income through side jobs or freelance work. This additional income can be directed entirely towards retirement savings. Many people find fulfillment in pursuing hobbies or skills that can generate extra cash flow while also contributing to their long-term financial goals.

Seeking Professional Guidance

If navigating retirement planning feels overwhelming, consider consulting with a financial advisor. They can provide personalized advice tailored to your unique situation and help create a comprehensive plan that addresses all aspects of your financial life.

The Value of Professional Insights

A financial advisor can offer insights into tax-efficient strategies for withdrawals during retirement or suggest investment opportunities that align with market trends. Their expertise can be invaluable in ensuring that you're making informed decisions about your future.

Conclusion: Taking Control of Your Retirement Future

In conclusion, assessing whether you're on track with your retirement savings is a vital step toward securing a comfortable future. By calculating your needs, reviewing current savings and investment strategies, and making necessary adjustments, you can take proactive steps toward achieving your retirement goals.

Remember Sarah and Mike's story it illustrates that the earlier you start planning and saving for retirement, the better off you'll be in the long run. Don't hesitate take charge of your financial future today! Whether it’s increasing contributions or seeking professional advice, every step counts towards building a secure and fulfilling retirement.

Finance & Investment

View All

February 26, 2025

Nissan Finance Account LoginMaster expert SEO content! Go beyond keywords to build trust, deliver value, and rank higher. Understand Google's E-E-A-T framework for success.

Ellie Moore

June 16, 2025

Magic The Gathering Reddit Finance InsightsUnlock success with expert SEO content. Learn how E-E-A-T drives high-quality, valuable content that ranks and engages users and search engines.

Ellie Moore

January 21, 2025

Navy Federal Car Financing GuideMaster expert SEO content! This blueprint shows you how to leverage E-E-A-T to build authority, earn trust, and achieve top search engine rankings.

Ellie Moore

October 27, 2025

VOO Yahoo Finance ETF TrackerGo beyond keywords! Learn to create expert SEO content that builds authority, trust & ranks high using Google's E-E-A-T framework.

Ellie Moore

May 9, 2025

Ally Auto Finance OptionsUnlock higher rankings & engaged readers with expert SEO content. Learn to create valuable, authoritative content that satisfies both users & search engines.

Ellie Moore

October 12, 2025

Federal Housing Administration LoansUnlock organic traffic & become an authority with expert SEO content. Learn how E-E-A-T, user intent, and quality build high-ranking, valuable content.

Ellie Moore

Insurance

View AllDiscover how microinsurance provides affordable coverage solutions for underserved populations worldwide.

Ellie Moore

Navigate dental insurance with our guide. Find essential plans for comprehensive coverage, financial security, and peace of mind for you or your business.

Ellie Moore

Don't gamble with your finances. Discover essential auto insurance coverage to protect your assets, minimize risk, and gain peace of mind on the road.

Ellie Moore

Discover how artificial intelligence simplifies claims, enhances accuracy, and speeds up insurance processes.

Ellie Moore

Understand the legal side of insurance with this guide to policy exclusions. Learn what’s not covered and why it matters.

Ellie Moore

Protect yourself from online risks with cybersecurity insurance. Learn why it’s essential for individuals in a digital world.

Ellie Moore

Education

View AllLearn key strategies for creating inclusive classrooms. Discover how to foster equality, engagement, and a sense of belonging for every student.

Read MoreResearch universities play a key role in advancing knowledge. Explore how they drive innovation, discovery, and societal progress.

Read MorePlay is crucial in early learning! Discover how play-based learning enhances cognitive, emotional, and social development in young children.

Read MoreLearn how UNESCO promotes education for all globally. Explore key initiatives and efforts aimed at fostering equal learning opportunities for everyone.

Read MoreTake learning beyond the textbook with experiential education. Discover how real-world experiences create lasting knowledge and skills.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 8, 2025

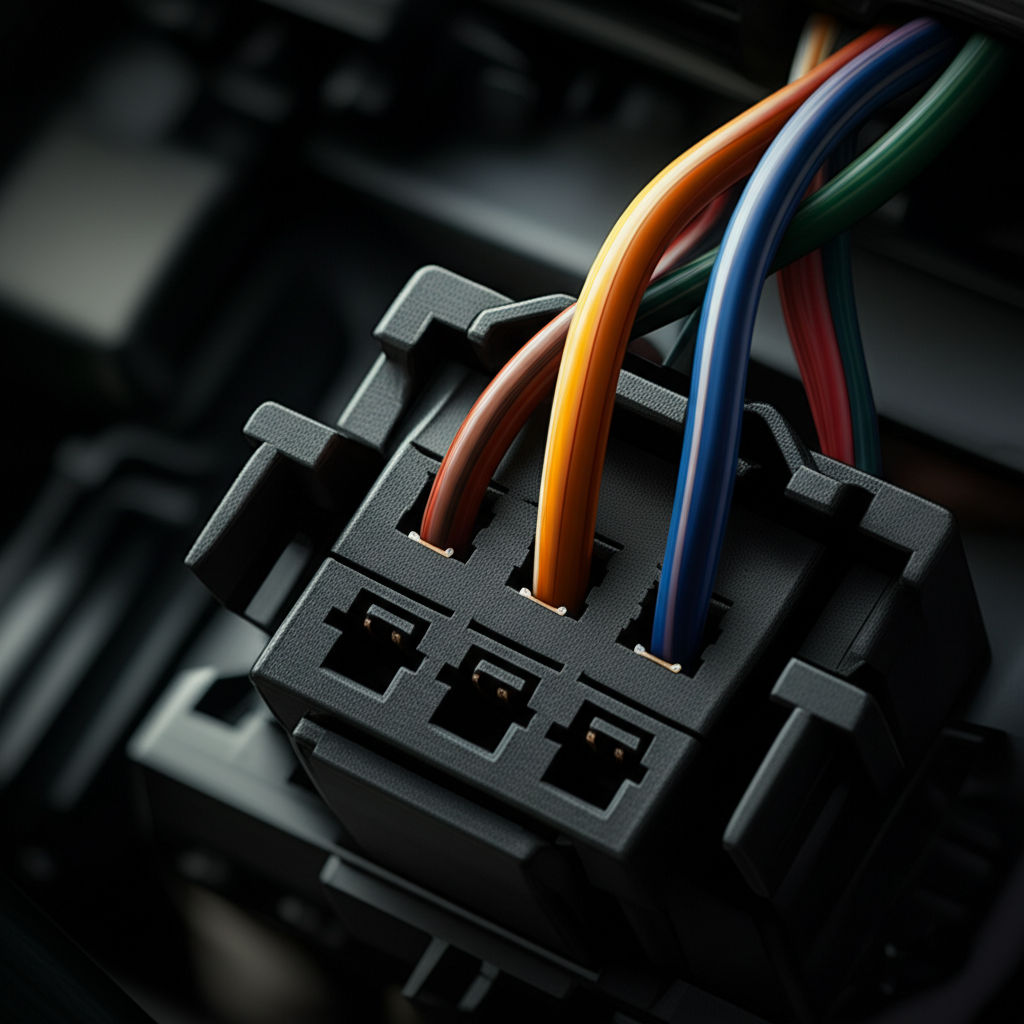

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

August 2, 2025

Automotive Painter Jobs And How To Get Hired

Drive your career forward! Learn how to get hired as an automotive painter, mastering the art of vehicle refinishing for a rewarding profession.

July 20, 2025

Smith Automotive Services With Great Reviews

Searching for reliable auto service? Leverage the power of online reviews to find trusted car repair shops and ensure transparent, quality care.

September 5, 2025

Best Deals On Automotive Tint Near Me

Get the best deals on automotive tint near you! Enhance privacy, reduce heat & UV, and boost style with our comprehensive guide.

February 1, 2025

Hybrid vs. Electric Cars: Which Should You Buy?

Comparing hybrid and electric cars? See which is better for your needs. Find out which vehicle offers the best value, efficiency, and performance.

August 29, 2025

Southeast Automotive Trusted Local Repairs

Navigate auto repairs in the Southeast with confidence! Find trusted local shops for expert care & lasting peace of mind.