Life Insurance as an Investment: Is It Worth It?

Ellie Moore

Photo: Life Insurance as an Investment: Is It Worth It?

Life Insurance as an Investment: Is It Worth It?

Life insurance is one of the most crucial financial products you can invest in. It's designed to provide financial protection for your loved ones in the event of your death. But beyond this primary function, there's been increasing interest in using life insurance as an investment strategy. While the notion of combining life insurance with investment is appealing to some, it’s important to carefully weigh the pros and cons before making a decision.

In this article, we’ll explore life insurance as an investment, its potential benefits, its drawbacks, and whether it’s truly worth it. We’ll also look into the different types of life insurance policies available and how they compare to other investment options. By the end of this article, you should have a clearer understanding of whether life insurance is the right investment choice for your financial goals.

What Is Life Insurance as an Investment?

At its core, life insurance is designed to provide financial protection to your beneficiaries after your passing. But with certain types of policies, such as whole life insurance and universal life insurance, there is an investment component attached. These policies not only offer a death benefit but also allow you to accumulate a cash value over time.

In these types of life insurance, a portion of your premiums goes toward the death benefit, and the other portion is invested by the insurance company in various financial instruments, such as bonds, stocks, or other assets. The accumulated cash value grows over time and may provide a source of funds that you can access during your lifetime.

While this may sound like a great way to simultaneously protect your loved ones and grow your wealth, it’s essential to understand the mechanics behind it to determine if it's worth considering as an investment.

Types of Life Insurance Policies with Investment Features

Not all life insurance policies come with an investment component. To understand life insurance as an investment, you first need to be familiar with the types of life insurance that offer this feature. Here are the most common ones:

1. Whole Life Insurance

Whole life insurance is the most well-known type of permanent life insurance. It provides lifelong coverage and includes an investment component in the form of cash value accumulation. The cash value grows at a guaranteed rate set by the insurance company, and you can access this money during your lifetime through withdrawals or loans.

Advantages of Whole Life Insurance:

- Guaranteed cash value growth.

- Fixed premiums for the life of the policy.

- Death benefit that passes to your beneficiaries tax-free.

Disadvantages of Whole Life Insurance:

- Higher premiums compared to term life insurance.

- Investment returns may be lower than other investment options.

- The policy can be complex to manage.

2. Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance. While it still includes an investment component, you can adjust your premiums and death benefits over time. The cash value in a universal life policy grows based on the performance of a subaccount, which may involve various investment options.

Advantages of Universal Life Insurance:

- Flexible premium payments and death benefits.

- Potential for higher cash value growth based on market performance.

- Option to borrow against the cash value.

Disadvantages of Universal Life Insurance:

- Investment returns are not guaranteed.

- Premiums may increase over time.

- Fees associated with the policy can be high.

3. Variable Life Insurance

Variable life insurance combines permanent life insurance with investment choices. With this type of policy, you can choose from a range of investment options, such as mutual funds, to allocate your cash value. The value of your policy can fluctuate based on the performance of the underlying investments.

Advantages of Variable Life Insurance:

- Potential for higher returns through investment options.

- Flexibility in choosing investment strategies.

- Tax-deferred growth on the cash value.

Disadvantages of Variable Life Insurance:

- Risk of losing cash value if investments perform poorly.

- High fees and administrative costs.

- Requires active management and understanding of investments.

Pros and Cons of Using Life Insurance as an Investment

Before diving into whether life insurance is worth it as an investment, let’s take a look at the pros and cons of using it for this purpose.

Pros:

- Tax Benefits: The cash value growth is typically tax-deferred, and the death benefit is paid out tax-free to beneficiaries.

- Lifelong Coverage: As long as you continue to pay premiums, you can enjoy permanent coverage, unlike term life insurance which expires after a set period.

- Access to Cash Value: Some policies allow you to borrow against the accumulated cash value, providing a source of funds for emergencies or other financial needs.

- Estate Planning Tool: Life insurance can be a useful tool for estate planning, helping to provide for your beneficiaries after your death.

Cons:

- High Premiums: Life insurance policies with an investment component tend to be significantly more expensive than term life insurance.

- Lower Returns: The investment returns are often lower compared to other traditional investment vehicles, such as stocks or bonds.

- Complexity: These policies can be difficult to understand, with many moving parts, including premiums, investment performance, and death benefits.

- Fees and Charges: There are often high fees associated with life insurance policies with an investment component, including administrative fees, insurance charges, and more.

Is Life Insurance Worth It as an Investment?

Now, let’s get to the most important question: Is life insurance worth it as an investment? The answer depends on your specific financial goals and circumstances.

When Life Insurance May Be a Good Investment

- You Need Lifelong Coverage: If you're looking for permanent life insurance with a cash value component, whole life or universal life insurance may be a good fit. These policies provide both protection and the potential to accumulate cash value.

- You Want to Leave a Legacy: If you’re interested in leaving a financial legacy for your beneficiaries, the death benefit from a life insurance policy can be a tax-efficient way to do so.

- You Want Tax-Deferred Growth: Life insurance policies often offer tax-deferred growth on the cash value, which could be appealing if you're already maxing out your retirement accounts and looking for other tax-advantageous investment options.

When Life Insurance May Not Be a Good Investment

- You’re Looking for High Investment Returns: If your primary goal is investment growth, life insurance policies may not be the best option. They tend to offer lower returns compared to other investment vehicles like stocks, mutual funds, or real estate.

- You’re on a Budget: The higher premiums for whole life or universal life insurance policies might not fit within your budget, especially if you’re just starting out in your career or have other financial obligations.

- You Need Simpler Coverage: If you just need basic life insurance to cover expenses like a mortgage, children’s education, or other debts, term life insurance might be a better option. It’s more affordable and provides pure life coverage without the investment component.

Alternatives to Life Insurance as an Investment

If you’re considering life insurance primarily as an investment vehicle, there are other options worth exploring. Here are a few:

- 401(k) or IRA: Contributing to retirement accounts like a 401(k) or IRA allows you to invest in stocks, bonds, and other assets with tax advantages. These accounts typically offer higher returns than life insurance policies with investment components.

- Mutual Funds: If you’re looking for diversification, mutual funds allow you to pool your money with other investors to invest in a range of stocks, bonds, and other assets, typically offering a better potential return than cash value life insurance.

- Real Estate: Real estate can provide both income and appreciation potential over time, and it’s an investment that offers tax advantages.

Conclusion

Life insurance is a critical financial product that offers protection for your loved ones in the event of your death. However, using life insurance primarily as an investment may not be the most efficient way to grow your wealth. While there are benefits such as tax-deferred growth and a death benefit for beneficiaries, the investment returns are often lower than other traditional investment options.

Before deciding to use life insurance as an investment, carefully assess your financial goals, risk tolerance, and budget. If your primary goal is to grow wealth, you might be better off exploring other investment options. On the other hand, if you're looking for permanent life insurance with additional benefits, then life insurance could be worth considering as part of a broader financial strategy.

FAQs About Life Insurance as an Investment

1. Can I use the cash value of my life insurance for retirement?

Yes, the cash value of certain life insurance policies can be accessed through loans or withdrawals, which can be used as supplementary retirement income. However, keep in mind that taking a loan may reduce the death benefit.

2. Is life insurance a good investment for tax savings?

Life insurance policies with a cash value component can provide tax-deferred growth. Additionally, the death benefit is usually paid out tax-free to beneficiaries, which can be a useful estate planning tool.

3. Can I switch from a term life insurance policy to a permanent one?

Some policies allow you to convert term life insurance to a whole or universal life policy. However, this depends on the terms of your policy, so it’s important to review your specific policy or speak with your insurance provider.

By considering these questions, you can make a more informed decision about whether life insurance is the right investment for you.

Finance & Investment

View All

October 15, 2025

Understanding First American FinanceGo beyond keywords. Discover how expert SEO content builds authority, trust, and boosts rankings, driving growth in today's digital landscape.

Ellie Moore

November 22, 2025

New York State Tax and Finance HelpElevate your online presence with expert SEO content. Boost rankings, build authority, and engage your audience with valuable, E-E-A-T compliant information.

Ellie Moore

June 20, 2025

SMCI Yahoo Finance Stock Market UpdatesCraft expert SEO content that ranks high and helps your audience. Learn to build trust, authority, and apply E-E-A-T, comprehensive insights for search success.

Ellie Moore

November 23, 2024

The Best Financial Management Software for Small Business OwnersStreamline your business finances with the best financial management software! Discover powerful tools to track expenses, manage invoices, and optimize cash flow. Start growing your business today!

Ellie Moore

October 3, 2025

Academy of Finance and Enterprise InfoDominate search in 2025! Discover expert SEO content strategies to create high-quality, trustworthy information that resonates with users and search engines.

Ellie Moore

October 5, 2025

Best Colleges for Finance DegreesGo beyond keywords! Learn to craft expert SEO content that builds online authority, drives organic traffic, and earns trust with search engines.

Ellie Moore

Insurance

View AllFind optimal premium car insurance quotes online. This guide helps policyholders, agents & risk managers compare rates for robust, high-value coverage.

Ellie Moore

Explore emerging trends reshaping insurance in 2025. Stay ahead with insights on AI, blockchain, and coverage innovations.

Ellie Moore

Understand the legal side of insurance with this guide to policy exclusions. Learn what’s not covered and why it matters.

Ellie Moore

Moving abroad? Learn everything about international health insurance, from coverage options to must-have benefits for expats.

Ellie Moore

Discover how artificial intelligence simplifies claims, enhances accuracy, and speeds up insurance processes.

Ellie Moore

Unlock optimal Farmers Insurance coverage & value. This guide helps policyholders, agents & risk managers find top plans to safeguard assets.

Ellie Moore

Education

View AllMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreLearn how gamification is transforming modern classrooms. Explore fun, interactive strategies that boost engagement and learning outcomes.

Read MoreExplore the benefits of hybrid learning models. Learn how to balance online and face-to-face teaching for a more flexible education experience.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MoreMultilingual education promotes diversity and cultural understanding. Learn why it matters and how it benefits students in a globalized world.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 25, 2025

KC Automotive Trusted Experts Near You

Seeking trusted auto repair in KC? Our guide connects you with reliable experts for safe, long-lasting car care & peace of mind.

July 23, 2025

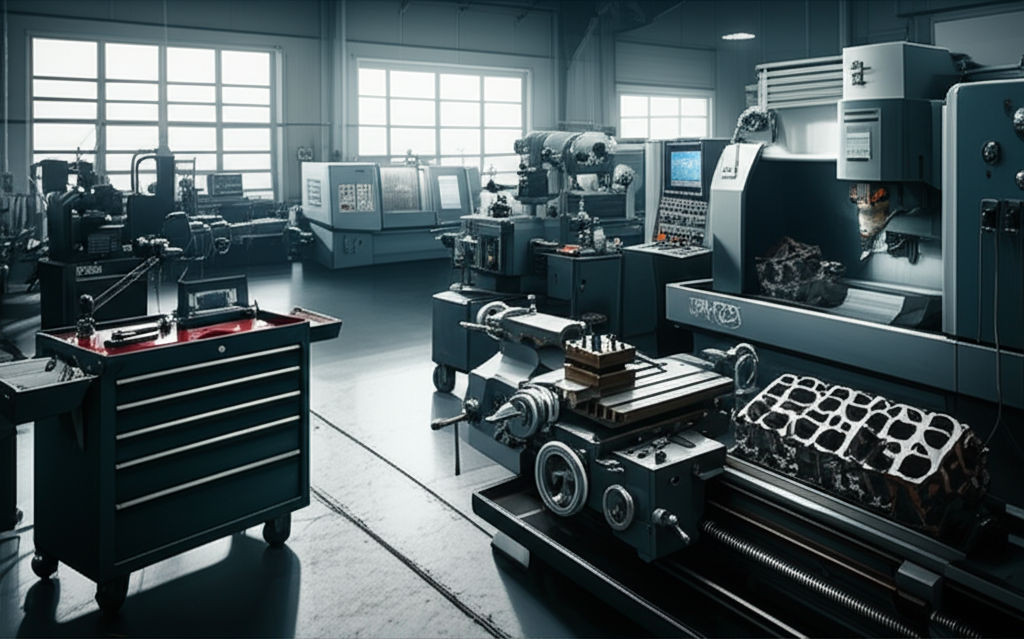

Find Reliable Automotive Machine Shops Near Me

Locate top automotive machine shops for engine repair. Ensure your vehicle's performance, longevity, and save money with expert engine services.

July 28, 2025

Mayse Automotive Services For Every Vehicle Type

Mayse Automotive: Your trusted partner for comprehensive care across all vehicle types. Expert, certified technicians & advanced tools ensure smooth driving.

July 13, 2025

Beginner’s Guide To Automotive Primer Application

Master flawless car paint! This guide demystifies automotive primer, covering types & application for stunning, durable finishes. Essential for beginners.

February 3, 2025

Car Maintenance Basics: Oil Changes & More

New to car maintenance? This beginner’s guide covers oil changes, filter replacements, and essential care tips to keep your car running smoothly.

February 3, 2025

Hydrogen Fuel Cell Cars: The Next Big Thing?

Are hydrogen fuel cell cars the future of green driving? Discover how they work, their benefits, and whether they’re the future of clean transportation.