Debunking 5 Common Myths About Life Insurance

Ellie Moore

Photo: Debunking 5 Common Myths About Life Insurance

Debunking 5 Common Myths About Life Insurance

Life insurance is a crucial component of financial planning, yet numerous myths can deter individuals from securing the coverage they need. Understanding the realities behind these misconceptions is essential for making informed decisions. In this article, we’ll debunk five common myths about life insurance, providing you with the knowledge to protect your loved ones effectively.

Myth 1: Life Insurance Is Too Expensive

The Reality: Affordable Options Exist for Various Budgets

One of the most pervasive myths is that life insurance is prohibitively expensive. While premiums can vary based on factors like age, health, and coverage amount, there are affordable options available for most budgets.

Term Life Insurance: Cost-Effective Coverage

Term life insurance offers substantial coverage for a specific period, typically 10, 20, or 30 years, at a lower cost compared to permanent policies. This makes it an excellent choice for individuals seeking high coverage without breaking the bank.

Customized Policies to Fit Your Needs

Insurance providers offer a range of policies tailored to different financial situations. By assessing your needs and financial goals, you can find a plan that provides adequate protection without unnecessary expenses.

Actionable Tip: Compare quotes from multiple insurers and consider factors like policy length and coverage amount to find the most cost-effective option for your situation.

Myth 2: Young and Healthy Individuals Don’t Need Life Insurance

The Reality: Securing Lower Premiums Early Can Benefit You and Your Family

Many young, healthy individuals believe they don’t need life insurance. However, purchasing a policy early can lead to lower premiums and provide financial security for unexpected events.

Locking in Lower Rates

Insurance premiums are generally lower when you’re younger and in good health. By securing a policy early, you lock in these favorable rates, potentially saving thousands over the life of the policy.

Financial Protection for Future Responsibilities

Even if you don’t have dependents now, life circumstances can change. A life insurance policy can cover future responsibilities, such as a mortgage or children’s education, ensuring you’re prepared for whatever the future holds.

Real-Life Example: John, 25, secured a term life insurance policy with low premiums. Ten years later, after getting married and having children, his policy provided essential financial support, proving the value of his early decision.

Myth 3: Employer-Provided Life Insurance Is Sufficient

The Reality: Relying Solely on Employer Coverage Can Be Risky

Employer-provided life insurance is a valuable benefit, but it shouldn’t be the only coverage you rely on. Here’s why:

Limited Coverage Amounts

Employer policies often offer limited coverage, typically a multiple of your salary. This may not be enough to cover your family’s financial needs in the event of your untimely death.

Lack of Portability

If you change jobs, you might lose your employer-provided coverage or face higher premiums. Having an individual policy ensures continuous protection regardless of your employment status.

Actionable Tip: Assess your life insurance needs independently of your employer’s offerings and consider supplementing with an individual policy to ensure comprehensive coverage.

Myth 4: Life Insurance Is Only for Breadwinners

The Reality: Life Insurance Benefits All Families, Regardless of Income

The misconception that life insurance is solely for primary earners overlooks its broader benefits. Both breadwinners and non-earnings family members can significantly impact financial stability.

Coverage for Non-Earning Spouses

Non-earning spouses contribute to the household in various ways, such as caregiving and managing the home. Life insurance can compensate for the loss of these contributions, ensuring financial equilibrium.

Estate Planning and Debt Coverage

Life insurance can play a critical role in estate planning, helping to cover debts, taxes, and other obligations, regardless of who the primary earner is.

Case Study: Emily, a stay-at-home mom, secured a life insurance policy to cover potential healthcare costs and ensure her husband could maintain their standard of living. This proactive step provided peace of mind and financial security.

Myth 5: Life Insurance Is Complicated and Hard to Understand

The Reality: Simplified Policies and Professional Guidance Make It Accessible

Life insurance may seem complex, but with the right resources and guidance, it becomes manageable and accessible.

User-Friendly Policy Options

Many insurance companies offer straightforward policies with clear terms and conditions. Term life insurance, for example, provides simple, easy-to-understand coverage without unnecessary complexities.

Professional Assistance

Insurance agents and financial advisors can demystify the process, helping you navigate different options and choose a policy that aligns with your needs and budget.

Practical Steps:

- Educate Yourself: Utilize online resources and tools to understand the basics of life insurance.

- Consult a Professional: Seek advice from a certified insurance agent to explore suitable options.

- Review Regularly: Periodically reassess your policy to ensure it continues to meet your evolving needs.

Taking the Next Step: Securing Your Future Today

Understanding the truths behind these common life insurance myths empowers you to make informed decisions. Whether you’re young and healthy, a breadwinner, or planning for the future, life insurance provides essential financial protection for you and your loved ones.

Call to Action: Don’t let misconceptions prevent you from securing the coverage you need. Contact a trusted insurance advisor today to explore your options and find a policy that fits your life and budget. Share this article with friends and family to help them make informed life insurance decisions as well.

Frequently Asked Questions (FAQ)

1. How much life insurance coverage do I need?

The amount of coverage depends on factors like your income, debts, future financial obligations, and the needs of your dependents. A common guideline is to have a policy that is 10-15 times your annual income.

2. Can I have multiple life insurance policies?

Yes, you can hold multiple policies to meet different financial goals, such as covering a mortgage with one policy and future education expenses with another.

3. What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period, typically at a lower cost, while whole life insurance offers lifelong coverage with an investment component, generally at a higher premium.

4. How does my health affect life insurance premiums?

Better health typically results in lower premiums. Insurers assess factors like age, medical history, and lifestyle to determine your risk level and pricing.

5. Can I change my life insurance policy later?

Many policies offer flexibility to adjust coverage as your needs change. It’s important to review and update your policy regularly to ensure it aligns with your current circumstances.

Finance & Investment

View All

September 3, 2025

Manufactured Home Financing OptionsGo beyond keywords! Discover Expert SEO Content, focusing on Google's E-E-A-T to build trust, authority, and achieve lasting online success.

Ellie Moore

April 23, 2025

American Honda Finance Login HelpElevate your brand with expert SEO content! Go beyond keywords to create valuable, authoritative material that boosts rankings, drives traffic, and builds trust...

Ellie Moore

October 6, 2025

Top Rated Finance Schools WorldwideMaster expert SEO content to boost rankings & engage readers. Discover how E-E-A-T and people-first content drive authority and trust for 2025.

Ellie Moore

April 27, 2025

Financial Financing ExplainedUnlock online authority with expert SEO content. Learn how to build trust, demonstrate expertise, and rank higher by mastering Google's E-E-A-T.

Ellie Moore

June 27, 2025

Automobile Financement Global Car Loan GuideUnlock SEO success! Create expert content that ranks high, drives organic traffic, and builds authority by satisfying both users and search engines.

Ellie Moore

May 21, 2025

HVAC Financing Options That WorkUnlock higher rankings & engage readers with expert SEO content. Learn to create valuable, optimized content that drives traffic & builds authority.

Ellie Moore

Insurance

View AllSecure your future with confidence using Essential Term Life Insurance. This guide helps you find the best policies, navigate quotes, and protect loved ones & b...

Ellie Moore

Discover the world of reinsurance, its purpose, and how it protects insurers against big claims.

Ellie Moore

Unlock the secrets to getting cheap auto insurance fast! Our guide helps you find the best rates and reliable coverage, turning a daunting task into a financial...

Ellie Moore

Save on premiums with usage-based auto insurance. Learn how your driving habits shape coverage and costs!

Ellie Moore

Learn how gig workers can protect themselves with insurance solutions designed for freelance and flexible work.

Ellie Moore

Explore how InsurTech startups are transforming the insurance industry with innovation and cutting-edge solutions.

Ellie Moore

Education

View AllExplore how virtual reality is revolutionizing learning by providing immersive educational experiences. Ready to see VR in action?

Read MoreExplore the benefits of hybrid learning models. Learn how to balance online and face-to-face teaching for a more flexible education experience.

Read MoreUnderstand dyslexia and discover effective ways to support dyslexic students in the classroom. Learn proven strategies to improve learning outcomes.

Read MoreOutdoor learning promotes cognitive and social growth. Explore how nature-based education enhances learning outcomes and student well-being.

Read MoreMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MoreLifelong learning is the new normal! Discover why continuous learning is essential for personal growth, career success, and adapting to change.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 10, 2025

Island Automotive Local Repairs You Can Trust

Struggling to find reliable auto repair? Discover how to choose a trustworthy "island" car service that prioritizes expertise, transparency, & your safety.

August 19, 2025

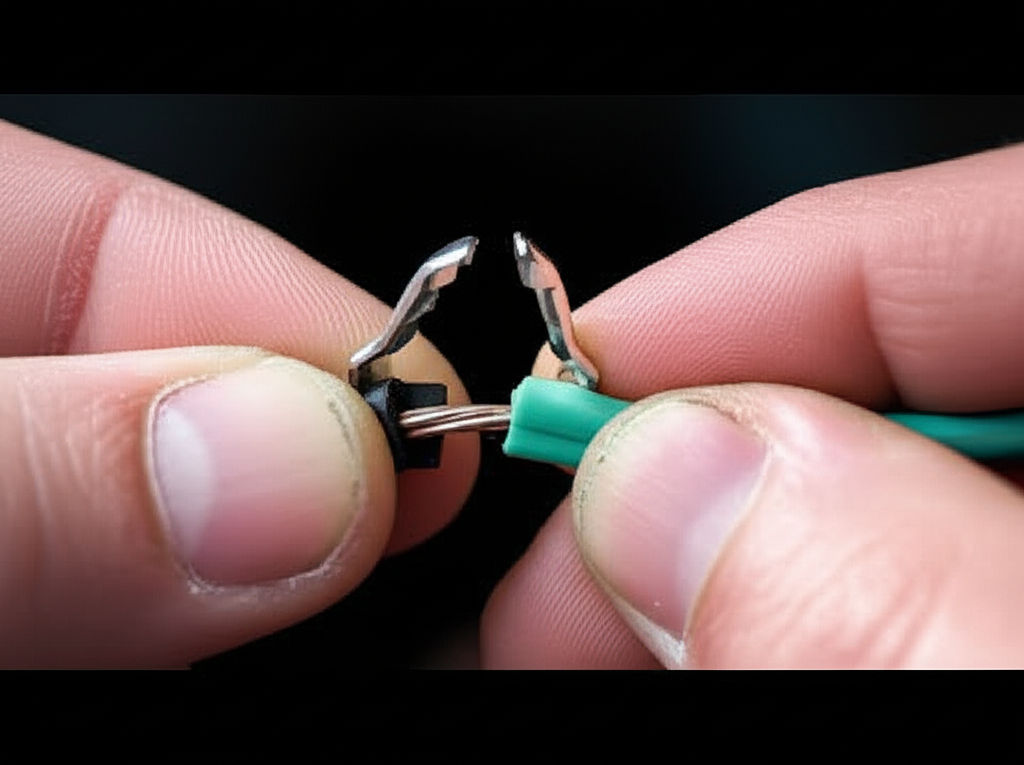

How To Use Automotive Wire Connectors Safely

Master automotive wire connectors for safe, reliable, and high-performance vehicle electrical systems. Avoid hazards & ensure peace of mind!

July 23, 2025

Automotive Lawyers You Need For Legal Support

Need an automotive lawyer? Discover when & why expert legal support is crucial for car accidents, lemon law, fraud, and vehicle disputes. Protect your rights!

July 25, 2025

Family Automotive Shops You Can Trust Today

Find a trustworthy auto mechanic! This guide helps you locate reliable car repair shops that prioritize honesty & customer relationships for peace of mind.

July 18, 2025

Leader Automotive Group Settlement Explained Simply

Understand the $20M Leader Automotive Group settlement. Learn how this landmark case addresses deceptive car sales and protects consumer rights.

July 21, 2025

Williams Automotive Care And Service Insights

Ensure a healthier, safer, and longer-lasting vehicle. Learn proactive car care insights from Williams Automotive to prevent costly repairs.