Finding Your Perfect Health Insurance Plan

Ellie Moore

Photo: Finding Your Perfect Health Insurance Plan

Finding Your Perfect Health Insurance Plan: A Comprehensive Guide

Navigating the maze of health insurance options can be daunting. With numerous plans, coverage options, and premiums to consider, finding the perfect health insurance plan tailored to your needs requires careful consideration. This guide aims to simplify the process, providing you with actionable insights and practical tips to secure the best health coverage for you and your family.

Understanding Health Insurance Basics

Before diving into the selection process, it's essential to grasp the fundamental aspects of health insurance.

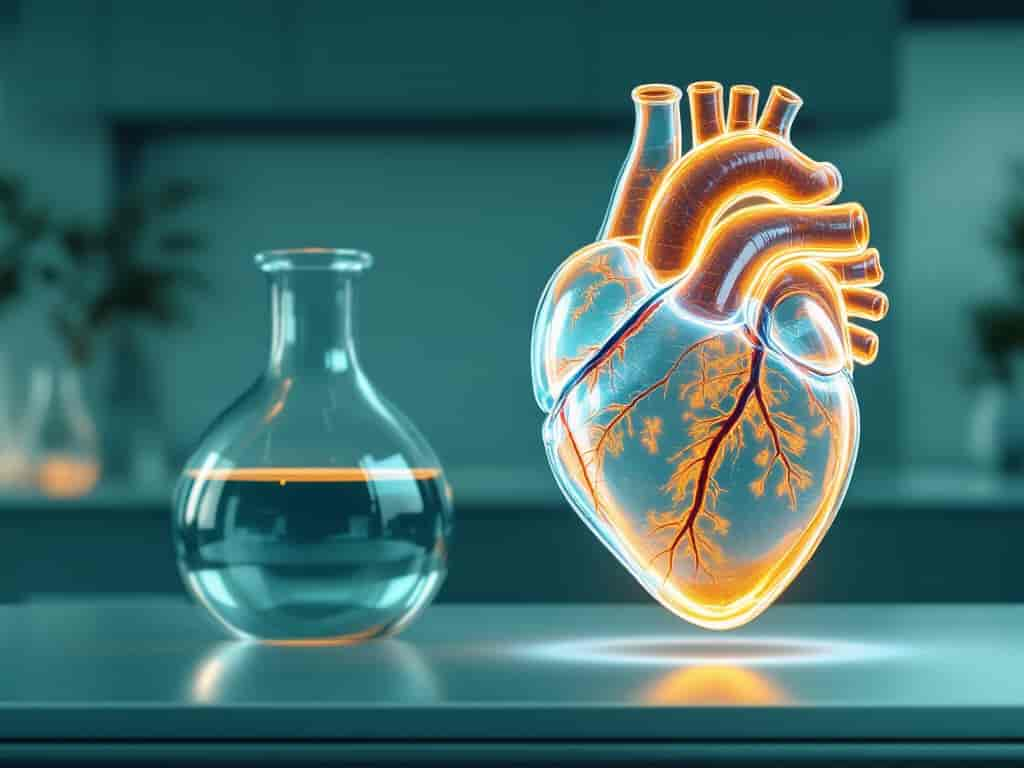

What is Health Insurance?

Health insurance is a contract between you and an insurance provider that outlines the coverage for medical expenses. In exchange for regular premium payments, the insurer agrees to cover a portion of your healthcare costs, including doctor visits, hospital stays, surgeries, and prescription medications.

Key Terms to Know

- Premium: The amount you pay monthly for your health insurance plan.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Copayment (Copay): A fixed fee you pay for specific services, such as a doctor's visit.

- Coinsurance: The percentage of costs you pay after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you'll pay for covered services in a year.

Assessing Your Health Insurance Needs

Identifying your healthcare needs is the first step in finding the perfect health insurance plan.

Evaluate Your Health Status

Consider your current health condition and any ongoing medical treatments. If you have chronic illnesses or require regular medications, a plan with comprehensive coverage for prescriptions and specialist visits may be ideal.

Consider Your Budget

Determine how much you can afford to spend on premiums, deductibles, and other out-of-pocket expenses. Balancing cost and coverage is crucial to ensure you’re not overpaying for unnecessary benefits or underinsured.

Anticipate Future Needs

Think about potential future healthcare needs, such as planned surgeries, family planning, or aging-related health issues. Choosing a plan that accommodates these possibilities can save you from unexpected expenses down the line.

Types of Health Insurance Plans

Understanding the different types of health insurance plans helps you make an informed decision.

Health Maintenance Organization (HMO)

- Pros: Lower premiums, coordinated care through a primary care physician (PCP).

- Cons: Limited network of providers, need for referrals to see specialists.

Preferred Provider Organization (PPO)

- Pros: Greater flexibility in choosing healthcare providers, no need for referrals.

- Cons: Higher premiums, out-of-network services come with higher costs.

Exclusive Provider Organization (EPO)

- Pros: Lower premiums than PPOs, no need for referrals.

- Cons: No coverage for out-of-network providers except in emergencies.

Point of Service (POS)

- Pros: Combines features of HMOs and PPOs, flexibility in choosing providers.

- Cons: Requires referrals for specialists, higher costs for out-of-network services.

High-Deductible Health Plan (HDHP)

- Pros: Lower premiums, eligibility for Health Savings Accounts (HSAs).

- Cons: Higher out-of-pocket costs before coverage kicks in.

Steps to Find the Perfect Health Insurance Plan

Follow these steps to streamline your search for the ideal health insurance plan.

1. Determine Your Coverage Needs

List your essential healthcare services, including:

- Regular doctor visits

- Prescription medications

- Specialist consultations

- Mental health services

- Preventive care

2. Compare Plan Types

Evaluate the pros and cons of different plan types (HMO, PPO, EPO, POS, HDHP) based on your coverage needs and budget.

3. Check Network Coverage

Ensure your preferred doctors, hospitals, and specialists are within the plan’s network. Out-of-network services can lead to significantly higher costs.

4. Evaluate Costs

Analyze the total cost of each plan, including:

- Monthly premiums

- Annual deductibles

- Copayments and coinsurance

- Out-of-pocket maximums

5. Review Prescription Coverage

If you take medications regularly, verify that your prescriptions are covered and check the associated costs.

6. Consider Additional Benefits

Some plans offer extra benefits like dental, vision, wellness programs, and telehealth services. Assess whether these extras add value to your healthcare needs.

7. Read the Fine Print

Carefully review the plan’s terms and conditions, including coverage limitations, exclusions, and the claims process.

Practical Tips for Choosing the Right Plan

Utilize Online Comparison Tools

Leverage online resources and comparison tools to evaluate different health insurance plans side by side. These tools can help you visualize the cost differences and coverage variations.

Seek Professional Advice

Consult with a licensed insurance broker or a healthcare navigator who can provide personalized guidance based on your specific needs and circumstances.

Consider Employer-Sponsored Plans

If available, employer-sponsored health insurance plans often offer group rates and comprehensive coverage options that may be more affordable than individual plans.

Understand the Enrollment Periods

Be aware of the open enrollment periods and special enrollment triggers to ensure you don’t miss the window to enroll or make changes to your plan.

Assess Customer Service

Research the insurer’s reputation for customer service, claim processing efficiency, and overall reliability. Positive customer experiences can indicate a trustworthy provider.

Real-Life Example: Choosing Between HMO and PPO

Case Study: Sarah’s Dilemma

Sarah, a 35-year-old graphic designer, needs a new health insurance plan. She prefers having a wide range of doctors to choose from and doesn't want to deal with referrals for specialists. After evaluating her options:

- HMO Plan: Lower premiums but restricted to a specific network and requires referrals.

- PPO Plan: Higher premiums but offers greater flexibility in choosing healthcare providers without needing referrals.

Decision: Sarah opts for the PPO plan, valuing the freedom to see any specialist without additional steps, despite the higher cost.

Common Mistakes to Avoid

Ignoring Network Restrictions

Selecting a plan with a limited network can lead to higher out-of-pocket costs if you need to seek care outside the network.

Overlooking Total Costs

Focusing solely on monthly premiums without considering deductibles, copayments, and coinsurance can result in unexpected expenses.

Not Considering Future Needs

Failing to account for potential future healthcare needs can leave you underinsured or overpaying for unnecessary coverage.

Skipping the Fine Print

Overlooking the details of coverage, exclusions, and the claims process can lead to misunderstandings and unmet expectations when you need care.

Enhancing Your Health Insurance Experience

Utilize Preventive Services

Take advantage of covered preventive services like vaccinations, screenings, and annual check-ups to maintain your health and potentially reduce future medical costs.

Manage Your Healthcare Usage

Be mindful of how you use healthcare services to stay within your plan’s coverage limits and avoid unnecessary expenses.

Keep Records Organized

Maintain organized records of your medical expenses, claims, and correspondence with your insurance provider to streamline the process in case of disputes or audits.

Frequently Asked Questions (FAQ)

1. What is the difference between HMO and PPO plans?

HMO plans require you to select a primary care physician and get referrals to see specialists, offering lower premiums but limited provider networks. PPO plans provide more flexibility in choosing healthcare providers without needing referrals, though they come with higher premiums.

2. How can I lower my health insurance costs?

You can lower costs by selecting a higher deductible plan, utilizing Health Savings Accounts (HSAs), choosing in-network providers, and taking advantage of employer-sponsored plans if available.

3. What should I do if I need to change my health insurance plan?

You can change your health insurance plan during the annual open enrollment period or qualify for a special enrollment period due to life events such as marriage, birth of a child, or loss of other coverage.

4. Are preventive services covered by all health insurance plans?

Under the Affordable Care Act (ACA), most health insurance plans are required to cover preventive services without charging a copayment or deductible. However, it's essential to verify this with your specific plan.

5. What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account available to individuals enrolled in high-deductible health plans (HDHPs). It allows you to save money for medical expenses with pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Take Action Today

Finding your perfect health insurance plan doesn't have to be overwhelming. By understanding your needs, evaluating your options, and utilizing the tips provided in this guide, you can make an informed decision that ensures comprehensive coverage and peace of mind. Start your search today compare plans, consult with experts, and secure the health insurance that best fits your lifestyle and budget. If you found this guide helpful, share it with others or leave a comment below with your experiences and questions!

Finance & Investment

View All

June 24, 2025

Yahoo Finance NVIDIA Stock Analysis 2025Go beyond keywords! Create expert SEO content that builds E-E-A-T, delivers genuine value, and earns top rankings by truly helping your audience.

Ellie Moore

August 12, 2025

Marine Finance for Boat BuyersWhy simply having content isn't enough. Discover Expert SEO Content: high-value, E-E-A-T-driven material that boosts rankings, traffic, and brand trust.

Ellie Moore

June 2, 2025

Auto Finance Near Me 2025Go beyond keywords! Learn to create expert SEO content that truly ranks. Drive organic traffic, build authority, and satisfy users with our actionable guide.

Ellie Moore

April 2, 2025

Cryptocurrency Staking: A Smart Investment GuideUnderstand cryptocurrency staking and how it works. Learn strategies to earn passive income and maximize rewards in the crypto world!

Ellie Moore

January 10, 2025

Latest Google Finance News UpdatesStand out online! Discover how expert SEO content, focused on E-E-A-T, improves search rankings, builds trust, and converts visitors into loyal customers.

Ellie Moore

March 28, 2025

Viva Finance Review You Should ReadUnlock online success! Discover why expert SEO content, driven by E-E-A-T, user intent, and true value, is non-negotiable for ranking & authority.

Ellie Moore

Insurance

View AllUnderstand the differences between HMO, PPO, and EPO health insurance networks. Pick the plan that suits your needs best!

Ellie Moore

Don't settle for basic car insurance. Get a premium quote for superior, comprehensive coverage. Protect assets & ensure financial security for policyholders & r...

Ellie Moore

Explore how your credit score affects insurance premiums. Learn how to improve your score and save on coverage!

Ellie Moore

Protect yourself from online risks with cybersecurity insurance. Learn why it’s essential for individuals in a digital world.

Ellie Moore

Essential Otto Insurance: Comprehensive protection for policyholders & risk managers. Optimize risk, find best rates, and secure your financial future.

Ellie Moore

Discover how artificial intelligence simplifies claims, enhances accuracy, and speeds up insurance processes.

Ellie Moore

Education

View AllCompetency-based education focuses on mastery over seat time. Learn how this model is reshaping how we measure student success.

Read MoreIs self-directed learning the future? Learn how students can take control of their own education, boost motivation, and achieve better results.

Read MoreOnline homeschooling communities are growing fast. Explore how they provide support, resources, and a sense of belonging to families worldwide.

Read MoreThe digital divide limits education access. Explore strategies and initiatives to bridge this gap and ensure global learning equality.

Read MoreFinancial literacy is essential for today’s students. Discover why teaching money management early can lead to smarter financial decisions.

Read MoreDiscover how flipped classrooms work and why they’re becoming popular. Learn the key benefits of this innovative teaching approach.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 21, 2025

Cera Automotiva Propaganda Homem Meaning

Por que homens enceram carros em anúncios? Desvende o significado por trás do clichê: marketing, estereótipos e a ligação com status e identidade.

July 21, 2025

Williams Automotive Care And Service Insights

Ensure a healthier, safer, and longer-lasting vehicle. Learn proactive car care insights from Williams Automotive to prevent costly repairs.

July 23, 2025

Find Reliable Automotive Machine Shops Near Me

Locate top automotive machine shops for engine repair. Ensure your vehicle's performance, longevity, and save money with expert engine services.

August 31, 2025

A To Z Automotive Complete Car Care Experts

Unlock your car's full potential with A to Z complete automotive care. Learn why proactive maintenance ensures longevity, safety, and saves you money.

August 28, 2025

R&R Automotive Your Go-To Shop For Repairs

R&R Automotive: Your trusted shop for reliable car repairs & maintenance. Expect expert service, transparent pricing, and peace of mind.

August 3, 2025

Choosing The Best Automotive Spray Gun For Jobs

Achieve a flawless finish! Our guide helps you choose the perfect automotive spray gun, covering HVLP, RP, and LVLP types for pro results.