The General Insurance Solutions

Ellie Moore

Photo: The General Insurance Solutions

The General Insurance Solutions: Securing Your Future in a Dynamic World

Are you an insurance agent, policyholder, or risk manager grappling with the complexities of escalating risks and the imperative for comprehensive protection? In today's rapidly evolving landscape, inadequate coverage can lead to significant financial losses and operational disruptions. This guide reveals how insurance agents, policyholders, and risk managers can navigate the intricacies of The General Insurance Solutions to mitigate risks, secure assets, and optimize coverage, ensuring peace of mind and sustained growth.

What Makes a Premium The General Insurance Solutions Essential for Insurance Agents, Policyholders, and Risk Managers?

In a world brimming with unpredictable events, from natural disasters to cyber threats, robust general insurance is no longer a luxury but a fundamental necessity. For businesses, this means safeguarding against liabilities that could otherwise derail operations and profitability. From an insurance perspective, the global general insurance market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.93% from 2024 to 2035, reaching an anticipated valuation of $1896.6 billion by 2035. This significant general insurance market growth underscores the increasing demand for comprehensive protection across various sectors.

The return on investment (ROI) of a premium general insurance solution is often realized not in direct financial gains, but in the avoidance of substantial losses. Consider the cost of an uninsured property damage claim or a major liability lawsuit versus the investment in a comprehensive policy. The proactive protection offered by The General Insurance Solutions allows businesses to operate with confidence, knowing that unexpected events won't cripple their financial stability.

Critical Evaluation Criteria for Insurance Agents, Policyholders, and Risk Managers:

Selecting the right general insurance solution requires a meticulous approach. Here are key criteria to consider:

Cost Structure Analysis

Understanding the general insurance policy pricing is paramount. Beyond the headline premium, delve into the overall cost structure. This includes deductibles, policy limits, and any additional fees. A thorough cost structure analysis should also consider potential discounts for risk mitigation efforts, such as implementing advanced security systems or robust employee training programs. When evaluating different providers, it's beneficial to utilize a commercial insurance premium calculator to compare options effectively and understand the true total cost of ownership (TCO) over the policy term.

Compliance & Security Requirements

Regulatory compliance is non-negotiable in the insurance sector. For insurance agents, policyholders, and risk managers, ensuring that The General Insurance Solutions adheres to relevant industry standards is crucial. The National Association of Insurance Commissioners (NAIC) develops model laws and guidelines to standardize insurance regulation across states, playing a vital role in harmonizing the legal framework for insurance. Look for providers that demonstrate adherence to these standards and possess certifications relevant to your industry, such as specific data security protocols for cyber liability insurance. This ensures your coverage is not only comprehensive but also legally sound.

Integration Capabilities

In today's interconnected business environment, the ability of The General Insurance Solutions to integrate seamlessly with existing systems is a significant advantage. This includes insurance policy management software integration and compatibility with risk management platforms. Robust integration capabilities, often facilitated by a well-documented general insurance API for brokers, can streamline policy administration, claims processing, and data reporting, ultimately enhancing operational efficiency and accuracy.

Implementation Roadmap: Maximizing The General Insurance Solutions ROI

Implementing a new general insurance solution should be a strategic process to ensure maximum ROI. Here’s a step-by-step roadmap:

- Comprehensive Risk Assessment: Begin with a thorough evaluation of your current and emerging risks. This forms the foundation for tailoring your insurance needs.

- Provider Selection: Based on your evaluation criteria, select a provider that offers not just competitive general insurance pricing models but also a strong track record of claims handling and customer service.

- Policy Customization: Work closely with your chosen provider to customize your coverage. This might involve exploring tailored business insurance packages that align precisely with your specific operational profile and risk exposure.

- Seamless Onboarding: A smooth general insurance policy implementation timeline is critical. Ensure the provider offers clear guidance and support throughout the onboarding process, including data migration and system integration.

- Ongoing Review and Adjustment: The risk landscape is constantly changing. Regularly review your policies and make necessary adjustments to ensure your coverage remains optimal. This proactive approach helps in maximizing the long-term ROI of your insurance investment.

2025 Trends: The Future of The General Insurance Solutions for Insurance Agents, Policyholders, and Risk Managers:

The insurance industry is undergoing a profound transformation, driven by technological advancements and evolving customer expectations. According to the Allianz Global Insurance Report 2025, the global insurance industry grew by an estimated 8.6% in 2024, surpassing the previous year's record growth. This growth is fueled by a rising demand for protection and innovative solutions.

Key emerging insurance technologies are reshaping how general insurance is delivered and managed. Artificial intelligence (AI) and machine learning (ML) are at the forefront, automating claims processing, detecting fraud, and enhancing customer service through chatbots and virtual assistants. Predictive analytics is enabling insurers to assess risks more accurately and tailor policies to individual needs, leading to more personalized products.

Digital platform integration and the development of comprehensive ecosystems are also prominent trends, incorporating wellness programs, financial advisory services, and risk management tools to strengthen market positioning and generate new revenue streams. Cybersecurity architecture is becoming increasingly sophisticated, with multi-layered security and specialized cyber insurance products addressing the complex digital threat landscape. For insurance agents, policyholders, and risk managers, this means greater efficiency, more personalized coverage, and enhanced risk mitigation capabilities.

Conclusion

Navigating the complexities of risk and securing comprehensive protection is a fundamental challenge for insurance agents, policyholders, and risk managers. By strategically evaluating and implementing The General Insurance Solutions, you can safeguard your assets, ensure regulatory compliance, and optimize your coverage for maximum value. The evolving landscape, driven by technological innovations, presents unprecedented opportunities for more efficient, personalized, and robust risk management.

Don't leave your future to chance. Take control of your risk management strategy today. Get customized General Insurance Solutions quotes from leading providers and explore how advanced general insurance solutions can be tailored to your unique needs.

FAQ Section:

1. What's the typical cost range for premium The General Insurance Solutions?

The cost range for premium The General Insurance Solutions varies significantly based on factors such as the type of coverage, industry, business size, location, and chosen provider. While some basic policies might start at a few hundred dollars annually, comprehensive general insurance pricing models for large enterprises or high-risk industries can run into tens of thousands or even millions. Factors affecting premiums include the level of coverage, deductibles, claims history, and specific risk mitigation measures in place. It's essential to obtain multiple quotes and compare policy features thoroughly.

2. How quickly can Insurance Agents, Policyholders, and Risk Managers implement The General Insurance Solutions?

The speed of implementation for The General Insurance Solutions depends on the complexity of the policy and the efficiency of the provider. For standard policies, fast general insurance policy setup can often occur within a few days to a couple of weeks, especially with streamlined digital processes. However, more complex risk management solution deployment involving detailed risk assessments, customization, and integration with existing systems may take several weeks or even a few months. Clear communication with your insurance provider about expected timelines is crucial.

3. What compliance standards should The General Insurance Solutions meet?

The General Insurance Solutions should meet a range of compliance standards, primarily those set by regulatory bodies like the National Association of Insurance Commissioners (NAIC) in the United States. These include standards for financial solvency, consumer protection, fair claims practices, and data privacy. Depending on the specific type of insurance and industry, additional compliance requirements such as HIPAA for health-related data or industry-specific security certifications may apply. Always ensure your chosen solution aligns with all relevant insurance industry compliance standards and general insurance legal requirements.

4. Can The General Insurance Solutions integrate with existing insurance-specific systems?

Yes, modern The General Insurance Solutions are increasingly designed for seamless integration with existing insurance-specific systems. This includes integration with insurance CRM integration platforms, policy administration systems, claims management software, and enterprise resource planning (ERP) systems. Providers often offer general insurance system compatibility through APIs (Application Programming Interfaces) or other integration tools, allowing for automated data exchange and streamlined workflows. This capability is vital for enhancing operational efficiency and data accuracy across your insurance operations.

Finance & Investment

View All

March 21, 2025

Kia Finance Phone Number and Quick SupportUnlock top rankings with expert SEO content. Learn how E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) creates valuable, people-first conten...

Ellie Moore

June 1, 2025

AI Finance Trends Shaping 2025Stand out online! Discover how expert SEO content, focused on E-E-A-T & value, drives higher rankings, organic traffic, and builds brand authority.

Ellie Moore

January 9, 2025

Best Ford Finance Offers 2025Elevate your rankings with expert SEO content. Learn how E-E-A-T drives authority, trust, and traffic by delivering genuine value, not just keywords.

Ellie Moore

October 26, 2025

Vanderbilt Mortgage Finance ReviewCreate expert SEO content that ranks! Learn E-E-A-T to build trust, authority, and drive traffic with valuable, Google-loved content.

Ellie Moore

October 6, 2025

Baby Boy Names Meaning WealthGo beyond keywords! Create expert SEO content that ranks high, satisfies E-E-A-T, and genuinely helps your audience. Get actionable strategies.

Ellie Moore

April 18, 2025

Power Finance Loans You Can TrustGo beyond "good enough." Master expert SEO content to rank higher, build authority, and deeply engage your audience with E-E-A-T principles.

Ellie Moore

Insurance

View AllPolicyholders & risk managers: Navigate life insurance with confidence. Find essential coverage to safeguard your financial legacy and ensure peace of mind.

Ellie Moore

Understand the differences between HMO, PPO, and EPO health insurance networks. Pick the plan that suits your needs best!

Ellie Moore

Understand the legal side of insurance with this guide to policy exclusions. Learn what’s not covered and why it matters.

Ellie Moore

Safeguard your assets with our guide to Complete Safeco Insurance Coverage. Understand options, compare quotes, and get peace of mind.

Ellie Moore

Protect your property from natural disasters. Find out what’s included in insurance policies for floods, earthquakes, and more!

Ellie Moore

Follow this simple step-by-step guide to filing an insurance claim successfully. Avoid mistakes and get the coverage you need.

Ellie Moore

Education

View AllLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreEthics in education is vital for balanced learning. Learn how to teach morality alongside knowledge transfer in today’s classrooms.

Read MoreArts education is key to fostering creativity. Learn why it’s important in schools and how it helps students develop essential life skills.

Read MoreLearn how UNESCO promotes education for all globally. Explore key initiatives and efforts aimed at fostering equal learning opportunities for everyone.

Read MoreDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MoreLearn how gamification is transforming modern classrooms. Explore fun, interactive strategies that boost engagement and learning outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

January 31, 2025

Top Tips for Restoring Classic Cars Like a Pro

Want to restore a classic car? Get expert tips and tricks for a flawless restoration. Discover how to bring vintage beauties back to life!

July 16, 2025

Explore Exciting Cox Automotive Jobs Opportunities

Drive your career forward with Cox Automotive! Explore diverse job opportunities shaping the future of mobility through innovation and technology.

August 8, 2025

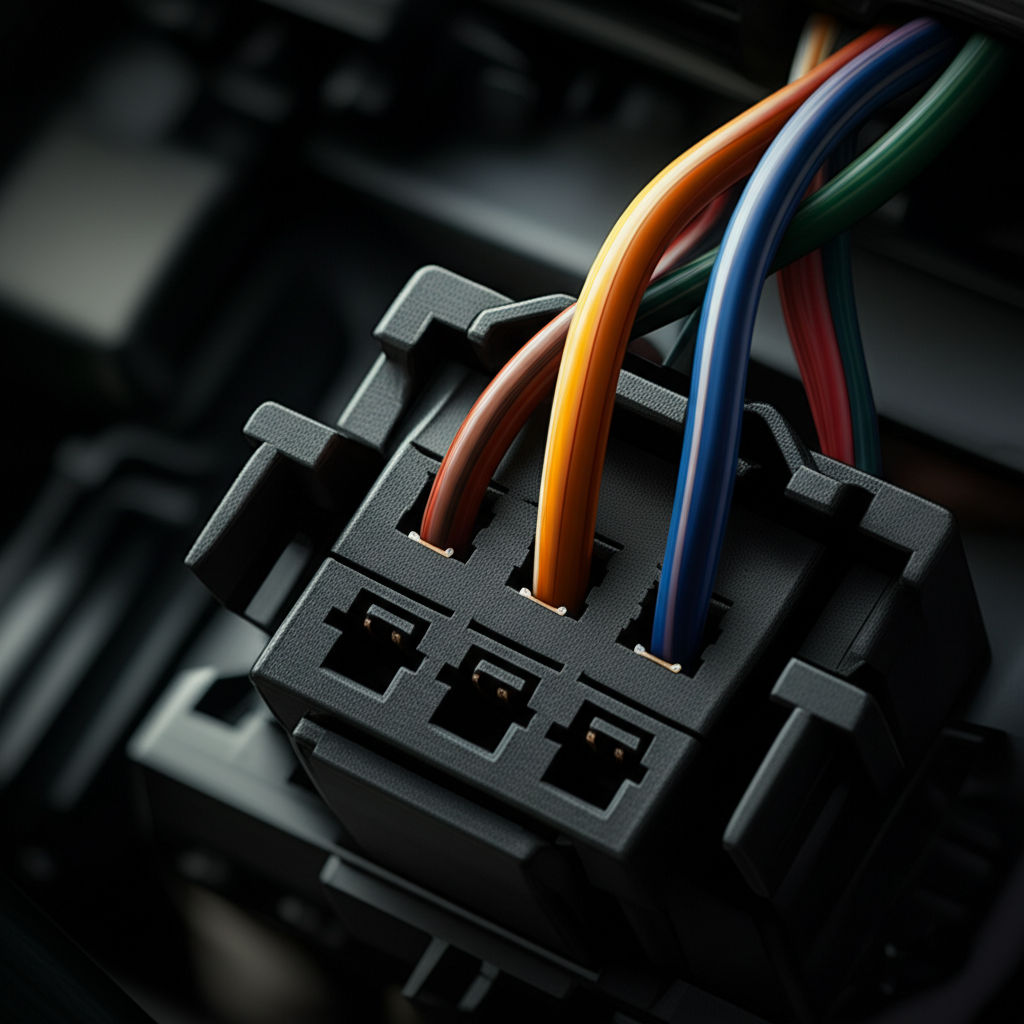

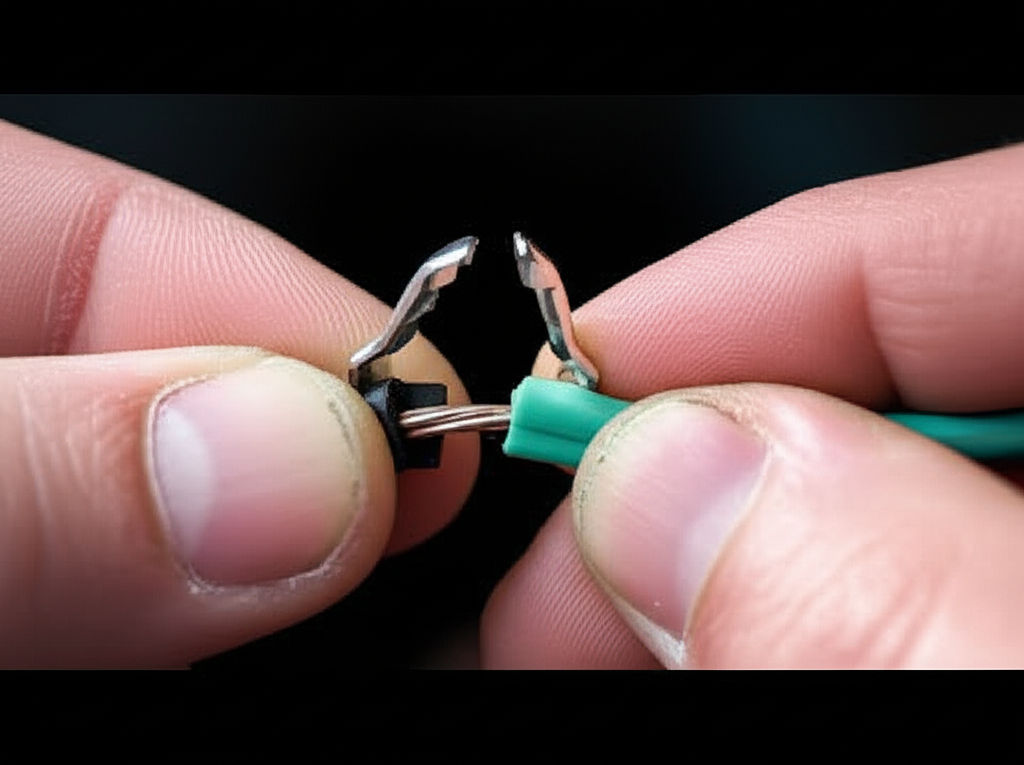

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

August 12, 2025

Thomas Automotive Repairs With A Personal Touch

Thomas Automotive: Expert auto repair with a personal touch. We build trust through clear communication & genuine care, not just fix cars.

August 19, 2025

How To Use Automotive Wire Connectors Safely

Master automotive wire connectors for safe, reliable, and high-performance vehicle electrical systems. Avoid hazards & ensure peace of mind!

August 16, 2025

Where To Find Automotive Mechanic Jobs Today

Unlock a rewarding auto mechanic career! Discover high-demand jobs in a rapidly evolving, high-tech automotive industry. Your guide to success.