Essential Medical Insurance Plans

Ellie Moore

Photo: Essential Medical Insurance Plans

Essential Medical Insurance Plans: Securing Your Future with Confidence

Are you losing valuable peace of mind and facing unexpected financial burdens due to inadequate medical coverage? For policyholders and risk managers, navigating the complex landscape of health benefits can feel overwhelming, often leading to crucial gaps in protection. Understanding the nuances of Essential Medical Insurance Plans is not just about compliance; it's about safeguarding financial stability and ensuring access to quality care. This guide reveals how policyholders and risk managers can secure comprehensive protection and make informed decisions about their health coverage, exploring vital aspects like affordable medical insurance plans and the offerings from leading medical insurance coverage providers.

What Makes a Premium Essential Medical Insurance Plans Essential for Policyholders and Risk Managers?

In today's dynamic healthcare environment, a robust medical insurance plan is more than a safety net; it's a strategic asset. The health insurance market continues to evolve, with average costs for Affordable Care Act (ACA) marketplace plans ranging from approximately $590 to $621 per month without subsidies in 2025, and projections showing a 7-8% increase in premiums. This upward trend underscores the importance of evaluating your options carefully.

For policyholders, the commercial angle is clear: investing in a premium plan offers a significant return on investment (ROI) through financial protection against unexpected medical emergencies, which can quickly deplete savings. From a risk management perspective, comprehensive coverage mitigates the financial risks associated with employee health, reduces absenteeism, and enhances overall workforce well-being and productivity. Group health insurance plans, for instance, often present lower costs due to risk pooling and shared premiums between employers and employees, offering substantial benefits for businesses.

Critical Evaluation Criteria for Policyholders and Risk Managers:

Choosing the right medical insurance involves a thorough assessment of several key factors.

Cost Structure Analysis

Understanding the true cost of Essential Medical Insurance Plans goes beyond the monthly premium. It encompasses deductibles, co-pays, and co-insurance. A deductible is the amount you pay out-of-pocket for covered services before your insurance begins to contribute. Plans with lower deductibles typically come with higher monthly premiums, and vice versa. Utilizing a medical insurance premium calculator is crucial for estimating the total cost of medical insurance based on age, location, and desired coverage, allowing for a clearer financial picture.

Compliance & Security Requirements

For policyholders and risk managers, regulatory compliance is non-negotiable. HIPAA compliant medical insurance ensures the privacy and security of sensitive patient health information. Beyond HIPAA, understanding broader medical insurance regulatory standards is vital to avoid penalties and maintain trust. Insurers must adhere to various state and federal regulations governing coverage, benefits, and data protection.

Integration Capabilities

The ability of a medical insurance plan to integrate with existing healthcare systems and administrative processes is increasingly important. This includes seamless medical insurance claims processing integration and compatibility with electronic health records (EHRs). For larger organizations, the ease with which a plan's systems can communicate with internal HR and payroll platforms can significantly streamline administration and reduce operational overhead. Modern solutions are also exploring integration with digital health tools and telemedicine platforms.

Implementation Roadmap: Maximizing Essential Medical Insurance Plans ROI

Maximizing the return on investment from your medical insurance plan involves a strategic approach, from selection to ongoing management.

- Needs Assessment: Begin by thoroughly evaluating the specific health needs of individuals or your employee base. Consider demographics, common health concerns, and desired access to specialists or specific services.

- Marketplace Exploration: Explore options through the Health Insurance Marketplace (for individuals and families) or directly from medical insurance coverage providers. The Marketplace offers a range of ACA-compliant plans, often with subsidies to reduce costs.

- Compare Providers and Plans: Don't settle for the first option. Use online tools to compare medical insurance policies and their features, benefits, and limitations side-by-side. Pay close attention to network size, prescription drug coverage, and out-of-pocket maximums.

- Leverage Premium Calculators: As mentioned, a medical insurance premium calculator is indispensable for comparing costs and understanding how different variables affect premiums.

- Understand Enrollment: Be aware of the medical insurance enrollment timeline, particularly the annual Open Enrollment Period for ACA plans, which typically runs from November 1 to January 15 in most states. Special Enrollment Periods may apply for qualifying life events.

- Ongoing Review: Regularly review your plan's performance and suitability. Healthcare needs and market offerings change, so an annual re-evaluation is a prudent step to ensure continued optimal coverage.

2025 Trends: The Future of Essential Medical Insurance Plans for Policyholders and Risk Managers

The health insurance landscape is undergoing a significant transformation, with several key trends shaping its future in 2025. Rising healthcare costs and regulatory shifts are pushing insurers to innovate.

- Personalization and Flexibility: There's a growing demand for personalized coverage options, moving away from one-size-fits-all plans. Insurers are increasingly offering flexible benefits that allow individuals and employees to tailor coverage to their specific needs, potentially through health benefit accounts.

- Technological Integration: Emerging health insurance technologies like Artificial Intelligence (AI), machine learning, blockchain, and the Internet of Things (IoT) are revolutionizing the industry. AI, for instance, is projected to save the U.S. healthcare system up to $150 billion annually by 2026 by automating claims processing, improving customer service, and enhancing predictive analytics. Blockchain technology is enhancing security and transparency in claims processing and contract management.

- Emphasis on Mental Health: Mental health support is taking center stage, with more employers adding mental health services to their insurance plans, recognizing its link to overall well-being and workplace performance.

- Telemedicine Expansion: The adoption of telemedicine services continues to accelerate, providing policyholders with convenient access to healthcare and reducing operational costs for insurers.

According to PwC's Health Research Institute, an 8% year-on-year medical cost trend is projected for the group market in 2025, and 7.5% for the individual market, reflecting the highest increase in 13 years. This highlights the ongoing need for robust Essential Medical Insurance Plans that can adapt to these evolving challenges.

Conclusion

Choosing the right Essential Medical Insurance Plans is a critical decision that impacts both personal well-being and financial security. For policyholders and risk managers, understanding cost structures, ensuring regulatory compliance, and embracing technological advancements are key to securing optimal coverage. By carefully evaluating options, leveraging tools like medical insurance premium calculators, and staying informed about market trends, you can gain the peace of mind that comes with comprehensive medical insurance coverage. Don't leave your health and financial future to chance.

Ready to find the perfect plan for your needs? Compare Essential Medical Insurance Plans quotes today and secure your peace of mind.

FAQ Section (HPK-Optimized)

1. What's the typical cost range for premium Essential Medical Insurance Plans?

The typical cost range for premium Essential Medical Insurance Plans varies significantly based on factors like age, location, and plan type. For ACA marketplace plans in 2025, the average monthly premium without subsidies can be between $590 and $621, with Bronze plans being cheaper but having higher deductibles, and Gold/Platinum plans having higher premiums but lower out-of-pocket costs. Understanding medical insurance premium structures is essential for budgeting.

2. How quickly can policyholders and risk managers implement Essential Medical Insurance Plans?

The speed of implementation for Essential Medical Insurance Plans largely depends on the type of plan and enrollment period. For individual and family ACA Marketplace plans, enrollment typically occurs during the annual Open Enrollment Period (November 1 to January 15 in most states). However, certain life events can trigger a Special Enrollment Period, allowing for quicker activation. For group plans, the quick medical insurance enrollment process is usually managed by the employer during their designated enrollment periods.

3. What compliance standards should Essential Medical Insurance Plans meet?

Essential Medical Insurance Plans must adhere to stringent medical insurance regulatory standards, with HIPAA (Health Insurance Portability and Accountability Act) being a primary concern for protecting patient health information. Additionally, plans offered through the ACA Marketplace must comply with the Affordable Care Act's provisions, including covering essential health benefits.

4. Can Essential Medical Insurance Plans integrate with existing systems?

Yes, modern Essential Medical Insurance Plans are increasingly designed for seamless medical insurance provider network integration and compatibility with existing systems. This often includes integration with electronic health records (EHRs), claims processing platforms, and employer HR systems to streamline administration and enhance efficiency. Technological advancements like APIs are facilitating this integration for improved data management and service delivery.

Finance & Investment

View All

July 9, 2025

Finance Books Everyone Should ReadDominate search & build authority with expert SEO content. Learn how E-E-A-T principles drive top rankings and establish credibility.

Ellie Moore

October 4, 2025

Ally Finance Auto Loan ReviewUnlock digital success with expert SEO content. Discover how to create authoritative, E-E-A-T-driven content that ranks high and builds trust.

Ellie Moore

March 22, 2025

Build Wealth with Diversification StrategiesLearn how to create a balanced investment portfolio with smart diversification strategies. Protect your investments and maximize returns!

Ellie Moore

June 7, 2025

Ultimate Finance Guide 2025Master expert SEO content to rank higher, build trust, and boost conversions. Learn why E-E-A-T is crucial for digital marketing success.

Ellie Moore

April 3, 2025

Choosing the Best Brokerage Account Made SimpleLearn how to pick the right brokerage account for your needs. Compare fees, features, and options to start your investing journey with confidence!

Ellie Moore

October 16, 2025

GMAC Finance Auto Loan OptionsGo beyond keywords! Master expert SEO content to build authority, boost rankings, and earn trust with valuable, E-E-A-T aligned content.

Ellie Moore

Insurance

View AllSecure superior protection with Premium Freeway Insurance Coverage. Go beyond basic policies to mitigate risks, ensure financial stability & peace of mind.

Ellie Moore

Michigan drivers: Find top-rated car insurance for optimal coverage & peace of mind. Navigate high costs & complex laws with our expert guide.

Ellie Moore

Secure your future with top-rated marketplace insurance for 2025. Trusted insights on plans, pricing, regulations & tech for all insurance roles.

Ellie Moore

Protect your valuable vehicle with premium auto insurance. Discover comprehensive coverage, competitive rates, and peace of mind tailored to your needs.

Ellie Moore

Concerned about financial risks? Discover how top-rated auto & renters insurance offers optimal protection, savings, and peace of mind for your assets.

Ellie Moore

Secure your home with premium insurance. This guide helps you navigate quotes, find comprehensive protection, and achieve peace of mind against unforeseen damag...

Ellie Moore

Education

View AllGPKP kritik keras Dinas TPH&Nak Musi Rawas soal transparansi pupuk bersubsidi. Penutupan data publik dinilai langgar UU KIP dan merugikan hak petani kecil.

Read MoreDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MoreUnschooling is redefining education. Learn how this self-directed approach works and why more families are embracing it as an alternative to traditional schooling.

Read MoreDiscover why liberal arts education remains valuable in today’s tech-driven world. Explore how it fosters critical thinking and adaptability.

Read MoreDiscover how AI-powered personalized learning is reshaping education. Learn how smart tech tailors content to fit individual student needs.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 10, 2025

Island Automotive Local Repairs You Can Trust

Struggling to find reliable auto repair? Discover how to choose a trustworthy "island" car service that prioritizes expertise, transparency, & your safety.

February 10, 2025

3D Printing in Auto Repairs: 5 Amazing Applications

Discover surprising ways 3D printing is transforming automotive repairs. Learn how this tech is speeding up fixes and cutting costs.

August 19, 2025

B&B Automotive Services That You Can Rely On

Searching for trustworthy auto repair? B&B Automotive offers expert service, peace of mind, & reliable care for your vehicle's safety & longevity.

February 5, 2025

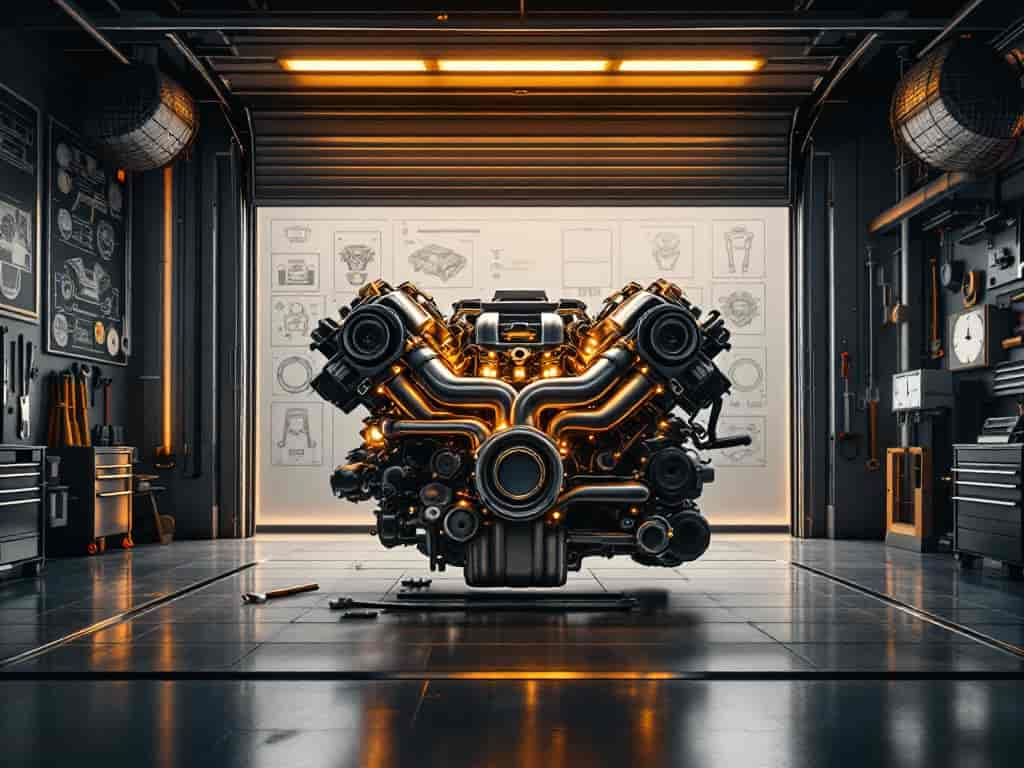

Understanding Car Engines: Types & Their Benefits

Confused about car engines? Learn about different engine types, how they work, and which one is best for your driving needs. Start learning now!

January 30, 2025

The Future of EV Charging: What’s Next in Tech?

Discover the latest innovations shaping the future of electric vehicle charging. Find out what’s next and how it affects EV owners. Click to learn more!

July 17, 2025

Grote Automotive Products And Services Review

Grote Automotive: A century of innovation in vehicle safety & visibility. Discover trusted products for enhanced performance, reliability, and peace of mind.