Cryptocurrency Investing: Risks & Rewards

Ellie Moore

Photo: Cryptocurrency Investing: Risks & Rewards

Cryptocurrency Investing: Risks & Rewards

The cryptocurrency market has captured the attention of investors worldwide, promising unprecedented opportunities and, conversely, substantial risks. Whether you're a seasoned investor or just dipping your toes into the world of digital assets, understanding the intricacies of cryptocurrency investing is crucial. In this guide, we’ll explore the risks and rewards of cryptocurrency investment, providing actionable insights to help you navigate this volatile yet exciting market.

The Rise of Cryptocurrency Investing

Cryptocurrency has transitioned from a niche concept to a global financial phenomenon. With flagship coins like Bitcoin (BTC) and Ethereum (ETH) paving the way, the market now boasts thousands of cryptocurrencies, each with unique applications and potential. According to a report by CoinMarketCap, the total cryptocurrency market capitalization reached over $2 trillion at its peak in 2021, reflecting the massive influx of interest and investment.

Primary Keywords: cryptocurrency investing, risks and rewards

Secondary Keywords: crypto market, digital assets, blockchain technology

The Rewards of Cryptocurrency Investing

1. High Growth Potential

Cryptocurrencies have demonstrated extraordinary growth over the years. Bitcoin, for instance, surged from under $1 in 2009 to over $68,000 in 2021. For investors willing to weather the market’s volatility, cryptocurrencies offer a high-risk, high-reward opportunity.

2. Decentralized Finance Opportunities

Cryptocurrencies operate on blockchain technology, which underpins decentralized finance (DeFi) platforms. These platforms eliminate intermediaries like banks, enabling peer-to-peer transactions and innovative financial products such as staking, yield farming, and liquidity pooling.

3. Portfolio Diversification

Adding cryptocurrencies to an investment portfolio provides diversification, which can be valuable in mitigating risks associated with traditional asset classes like stocks and bonds. Cryptocurrencies often have low correlations with traditional markets, offering a hedge against economic downturns.

4. Accessibility and Transparency

Unlike traditional investments, cryptocurrencies are accessible 24/7, offering unparalleled convenience. Additionally, blockchain technology ensures transaction transparency, which can enhance trust in the system.

The Risks of Cryptocurrency Investing

While the rewards can be enticing, it’s essential to understand the inherent risks involved in cryptocurrency investment.

1. Market Volatility

Cryptocurrency prices are notoriously volatile. For instance, Bitcoin's value dropped from $68,000 in November 2021 to around $16,000 by late 2022. Such fluctuations can lead to significant financial losses for unprepared investors.

2. Regulatory Uncertainty

Governments worldwide are grappling with how to regulate cryptocurrencies. Changes in regulatory frameworks can dramatically impact the value and legality of certain cryptocurrencies. For example, China's 2021 ban on crypto trading caused a market-wide crash.

3. Security Concerns

Despite blockchain technology’s inherent security, investors face risks such as hacking, phishing scams, and wallet theft. According to Chainalysis, over $14 billion worth of cryptocurrency was lost to scams and cyberattacks in 2021 alone.

4. Lack of Consumer Protection

Unlike traditional banking systems, cryptocurrencies lack robust consumer protection mechanisms. If a transaction goes wrong or a wallet is compromised, recovering lost funds is nearly impossible.

5. Complexity and Learning Curve

For beginners, understanding how cryptocurrency works, from managing private keys to navigating exchanges, can be overwhelming. Mistakes, such as sending crypto to the wrong wallet address, are irreversible.

How to Mitigate Risks in Cryptocurrency Investing

- Educate Yourself

- Learn the basics of blockchain technology, how cryptocurrency wallets work, and how to securely store your assets.

- Follow reputable resources like CoinDesk, CryptoSlate, and government advisories on cryptocurrency regulations.

- Start Small

- Begin with a small investment to minimize potential losses. Avoid investing more than you can afford to lose.

- Diversify Your Portfolio

- Spread your investment across multiple cryptocurrencies to reduce exposure to the volatility of a single asset.

- Use Secure Wallets

- Opt for hardware wallets, such as Ledger Nano X or Trezor, to store your crypto securely offline.

- Stay Updated on Regulations

- Monitor regulatory developments in your country and globally. This can help you make informed investment decisions.

- Adopt a Long-Term Mindset

- Resist the urge to make impulsive trades based on short-term market trends. Cryptocurrency investing often rewards patience.

Real-Life Examples of Cryptocurrency Success and Failure

- Success Story: In 2013, a Norwegian man invested $27 in Bitcoin, forgetting about it. Years later, his investment had grown to $886,000, showcasing the power of long-term holding.

- Failure Story: In contrast, some investors have lost their entire portfolios to scams or by mismanaging their private keys. For instance, over 20% of Bitcoin's supply is reportedly locked in inaccessible wallets due to lost keys.

FAQs About Cryptocurrency Investing

Q1. What is the best cryptocurrency to invest in?

There’s no definitive answer, as the best cryptocurrency depends on your goals and risk tolerance. Popular choices include Bitcoin, Ethereum, and emerging altcoins like Solana and Polkadot.

Q2. Is cryptocurrency a good investment for beginners?

Cryptocurrency can be a good investment if beginners take the time to educate themselves, start small, and adopt a cautious approach.

Q3. How can I avoid cryptocurrency scams?

Always use reputable exchanges, double-check wallet addresses before sending funds, and avoid offers that seem too good to be true.

Conclusion

Cryptocurrency investing is a dynamic and evolving field, offering both unparalleled opportunities and significant risks. By understanding the nuances of the market, adopting a cautious approach, and staying informed, you can harness the potential rewards while minimizing pitfalls. Whether you're investing in Bitcoin, Ethereum, or exploring new tokens, the key is to remain vigilant and proactive.

Call-to-Action: If you found this guide helpful, share it with your network! Have questions or insights? Drop a comment below, and let’s start a conversation about cryptocurrency investing. For more in-depth articles, explore our blog and take your financial knowledge to the next level.

Finance & Investment

View All

June 14, 2025

Hyundai Finance Contact and Payment GuideGo beyond keywords! Discover how to create expert SEO content that leverages E-E-A-T, user intent, and deep value to rank higher & build authority.

Ellie Moore

September 18, 2025

Smart Auto and Personal FinancingStand out online with expert SEO content. Attract your ideal audience, boost rankings, and build trust with E-E-A-T-driven strategies.

Ellie Moore

May 16, 2025

Exterior Finance Solutions 2025Dominate search results with expert SEO content. Our guide shows you how to create high-value, authoritative material that ranks, drives traffic & converts.

Ellie Moore

January 17, 2025

Find Local Finance Companies Near YouElevate your SEO with expert content! Learn to craft valuable, authoritative, and E-E-A-T compliant content that ranks and serves your audience.

Ellie Moore

April 10, 2025

What Addl Finance Really MeansDominate search results with expert SEO content! Craft high-value, authoritative content using E-E-A-T for top rankings and organic traffic.

Ellie Moore

November 22, 2025

NY Dept of Finance ExplainedUnlock online success with expert SEO content. Go beyond keywords to build authority, trust, and deliver real value for top rankings and visibility.

Ellie Moore

Insurance

View AllOverpaying for car insurance? Discover top-rated solutions for optimal coverage & value. Protect your finances with our comprehensive guide.

Ellie Moore

Discover how peer-to-peer insurance models operate, offering community-based risk-sharing alternatives.

Ellie Moore

Explore how InsurTech startups are transforming the insurance industry with innovation and cutting-edge solutions.

Ellie Moore

Find optimal premium car insurance quotes online. This guide helps policyholders, agents & risk managers compare rates for robust, high-value coverage.

Ellie Moore

Secure your future with confidence using Essential Term Life Insurance. This guide helps you find the best policies, navigate quotes, and protect loved ones & b...

Ellie Moore

Secure your home with premium insurance. This guide helps you navigate quotes, find comprehensive protection, and achieve peace of mind against unforeseen damag...

Ellie Moore

Education

View AllDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MoreMultilingual education promotes diversity and cultural understanding. Learn why it matters and how it benefits students in a globalized world.

Read MoreLifelong learning is the new normal! Discover why continuous learning is essential for personal growth, career success, and adapting to change.

Read MoreDigital citizenship teaches responsible tech use. Learn how to help students navigate the digital world safely and ethically.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

September 3, 2025

Best Automotive Polishing Compound For Shine

Transform your car's paint! Discover how to use automotive polishing compounds to eliminate defects & achieve a brilliant, mirror-like shine.

July 28, 2025

Portable Automotive Air Conditioner Buying Guide

Transform hot drives into cool cruises! Our guide to portable car ACs offers instant relief, efficiency, and versatility for ultimate comfort.

August 25, 2025

How To Dispose Of Automotive Oil Safely

Don't dump it! Discover why safe automotive oil disposal is vital for the environment and how to recycle used motor oil properly.

August 8, 2025

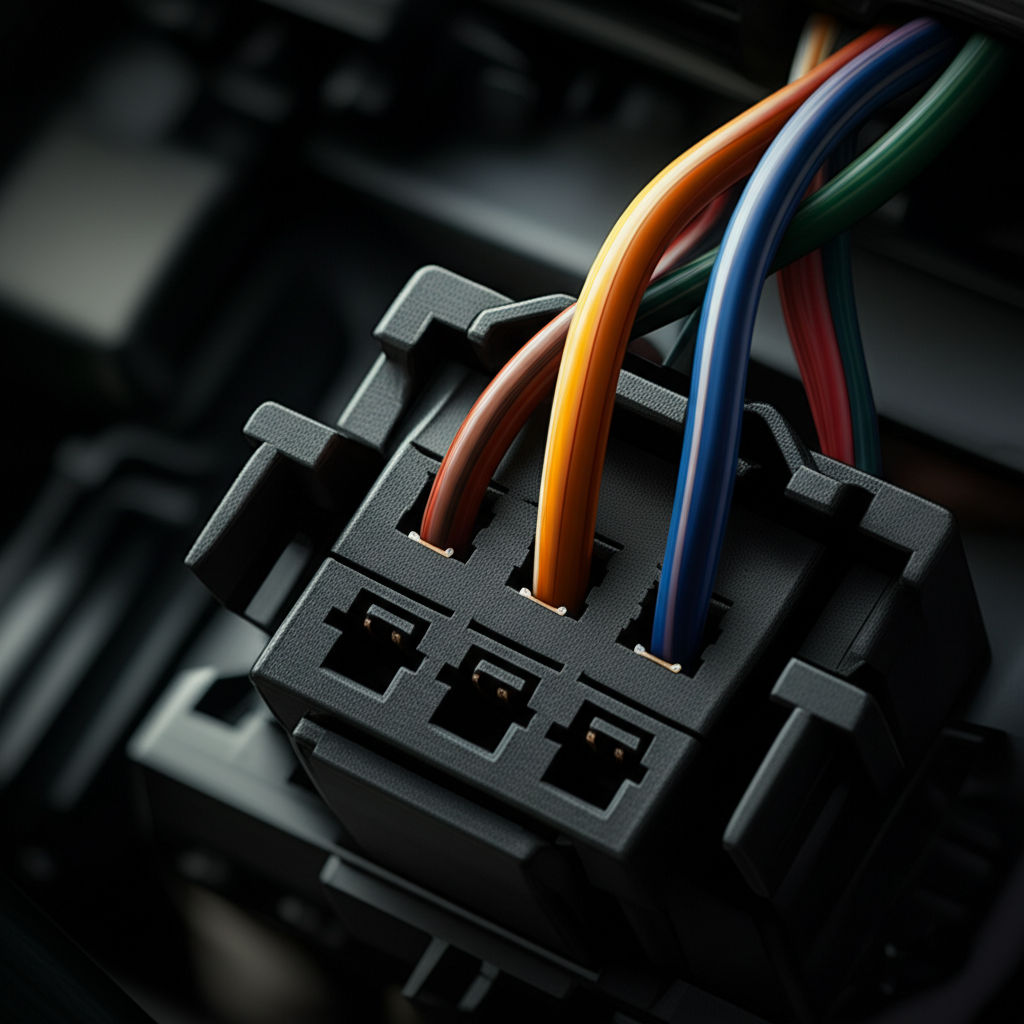

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

September 11, 2025

Jay's Automotive Gets The Job Done Right

Jay's Automotive: Experience reliable, expert car repair. We get the job done right every time, ensuring your vehicle's safety & your peace of mind.

September 12, 2025

Joe Bullard Automotive Premier Car Solutions

Joe Bullard Automotive: Your trusted partner for premier car solutions. Experience unparalleled service, expertise, and a customer-first approach since 1955.