Complete Safeco Insurance Coverage

Ellie Moore

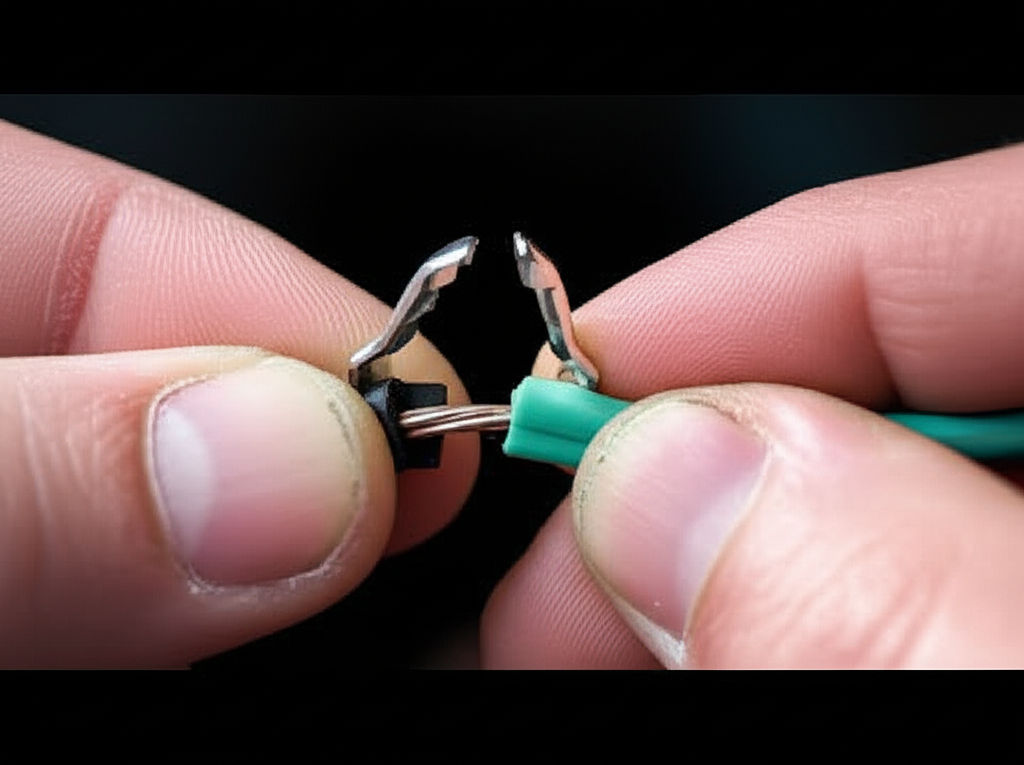

Photo: Complete Safeco Insurance Coverage

Complete Safeco Insurance Coverage: Your Guide to Comprehensive Protection

Are you leaving your assets vulnerable to unforeseen risks, potentially costing you thousands or even millions in losses? In today's unpredictable world, securing robust protection is not just an option—it's a necessity. Understanding your Complete Safeco Insurance Coverage is the first step toward safeguarding what matters most. Many policyholders often navigate a labyrinth of terms and conditions, struggling to find the ideal Safeco insurance policy options or to perform an effective Safeco insurance quotes comparison.

This comprehensive guide reveals how policyholders and risk managers can secure comprehensive protection and peace of mind through Safeco's offerings, ensuring you're prepared for whatever life throws your way.

What Makes a Premium Complete Safeco Insurance Coverage Essential for Policyholders and Risk Managers?

The global insurance industry is a colossal and continuously expanding sector, demonstrating its critical role in financial security. In 2024, the global insurance market size grew by an estimated 8.6%, reaching a staggering EUR 7.0 trillion (approximately USD 7.8 trillion) in total premium income. The property and casualty (P&C) segment alone saw a 7.7% growth, with North America being a significant driver of this expansion. These insurance market growth trends highlight the increasing demand for reliable protection.

For policyholders and risk managers, investing in premium Complete Safeco Insurance Coverage translates directly into a strong return on investment (ROI). Consider the alternative: an unexpected event, like a severe weather incident or a major car accident, could lead to monumental financial strain if you're underinsured. Safeco, a subsidiary of Liberty Mutual, offers a broad spectrum of coverage designed to mitigate such risks, including auto, home, boat, RV, and even classic car insurance. From an insurance perspective, comprehensive coverage acts as a financial safety net, protecting your investments and ensuring business continuity or personal stability. Can policyholders afford to ignore comprehensive Safeco coverage when the stakes are so high?

Critical Evaluation Criteria for Policyholders and Risk Managers:

Choosing the right insurance involves a careful assessment of several key factors.

Cost Structure Analysis

Understanding the cost of your Complete Safeco Insurance Coverage is paramount. Safeco's pricing is influenced by various factors, including your location, driving history, vehicle type, and the specific coverage amounts you select. Fortunately, Safeco offers numerous discounts that can make premium coverage more affordable. These include multi-policy discounts (often up to 15% when bundling home and auto), safe driver discounts, and good student discounts. Utilizing a Safeco insurance premium calculator or directly comparing Safeco insurance pricing models can help you estimate your costs and identify potential savings. Remember, your deductible also plays a significant role; a higher deductible typically leads to lower monthly premiums but requires a larger out-of-pocket payment in the event of a claim.

Compliance & Security Requirements

In the highly regulated insurance landscape, Safeco regulatory compliance is a critical consideration. The National Association of Insurance Commissioners (NAIC) plays a pivotal role in establishing standards and guidelines for the U.S. insurance industry, promoting uniformity and consumer protection across states. All U.S. states, Washington D.C., and the U.S. Virgin Islands are accredited by the NAIC, ensuring a baseline level of oversight for insurers. This means that when you choose Safeco, you can be reassured that their policies and operations adhere to established industry and state-specific regulations, fostering fair pricing and financial solvency.

Integration Capabilities

For insurance agents and policyholders alike, seamless integration with existing systems and digital tools is increasingly vital. Safeco supports its independent agents with advanced tools, including Agency Management System (AMS) integration, which allows for real-time quoting and the efficient reception of policy information. This streamlined process enhances efficiency and customer service. For policyholders, Safeco provides digital platforms and a mobile app that enable online account management, bill payment, access to ID cards, and convenient claims reporting. This focus on Safeco policy management system integration ensures a smooth and accessible experience for all users.

Implementation Roadmap: Maximizing Complete Safeco Insurance Coverage ROI

Maximizing the return on your insurance investment involves a strategic approach to policy selection and management.

- Assess Your Needs: Begin by thoroughly evaluating your personal or business assets and potential risks. Do you need auto, home, renters, boat, RV, or even landlord protection insurance? Safeco offers a diverse range of options to cover various aspects of your life.

- Obtain and Compare Quotes: Utilize online tools or work with an independent agent to get Safeco insurance quotes. It's wise to compare these with other providers to ensure you're getting competitive rates for the desired coverage.

- Review Policy Details: Once you have a quote, meticulously review the policy details, coverage limits, and any exclusions. Understand what is covered, up to what amount, and under what circumstances.

- Understand the Claims Process: Familiarize yourself with Safeco's claims process. Knowing how to report an incident and what to expect can significantly reduce stress during a challenging time. Safeco offers 24/7 claims service.

- Utilize Digital Tools for Management: After activating your policy, leverage Safeco's online account services and mobile app for easy access to policy documents, billing, and claims management. This can facilitate a rapid Safeco policy activation and ongoing efficient management.

2025 Trends: The Future of Complete Safeco Insurance Coverage for Policyholders and Risk Managers:

The insurance industry is in the midst of a significant technological transformation, and emerging Safeco insurance technologies are poised to enhance how policyholders and risk managers interact with their coverage. According to the Allianz Global Insurance Report 2025, the global insurance market is expected to continue its strong growth, with technology playing a crucial role.

Key trends shaping the future of insurance include:

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are revolutionizing claims processing, fraud detection, and underwriting, leading to faster, more accurate, and personalized services. For policyholders, this means quicker claim settlements and potentially more tailored policy recommendations.

- Internet of Things (IoT) and Telematics: The integration of IoT devices and telematics is enhancing risk assessment by providing real-time data, particularly in auto and home insurance. This allows for more dynamic pricing and can even incentivize safer behaviors.

- Digital Experience Platforms: Insurers are investing in sophisticated digital platforms to improve the customer journey, offering seamless online interactions for policy management, quotes, and support.

- Cloud-Native Ecosystems: The shift to cloud-native infrastructure provides insurers with unparalleled scalability and flexibility, streamlining operations and accelerating policy processing.

These advancements will empower policyholders with greater control, transparency, and efficiency in managing their Complete Safeco Insurance Coverage.

Conclusion

Securing Complete Safeco Insurance Coverage is a strategic decision that provides essential protection and invaluable peace of mind for policyholders and risk managers. By offering a diverse range of Safeco insurance policy options for home, auto, and specialized assets, coupled with a commitment to regulatory compliance and leveraging cutting-edge technology, Safeco stands as a trustworthy and reassuring partner in risk management. Backed by the financial strength of Liberty Mutual, a Fortune 100 company, Safeco ensures reliability when you need it most.

Don't leave your future to chance. Explore the tailored solutions that Safeco offers.

Get customized Safeco Insurance quotes today and compare Safeco policy options to find the perfect enterprise-grade Safeco insurance solutions that fit your unique needs. Take control of your protection and secure your future with confidence.

FAQ Section (HPK-OPTIMIZED)

1. What's the typical cost range for premium Complete Safeco Insurance Coverage?

The cost of Complete Safeco Insurance Coverage varies significantly based on factors such as your location, driving record, the type of vehicle or property being insured, and the specific coverage limits and deductibles you choose. Safeco offers competitive Safeco insurance pricing models and various discounts, including multi-policy, safe driver, and good student discounts, which can help reduce your premiums. For an accurate estimate, it's best to get a personalized quote.

2. How quickly can Policyholders and Risk Managers implement Complete Safeco Insurance Coverage?

Implementing Complete Safeco Insurance Coverage can be a surprisingly rapid process, especially with Safeco's digital capabilities. You can often get online quotes quickly, and with the assistance of an independent agent, policy activation can be streamlined. Safeco’s online account services and mobile app further facilitate efficient policy management, making for rapid Safeco policy activation and ongoing convenience.

3. What compliance standards should Complete Safeco Insurance Coverage meet?

Complete Safeco Insurance Coverage adheres to rigorous compliance standards set by state regulatory bodies and guided by the National Association of Insurance Commissioners (NAIC). The NAIC develops model laws and guidelines to ensure consistency, consumer protection, and fair competition across the U.S. insurance industry. All U.S. states are NAIC accredited, meaning Safeco's operations and policies meet these essential Safeco insurance certification requirements.

4. Can Complete Safeco Insurance Coverage integrate with existing business systems?

Yes, for insurance agents, Safeco offers robust Safeco insurance system integration capabilities, including seamless integration with Agency Management Systems (AMS) for real-time quoting and policy information access. For policyholders, Safeco's digital platforms and mobile app allow for convenient online management, enabling you to access policy details, pay bills, and report claims, effectively integrating with your digital lifestyle.

Finance & Investment

View All

January 23, 2025

Secrets to Entrepreneurial GrowthUnlock secrets to building a growth-oriented entrepreneurial mindset. Scale your business effectively!

Ellie Moore

April 6, 2025

Hedge Funds: Their Role in Modern Financial MarketsExplore the role of hedge funds in the financial market. Understand their strategies, risks, and why they matter for investors.

Ellie Moore

March 2, 2025

New York State Taxation and FinanceDominate search in 2025 with expert SEO content. Craft high-quality, E-E-A-T optimized content to boost rankings, drive traffic, and build authority.

Ellie Moore

April 18, 2025

Power Finance Texas Review for LocalsMaster expert SEO content strategy. Blend compelling writing with SEO science, focusing on user intent, keywords, and quality to rank high & deliver value.

Ellie Moore

June 23, 2025

What Is the National Finance CommissionElevate your online presence! Discover how expert SEO content drives rankings, builds trust, and boosts conversions for sustainable digital growth.

Ellie Moore

August 14, 2025

Mazda Financing Deals You’ll LoveUnlocking Top Rankings: Your Guide to Expert SEO Content In today's crowded digital landscape, simply having content isn't enough. To truly stand out, attract y...

Ellie Moore

Insurance

View AllUnpredictable risks threaten your business. Secure comprehensive protection with Complete Business Insurance Plans to safeguard assets, ensure continuity, and f...

Ellie Moore

Separate fact from fiction! Uncover the truth about life insurance myths and make informed decisions for your future.

Ellie Moore

Secure optimal auto insurance coverage and significant savings! Our guide helps you compare top-rated companies to beat rising premiums.

Ellie Moore

Decode your insurance policy! Learn to understand terms, coverage, and conditions with this beginner-friendly guide.

Ellie Moore

Concerned about financial risks? Discover how top-rated auto & renters insurance offers optimal protection, savings, and peace of mind for your assets.

Ellie Moore

Navigate healthcare's future. Discover essential health insurance companies for robust, affordable coverage, ensuring peace of mind for policyholders & pros.

Ellie Moore

Education

View AllStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MoreSocial skills training is key for kids with autism. Learn practical strategies to improve social interaction and communication in children with ASD.

Read MoreLearn how gamification is transforming modern classrooms. Explore fun, interactive strategies that boost engagement and learning outcomes.

Read MoreIs a college degree still worth it? Dive into a detailed analysis of the ROI on higher education, including costs, benefits, and future prospects.

Read MoreShould smartphones be allowed in classrooms? Explore the pros and cons of using smartphones in education and their impact on learning.

Read MoreMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

February 10, 2025

Electric Motorcycles: The Future of Two-Wheel Rides

Are electric motorcycles the next big thing? Explore the latest models, benefits, and how they compare to traditional bikes. Ready to switch gears?

February 10, 2025

Retro Car Features We Miss and Want Back

From bench seats to hidden headlights, check out the retro car features we’d love to see return. Which nostalgic design is your favorite?

August 19, 2025

How To Use Automotive Wire Connectors Safely

Master automotive wire connectors for safe, reliable, and high-performance vehicle electrical systems. Avoid hazards & ensure peace of mind!

February 2, 2025

Must-Know Vehicle Safety Features for Every Driver

Stay safe on the road by learning about essential vehicle safety features. Discover the tech that could save your life. Drive smart, drive safe!

February 16, 2025

Top Electric Vehicle Myths Debunked

Don’t believe the EV myths! We debunk the top misconceptions about electric vehicles and reveal the truth behind green driving.

February 8, 2025

Winter Driving 101: Tips & Must-Have Equipment

Stay safe on icy roads with these essential winter driving tips and equipment recommendations. Don’t hit the road unprepared!