Top-Rated Insurance Agency Services

Ellie Moore

Photo: Top-Rated Insurance Agency Services

Top-Rated Insurance Agency Services: Your Guide to Unlocking Growth and Security

Are you an insurance agent, policyholder, or risk manager feeling the pressure of a rapidly evolving market, where inefficient processes or inadequate coverage could mean significant financial setbacks? The right insurance agency services are no longer a luxury but a fundamental necessity for navigating today's complex risk landscape. This comprehensive guide reveals how insurance professionals, policyholders, and risk managers can identify and leverage Top-Rated Insurance Agency Services to achieve unparalleled commercial benefits, from optimized operations to robust risk mitigation. We'll delve into everything from understanding Top-Rated Insurance Agency Services pricing to identifying leading enterprise Top-Rated Insurance Agency Services providers that can truly transform your insurance experience.

What Makes a Premium Top-Rated Insurance Agency Services Essential for Insurance Professionals?

In an industry marked by constant change, premium Top-Rated Insurance Agency Services are the bedrock of success. They offer more than just policy transactions; they provide strategic advantages, enabling agencies to streamline operations, enhance customer satisfaction, and ensure compliance. For policyholders and risk managers, these services translate to superior coverage, proactive risk assessment, and ultimately, greater peace of mind.

The market growth Top-Rated Insurance Agency Services sector is experiencing robust expansion, driven by increasing demand for digital transformation and advanced risk management solutions. The global insurance agency portal market size, for instance, was valued at USD 6.10 billion in 2025 and is projected to reach nearly USD 14.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15%. This growth highlights a clear industry shift towards integrated, efficient, and technologically advanced solutions. Furthermore, the overall U.S. insurance services market is expected to grow at a CAGR of 3.4% from 2025 to 2029, reaching $4.5 trillion in gross written premiums. This upward trend underscores the critical importance of selecting services that can keep pace with an expanding and increasingly complex market.

For insurance agencies, this means investing in services that offer a clear return on investment (ROI) through boosted efficiency and productivity. Agency management systems (AMS) can automate routine, time-consuming tasks like policy issuance, renewals, and claims processing, reducing manual errors and cutting down turnaround times. This allows agents and staff to focus on higher-value activities like client engagement and sales, ultimately increasing overall productivity and reducing operational costs.

Critical Evaluation Criteria for Insurance Agencies and Policyholders:

Choosing the right Top-Rated Insurance Agency Services requires a meticulous evaluation process. Consider these key criteria to ensure your investment yields maximum value and security.

Cost Structure Analysis

Understanding the true cost of Top-Rated Insurance Agency Services goes beyond the initial price tag. A comprehensive Top-Rated Insurance Agency Services TCO calculator should factor in implementation, licensing, subscription, support, infrastructure, and training costs over a 5-year period. While insurance brokers typically earn commissions paid by the insurance company (often 2% to 8% of premiums), some may also charge agent or service fees for specific services. It's crucial for policyholders and agencies to understand these models to avoid unexpected expenses and negotiate effectively.

For insurance agencies, the average monthly cost for errors and omissions insurance is around $65, general liability insurance is $29, and a business owner's policy (BOP) is approximately $45 per month. These figures highlight the ongoing operational costs that need to be considered in a comprehensive TCO analysis.

Compliance & Security Requirements

In the highly regulated insurance industry, adherence to legal and ethical standards is non-negotiable. Regulatory compliant Top-Rated Insurance Agency Services are essential to safeguard sensitive client data and maintain market stability. Insurance companies and individual agents must be licensed by the state in which they operate, and these licenses often require periodic renewal and continuing education.

Key areas of compliance include:

- Anti-Money Laundering (AML): Protecting against illicit financial activities.

- Data Protection: Ensuring customer information is secure and private.

- State-Level Regulations: Each state has its own rules regarding licensing, policy form approval, rate filings, claims handling practices, and solvency standards.

Robust security features, such as multi-factor authentication, encryption, and audit trails, are vital for AMS platforms to protect data integrity and privacy.

Integration Capabilities

Seamless insurance agency management software integration is crucial for maximizing efficiency and performance. Integrated systems allow data to flow smoothly between different platforms, eliminating manual data entry, reducing errors, and accelerating workflows. This means quicker responses to client queries and improved accuracy in policy information.

Modern agency management systems are designed to integrate with:

- Third-party applications

- Carrier systems

- Vendor platforms

- CRM systems

- Accounting software

By connecting various tools, insurers can automate processes like policy management, document management, and communication tracking, leading to smoother workflows and more efficient service delivery.

Implementation Roadmap: Maximizing Top-Rated Insurance Agency Services ROI

Implementing new Top-Rated Insurance Agency Services requires a strategic approach to ensure a smooth transition and maximize your return on investment.

Step-by-Step Guide with Commercial Focus:

- Define Clear Objectives: Before selecting a service, clearly outline your agency's or organization's specific commercial goals. Are you aiming to reduce operational costs, increase policy renewals, improve customer satisfaction, or enhance risk assessment capabilities?

- Conduct a Thorough Needs Assessment: Evaluate your current processes and identify pain points that Top-Rated Insurance Agency Services can address. This includes assessing your existing technology stack and identifying necessary insurance agency system integration points.

- Vendor Selection and Due Diligence: Research and compare enterprise Top-Rated Insurance Agency Services providers. Request detailed Top-Rated Insurance Agency Services pricing models and look for providers with a proven track record in the insurance niche. Consider their support, training, and long-term partnership potential.

- Phased Deployment Strategy: For complex systems, a phased deployment can minimize disruption. Start with a pilot program or implement core functionalities first, then gradually roll out additional features.

- Comprehensive Training: Invest in thorough training for your team to ensure they can fully leverage the new services. This will accelerate adoption and maximize efficiency gains.

- Data Migration and Validation: Meticulously plan and execute data migration from legacy systems to the new platform, ensuring data accuracy and integrity.

- Ongoing Optimization and Support: Regularly review the performance of your Top-Rated Insurance Agency Services and work with your provider to optimize their use. Ensure robust support is available for any issues.

The Top-Rated Insurance Agency Services deployment timeline can vary significantly. While a typical timeline for Agency Management System (AMS) implementation ranges from 2-3 months, rapid implementations for smaller firms with well-defined requirements can occur in as little as two weeks. Cloud-based deployments generally have shorter durations (averaging 17 months) compared to on-premises deployments (averaging 29 months).

2025 Trends: The Future of Top-Rated Insurance Agency Services for Insurance Professionals:

The insurance industry is at the forefront of technological innovation, with several key trends shaping the future of Top-Rated Insurance Agency Services.

According to industry reports, the global insurance industry is anticipated to generate $7.7 trillion in premiums by 2025, indicating significant growth and complexity. This growth is further propelled by digital transformation, security technology advancements, artificial intelligence, and automation.

Emerging insurance agency technologies are revolutionizing how insurance professionals operate:

- Artificial Intelligence (AI) and Machine Learning (ML): AI is drastically changing the industry, offering unprecedented opportunities for agencies to simplify operations, improve customer experiences, and stay competitive. AI can optimize product pricing, provide tailored solutions, enhance customer experience, and improve operational efficiency. AI-powered tools can assist agents in crafting personalized messaging, summarizing client interactions, and improving training materials. AI models can also analyze anomalies in claims to detect potential fraud and automate underwriting.

- Automation: Insurance automation software streamlines repetitive tasks like policy changes, certificate issuance, and follow-up tasks, allowing human resources to focus on higher-value activities.

- Predictive Analytics: This enables insurers to predict claims, identify customers likely to switch providers, and enhance underwriting precision.

- Cloud Computing: Cloud-based solutions offer scalability, flexibility, and reduced infrastructure costs, making them increasingly popular for insurance agency software.

- Digital Experience Platforms (DXPs): These platforms aim to simplify the often-complex and frustrating insurance experience for customers.

- Small Language Models (SLMs): These can provide highly relevant responses to insurance-specific queries about policy details and claim statuses, improving customer service.

- Spatial Computing: Using augmented and virtual reality can help enhance how companies visualize insurance policies.

From an insurance perspective, these advancements mean more accurate risk assessments, personalized product development, and enhanced operational efficiency. For instance, advanced data analytics frameworks are redefining risk assessment by analyzing complex datasets to develop nuanced pricing strategies and robust risk management protocols.

Conclusion

Choosing the right Top-Rated Insurance Agency Services is a strategic decision that can profoundly impact the success and resilience of your insurance business. From optimizing daily operations and ensuring stringent regulatory compliance to embracing cutting-edge technologies like AI and predictive analytics, these services are vital for staying competitive and delivering exceptional value to policyholders. By carefully evaluating cost structures, prioritizing robust compliance and security, and demanding seamless integration capabilities, insurance agents, policyholders, and risk managers can make informed decisions that drive growth and secure their future. The ongoing digital transformation of the insurance sector presents immense opportunities for those who invest wisely in enterprise-grade Top-Rated Insurance Agency Services.

Ready to transform your insurance operations and secure a competitive edge? Don't leave your agency's future to chance. Get customized Top-Rated Insurance Agency Services quotes today and discover how a premium solution can empower your success.

FAQ Section

1. What's the typical cost range for premium Top-Rated Insurance Agency Services?

The cost of premium Top-Rated Insurance Agency Services varies significantly based on factors like the size of your agency, the complexity of your operations, and the specific features and integrations required. While insurance brokers typically receive commissions (2% to 8% of premiums) from insurance companies, some may also charge additional agent or service fees. When evaluating costs, consider a comprehensive Top-Rated Insurance Agency Services pricing models analysis, including implementation, licensing, subscription, support, infrastructure, and training expenses over a 5-year period.

2. How quickly can insurance agencies implement Top-Rated Insurance Agency Services?

The rapid Top-Rated Insurance Agency Services deployment timeline depends on several factors, including the size and complexity of the agency, the chosen solution (cloud-based vs. on-premises), and the extent of data migration and customization. While a typical implementation for an Agency Management System (AMS) can take 2-3 months, smaller firms with clear requirements and cloud-based solutions might see deployment in as little as two weeks. Cloud-based deployments generally have shorter average durations (17 months) compared to on-premises solutions (29 months).

3. What compliance standards should Top-Rated Insurance Agency Services meet?

Insurance agency certification requirements are stringent and crucial for legal operation and consumer protection. Top-Rated Insurance Agency Services must adhere to state and federal regulations, which often include licensing for both companies and individual agents, annual financial reporting, and policy contract standards. Key compliance areas include Anti-Money Laundering (AML) and data protection, ensuring sensitive client information is secure and private. Robust platforms incorporate features like multi-factor authentication, encryption, and audit trails to assist with regulatory adherence.

4. Can Top-Rated Insurance Agency Services integrate with existing agency management systems?

Yes, a core benefit of Top-Rated Insurance Agency Services is their ability to integrate seamlessly with existing insurance agency system integration. Modern solutions are designed to connect with various third-party applications, carrier systems, CRM platforms, and accounting software. This integration facilitates real-time data exchange, automates workflows, reduces manual errors, and enhances overall operational efficiency, leading to improved customer service and faster claims processing.

Finance & Investment

View All

April 7, 2025

Tesla Yahoo Finance Market PerformanceGo beyond keywords! Learn to craft expert SEO content that ranks higher, builds authority, enhances user experience, and drives conversions.

Ellie Moore

December 3, 2024

How to Prepare for Retirement with No SavingsStart preparing for retirement, even with no savings! Learn practical strategies to build a retirement fund, manage expenses, and secure your financial future. It's never too late to start!

Ellie Moore

January 13, 2025

Owner Financing Homes in San AntonioGo beyond basic SEO. Learn to create expert content that leverages E-E-A-T to build credibility, rank higher, and truly engage your audience in 2024.

Ellie Moore

November 7, 2024

The Beginner's Guide to Stock Market Success: From Zero to Hero InvestorTransform from a beginner to a hero investor! This guide will teach you the fundamentals of stock market success. Start your investment journey today!

Ellie Moore

October 11, 2025

Curve Finance DeFi Platform ExplainedUnlock online visibility with expert SEO content. Go beyond keywords to create high-quality, user-focused content that ranks and builds authority.

Ellie Moore

November 7, 2025

Understanding Campaign FinanceUnlock your digital visibility with expert SEO content. Drive organic traffic, boost rankings, build authority, and convert visitors into loyal customers.

Ellie Moore

Insurance

View AllDecode your insurance policy! Learn to understand terms, coverage, and conditions with this beginner-friendly guide.

Ellie Moore

Separate fact from fiction! Uncover the truth about life insurance myths and make informed decisions for your future.

Ellie Moore

Explore aviation insurance options, from aircraft liability to passenger protection. Secure the skies for your operations!

Ellie Moore

Learn how high-net-worth individuals get specialized insurance tailored to unique assets and risks. Discover luxury coverage!

Ellie Moore

Essential Travel Insurance Plans: Navigate coverage, costs, compliance, and tech. Secure your trip with insights for policyholders, agents, & risk managers.

Ellie Moore

Secure your future with confidence using Essential Term Life Insurance. This guide helps you find the best policies, navigate quotes, and protect loved ones & b...

Ellie Moore

Education

View AllProviding education in conflict zones is a major challenge. Learn about the barriers and efforts to ensure learning continuity in crisis situations.

Read MoreProject-based learning engages students by tackling real-world problems. Learn how this approach fosters critical thinking and creativity.

Read MoreSocial skills training is key for kids with autism. Learn practical strategies to improve social interaction and communication in children with ASD.

Read MoreUnderstanding memory is key to better teaching. Learn how memory functions and how to use this knowledge to enhance teaching techniques.

Read MoreFinancial literacy is essential for today’s students. Discover why teaching money management early can lead to smarter financial decisions.

Read MoreCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

February 12, 2025

Hot Wheels Collecting: Hobby or Smart Investment?

Is collecting Hot Wheels just a hobby, or can it be a smart investment? Learn about rare models, values, and tips to grow your collection.

August 11, 2025

Star Automotive Service Reviews And Customer Care

Driving Trust in auto service: Learn how Star Automotive Service Reviews & exceptional customer care guide you to reliable car repair & peace of mind.

February 10, 2025

DIY Paint & Bodywork: Tips for a Flawless Finish

Learn what you need to know about DIY paint and bodywork. Get essential tips for achieving a professional-grade finish on your car at home!

August 24, 2025

Hayes Automotive Top Repairs And Diagnostics

Demystify car troubles! Discover expert diagnostics & repairs for common vehicle issues, ensuring peace of mind & superior automotive care.

August 21, 2025

C&J Automotive And Tire Of Lansdale Review

Searching for a trustworthy auto shop in Lansdale? This review of C&J Automotive And Tire explores what defines excellent service & how they measure up.

July 23, 2025

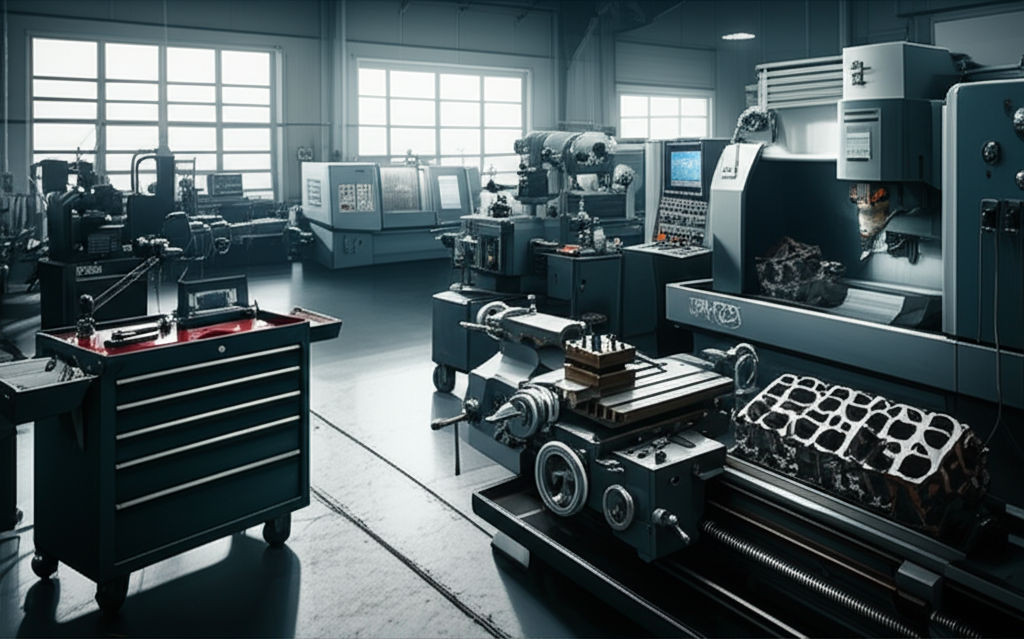

Find Reliable Automotive Machine Shops Near Me

Locate top automotive machine shops for engine repair. Ensure your vehicle's performance, longevity, and save money with expert engine services.