The Best Tax-Advantaged Accounts for Retirement

Ellie Moore

Photo: The Best Tax-Advantaged Accounts for Retirement – Don’t Miss These

Planning for retirement can feel like navigating a complex maze. One of the most effective ways to ensure financial security during your golden years is through tax-advantaged accounts. These accounts offer unique benefits that can significantly boost your savings. In this article, we will explore the best tax-advantaged accounts available, why they matter, and how you can make the most of them.

Understanding Tax-Advantaged Accounts

Before diving into specific types of accounts, let’s clarify what tax-advantaged accounts are. These are financial accounts that provide some form of tax benefit, whether it’s tax deductions, tax-free growth, or tax-free withdrawals. The primary goal of these accounts is to encourage saving for retirement by making it more financially appealing.

Why Tax Advantages Matter

Consider this: if you invest $10,000 in a regular brokerage account, you’ll owe taxes on any capital gains and dividends. However, with a tax-advantaged account, your investment grows tax-free or tax-deferred, allowing you to accumulate wealth more efficiently. The difference can be monumental over time. As Albert Einstein famously said, “Compound interest is the eighth wonder of the world.”

Types of Tax-Advantaged Accounts

1. Traditional IRA

A Traditional Individual Retirement Account (IRA) is one of the most common retirement accounts. Contributions to a Traditional IRA may be tax-deductible, and the investments grow tax-deferred until you withdraw them in retirement.

Key Features:

- Tax Deduction: Depending on your income, you may be able to deduct contributions from your taxable income.

- Withdrawal Rules: Withdrawals are taxed as ordinary income, which can be beneficial if you expect to be in a lower tax bracket during retirement.

Example: Imagine Sarah, a 30-year-old graphic designer, who contributes $5,000 annually to her Traditional IRA. By the time she retires at 65, assuming an average annual return of 7%, her account could grow to over $1 million. The tax deduction she received during her working years adds to her overall savings.

2. Roth IRA

The Roth IRA works differently. Contributions are made with after-tax dollars, meaning you don’t get an upfront tax deduction. However, your investments grow tax-free, and qualified withdrawals in retirement are also tax-free.

Key Features:

- Tax-Free Growth: No taxes on earnings as long as you follow the rules.

- Flexibility: You can withdraw your contributions at any time without penalty.

Example: John, a 25-year-old teacher, opts for a Roth IRA. He invests $5,000 each year. When he retires at 65, if his portfolio grows similarly to Sarah's, he can withdraw his funds tax-free, providing him with a substantial financial cushion.

3. 401(k) and 403(b) Plans

Employers often offer 401(k) or 403(b) plans, which are types of retirement savings accounts. These plans allow you to contribute a portion of your salary before taxes are taken out.

Key Features:

- Employer Match: Many employers match contributions, which is essentially free money.

- Higher Contribution Limits: You can contribute significantly more than in an IRA.

Analysis: Consider the case of Tom, who works for a tech company with a generous 401(k) match. By contributing enough to get the full match, he not only benefits from tax advantages but also accelerates his savings with the employer's contribution.

4. Health Savings Account (HSA)

While primarily intended for medical expenses, HSAs can also serve as a powerful retirement savings tool. Contributions are tax-deductible, the account grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

Key Features:

- Triple Tax Advantage: Tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified expenses.

- Long-Term Investment: Funds can be invested for growth, similar to other retirement accounts.

Real-Life Scenario: Emily, a freelance writer, uses an HSA to save for medical expenses. By investing her contributions, she not only covers her health costs but also builds a nest egg for retirement, which she can use for medical expenses tax-free later on.

Making the Right Choice for You

Choosing the right tax-advantaged account depends on various factors, including your income, tax situation, and retirement goals. It’s essential to evaluate your current financial status and future expectations.

Factors to Consider:

- Income Level: Higher earners might benefit more from a Traditional IRA, while lower earners may prefer a Roth IRA.

- Tax Bracket: If you expect to be in a higher tax bracket in retirement, a Roth IRA could be more advantageous.

- Employer Benefits: Always take full advantage of employer-matched retirement accounts.

Conclusion

Tax-advantaged accounts are invaluable tools for retirement planning. By understanding the unique features of each type whether it’s a Traditional IRA, Roth IRA, 401(k), or HSA you can make informed decisions that align with your financial goals. As you embark on your journey to secure your financial future, remember that the earlier you start saving, the more time your money has to grow. Don’t miss out on these opportunities they can make a significant difference in your retirement lifestyle.

In the world of retirement planning, knowledge is power. Equip yourself with the right information, and you’ll be well on your way to a financially secure future.

Finance & Investment

View All

March 31, 2025

Comparing Auto Finance Rates in 2025Go beyond keywords! Learn to craft expert SEO content that truly engages, ranks high, and provides value. Master search intent & E-E-A-T for online success.

Ellie Moore

November 25, 2025

Driveway Finance Car OwnershipUnlock organic growth! Learn why expert SEO content, built on E-E-A-T, is crucial for higher rankings, trust, and attracting your ideal audience.

Ellie Moore

February 20, 2025

Snap Finance Login AssistanceMaster expert SEO content! Learn to create high-ranking, authoritative content that genuinely helps users and builds trust with E-E-A-T.

Ellie Moore

November 10, 2024

Top Trading Platforms for 2023: A Comprehensive ReviewDiscover the best trading platforms for 2023! Our comprehensive review helps you choose the right platform. Elevate your trading experience today!

Ellie Moore

November 21, 2024

How to Build a Diversified Investment Portfolio on a BudgetCreate a diversified investment portfolio without breaking the bank! Learn how to allocate assets, choose investments, and manage risk on a budget. Start building wealth today!

Ellie Moore

November 14, 2025

Finance Careers in ChicagoUnlock business growth with expert SEO content. Learn how E-E-A-T, user-centricity, and value drive organic traffic, build authority, and satisfy users.

Ellie Moore

Insurance

View AllExplore how your credit score affects insurance premiums. Learn how to improve your score and save on coverage!

Ellie Moore

Don't let vet bills break the bank. Discover top pet insurance solutions to secure your furry friend's health and your financial peace of mind.

Ellie Moore

Learn how gig workers can protect themselves with insurance solutions designed for freelance and flexible work.

Ellie Moore

Policyholders & risk managers: Secure premium insurance quotes for optimal coverage, maximum savings, and tailored protection.

Ellie Moore

Is pet insurance right for you? Explore the pros, cons, and costs of coverage to keep your furry friend healthy.

Ellie Moore

Save on premiums with usage-based auto insurance. Learn how your driving habits shape coverage and costs!

Ellie Moore

Education

View AllRevive ancient teaching with the Socratic method! Learn how this questioning approach encourages deep thinking and active learning.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreOnline homeschooling communities are growing fast. Explore how they provide support, resources, and a sense of belonging to families worldwide.

Read MoreDiscover how flipped classrooms work and why they’re becoming popular. Learn the key benefits of this innovative teaching approach.

Read MoreDifferent cultures approach early education in unique ways. Discover how cultural values shape learning practices for young children around the world.

Read MoreTeacher burnout is on the rise. Learn about its causes, consequences, and practical solutions to support educators and improve well-being.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

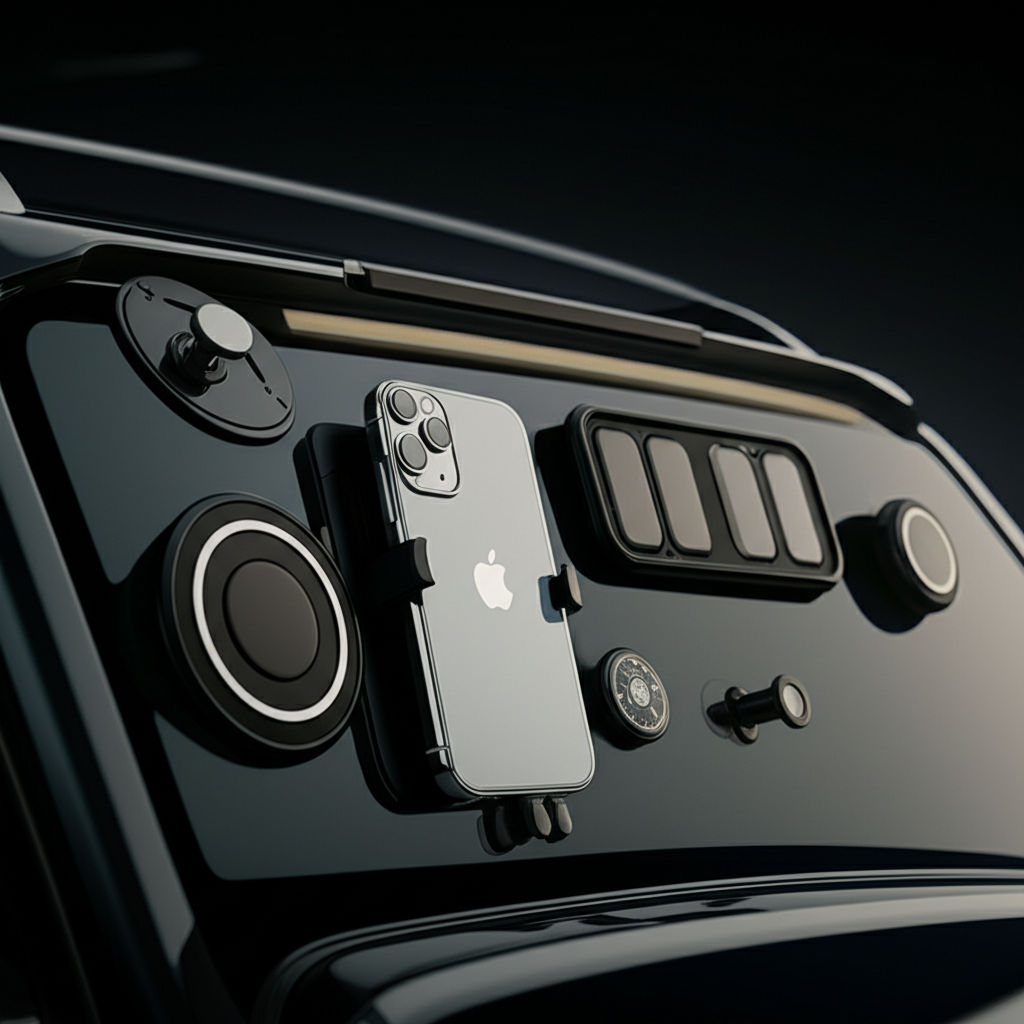

August 3, 2025

Where To Find Automotive Technician Jobs Near Me

Find in-demand automotive technician jobs near you! Discover top mechanic careers, online resources & local tips to rev up your job search.

February 9, 2025

Brake Maintenance Tips: When to Replace & Repair

Learn the basics of brake maintenance. Discover when to replace pads, rotors, and how to keep your braking system in top shape.

July 18, 2025

Magnetic Automotive Accessories For Your Vehicle

Transform your car with magnetic accessories! Enjoy effortless convenience, versatility & sleek design for phone mounts, organization & more. Simplify your driv...

September 3, 2025

Automotive Oil Film Cleaning Brush Explained

Banish frustrating oil film! Learn why standard cleaning fails & how the automotive oil film cleaning brush restores crystal-clear windshields for safer driving...

September 10, 2025

Island Automotive Local Repairs You Can Trust

Struggling to find reliable auto repair? Discover how to choose a trustworthy "island" car service that prioritizes expertise, transparency, & your safety.

September 11, 2025

J&M Automotive Naugatuck Services Reviewed

J&M Automotive Naugatuck: Beyond used cars, find a comprehensive service center for expert maintenance & repairs by ASE-certified technicians.