Robo-Advisors: Are They Worth It for New Investors?

Ellie Moore

Photo: Robo-Advisors: Are They Worth It for New Investors?

Robo-Advisors: Are They Worth It for New Investors?

In the ever-evolving world of investing, technology has taken center stage, providing innovative solutions for individuals looking to grow their wealth. One such innovation is the robo-advisor a digital financial advisor that automates investment management. But are robo-advisors worth it for new investors? Let’s dive deep into the pros, cons, and considerations to help you make an informed decision.

What Are Robo-Advisors?

Robo-advisors are automated platforms that use algorithms to manage investment portfolios. They typically assess your financial goals, risk tolerance, and investment timeline through an online questionnaire. Based on this information, they create a diversified portfolio tailored to your needs, often using low-cost exchange-traded funds (ETFs).

Key Features:

- Automated Portfolio Management: Handles buying, selling, and rebalancing investments automatically.

- Low Fees: Robo-advisors charge significantly lower fees compared to traditional financial advisors.

- Accessibility: Most platforms require minimal investment, making them ideal for beginners.

The Advantages of Robo-Advisors for New Investors

If you’re new to investing, navigating the complex world of stocks, bonds, and mutual funds can be overwhelming. Robo-advisors simplify this process, offering several key benefits:

1. Cost-Effective

Traditional financial advisors often charge a management fee of 1-2% of your portfolio. In contrast, robo-advisors typically charge between 0.25% and 0.50%. For a $10,000 portfolio, that’s a difference of $175–$1750 annually a significant saving for small-scale investors.

2. Beginner-Friendly

Robo-advisors are designed with simplicity in mind. They provide an easy-to-use interface, educational resources, and step-by-step guidance, making them perfect for individuals without prior investment knowledge.

3. Diversification

Investing in a single stock is risky, especially for beginners. Robo-advisors automatically build diversified portfolios across various asset classes, reducing risk and enhancing long-term returns.

4. Hands-Off Approach

For those who lack time or interest in actively managing investments, robo-advisors are a blessing. They handle everything from asset allocation to portfolio rebalancing, so you can focus on other priorities.

Potential Drawbacks to Consider

While robo-advisors offer many advantages, they’re not without limitations. Before diving in, it’s essential to weigh these factors:

1. Lack of Personalization

Although robo-advisors customize portfolios based on your preferences, they rely on algorithms and standardized models. Complex financial situations or specific goals may require the expertise of a human advisor.

2. Limited Financial Planning

Robo-advisors excel at managing investments, but they don’t provide comprehensive financial planning. For example, they won’t offer advice on tax strategies, estate planning, or retirement withdrawals.

3. Over-Simplification

While simplicity is a strength, it can also be a weakness. New investors may miss out on learning the nuances of investing, as the process is entirely automated.

Who Should Use Robo-Advisors?

Robo-advisors are best suited for:

- First-Time Investors: Their low-cost, beginner-friendly approach is ideal for those starting out.

- Busy Professionals: If you lack the time to manage investments actively, a robo-advisor can do the heavy lifting.

- Cost-Conscious Individuals: With minimal fees, robo-advisors help you maximize returns on small portfolios.

Popular Robo-Advisors to Consider

Here’s a quick look at some leading robo-advisors and what they offer:

1. Betterment

- Best For: Goal-based investing.

- Features: Tax-loss harvesting, retirement planning tools, and low fees.

2. Wealthfront

- Best For: Automated financial planning.

- Features: Cash management, portfolio line of credit, and tax-optimized investing.

3. Acorns

- Best For: Micro-investing.

- Features: Rounds up spare change from purchases to invest automatically.

4. Vanguard Digital Advisor

- Best For: Long-term investors.

- Features: Low fees and a focus on diversified ETFs.

How to Get Started with a Robo-Advisor

Ready to take the plunge? Here’s how to begin:

- Identify Your Goals: Determine what you’re investing for retirement, a down payment, or general wealth growth.

- Research Platforms: Compare fees, features, and customer reviews to find a robo-advisor that suits your needs.

- Complete the Questionnaire: Provide details about your financial situation and risk tolerance.

- Deposit Funds: Start with the minimum required investment (often as low as $500 or less).

- Monitor Your Portfolio: While robo-advisors handle the heavy lifting, it’s still wise to check in periodically.

FAQs About Robo-Advisors

Q: Are robo-advisors safe?

A: Yes, most robo-advisors are regulated by financial authorities and use encryption to protect your data and funds.

Q: Can I lose money with a robo-advisor?

A: Like any investment, there’s a risk of loss. However, diversification and algorithm-driven strategies aim to minimize risk.

Q: Do robo-advisors charge hidden fees?

A: Most platforms are transparent about fees, but always read the fine print to avoid surprises.

Q: Can I switch from a robo-advisor to a human advisor later?

A: Absolutely. Many investors start with robo-advisors and transition to traditional advisors as their portfolios grow.

Conclusion: Are Robo-Advisors Worth It?

For new investors, robo-advisors can be a game-changer. They offer an affordable, beginner-friendly way to dip your toes into the investing world without the steep learning curve. However, they’re not a one-size-fits-all solution. If your financial situation is complex or you value personalized advice, a hybrid approach combining robo-advisors with occasional human guidance may be ideal.

Ready to start investing? Explore the best robo-advisors and take the first step toward achieving your financial goals. Have questions or insights to share? Leave a comment below! And don’t forget to share this article with fellow aspiring investors.

Finance & Investment

View All

January 11, 2025

Marketing for Business GrowthBoost your business with powerful marketing strategies that drive growth and sales. Start your journey now!

Ellie Moore

March 8, 2025

NYC Department of Finance PortalUnlock higher rankings & trust with expert SEO content. Discover how to leverage E-E-A-T and user intent for authoritative, valuable online presence.

Ellie Moore

April 15, 2025

Honda Finance Login Quick Access GuideElevate your brand with expert SEO content. Discover your blueprint for higher rankings, organic traffic, and establishing online authority and trust.

Ellie Moore

January 19, 2025

Mercedes Benz Finance Plans 2025Build online authority with expert SEO content. Focus on E-E-A-T, user intent, and quality to stand out, drive traffic, and become a credible leader.

Ellie Moore

March 19, 2025

Best Honda Financing Deals This YearYour blueprint for online authority: Master expert SEO content. Create valuable, trustworthy material that ranks high & engages your audience.

Ellie Moore

January 7, 2025

Yahoo Finance NVDA Stock InsightsGo beyond keywords! Learn to craft expert SEO content that builds trust, authority, and ranks high. Master E-E-A-T for superior user value.

Ellie Moore

Insurance

View AllProtect your finances with Liberty Mutual Car Insurance. Our comprehensive guide helps policyholders & risk managers optimize coverage & compare rates.

Ellie Moore

Unlock the secrets to getting cheap auto insurance fast! Our guide helps you find the best rates and reliable coverage, turning a daunting task into a financial...

Ellie Moore

Remote work brings new risks—find out what insurance coverage digital nomads and remote workers need in a changing world.

Ellie Moore

Guide to Premium Acceptance Insurance Plans: Secure flexible, comprehensive coverage, boost client satisfaction & strategic growth for agents & policyholders.

Ellie Moore

Secure your future with confidence using Essential Term Life Insurance. This guide helps you find the best policies, navigate quotes, and protect loved ones & b...

Ellie Moore

Secure your business future! Learn how Essential Next Insurance Plans help agents, policyholders, and risk managers mitigate risk & optimize premiums.

Ellie Moore

Education

View AllProviding education in conflict zones is a major challenge. Learn about the barriers and efforts to ensure learning continuity in crisis situations.

Read MoreHow does social media affect learning and behavior? Uncover the positive and negative effects of social platforms on students today.

Read MoreIs a college degree still worth it? Dive into a detailed analysis of the ROI on higher education, including costs, benefits, and future prospects.

Read MoreArts education is key to fostering creativity. Learn why it’s important in schools and how it helps students develop essential life skills.

Read MoreLearn how UNESCO promotes education for all globally. Explore key initiatives and efforts aimed at fostering equal learning opportunities for everyone.

Read MoreDiscover how portfolio-based assessments offer a better way to measure student progress. See how they foster creativity and critical thinking.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 28, 2025

Ray's Automotive Fast Friendly Dependable

Ray's Automotive sets the gold standard for fast, friendly, and dependable car care. Discover how their service ensures peace of mind on the road.

July 23, 2025

How To Land Automotive Sales Jobs Quickly

Fast-track your career in automotive sales! Learn actionable strategies to quickly land a high-paying job in this dynamic industry.

February 8, 2025

Ride-Sharing’s Impact on Car Ownership Explained

Discover how ride-sharing services are changing car ownership. Learn about the economic and environmental effects of this evolving trend.

July 28, 2025

Portable Automotive Air Conditioner Buying Guide

Transform hot drives into cool cruises! Our guide to portable car ACs offers instant relief, efficiency, and versatility for ultimate comfort.

July 23, 2025

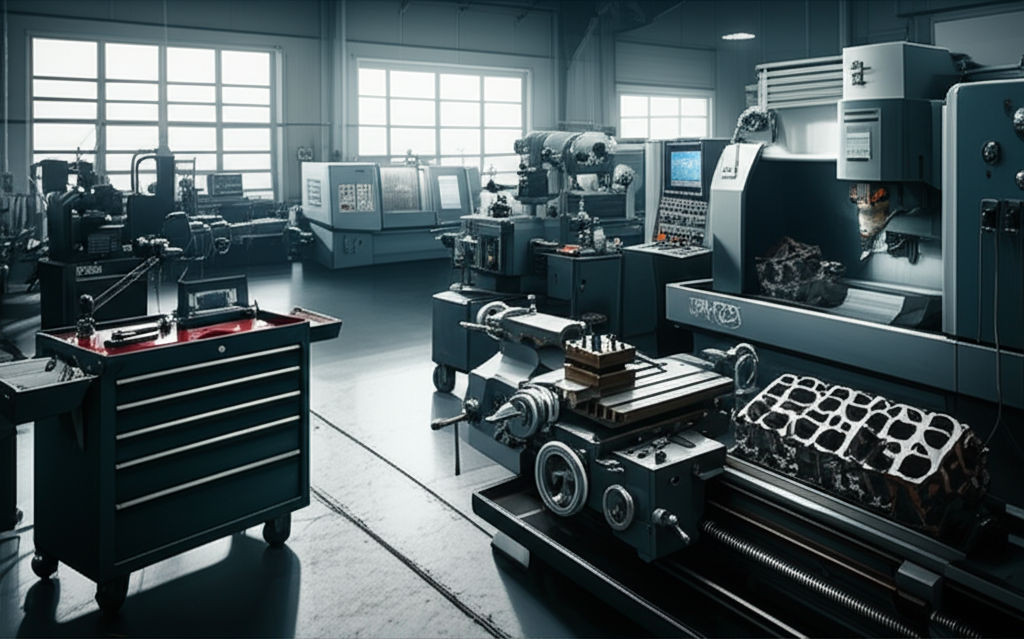

Find Reliable Automotive Machine Shops Near Me

Locate top automotive machine shops for engine repair. Ensure your vehicle's performance, longevity, and save money with expert engine services.

August 17, 2025

Automotive Record Player A Retro Ride Upgrade

Upgrade your ride with a retro automotive record player! Experience the warm, rich sound of in-car vinyl for a truly unique analog journey.