IPOs vs. SPACs: Key Differences for Investors

Ellie Moore

Photo: IPOs vs. SPACs: Key Differences for Investors

IPOs vs. SPACs: Key Differences for Investors

In the ever-evolving financial landscape, companies seeking capital have a variety of options to go public. Two of the most prominent methods are Initial Public Offerings (IPOs) and Special Purpose Acquisition Companies (SPACs). For investors, understanding the key differences between these approaches is critical to making informed decisions. Let’s dive into the nuances of IPOs and SPACs, comparing their structures, benefits, risks, and implications for potential investors.

What is an IPO?

An Initial Public Offering (IPO) is a traditional route for a private company to become publicly traded by selling shares to the public for the first time. This process often involves underwriters (typically investment banks) who help determine the share price, attract investors, and manage regulatory filings.

Key Features of IPOs

- Lengthy Preparation: Companies undergo extensive due diligence, audit processes, and regulatory scrutiny.

- Valuation Transparency: The market determines the company’s value based on extensive financial disclosures.

- Investor Confidence: IPOs are often seen as a sign of maturity and stability.

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is essentially a shell corporation created to raise funds through its own IPO with the sole purpose of acquiring a private company. Once the acquisition is complete, the private company merges with the SPAC and becomes publicly traded.

Key Features of SPACs

- Faster Route to Market: SPACs offer a quicker pathway for companies to go public compared to traditional IPOs.

- Sponsor-Driven: SPACs are typically led by sponsors experienced executives or investors who promise to find attractive acquisition targets.

- Reduced Disclosure: Compared to IPOs, SPACs often require fewer upfront disclosures, though regulatory scrutiny is tightening.

IPOs vs. SPACs: A Detailed Comparison

To better understand which approach aligns with your investment strategy, let’s explore the key differences between IPOs and SPACs across critical dimensions.

1. Timeline and Process

- IPO: Preparing for an IPO can take anywhere from six months to a year. Companies must complete rigorous due diligence, file detailed disclosures with the SEC, and conduct roadshows to attract investors.

- SPAC: SPACs drastically shorten the timeline, often completing mergers in as little as 3-6 months. This streamlined process appeals to companies looking for a faster path to public markets.

2. Valuation

- IPO: Valuation in an IPO is market-driven, relying on investor demand during the roadshow and open market trading.

- SPAC: In a SPAC merger, the valuation is negotiated between the private company and the SPAC sponsors, which can sometimes lead to overvaluations or misaligned incentives.

3. Risk Factors

- IPO: IPOs carry the risk of market volatility, which can delay the process or lead to lower-than-expected valuations.

- SPAC: SPACs are often criticized for their speculative nature, as investors have limited visibility into the eventual acquisition target at the time of investment.

4. Regulatory Oversight

- IPO: Companies must adhere to stringent SEC regulations, ensuring transparency and accountability.

- SPAC: While initially less regulated, SPACs are now under greater scrutiny, with the SEC demanding more detailed disclosures about target acquisitions.

5. Costs

- IPO: IPOs involve substantial costs, including underwriter fees (typically 7% of gross proceeds), legal expenses, and roadshow costs.

- SPAC: While upfront costs are lower, the dilution caused by SPAC sponsor shares and warrants can reduce long-term value for investors.

Real-World Examples

Example 1: IPO Success Story – Airbnb

Airbnb’s IPO in December 2020 raised $3.5 billion, with its stock soaring over 100% on the first day of trading. The company’s detailed disclosures and strong market demand contributed to its success.

Example 2: SPAC Case Study – DraftKings

DraftKings went public via a SPAC merger in 2020. The process allowed the company to access public capital quickly, fueling its rapid expansion in the sports betting market.

Pros and Cons of IPOs for Investors

Pros

- Transparent financial disclosures.

- Market-driven valuation ensures fair pricing.

- Proven track record of success for established companies.

Cons

- Lengthy and expensive process.

- Susceptibility to market volatility.

- Limited opportunities for smaller, emerging companies.

Pros and Cons of SPACs for Investors

Pros

- Faster and simpler process.

- Early access to high-growth opportunities.

- Backed by experienced sponsors.

Cons

- Limited transparency during the initial investment phase.

- Potential for overvaluation or mismanagement.

- Increased dilution due to sponsor incentives.

Actionable Insights for Investors

- Research the Track Record: For IPOs, analyze the company’s financial performance and market potential. For SPACs, investigate the sponsors’ history and expertise.

- Understand the Risks: SPACs are often more speculative, making them riskier than IPOs. Consider your risk tolerance before investing.

- Diversify Your Portfolio: Avoid putting all your capital into a single IPO or SPAC. Diversification reduces exposure to market volatility and poor performance.

FAQ Section

1. Are SPACs better than IPOs?

It depends on your investment goals and risk tolerance. SPACs are faster and more speculative, while IPOs offer greater transparency and stability.

2. How do SPACs affect company valuations?

SPAC valuations are negotiated, which can sometimes lead to inflated prices. Investors should carefully evaluate whether the valuation aligns with the company’s fundamentals.

3. What are the risks of investing in a SPAC?

The main risks include limited transparency, potential overvaluation, and dilution from sponsor shares and warrants.

Final Thoughts: Which Is Right for You?

Whether you choose to invest in IPOs or SPACs, the key is to align your investment strategy with your risk tolerance, financial goals, and market insights. IPOs may be a safer bet for those seeking transparency and long-term stability, while SPACs offer an exciting, albeit riskier, avenue for accessing high-growth opportunities.

What’s your take on IPOs vs. SPACs? Share your thoughts in the comments below or explore our related content to deepen your financial knowledge.

Finance & Investment

View All

October 2, 2025

Top 0 Financing Car OffersUnlock expert SEO content that ranks & resonates. Blend audience needs with algorithms, emphasizing E-E-A-T for trusted authority & top search results.

Ellie Moore

April 22, 2025

American Financing for Home LoansUnlock higher rankings & build trust with expert SEO content. Learn how E-E-A-T drives value, authority, and engagement for your brand.

Ellie Moore

January 30, 2025

CarMax Auto Finance Made SimpleUnlock your online potential! Expert SEO content drives organic traffic, builds trust, and improves search rankings for ultimate business success.

Ellie Moore

January 9, 2025

Best Ford Finance Offers 2025Elevate your rankings with expert SEO content. Learn how E-E-A-T drives authority, trust, and traffic by delivering genuine value, not just keywords.

Ellie Moore

March 2, 2025

National Finance Commission RoleGo beyond keywords. Discover how to craft expert SEO content that leverages E-E-A-T, builds authority, and genuinely serves your audience for top rankings.

Ellie Moore

May 12, 2025

Beyond Finance Customer ReviewsUnlock online visibility with expert SEO content. Go beyond keywords to build trust, demonstrate E-E-A-T, and deliver genuine value for sustainable growth.

Ellie Moore

Insurance

View AllNavigate American Family Insurance options with confidence. Find optimal coverage, understand pricing, and secure peace of mind for your evolving needs.

Ellie Moore

Unlock peace of mind with Ultimate Nationwide Insurance Plans. This guide helps you secure comprehensive protection for your assets, health, and financial futur...

Ellie Moore

Remote work brings new risks—find out what insurance coverage digital nomads and remote workers need in a changing world.

Ellie Moore

Why are millennials delaying life insurance? Explore the trends and factors influencing their decisions.

Ellie Moore

Don't just insure, secure! This guide reveals why complete home insurance is vital for protecting your home, finances, and peace of mind.

Ellie Moore

Find out why term life insurance is more popular, affordable, and flexible than whole life. Choose the right coverage for you!

Ellie Moore

Education

View AllProject-based learning engages students by tackling real-world problems. Learn how this approach fosters critical thinking and creativity.

Read MoreExplore the benefits of hybrid learning models. Learn how to balance online and face-to-face teaching for a more flexible education experience.

Read MoreDifferentiated instruction helps teachers reach diverse learners. Find out how tailored teaching improves outcomes for every student.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreExplore the ongoing debate on standardized testing. Learn its pros, cons, and whether it should remain a key part of education.

Read MoreStrong school-community partnerships can drive student success. Discover the benefits and strategies for effective collaboration.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

August 8, 2025

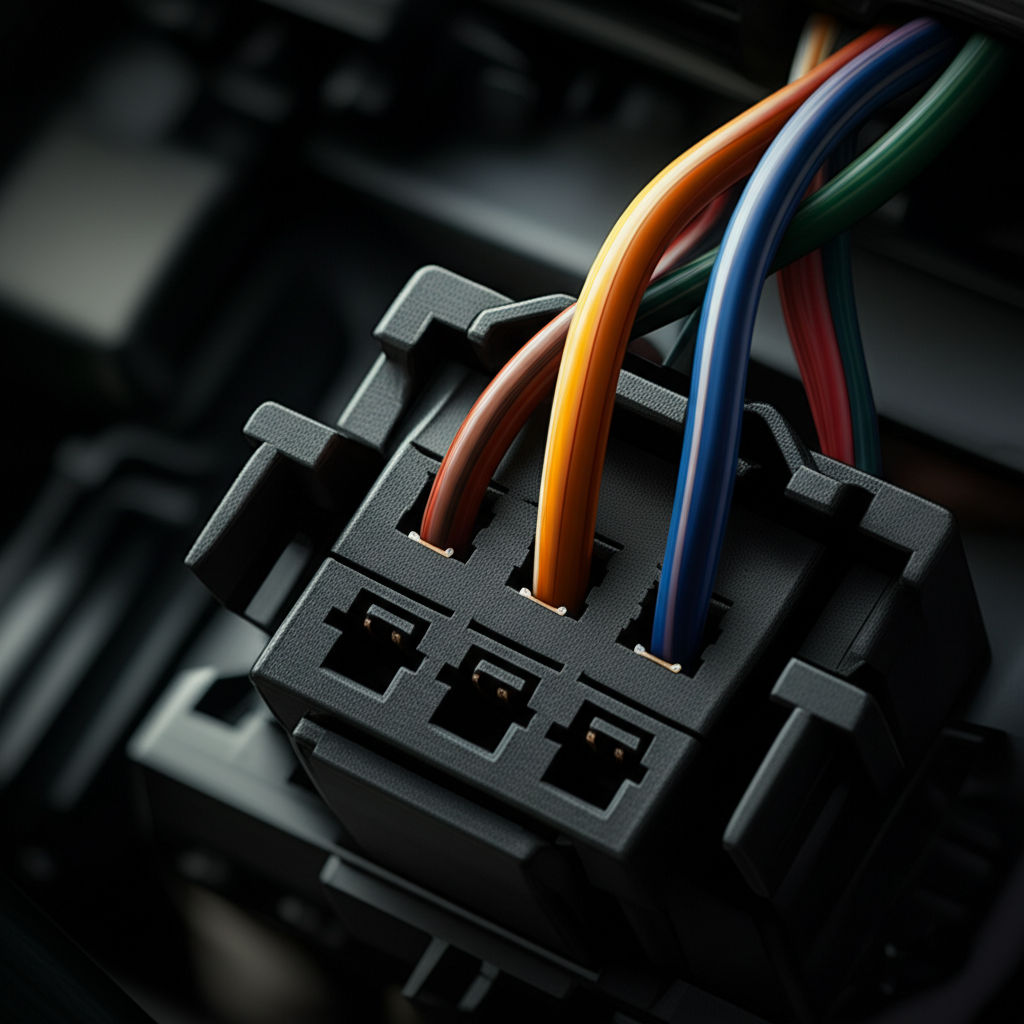

How To Connect Wires In An Automotive Plug Easily

DIY automotive wiring guide: Learn to connect car wires safely & reliably. Fix electrical issues and install accessories with confidence.

February 5, 2025

Prepping Your Car for Extreme Weather Conditions

Stay safe in any weather! Learn how to prep your car for extreme conditions—whether it’s snow, heat, or storms. Don’t get caught unprepared!

July 14, 2025

An Overview Of Automotive Components Holdings

Discover the automotive components industry! Learn about its structure, key players, trends, and challenges in this comprehensive guide.

August 16, 2025

Where To Find Automotive Mechanic Jobs Today

Unlock a rewarding auto mechanic career! Discover high-demand jobs in a rapidly evolving, high-tech automotive industry. Your guide to success.

July 24, 2025

Benefits Of Using An Automotive Steam Cleaner

Unlock a pristine, healthier car! Discover how automotive steam cleaners deep clean & sanitize, eradicating germs, mold, and allergens for a truly hygienic ride...

August 12, 2025

Thomas Automotive Repairs With A Personal Touch

Thomas Automotive: Expert auto repair with a personal touch. We build trust through clear communication & genuine care, not just fix cars.