Essential SR22 Insurance Coverage

Ellie Moore

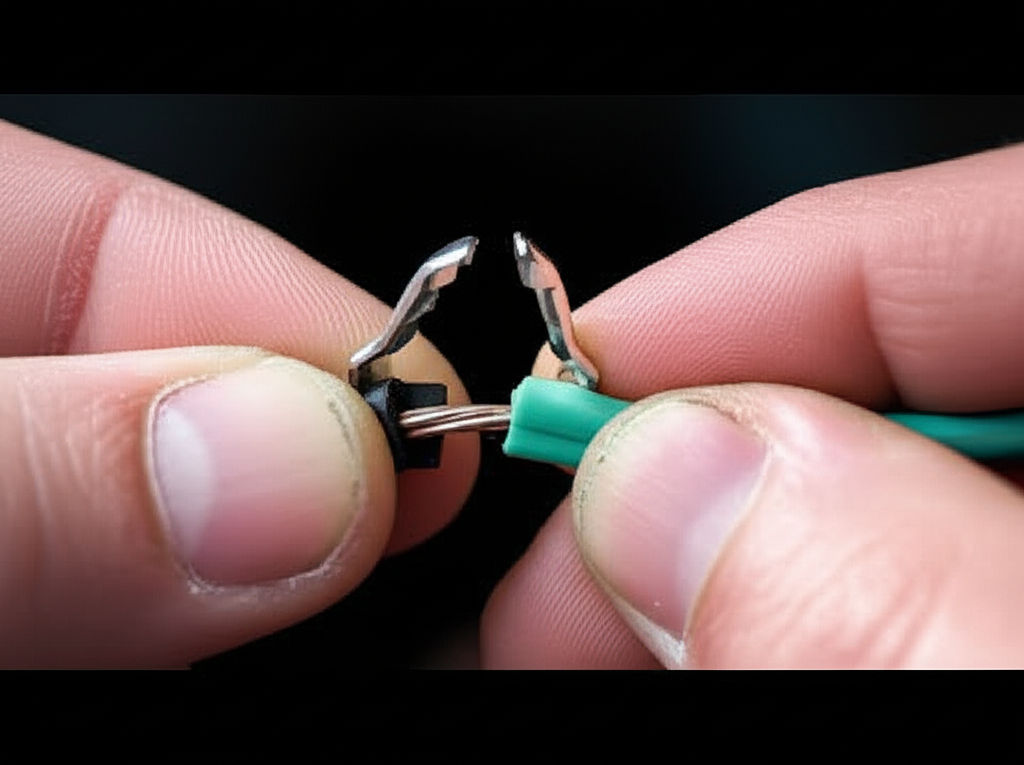

Photo: Essential SR22 Insurance Coverage

Navigating the aftermath of a driving infraction can be a stressful experience, particularly when it involves a mandate for specialized coverage. Facing the daunting prospect of high-risk driver status and skyrocketing premiums? Understanding your obligations is the first step toward regaining control. This comprehensive guide to Essential SR22 Insurance Coverage is designed to demystify the process, helping you find competitive SR22 insurance quotes and ultimately secure affordable SR22 insurance. This guide reveals how policyholders and risk managers can navigate the complexities of SR22 requirements, secure the best coverage, and minimize financial impact.

What Makes a Premium Essential SR22 Insurance Coverage Essential for Policyholders and Risk Managers?

Often mistakenly referred to as a type of insurance, an SR22 is, in fact, a certificate of financial responsibility. It's a document filed by your insurance company with your state's Department of Motor Vehicles (DMV) or equivalent agency, proving that you carry the minimum liability auto insurance coverage required by law. This crucial filing isn't about what you're insured for, but that you're insured, assuring the state you meet your financial obligations on the road.

SR22s are typically mandated for drivers deemed "high-risk" due to various violations. Common reasons include convictions for Driving Under the Influence (DUI) or Driving While Intoxicated (DWI), reckless driving, causing an accident while uninsured, or accumulating multiple serious traffic violations. The purpose is clear: to ensure these drivers maintain continuous insurance coverage, protecting other motorists and enforcing accountability.

From an insurance perspective, the market for such specialized filings is part of a larger, robust industry. The global insurance market size was valued at $9.0 trillion in 2023 and is projected to reach $28.5 trillion by 2032, growing at a compound annual growth rate (CAGR) of 13.5% from 2024 to 2032. This substantial insurance market growth underscores the ongoing need for diverse coverage options, including those for high-risk drivers. For policyholders, investing in Essential SR22 Insurance Coverage is not merely a legal obligation; it's a critical step to avoid further penalties, reinstate driving privileges, and safeguard long-term financial stability. Can policyholders afford to ignore proper SR22 coverage when their driving future is on the line?

Critical Evaluation Criteria for Policyholders and Risk Managers:

When faced with an SR22 requirement, a careful evaluation of your options is paramount. Understanding the intricacies of cost, compliance, and provider capabilities will empower you to make informed decisions.

Cost Structure Analysis

The actual SR22 filing itself usually involves a relatively small, one-time fee, typically ranging from $15 to $50. However, this is just one piece of the financial puzzle. The primary cost impact comes from the significant increase in your auto insurance premiums. Because drivers requiring an SR22 are classified as high-risk, insurers adjust rates accordingly. Drivers commonly face annual premiums between $2,000 and $5,600, with some states like Michigan seeing rates as high as $8,324 per year.

To navigate these increased costs, utilizing an SR22 insurance cost calculator (or comparing multiple quotes) becomes essential. It’s also worth noting that if you don't own a car but need an SR22, a non-owner SR22 insurance policy can often be a less expensive option, providing liability coverage when you drive a vehicle you don't own. Comparing providers and understanding different SR22 insurance pricing models is crucial to finding the most economical solution.

Compliance & Security Requirements

SR22 requirements are highly state-specific, meaning the rules can vary significantly depending on where you reside. It's important to confirm your state's specific mandates. Interestingly, not all states require an SR22 filing; for instance, Delaware, Kentucky, Minnesota, New Mexico, New York, North Carolina, Oklahoma, and Pennsylvania have alternative systems.

Furthermore, some states, notably Florida and Virginia, employ an FR-44 filing for more severe offenses like DUIs, which mandates significantly higher liability coverage limits than an SR22. Understanding these distinctions is critical for meeting SR22 filing requirements accurately. From an insurance perspective, ensuring regulatory compliance is non-negotiable, and a reliable provider will be well-versed in your state's specific SR22 state requirements.

Integration Capabilities

The "integration" aspect for Essential SR22 Insurance Coverage primarily refers to the seamless and efficient filing of the certificate with the state's authorities. Your chosen insurance provider is responsible for electronically submitting the SR22 form to the relevant state department. This electronic filing ensures timely compliance and reinstatement of driving privileges.

It's crucial to understand that not all insurance companies offer SR22 filings. Therefore, finding an insurer with a robust SR22 insurance provider network and efficient e-filing systems is a key evaluation criterion. A reliable provider should also promptly notify the DMV if your policy cancels or lapses, as this can lead to further license suspension.

Implementation Roadmap: Maximizing Essential SR22 Insurance Coverage ROI

Securing and maintaining your Essential SR22 Insurance Coverage involves a clear, step-by-step process designed to ensure compliance and protect your driving privileges. Following this roadmap can help maximize your return on investment by avoiding costly penalties and ensuring a smooth path back to standard insurance rates.

- Notify Your Insurer or Find a Specialized Provider: The first step in the SR22 insurance application process is to inform your current insurance agent that you require an SR22 filing. If your current provider doesn't offer this service, you'll need to seek out an insurer that specializes in SR22s or high-risk policies. Many companies are equipped to handle these specific needs.

- Ensure Minimum Coverage Requirements Are Met: Your auto insurance policy must meet your state's minimum liability coverage requirements for the SR22 to be valid. Your insurer will guide you in adjusting your coverage if necessary.

- Pay the Filing Fee: There is typically a small, one-time fee, ranging from $15 to $50, for the administrative process of filing the SR22 form.

- Insurer Files the SR22 Electronically: Once your policy is in place and the fee is paid, your insurance company will electronically submit the SR22 certificate to the appropriate state agency on your behalf. This official notification verifies your financial responsibility.

- Maintain Continuous Coverage: This is perhaps the most critical step. You will be required to maintain continuous SR22 coverage for a specific period, often three years, though this can vary by state and the nature of the offense. Any lapse in coverage will result in your insurer notifying the state, which can lead to the re-suspension of your license and additional penalties.

By diligently following these steps, policyholders can effectively manage their SR22 requirements, avoid further legal complications, and work towards a clean driving record.

2025 Trends: The Future of Essential SR22 Insurance Coverage for Policyholders and Risk Managers:

The insurance industry is in a constant state of evolution, driven by digital transformation and a focus on personalized risk assessment. For Essential SR22 Insurance Coverage, this means an ongoing shift towards more sophisticated and potentially fairer methods of evaluating and insuring high-risk drivers.

According to industry insights, the application of artificial intelligence (AI) in auto insurance is fundamentally changing how risk is approached, moving from generalized, outdated methods to dynamic assessments grounded in data science. We can expect to see emerging SR22 insurance technologies playing a more prominent role.

Key trends influencing the future of SR22 coverage include:

- Telematics and Usage-Based Insurance (UBI): These technologies, which collect data on driving behaviors like speed, braking, and mileage, are becoming mainstream. For high-risk drivers, UBI could offer a pathway to demonstrating improved driving habits, potentially leading to more personalized—and eventually, lower—premiums once the SR22 requirement is lifted.

- AI and Advanced Analytics: AI algorithms are analyzing vast datasets to identify patterns and predict risks with greater accuracy. This could lead to more refined underwriting for SR22 policies, potentially allowing insurers to better differentiate between varying levels of "high-risk" and offer more tailored pricing.

- Digital Policy Management: Mobile apps and online portals are becoming standard for managing policies, making it easier for policyholders to access their SR22 documents, track compliance periods, and make payments. This streamlines the SR22 insurance policy management process, offering greater convenience and transparency.

These technological advancements suggest a future where even specialized coverage like SR22 insurance could become more adaptive, allowing policyholders to actively influence their rates through responsible driving and efficient digital management.

Conclusion

Navigating the world of Essential SR22 Insurance Coverage can initially seem daunting, but with the right information and a proactive approach, it's a manageable process. By understanding that an SR22 is a certificate of financial responsibility rather than a standalone policy, and by focusing on compliance, cost-effectiveness, and reliable providers, policyholders can successfully meet their obligations. The benefits extend beyond legal compliance, offering peace of mind and a clear path toward reinstating full driving privileges and potentially reducing long-term insurance costs.

The evolving landscape of insurance technology, with advancements in AI and telematics, promises a future where even high-risk coverage becomes more personalized and manageable. Taking control of your SR22 requirements now is an investment in your driving future.

Ready to navigate your SR22 requirements with confidence? Don't let uncertainty dictate your driving future. Get customized SR22 insurance quotes today and ensure you're protected on the road. Compare providers to find the best SR22 insurance companies that meet your specific needs and help you get back on track.

FAQ Section

1. What's the typical cost range for premium Essential SR22 Insurance Coverage?

The actual filing fee for an SR22 certificate is usually a one-time charge between $15 and $50. However, the primary cost impact comes from significantly higher insurance premiums due to being classified as a high-risk driver. On average, drivers with an SR22 requirement might pay between $2,000 and $5,600 annually for their auto insurance, with some states seeing even higher rates. These costs can vary widely based on your driving history, location, and the insurance company you choose, making it important to compare different SR22 insurance pricing models.

2. How quickly can policyholders implement Essential SR22 Insurance Coverage?

The process of implementing Essential SR22 Insurance Coverage can be relatively quick once you find an insurance provider that offers SR22 filings. Your insurance company will electronically submit the SR22 form to your state's DMV or equivalent agency, which typically happens promptly after your policy is in place and the filing fee is paid. This electronic submission facilitates a fast SR22 insurance filing, allowing for quicker reinstatement of driving privileges.

3. What compliance standards should Essential SR22 Insurance Coverage meet?

Essential SR22 Insurance Coverage must meet your specific state's minimum liability insurance requirements. These requirements vary by state, so it's crucial to confirm the exact liability limits mandated where you live. Additionally, you must maintain continuous coverage for the entire duration specified by the court or state, which is often three years. Any lapse in coverage will be reported to the state and can lead to further penalties, highlighting the importance of understanding all SR22 state requirements.

4. Can Essential SR22 Insurance Coverage integrate with existing policyholder systems?

While SR22 itself isn't a system, the management of your Essential SR22 Insurance Coverage is increasingly integrated into digital platforms. Many insurance providers offer online portals or mobile apps that allow policyholders to access their policy documents, view their SR22 filing status, make payments, and manage their account. This digital approach to SR22 insurance policy management streamlines the process, making it easier for policyholders to stay compliant and informed.

Finance & Investment

View All

November 17, 2025

Honda Finance Incentives for 2025Go beyond keywords! Craft expert SEO content that aligns with E-E-A-T to boost rankings, drive organic traffic, and build brand authority.

Ellie Moore

October 11, 2025

Decentralized Finance Future of MoneyMaster expert SEO content to boost rankings, traffic, and brand authority. Learn what it is, why it's crucial, and how to create it for online success.

Ellie Moore

April 23, 2025

Bajaj Finance Share Price UpdateMaster expert SEO content to rank higher, build authority, and drive conversions. Discover the blueprint for valuable, E-E-A-T-compliant content.

Ellie Moore

October 18, 2025

Best Jeep Financing Deals 2025Unlock online success with expert SEO content. Discover how genuine value, E-E-A-T, and meeting user intent drive trust and higher rankings.

Ellie Moore

January 12, 2025

Global Strategies for Business GrowthTake your business global with proven strategies for international expansion and success. Start scaling now!

Ellie Moore

September 16, 2025

Quick Loans from Pronto FinanceUnlock top rankings & loyal users with expert SEO content. Discover how to create authoritative, E-E-A-T driven content that truly engages and converts.

Ellie Moore

Insurance

View AllExplore emerging trends reshaping insurance in 2025. Stay ahead with insights on AI, blockchain, and coverage innovations.

Ellie Moore

Unlock superior oral health & financial security with Premium Delta Dental Insurance. Strategic coverage for individuals & businesses to mitigate risks.

Ellie Moore

Protect your paycheck with disability insurance. Learn why income protection is a must-have for financial security.

Ellie Moore

Renting comes with risks. Safeguard your belongings, finances, and peace of mind with Allstate Renters Insurance. Explore coverage, costs, and essential benefit...

Ellie Moore

Unlock optimal Farmers Insurance coverage & value. This guide helps policyholders, agents & risk managers find top plans to safeguard assets.

Ellie Moore

Master Essential Direct Auto Insurance to cut costs, optimize coverage, and boost financial security. A must-read for policyholders, risk managers & agents.

Ellie Moore

Education

View AllCompare Montessori and traditional education methods. Discover which approach is more effective for fostering creativity and independence in students.

Read MoreThe digital divide limits education access. Explore strategies and initiatives to bridge this gap and ensure global learning equality.

Read MoreExplore the benefits of hybrid learning models. Learn how to balance online and face-to-face teaching for a more flexible education experience.

Read MoreMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MoreLifelong learning is the new normal! Discover why continuous learning is essential for personal growth, career success, and adapting to change.

Read MoreResearch universities play a key role in advancing knowledge. Explore how they drive innovation, discovery, and societal progress.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

10

Health

Automotive

View All

July 26, 2025

Five Star Automotive Service Reviews And Ratings

Discover why 5-star auto service reviews are crucial. They build trust, guide consumer decisions, and drive growth for top-tier repair shops.

August 28, 2025

Prestige Automotive Care With A Touch Of Class

Prestige Automotive Care: Meticulous detailing & specialized techniques preserve your luxury vehicle's soul & value. Elevate car care to an art.

July 20, 2025

STS Automotive Colorado Customer Service Highlights

STS Automotive Colorado redefines auto repair with unmatched customer service. Experience trust, transparency & peace of mind.

February 9, 2025

Ultimate Car Camping Guide: Gear & Road Trip Tips

Planning a car camping trip? Get the ultimate guide on gear, setups, and essential road trip tips for an unforgettable adventure!

August 19, 2025

How To Use Automotive Wire Connectors Safely

Master automotive wire connectors for safe, reliable, and high-performance vehicle electrical systems. Avoid hazards & ensure peace of mind!

August 14, 2025

All-Fit Automotive Lip Trim For Stylish Cars

Elevate your ride! Discover All-Fit Automotive Lip Trim for instant style, a lowered look, and crucial protection. Universal & affordable.