How Global Events Shape Financial Markets

Ellie Moore

Photo: How Global Events Shape Financial Markets

How Global Events Shape Financial Markets: Insights, Trends, and Strategies

The financial markets are a dynamic ecosystem, sensitive to a myriad of factors ranging from government policies to technological advancements. However, one of the most significant influences on these markets is global events. These events whether political upheavals, natural disasters, pandemics, or groundbreaking international agreements can send ripples across the globe, shaping financial markets in profound ways.

In this article, we’ll explore how global events shape financial markets, examine their impact on different asset classes, and provide actionable insights to navigate these changes effectively.

The Domino Effect: Understanding Global Events and Financial Markets

1. Political Events and Market Volatility

Political events, such as elections, coups, or policy shifts, play a pivotal role in market movements. For instance, the Brexit referendum in 2016 caused a dramatic drop in the British Pound, affecting global currency markets. Similarly, elections in major economies like the United States can drive volatility due to uncertainty about future economic policies.

Why It Matters

Markets dislike uncertainty. Political instability can lead to massive capital outflows, particularly in emerging economies. This is why investors often turn to safe-haven assets like gold or the Swiss Franc during turbulent times.

Actionable Insight

Stay informed about upcoming elections and geopolitical developments. Diversify your portfolio to include assets less susceptible to political risks, such as commodities or bonds.

2. Pandemics and Public Health Crises

The COVID-19 pandemic is a prime example of how a global health crisis can disrupt financial markets. In early 2020, equity markets worldwide saw historic drops, with the S&P 500 falling by 34% in just 33 days. The subsequent recovery, fueled by stimulus packages and low-interest rates, underscored the resilience of financial markets under extraordinary circumstances.

Sector Spotlight

Pandemics often create winners and losers in financial markets. For example:

- Winners: Tech companies (Zoom, Amazon), healthcare firms, and pharmaceutical giants.

- Losers: Travel, hospitality, and brick-and-mortar retail sectors.

Actionable Insight

Monitor sectors poised to benefit from global events. Long-term investors can capitalize on emerging trends, such as remote work or advancements in biotechnology.

3. Natural Disasters and Environmental Changes

Natural disasters, such as earthquakes, hurricanes, and wildfires, have immediate and far-reaching impacts on local and global economies. For instance, Hurricane Katrina in 2005 led to disruptions in the energy sector, causing oil prices to surge.

Global Spotlight

The increasing frequency of climate-related disasters has also heightened focus on ESG (Environmental, Social, and Governance) investing. Companies with robust ESG practices are seen as more resilient to environmental risks.

Actionable Insight

Consider investing in green energy and climate-resilient companies. These sectors are not only socially responsible but also poised for growth in a world grappling with climate change.

4. Global Trade Wars and Economic Sanctions

Trade wars, such as the U.S.-China trade dispute, can send shockwaves through financial markets. Tariffs and sanctions often lead to supply chain disruptions, increased production costs, and reduced profitability for multinational corporations.

Key Impact Areas

- Equities: Stock markets in affected countries often experience heightened volatility.

- Currencies: Trade tensions can weaken local currencies, making imports more expensive.

- Commodities: Prices of raw materials may rise or fall depending on supply chain dynamics.

Actionable Insight

Follow major trade negotiations and adjust your investment strategy accordingly. Emerging markets with diversified trade relationships often present better opportunities during trade disputes.

5. Technological Advancements and Innovation

Global events in technology, such as the advent of blockchain, AI, and renewable energy solutions, can reshape financial markets dramatically. For example, the rise of Bitcoin and other cryptocurrencies has created a new asset class that challenges traditional financial systems.

Technological Trends to Watch

- The integration of AI in financial services.

- Expansion of renewable energy solutions driven by global climate goals.

- Adoption of blockchain in supply chains and banking.

Actionable Insight

Stay ahead by investing in tech-focused ETFs or companies leading innovation. Understanding technological trends can position you for long-term gains.

How to Navigate Financial Markets During Global Events

Global events are inevitable, but their impact on financial markets can be managed with the right strategies:

- Diversification is Key: Spread your investments across asset classes, industries, and geographies. This reduces exposure to specific risks.

- Monitor Safe-Haven Assets: Keep an eye on gold, U.S. Treasuries, and other safe-haven assets during times of global uncertainty.

- Stay Updated: Subscribe to reliable financial news outlets and analysis to stay ahead of trends.

- Leverage Data and Analytics: Use tools that analyze market trends and provide insights into how global events might unfold.

- Consult Financial Advisors: Professional advice can be invaluable, especially during volatile times.

Real-Life Example: The Russia-Ukraine Conflict

The ongoing Russia-Ukraine conflict has had a profound impact on global markets:

- Oil and Gas Prices: Europe faced an energy crisis, causing a surge in energy prices worldwide.

- Agriculture: Ukraine’s role as a major grain exporter highlighted vulnerabilities in global food supply chains.

- Stock Markets: European and global equities experienced volatility, with energy and defense stocks gaining significantly.

This case underscores the interconnectedness of global markets and the need for a diversified investment strategy.

FAQs: Understanding the Financial Impact of Global Events

1. How do central banks respond to global events?

Central banks often adjust interest rates, implement quantitative easing, or introduce fiscal stimulus packages to stabilize markets during global events.

2. What are safe-haven assets, and why are they important?

Safe-haven assets, such as gold, U.S. Treasuries, and the Japanese Yen, retain or increase value during market turbulence, offering a hedge against uncertainty.

3. How can individual investors protect their portfolios?

Diversification, staying informed, and consulting financial advisors are key strategies to minimize risks during global events.

Conclusion: The Road Ahead

Global events will continue to shape financial markets, creating challenges and opportunities for investors. Understanding their impact and adapting your investment strategy is essential for navigating the complex financial landscape. Whether it’s a geopolitical event, a natural disaster, or a technological breakthrough, staying informed and agile can help you turn uncertainty into opportunity.

Call to Action

What strategies have you employed to protect your investments during global events? Share your thoughts in the comments below, and don’t forget to explore our other articles for more insights on market trends and investment strategies.

Finance & Investment

View All

November 18, 2025

Katapult Financing Buy Now Pay LaterElevate your brand with expert SEO content. Discover the blueprint for online authority, improved rankings, and trusted content that truly engages your audience...

Ellie Moore

July 31, 2025

Idaho Housing and Finance ProgramsDominate search with expert SEO content! Craft high-value, E-E-A-T compliant content that ranks higher and truly engages your audience.

Ellie Moore

November 11, 2025

Construction Financing Rates 2025Unlocking Visibility: The Power of Expert SEO Content In today's crowded digital landscape, simply having content isn't enough. To truly stand out, attract your...

Ellie Moore

April 15, 2025

Forex Trading for Beginners: Profiting from CurrencyUnderstand the basics of Forex trading. Learn how currency movements create profit opportunities and start trading smart today!

Ellie Moore

November 3, 2025

What You Can Do with a BA in FinanceGo beyond keywords! Learn to craft expert SEO content that builds authority, satisfies E-E-A-T, and dominates search rankings for lasting success.

Ellie Moore

April 24, 2025

Boat Financing Tips for BuyersElevate your SEO! Learn to create expert content by mastering user intent, deep keyword research, and authoritative writing to dominate SERPs.

Ellie Moore

Insurance

View AllExplore aviation insurance options, from aircraft liability to passenger protection. Secure the skies for your operations!

Ellie Moore

Is earthquake insurance worth it? Learn about coverage, costs, and risks to make an informed decision for your property.

Ellie Moore

Explore how your credit score affects insurance premiums. Learn how to improve your score and save on coverage!

Ellie Moore

Navigate car insurance with confidence. This guide helps policyholders & risk managers find top-rated agents for optimal coverage, best value, and peace of mind...

Ellie Moore

Overpaying for car insurance? Discover top-rated solutions for optimal coverage & value. Protect your finances with our comprehensive guide.

Ellie Moore

Navigate dental insurance with our guide. Find essential plans for comprehensive coverage, financial security, and peace of mind for you or your business.

Ellie Moore

Education

View AllMicro-credentials are on the rise! Discover how they provide fast, focused skills for today’s learners and reshape education.

Read MoreOnline homeschooling communities are growing fast. Explore how they provide support, resources, and a sense of belonging to families worldwide.

Read MoreExplore the benefits of hybrid learning models. Learn how to balance online and face-to-face teaching for a more flexible education experience.

Read MoreArts education is key to fostering creativity. Learn why it’s important in schools and how it helps students develop essential life skills.

Read MoreHow does social media affect learning and behavior? Uncover the positive and negative effects of social platforms on students today.

Read MoreLearn key strategies for creating inclusive classrooms. Discover how to foster equality, engagement, and a sense of belonging for every student.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

July 28, 2025

Mayse Automotive Services For Every Vehicle Type

Mayse Automotive: Your trusted partner for comprehensive care across all vehicle types. Expert, certified technicians & advanced tools ensure smooth driving.

August 6, 2025

Diamond Automotive Services That Shine Bright

Discover diamond-level car care! Learn what makes automotive services shine with expert technicians, transparency, and trust to protect your valuable vehicle.

February 6, 2025

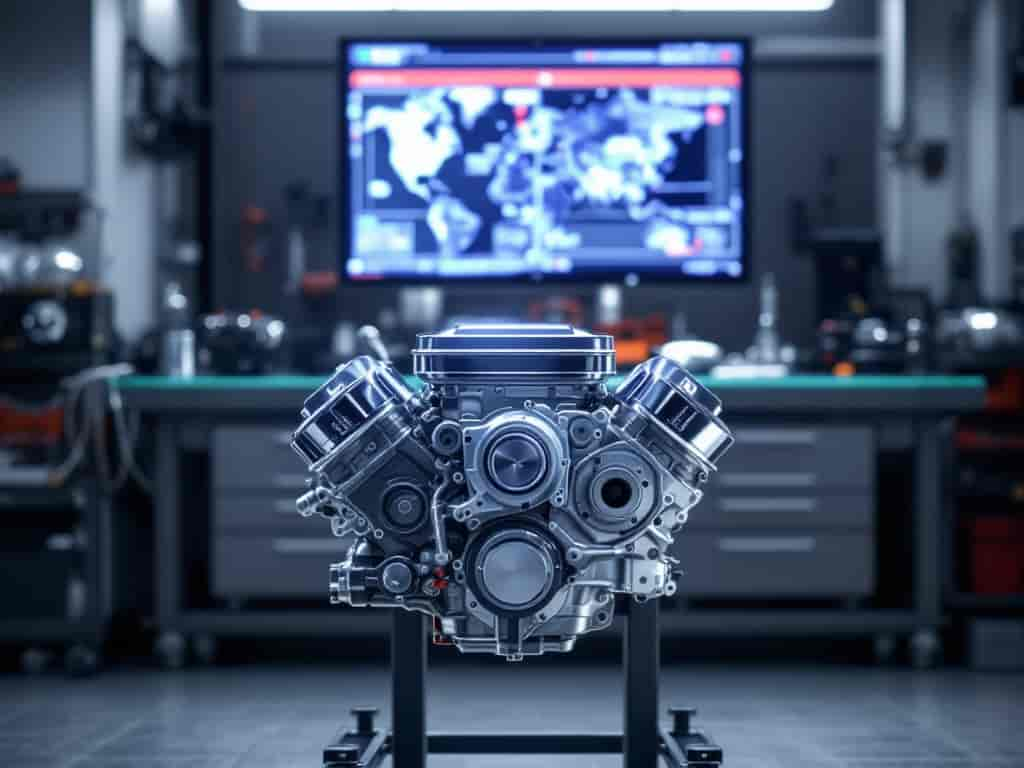

Performance Upgrades: Power Meets Reliability

Boost your car’s performance while ensuring reliability. Learn key upgrades that balance speed, power, and safety for optimal driving.

July 27, 2025

Ingersoll Automotive Danbury Connecticut Services

Ingersoll Automotive Danbury offers expert, trusted service for Chevrolet, Buick, GMC & Cadillac. Experience quality car care.

July 22, 2025

How Automotive Flex Enhances Vehicle Performance

Beyond horsepower: explore automotive flex! This engineered balance of rigidity & movement is vital for your car's performance, handling & comfort.

July 24, 2025

Dans Automotive Services That Save You Time

Reclaim your time! Dan's Automotive offers convenient, efficient car care. Streamline maintenance with express services & save stress.