Premium State Farm Insurance Plans

Ellie Moore

Photo: Premium State Farm Insurance Plans

Securing Your Future: A Deep Dive into Premium State Farm Insurance Plans

Are you navigating the complexities of personal and commercial risk, wondering if your current protection truly safeguards your assets and future? In a world of increasing uncertainties, the demand for robust and reliable insurance solutions has never been higher. This guide will take a comprehensive look at Premium State Farm Insurance Plans, exploring how these offerings stand out in a competitive market. We'll delve into the specifics of State Farm insurance quotes and the extensive State Farm coverage benefits available, revealing how policyholders and risk managers can secure comprehensive protection and optimize risk management strategies.

What Makes Premium State Farm Insurance Plans Essential for Policyholders and Risk Managers?

In the dynamic insurance landscape, having a trusted partner like State Farm can make all the difference. The global insurance market is a promising field, valued at $9 trillion in 2024 and projected to reach $28.5 trillion by 2032, with a compound annual growth rate (CAGR) of 13.5%. This growth underscores a rising awareness and demand for robust insurance solutions. State Farm, as a leading insurer, plays a significant role in this market. For policyholders, this means access to a wide array of options designed to protect their personal assets, from homes and vehicles to their very livelihoods. For risk managers, it signifies a partner capable of offering sophisticated solutions to mitigate complex commercial exposures.

From a risk management perspective, the return on investment (ROI) of premium insurance plans isn't just about covering losses; it's about peace of mind, financial stability, and the ability to recover swiftly from unexpected events. For instance, State Farm has consistently earned top financial strength and performance ratings from major rating agencies for its life insurance companies, which helps consumers evaluate an insurer's financial strength and claims-paying ability. While State Farm General Insurance Company has faced some downgrades in its financial strength ratings due to factors like weak underwriting performance and wildfire impacts, particularly in California, State Farm Mutual Automobile Insurance Company and its core subsidiaries generally maintain superior ratings. This financial bedrock is crucial, as it assures policyholders that claims can be paid even during widespread catastrophic events.

Can policyholders afford to ignore comprehensive insurance? The answer is a resounding no. Adequate coverage protects against unforeseen financial burdens, ensuring that a single incident doesn't derail long-term financial goals. State Farm offers over 100 products, including auto, home, and life insurance, as well as banking and mutual funds, servicing 83 million policies and accounts across the U.S.. This broad portfolio highlights its commitment to comprehensive protection.

Critical Evaluation Criteria for Policyholders and Risk Managers:

Choosing the right insurance plan requires careful consideration of several factors.

Cost Structure Analysis

Understanding the true cost of insurance goes beyond the initial premium. It involves evaluating the State Farm insurance TCO calculator — a holistic view of premiums, deductibles, potential discounts, and the long-term value of comprehensive coverage. State Farm offers a Personal Price Plan, allowing customers to personalize insurance to fit their needs and budget, potentially saving an average of $694 per year on car insurance for new policyholders who switch. Factors like your driving history, vehicle value, and the amount you can afford to pay out of pocket after an accident all influence your personalized plan. While State Farm is often cited as a competitive option for liability coverage, rates can vary significantly based on individual profiles and risk factors. Comparing State Farm insurance quotes from multiple providers is always a wise strategy to ensure competitive pricing and optimal coverage.

Compliance & Security Requirements

For both individuals and businesses, regulatory compliance and data security are paramount. State Farm regulatory compliance extends across various aspects of its operations, adhering to federal and state regulations governing the insurance industry. This includes robust claim handling standards that emphasize fairness, transparency, and adherence to legal requirements. In the digital age, cybersecurity is also a critical concern. InsurTech, which leverages tools like AI, blockchain, IoT, and cloud computing, is enhancing cybersecurity and data privacy in the insurance sector by introducing AI-powered threat detection and zero-trust frameworks, offering protection against data breaches and ransomware attacks.

Integration Capabilities

In today's interconnected world, the ability of insurance systems to integrate with existing financial planning tools and smart home technologies is increasingly important. State Farm policy management API compatibility, while not explicitly detailed as an open API for public use, is part of State Farm's broader digital transformation efforts. The company utilizes platforms like MuleSoft's Anypoint Platform to unlock data from third-party systems, integrating billing and claims management with Salesforce to deliver a connected customer experience. This allows for automated processes across different business areas, simplifying the experience for customers and associates. State Farm is also actively exploring the integration of IoT (Internet of Things) devices, such as smart home security systems (e.g., ADT) and Ting smart plugs for fire prevention, to offer proactive loss mitigation and potential insurance discounts. This forward-thinking approach aims to create a seamless, integrated experience, predicting and preventing losses before they occur.

Implementation Roadmap: Maximizing Premium State Farm Insurance Plans ROI

Maximizing the return on investment from your insurance plans involves a strategic approach, whether you are an individual policyholder or a risk manager overseeing a large portfolio.

- Assess Your Needs Thoroughly: Begin by conducting a detailed assessment of your personal or business risks. For individuals, this means evaluating assets, lifestyle, and financial dependents. For businesses, it involves a comprehensive risk assessment covering operational, financial, and strategic risks.

- Obtain and Compare State Farm Insurance Quotes: Don't settle for the first offer. Utilize online tools and engage with State Farm agents to get customized quotes for various coverage options. Compare these with offerings from other providers to ensure you're getting competitive rates for the desired level of protection. State Farm offers online quotes for auto, home, renters, and other insurance products.

- Understand Coverage Benefits: Carefully review the State Farm coverage benefits for each policy. Look beyond the basic liability and understand the nuances of comprehensive, collision, personal injury protection, and additional riders that might be beneficial. State Farm offers a wide range of coverage options for vehicles, homes, and life insurance.

- Leverage Discounts: Inquire about all available discounts. State Farm offers various discounts for safe driving, bundling multiple policies (e.g., auto and renters insurance can save customers an average of $834), good student status, and telematics programs.

- Regular Policy Reviews: Insurance needs evolve. Schedule annual reviews with your State Farm agent to adjust coverage as your life or business circumstances change. This ensures your policy remains optimized and you're not over-insured or under-insured.

- Understand the State Farm Policy Deployment Timeline: While State Farm may offer fast insurance quotes, the effective date of coverage can vary by state. Discuss the State Farm policy deployment timeline with your agent to ensure your coverage is active when you need it.

2025 Trends: The Future of Premium State Farm Insurance Plans for Policyholders and Risk Managers

The insurance industry is in constant evolution, driven by technological advancements and changing consumer expectations. For policyholders and risk managers, understanding these trends is key to staying ahead.

According to the National Association of Insurance Commissioners (NAIC), State Farm is projected to maintain its position as the leading insurer in the U.S. auto insurance market in 2025, with significant premium growth. This indicates a strong market presence and continued relevance.

Expert insights suggest that the insurance market is being profoundly shaped by emerging State Farm insurance technologies and broader InsurTech innovations. Artificial intelligence (AI) is at the forefront, transforming underwriting, claims processing, and customer service. State Farm is proactively investing in AI and data analytics to improve risk assessment, streamline customer communications, and combat fraud. AI-driven CRM and financial services platforms empower State Farm agents to provide personalized communications and a 360-degree view of customer interactions.

Other key trends include:

- IoT Integration: The Internet of Things (IoT) will continue to enable more personalized and proactive insurance. State Farm is already leveraging IoT for loss prevention in homes through partnerships with smart home technology providers. Connected cars and homes will provide real-time data for usage-based insurance and predictive analytics, leading to more accurate pricing and risk mitigation.

- Enhanced Customer Experience: Digital platforms, mobile apps, and AI-powered chatbots are improving customer service, streamlining operations, and offering quick, easy access to insurance services. State Farm's mobile app allows policyholders to track policies, pay bills, and file claims on the go.

- Predictive Analytics: Leveraging vast amounts of data, predictive analytics will enable insurers to make more data-driven decisions, optimize pricing, and streamline claims management, reshaping risk assessment and fraud detection.

- Cloud Computing: Cloud computing offers insurers enhanced data storage and accurate, real-time analytics, supporting growth and allowing for scalable IT resources. State Farm is undergoing a multi-year journey to modernize its core Property & Casualty Claims system by migrating applications and datastores to Amazon Web Services (AWS).

These advancements signify a future where insurance is more personalized, efficient, and responsive to individual and commercial needs.

Conclusion

Navigating the complexities of insurance requires a partner that offers both stability and innovation. Premium State Farm Insurance Plans provide a robust framework for comprehensive protection, backed by a century of experience and a commitment to customer-centric solutions. From understanding flexible State Farm insurance pricing models to leveraging cutting-edge technologies for risk management, State Farm empowers policyholders and risk managers to safeguard their futures effectively.

The insurance landscape is continually evolving, with emerging technologies promising even greater personalization and efficiency. By choosing State Farm, you align with an insurer dedicated to adapting to these changes, offering trustworthy and reassuring solutions for your unique needs.

Don't leave your financial security to chance. Take the proactive step to review and optimize your coverage. Get customized State Farm insurance quotes today and discover how their extensive enterprise-grade State Farm insurance options can provide the peace of mind you deserve.

Finance & Investment

View All

May 4, 2025

NYS Tax and Finance Login HelpElevate your online presence with expert SEO content. This guide reveals how E-E-A-T drives rankings, trust, and conversions for digital success.

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

January 26, 2025

Competitive Analysis: Best Practices for 2024Stay ahead with the latest best practices in competitive analysis for 2024. Gain actionable tips to enhance your strategy.

Ellie Moore

October 25, 2025

Tahoo Finance Market InsightsElevate your content! Learn to craft expert SEO content focused on E-E-A-T, depth & user intent to achieve higher rankings and truly engage your audience.

Ellie Moore

January 28, 2025

From Data to Strategy: Competitive Analysis TipsLearn how to transform raw data from competitive analysis into actionable strategies that drive business success.

Ellie Moore

July 5, 2025

Dept of Tax and Finance InformationUnlock the secrets to expert SEO content that ranks high, builds authority, and engages users. Learn E-E-A-T, research, and user intent for top results.

Ellie Moore

Insurance

View AllProtect your freelance career with tailored insurance. Discover coverage options for self-employed individuals.

Ellie Moore

Learn how blockchain is enhancing transparency and security in modern insurance policies. Is your coverage future-ready?

Ellie Moore

Find out why term life insurance is more popular, affordable, and flexible than whole life. Choose the right coverage for you!

Ellie Moore

Understand the differences between HMO, PPO, and EPO health insurance networks. Pick the plan that suits your needs best!

Ellie Moore

Explore how life insurance doubles as an investment tool. Learn about cash value policies and long-term financial benefits.

Ellie Moore

Car accidents are costly. Our ultimate guide reveals how to secure comprehensive auto insurance, minimize financial risk, and gain essential peace of mind.

Ellie Moore

Education

View AllLifelong learning is the new normal! Discover why continuous learning is essential for personal growth, career success, and adapting to change.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreExplore the ongoing debate on standardized testing. Learn its pros, cons, and whether it should remain a key part of education.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreLearn key strategies for creating inclusive classrooms. Discover how to foster equality, engagement, and a sense of belonging for every student.

Read MoreMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

July 17, 2025

JT Automotive Services Worth Checking Out

Unlock peace of mind & vehicle longevity. Discover why choosing the right car care partner, like JT Automotive Services, truly matters.

September 5, 2025

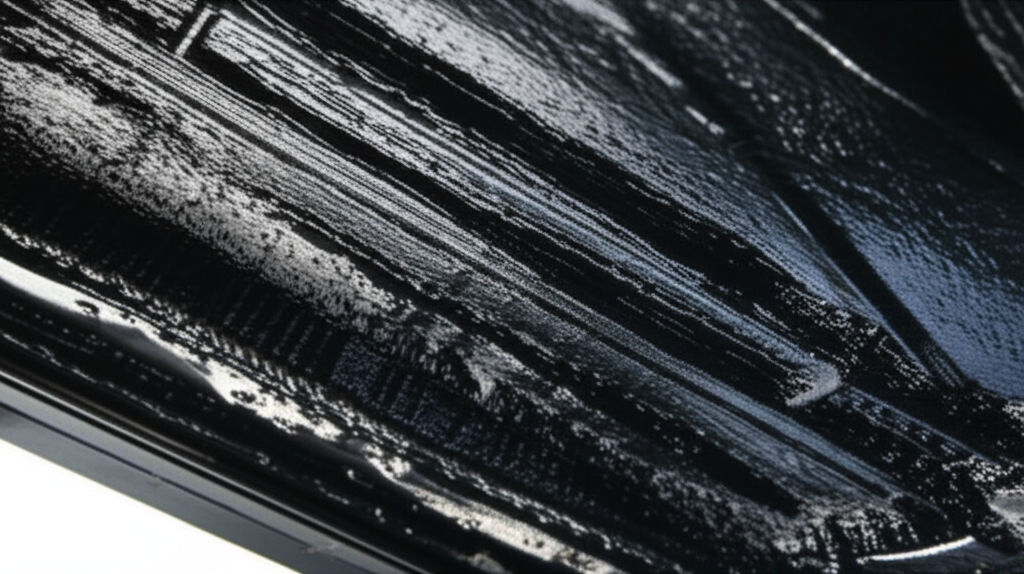

Automotive Undercoating To Protect Your Car

Safeguard your car from rust & corrosion! Automotive undercoating acts as an invisible shield, extending its lifespan and preserving its value.

July 27, 2025

Jones Automotive Experts Ready To Help You

Trust Jones Automotive Experts for reliable, expert care for your modern car. Ensure safety & efficiency with top-tier diagnostics & repairs.

August 1, 2025

How Automotive Gyroscope Technology Works Today

Explore how automotive gyroscopes are your car's unseen guardian, boosting safety, stability & enabling autonomous driving.

August 6, 2025

Diamond Automotive Services That Shine Bright

Discover diamond-level car care! Learn what makes automotive services shine with expert technicians, transparency, and trust to protect your valuable vehicle.

February 5, 2025

Must-Have Tools for Every DIY Mechanic

Are you a DIY mechanic? Equip yourself with these essential tools for hassle-free car repairs and maintenance. See what every toolbox needs!