Get Premium Auto Insurance Quotes

Ellie Moore

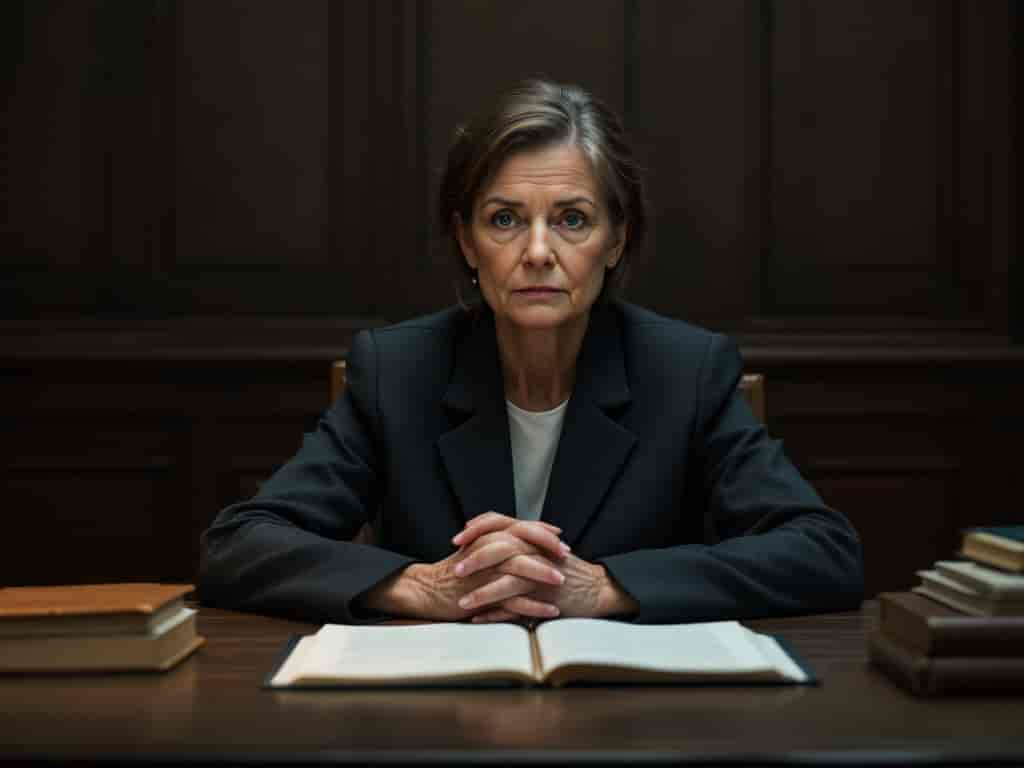

Photo: Get Premium Auto Insurance Quotes

Get Premium Auto Insurance Quotes: Your Guide to Optimal Coverage and Savings

Are you concerned about rising repair costs, increasing liability, and the ever-present threat of financial setbacks on the road? For many policyholders and risk managers, navigating the complex world of auto insurance can feel like a high-stakes gamble. The right coverage isn't just a legal requirement; it's a crucial shield against unforeseen expenses and a cornerstone of financial peace of mind. This guide reveals how policyholders and risk managers can secure optimal coverage, minimize financial risk, and find the best value when they get premium auto insurance quotes. We'll delve into the essential criteria for evaluating policies, explore the latest industry trends, and provide actionable steps to ensure you're protected without overpaying.

What Makes a Premium Auto Insurance Quote Essential for Policyholders?

In today's dynamic automotive landscape, a basic, minimum-coverage policy often falls short of providing adequate protection. Premium auto insurance goes beyond the bare necessities, offering comprehensive coverage that safeguards your assets and well-being. But why is this so critical for policyholders?

The global vehicle insurance market is projected to reach around USD 1,796.61 billion by 2034, growing at a CAGR of 7.03% from 2025 to 2034, indicating a robust and evolving industry. This growth is driven by increasing vehicle ownership and the rising costs associated with accidents and repairs. For instance, the average cost of full coverage car insurance in the U.S. is $2,671 per year, a 12% increase since 2024. This upward trend in costs underscores the need for robust coverage that offers a strong return on investment (ROI) in the event of an incident.

A premium policy ensures you're protected against significant financial burdens from accidents, theft, or natural disasters. It provides peace of mind, knowing that if the unexpected happens, you won't be left with crippling out-of-pocket expenses. This commercial angle is vital: investing in superior coverage now can prevent much larger losses later, effectively maximizing your financial security and minimizing long-term risk.

Critical Evaluation Criteria for Policyholders:

When you're ready to compare premium auto insurance options, it's crucial to evaluate policies based on several key criteria. Don't just look for the lowest price; consider the overall value, coverage breadth, and the insurer's reliability.

Cost Structure Analysis

Understanding the full cost of your policy is more than just the monthly premium. Factors like your age, location, driving record, and vehicle type significantly impact your individual insurance costs. When comparing policies, delve into the "premium auto insurance pricing models" and look for a "premium auto insurance TCO calculator" if available. This will help you understand the total cost of ownership (TCO) beyond just the initial quote. Remember that while state minimum coverage is often the cheapest, it may not adequately protect your assets. Many insurers offer discounts for safe driving, bundling policies, and vehicles with safety features, which can significantly lower your premium.

Compliance & Security Requirements

Auto insurance is mandatory in almost every U.S. state, with specific minimum liability requirements varying by state. It's essential to understand your "state auto insurance regulations" and ensure any policy you consider meets or exceeds these. Beyond basic legal compliance, consider the financial stability and reputation of the insurer. While "ISO-certified auto insurance providers" might not be a direct search term, look for insurers with strong financial ratings and a proven track record of reliable claims processing. Insurance compliance regulations are designed to protect consumers and the overall market, ensuring companies operate fairly and secure customer information.

Integration Capabilities

In an increasingly digital world, the ease of managing your auto insurance policy is a significant factor. Look for "digital auto insurance platforms" that offer seamless "auto insurance policy management systems". Many insurers now provide mobile apps and online portals that allow you to view policy details, make payments, submit claims, and even make policy changes directly from your devices. The ability to easily access and manage your policy, often referred to as "auto insurance system integration," can greatly enhance your customer experience and streamline administrative tasks.

Implementation Roadmap: Maximizing Your Auto Insurance ROI

Securing the right premium auto insurance policy doesn't have to be a daunting task. By following a structured approach, you can ensure you get the best coverage for your needs and maximize your return on investment.

- Assess Your Needs: Before you begin to get premium auto insurance quotes, evaluate your driving habits, vehicle value, and financial risk tolerance. Do you need full coverage, or is liability-only sufficient given your circumstances? Consider optional coverages like collision, comprehensive, and uninsured/underinsured motorist protection.

- Gather Necessary Information: To expedite the process, have your personal details (driver's license number, Social Security number), vehicle information (make, model, year, VIN), and driving history readily available.

- Compare Top Auto Insurance Providers: Utilize online comparison tools to "compare premium auto insurance" rates from multiple companies. These platforms allow you to input your information once and receive various "best auto insurance rates" side-by-side.

- Review Coverage Details Thoroughly: Don't just compare prices. Carefully examine the coverage limits, deductibles, and any exclusions. Ensure the policy aligns with your specific needs and offers the protection you expect.

- Inquire About Discounts: Many insurers offer a range of discounts, including multi-policy, good driver, safe vehicle, and even discounts for paying your premium in full. Always ask about available savings.

- Understand the "Auto Insurance Policy Deployment Timeline": While many policies can be activated almost immediately, especially online, some may require underwriting or additional verification. Ensure there's no lapse in coverage if you're switching providers.

- Finalize and Activate: Once you've chosen the best policy, finalize the purchase and ensure your coverage is active before hitting the road. You'll typically receive electronic proof of insurance immediately, with physical documents following later.

2025 Trends: The Future of Premium Auto Insurance for Policyholders:

The auto insurance industry is in a constant state of evolution, driven by technological advancements and changing consumer expectations. As we look towards 2025, several "emerging auto insurance technologies" are set to redefine how policyholders interact with their coverage.

According to industry reports, the auto insurance sector is undergoing significant changes in 2025. One of the most impactful trends is the continued maturation and widespread adoption of telematics and usage-based insurance (UBI). These programs, powered by devices or smartphone apps, collect data on driving behaviors like speed, braking, acceleration, and mileage, allowing for personalized risk assessment and customized pricing. This means safer drivers can potentially earn lower premiums, fostering a more equitable and data-driven approach to insurance.

The rise of electric vehicles (EVs) also brings new challenges and opportunities for insurers. EVs have different risk profiles, often leading to higher repair costs due to specialized parts and labor. Insurers are developing tailored EV insurance products that include coverage for charging equipment and battery replacements.

Furthermore, digital transformation and the integration of Artificial Intelligence (AI) and Machine Learning (ML) are deeply entrenched in the insurance sector. AI algorithms are improving claims processing by accelerating approvals and reducing fraud through predictive analysis. They also enhance risk assessment with more accurate modeling and improve customer experience through chatbots and mobile apps. This digital shift is streamlining interactions and making policy management more convenient for policyholders.

Can policyholders afford to ignore these advancements? From a policyholder perspective, these trends mean more personalized options, potentially lower premiums for safe driving, and a more streamlined, efficient insurance experience. Staying informed about these developments will be key to navigating the future of auto insurance.

Conclusion

Securing premium auto insurance is an investment in your financial security and peace of mind. By diligently evaluating your options, understanding cost structures, ensuring regulatory compliance, and embracing digital tools, you can confidently navigate the market. The commercial benefits are clear: comprehensive protection against rising costs, minimized financial risk, and a streamlined experience. Don't settle for inadequate coverage; empower yourself with the knowledge to make informed decisions.

Ready to take control of your auto insurance? Get customized premium auto insurance quotes today and discover the comprehensive coverage that best fits your needs and budget. Explore "high-value auto insurance policies" and compare options from leading providers to ensure you receive the best possible protection for your vehicle and your future.

FAQ Section

1. What's the typical cost range for premium auto insurance?

The average cost of full coverage car insurance in the U.S. is around $2,671 per year, or about $223 per month, but this can vary significantly based on factors like your age, driving history, location, and vehicle type. For accurate pricing, it's best to compare "premium auto insurance pricing models" from multiple providers.

2. How quickly can policyholders implement premium auto insurance?

In many cases, "rapid auto insurance coverage activation" is possible, especially when purchasing online. Most insurance companies can activate a policy almost immediately after the purchase is completed and payment is confirmed. However, if underwriting is required or you're switching providers, it's wise to plan to avoid any lapse in coverage.

3. What compliance standards should premium auto insurance meet?

All auto insurance policies must meet the minimum liability requirements set by your state. Beyond these "auto insurance regulatory compliance" standards, premium policies should align with industry best practices for financial stability, data security, and fair claims handling. Insurance compliance regulations are designed to protect consumers and ensure transparent operations.

4. Can premium auto insurance integrate with existing vehicle systems?

While direct integration with a vehicle's core systems is not standard for a policy itself, many premium auto insurance providers leverage "auto insurance system integration" through telematics and mobile apps. These digital platforms can connect with your driving data to offer usage-based insurance (UBI) and streamline policy management, claims processing, and customer support.

Finance & Investment

View All

May 4, 2025

NYS Tax and Finance Login HelpElevate your online presence with expert SEO content. This guide reveals how E-E-A-T drives rankings, trust, and conversions for digital success.

Ellie Moore

January 21, 2025

Neighborhood Finance Corporation HelpMaster expert SEO content to boost rankings & authority. Learn to create valuable, E-E-A-T-driven content that builds trust and dominates search.

Ellie Moore

January 26, 2025

Competitive Analysis: Best Practices for 2024Stay ahead with the latest best practices in competitive analysis for 2024. Gain actionable tips to enhance your strategy.

Ellie Moore

October 25, 2025

Tahoo Finance Market InsightsElevate your content! Learn to craft expert SEO content focused on E-E-A-T, depth & user intent to achieve higher rankings and truly engage your audience.

Ellie Moore

January 28, 2025

From Data to Strategy: Competitive Analysis TipsLearn how to transform raw data from competitive analysis into actionable strategies that drive business success.

Ellie Moore

July 5, 2025

Dept of Tax and Finance InformationUnlock the secrets to expert SEO content that ranks high, builds authority, and engages users. Learn E-E-A-T, research, and user intent for top results.

Ellie Moore

Insurance

View AllProtect your freelance career with tailored insurance. Discover coverage options for self-employed individuals.

Ellie Moore

Learn how blockchain is enhancing transparency and security in modern insurance policies. Is your coverage future-ready?

Ellie Moore

Find out why term life insurance is more popular, affordable, and flexible than whole life. Choose the right coverage for you!

Ellie Moore

Understand the differences between HMO, PPO, and EPO health insurance networks. Pick the plan that suits your needs best!

Ellie Moore

Explore how life insurance doubles as an investment tool. Learn about cash value policies and long-term financial benefits.

Ellie Moore

Car accidents are costly. Our ultimate guide reveals how to secure comprehensive auto insurance, minimize financial risk, and gain essential peace of mind.

Ellie Moore

Education

View AllLifelong learning is the new normal! Discover why continuous learning is essential for personal growth, career success, and adapting to change.

Read MoreDiscover how assistive technology empowers special needs learners. Learn about tools that foster inclusivity and enhance educational outcomes.

Read MoreExplore the ongoing debate on standardized testing. Learn its pros, cons, and whether it should remain a key part of education.

Read MoreLearn effective classroom strategies to manage ADHD. Discover how teachers can support students with ADHD for better learning outcomes.

Read MoreLearn key strategies for creating inclusive classrooms. Discover how to foster equality, engagement, and a sense of belonging for every student.

Read MoreMOOCs are transforming the landscape of higher education. Learn how massive open online courses are making learning accessible to all.

Read MorePopular Post 🔥

View All

1

2

3

4

5

6

7

8

9

10

Health

Automotive

View All

July 17, 2025

JT Automotive Services Worth Checking Out

Unlock peace of mind & vehicle longevity. Discover why choosing the right car care partner, like JT Automotive Services, truly matters.

September 5, 2025

Automotive Undercoating To Protect Your Car

Safeguard your car from rust & corrosion! Automotive undercoating acts as an invisible shield, extending its lifespan and preserving its value.

July 27, 2025

Jones Automotive Experts Ready To Help You

Trust Jones Automotive Experts for reliable, expert care for your modern car. Ensure safety & efficiency with top-tier diagnostics & repairs.

August 1, 2025

How Automotive Gyroscope Technology Works Today

Explore how automotive gyroscopes are your car's unseen guardian, boosting safety, stability & enabling autonomous driving.

August 6, 2025

Diamond Automotive Services That Shine Bright

Discover diamond-level car care! Learn what makes automotive services shine with expert technicians, transparency, and trust to protect your valuable vehicle.

February 5, 2025

Must-Have Tools for Every DIY Mechanic

Are you a DIY mechanic? Equip yourself with these essential tools for hassle-free car repairs and maintenance. See what every toolbox needs!